I wanted to have at least one unit in the portfolio and then add it to the portfolio as a small addition. I find the topic of robotics, prostheses and the link with AI extremely interesting and am very curious to see where we will end up with this topic in the coming months. I deliberately chose the higher TER because I like the ETF offering here better outside the mainstream. The higher expense ratio is manageable for me because the position will not become incredibly large.

- Markets

- ETFs

- L&G ROBO Global Robotics and Auto ETF USDAcc

- Forum Discussion

L&G ROBO Global Robotics and Auto ETF USDAcc

Price

Discussion about ROBE

Posts

4Future of Tech Pack

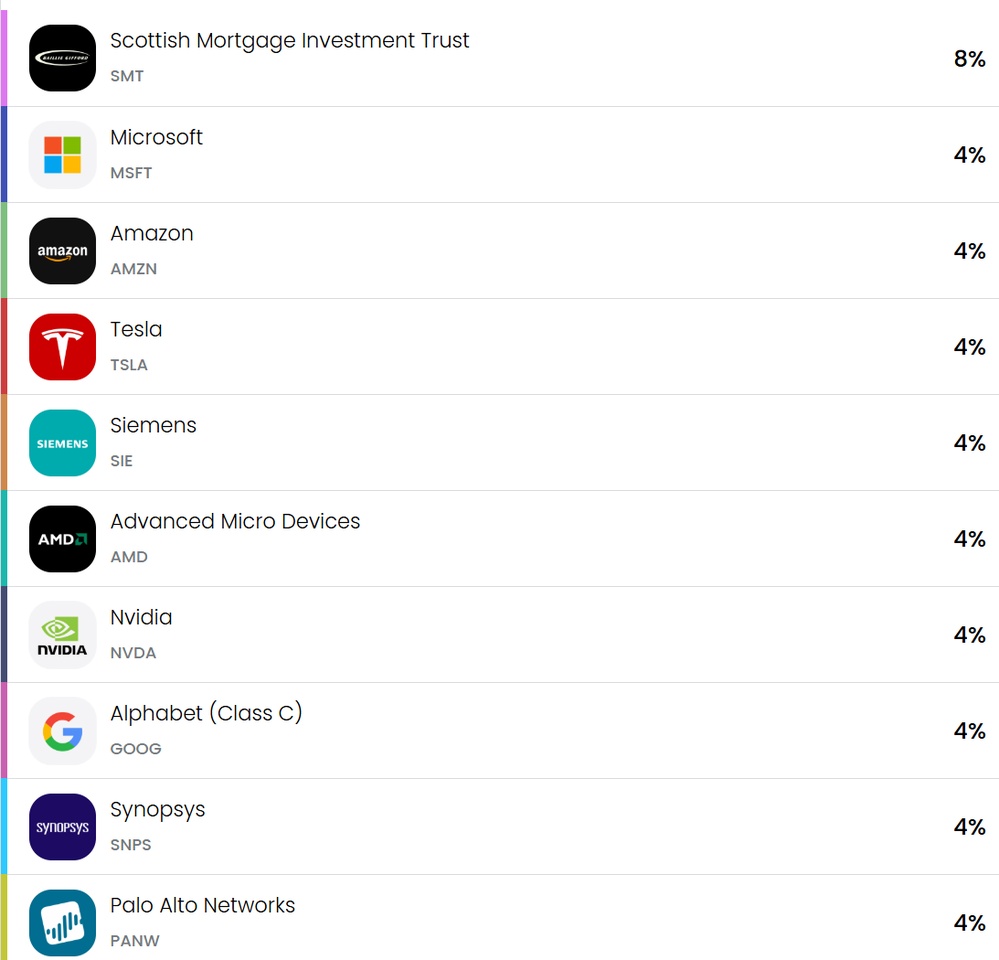

This is my future of tech pack, well rounded and solid choices for the future of Technology. 20-25 companies and funds embedding real tech into the physical world. Built for resilient long-term growth — no hype, just strategy.

Not financial advice.

https://www.trading212.com/pies/lua2LbG5mCkbey24uUDCHJHdUyIa9

$SMT (-1.17%) - offer both a good choice of companies and private equity exposure

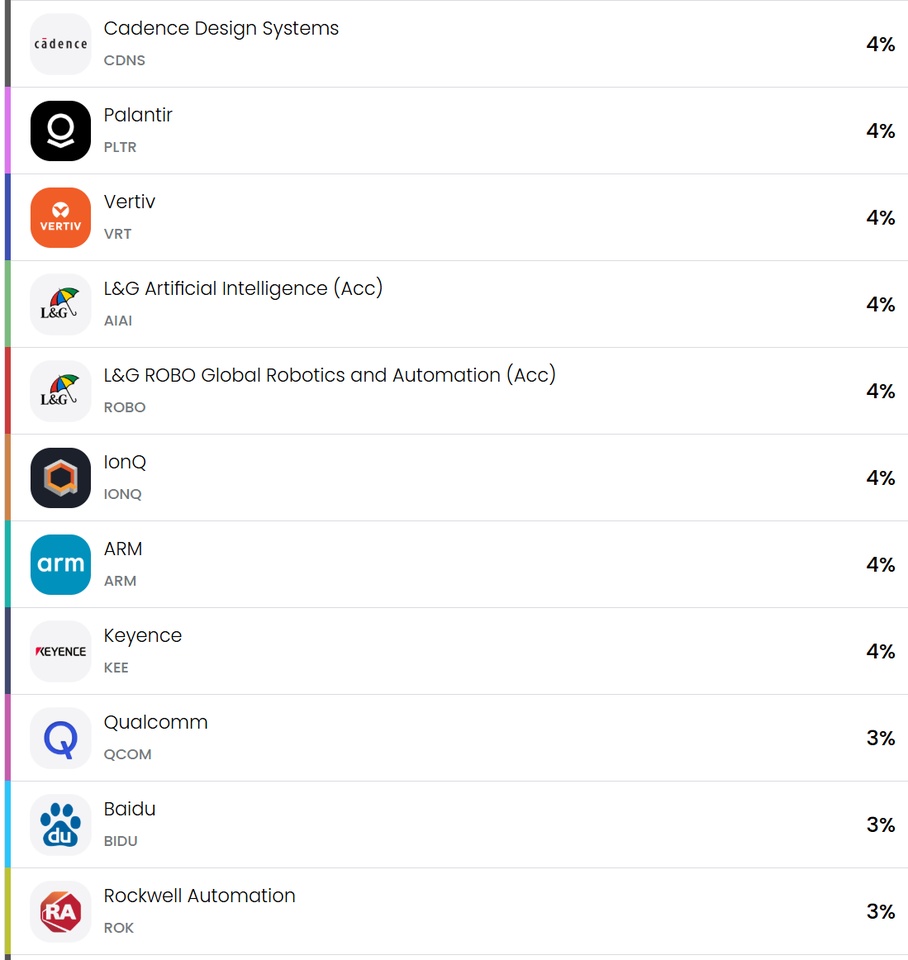

The L&G $AIAG (+0.53%) and $ROBE (+0.51%) funds reinforce some of the big techs and complement a small exposure to missing names.

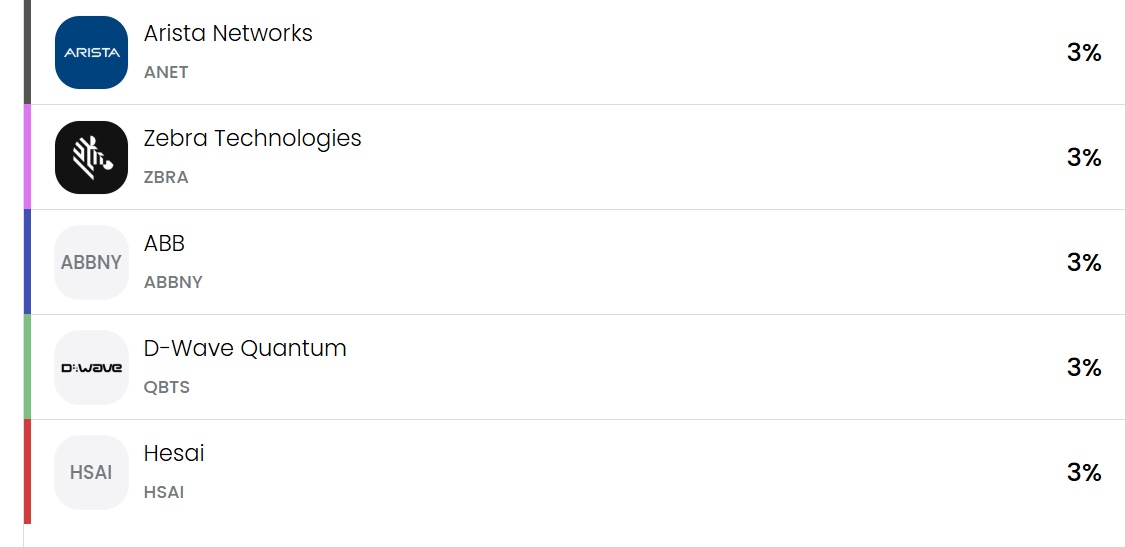

Although diversified, doesnt miss some of the big names like $NVDA (-0.45%) , $MSFT (-0.18%) , $GOOG (+0.03%) , some of the potencial outperformers like $PLTR (-0.49%) , or the most likely quantum performers like $IONQ (-2.46%) or $QBTS (-0.68%) and other interesting titles.

I readjust it from time to time. For example if $ONDS (+1.11%) keeps showing promise, I'll probably include it and take out for exemple $QCOM (-2.34%) somewhere in the future.

Have fun.

Trending Securities

Top creators this week