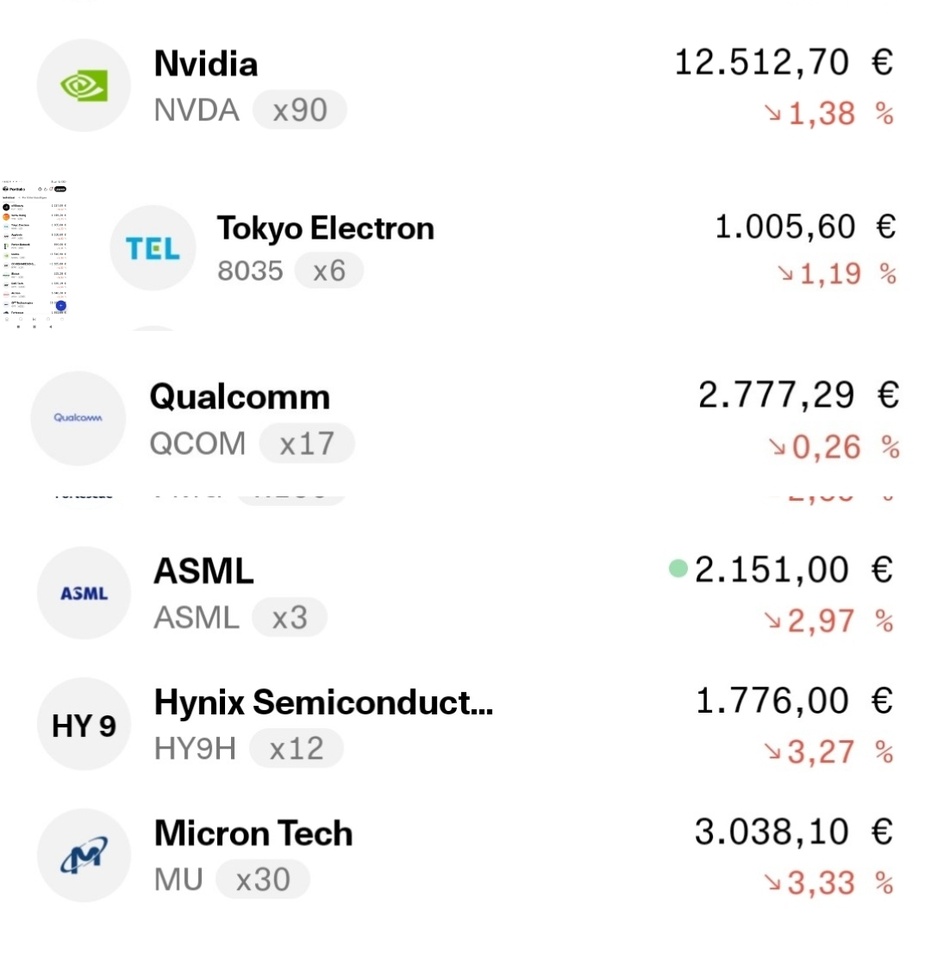

Today, my overweighting of the semiconductor sector is once again falling flat on its face.

Which stocks would you sell and why? Or would you stick with it everywhere?

$NVDA (-3.26%)

$HY9H (-4.1%) . $QCOM (-2.01%) . $MU (-7.24%)

$ASML (-3.69%)

$8035 (-6.59%)