Hello everyone,

Since there will probably be no significant changes to performance in the next few weeks, getquin has already published this.

I would really like to take this opportunity to thank everyone who has shared, commented or motivated shares and trade ideas here in the community!!!!

@Tenbagger2024

@Multibagger

@TomTurboInvest

@SAUgut777

@Dividendenopi

@EpsEra

@All-in-or-nothing@Wiktor_06

@Shiya

@Hotte1909

@BamBamInvest (where are you 🥲) @HoldTheMike

@Semos25

@Aktienfox

@Epi and many more!

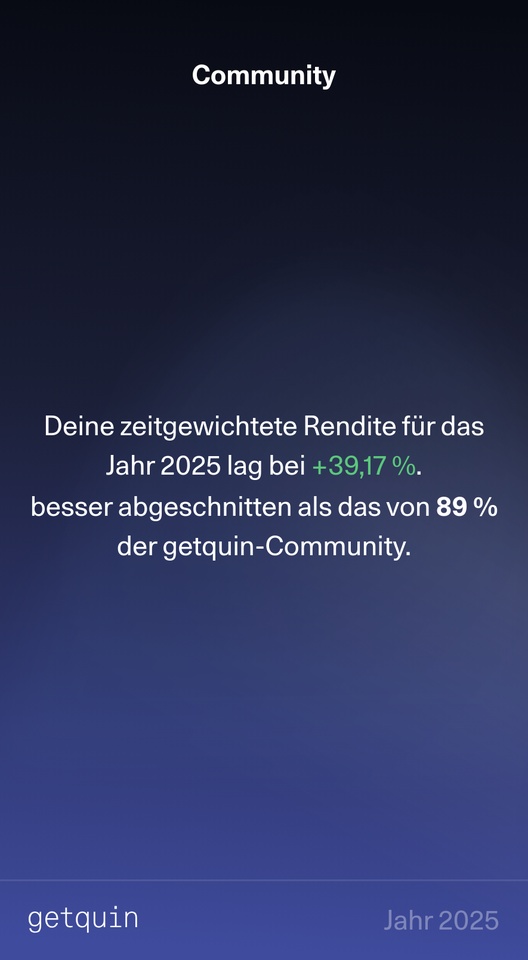

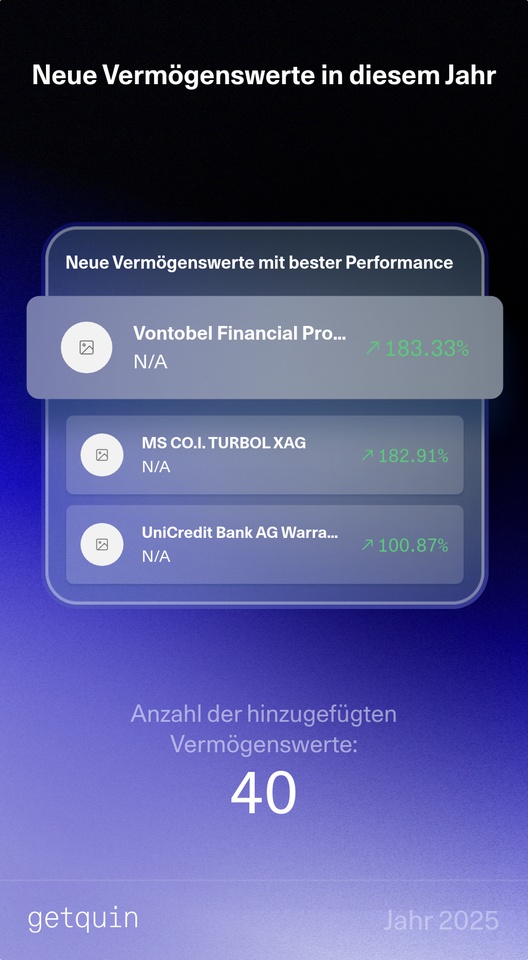

I have clearly exceeded my target of 20-25% p A, although you have to admit that I also bear a high risk due to my concentrated portfolio ($IREN (+8,21%)

$RKLB (+13,29%)

$SOFI (+4,83%)

$HIMS (-0,84%)

$PNG (+2,07%)

$BTC (+1,62%) )🙃 and in addition, the long OS on silver brought the highest return with over 100%... Thank you @Multibagger again

Even though November and December are red, at least so far, I am quite satisfied with my first year on the stock market 😁

And better than 89%? Did something go wrong with me 🤷😛

I've also finally been allowed to pass my practical test, so I don't have the financial burden of driving school for the time being!

To my dear critics:

@Pacco93 here's another amusing post 😉

@Ph1l1pp Anyone who thinks they have edge in fundamental analysis is lost 🙈🤝