For centuries, the North Sea has been regarded as a rough marginal sea. Now it is set to become the heart of Europe's energy supply. There are already 1600 wind turbines off the coasts, but this is just the beginning: electricity generation from offshore wind power is to be increased almost tenfold by 2050. This was decided by the energy ministers at the North Sea Summit in Hamburg on Monday.

The pact has the clear aim of dovetailing energy and industrial policy with increasingly important security interests. The ministers' plans go far beyond wind farms. The North Sea is to become a cross-border electricity hub that will make Europe less dependent on fossil fuel imports, stabilize electricity prices and give industry long-term planning security.

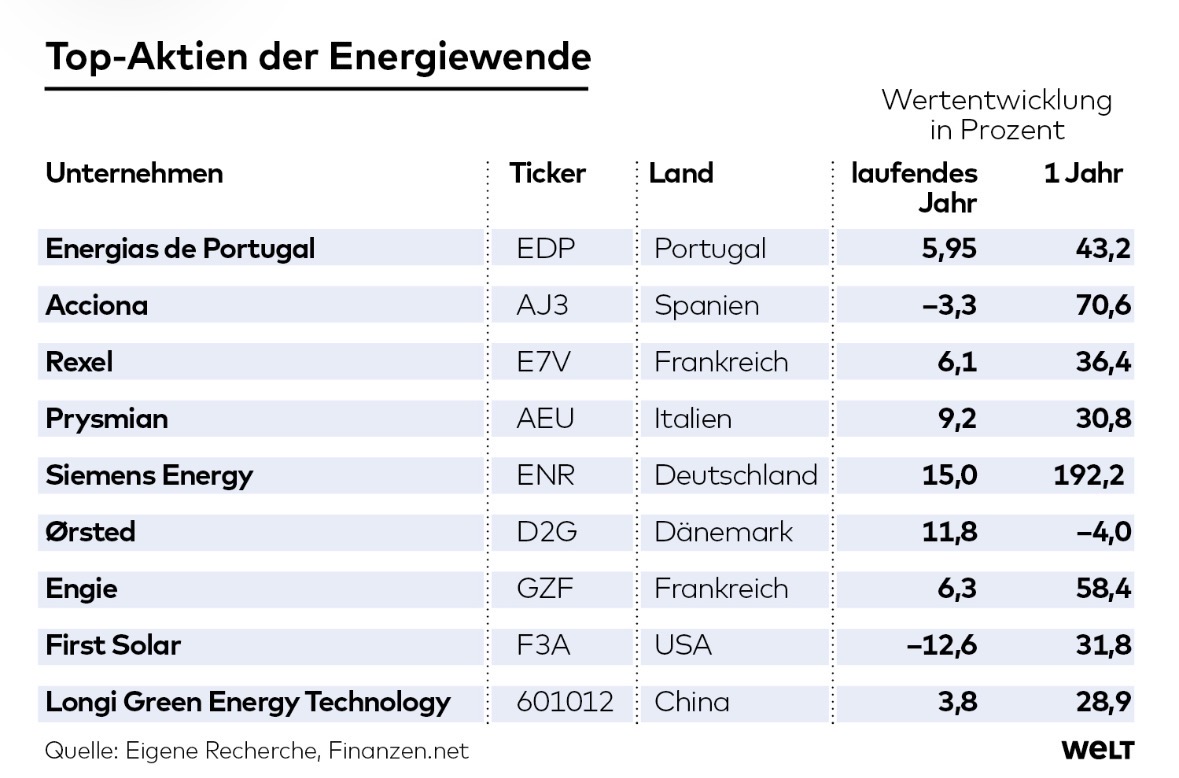

It is a course-setting move that is also being perceived on the financial markets. The long-term expansion plans are changing expectations for a sector that already celebrated a strong comeback last year. The industry is receiving an additional tailwind from the rapidly growing and ongoing energy requirements of digital technologies of the future, above all artificial intelligence, whose data centers require enormous amounts of reliable and affordable electricity. The sector is currently experiencing the perfect moment to become the new megatrend itself.

This should give investors hope, especially in combination with upcoming projects such as the North Sea Pact. After all, this involves up to 100 gigawatts of generation capacity being made available across borders. This would give both the wind energy and grid industries planning and investment security beyond 2030.

In return, the industry undertakes to reduce the costs of electricity generation by a total of 30 percent by 2040. In addition, around 9.5 billion euros are to be invested in new production capacities in Europe by 2030 and 91,000 additional jobs are to be created. According to "Wind Europe", a wind association, 32 million households can already be supplied with electricity from offshore wind energy today. With 300 gigawatts in 2050, this figure could grow to more than 330 million.

It is a new long-term perspective in the sector that should arouse the curiosity of private investors. It feeds the hope that the financial recovery in the sector reflects a lasting change in fundamentals - and that it will not fade away as quickly as it started. For example, UBS expects earnings growth in Europe this year. "The most attractive opportunities come from renewable energies and structural investments in Europe," says strategist Gerry Fowler.

Renewable energies are particularly in focus, supported by more than two trillion euros of investment in power grids and clean energy. Electrification companies are likely to benefit from supportive regulation and continued infrastructure spending.

The strategist leads Energias de Portugal

$EDP (+0,13%) as an example. EDP is one of the largest energy suppliers in Europe. With a market value of 17.5 billion euros, the company is currently the most valuable Portuguese company. The shares are currently trading at 4.24 euros. That is an increase of 6 percent since the beginning of the year and an increase of 50 percent in the past year. And: according to analysts, EDP's potential has not yet been exhausted. Ten experts recommend buying the share. The average target price is around 4.6 euros, with some firms even expecting the share to rise to around 5.9 euros. The Group's dividend yield is 4.7 percent.

According to Gerry Fowler from UBS, the general conditions are currently creating new global champions in the areas of renewable energies, electrification, defense and infrastructure. He specifically highlighted European stocks such as Acciona

$ANA (+0,41%) and Rexel

$RXL (+1,28%) as companies that are turning local advantages into international growth. Another example is Prysmian $PRY (-0,43%). The Italian company is the world's largest and most successful manufacturer of energy and telecommunications cables. The shares are trading at 98.06 euros, up 9 percent since the beginning of the year.

While UBS is putting the green underdogs in the spotlight, other analysts continue to focus on big names such as Siemens Energy $ENR (+0,35%), Ørsted $ORSTED (+1,5%) and Engie (GDF Suez) $ENGI (-0,53%).

Also First Solar

$FSLR (+2,98%) analysts also believe that First Solar will achieve a turnaround after a weak start to the new year with a drop of 11 percent. With a market capitalization of around 26 billion US dollars, the solar giant production power plant for large-scale systems is a heavyweight. Analysts are expecting a sharp jump in profits.

Earnings per share are expected to rise from an estimated USD 14.61 last year to USD 23.30 this year. An increase of more than 56 percent. The drivers are the high order backlog and new production capacities, including a planned 3.7 gigawatt factory in the USA, with which the company intends to convert additional demand directly into revenue.

The analysts also see potential in Longi Green Energy Technology $601012. The Chinese company specializes in the manufacture and sale of photovoltaic panels and solar energy products. The company is not only active on the Asian market, but is also increasingly present on the global market.

Source text (excerpt) & graphic: WELT