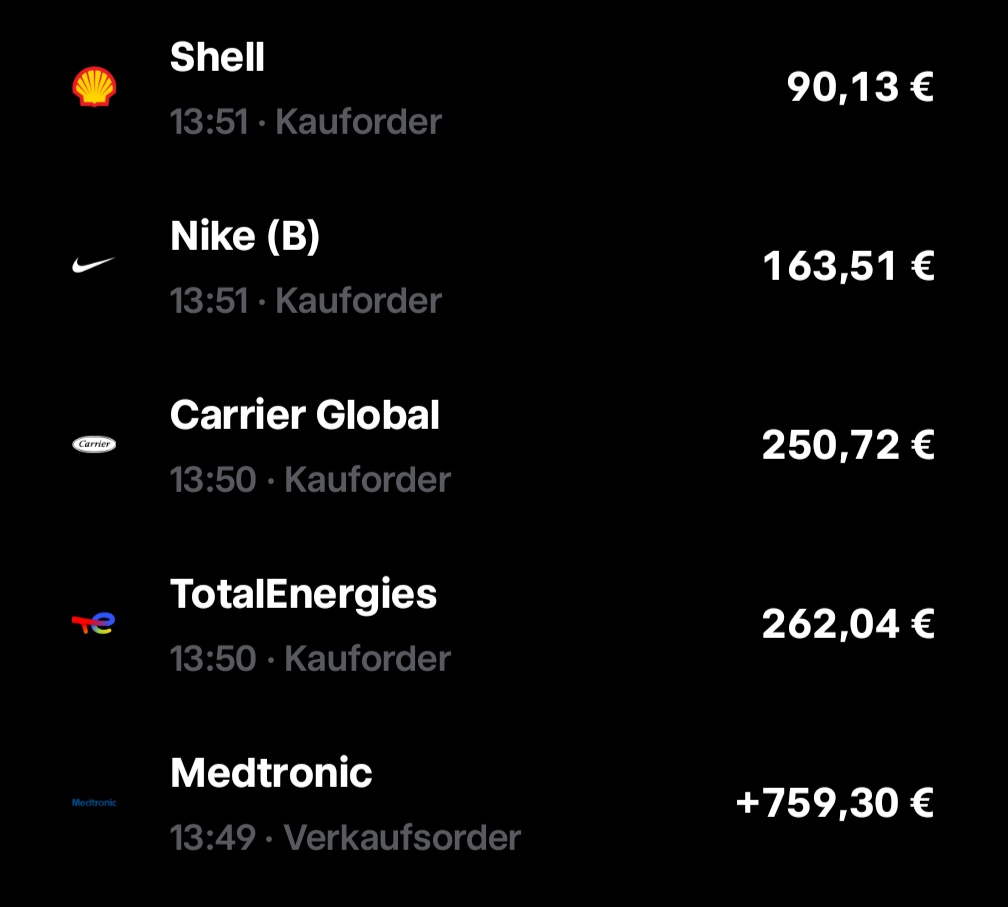

After 4 long years of stagnation and share price decline, I have decided to sell Medtronic and further expand my portfolio in line with my preferences.

To this end, I have reduced my positions

In Shell $SHEL (-0,09%) , Carrier Global $CARR (-0,41%) , Total Energies $TTE (-0,24%) and Nike $NKE (-0,4%) expanded.

With Nike I have now also reached my desired size 😁

There is currently only one single share in the standing order and that is Carrier Global.the standing order on the Vanguard FTSE all-world remains unchanged.

I still intend to $SHEL (-0,09%) , $TTE (-0,24%) , $XYL (+0,23%) , $ECL (-0,43%) and $LIN (-1,29%) to expand.

I am always open to comments and suggestions for improvement 😁