Chilling, sipping thea, and pretending I understand the markets. ☕📊

Vanguard FTSE All-World ETF

Price

Discussão sobre VWCE

Postos

485Now almost a month in... time for a first summary

First of all:

Thank you for the warm welcome to the getquin community!

Unfortunately, I did not read the HowTo:Portfolio feedback on GetQuin from @DonkeyInvestor

for a detailed presentation only later and this time I'm trying to write in more detail than the first time and to substantiate the decisions I made in order to possibly receive even more precise feedback from the community. 💛

My personal goal is to become completely debt-free and at the same time start steadily building up assets 📈to improve my private pension provision in 2026. I am expressly prepared to take a higher risk in the first year of my investment and am therefore trying out almost everything.

This year, I would like to operate according to the conscious principle of "set and forget" and consciously review my strategy at the end of 2026 between the holidays and adjust it if necessary.

Instead of "keep it simple", it's more likely to be "overenginerring."

I see your numerous tips as the reason for this, for which I would like to thank you again at

@Epi

@Gehebeltes-EFH

@Stullen-Portfolio

@Multibagger

@Sunrise-Mantis

@EisenEnte

@PositivePossum

@schlimmschlimm

and my general motto in life:

"Anyone can do simple!"

I think at this point in time, investing with "putting everything into the AllWorld ETF" would only be half as much fun for me and would rather bore me. Everything is still so new and unknown. 🤯

I'll then see whether the different investments were generally a good thumbs 👍🏻 or a very bad thumbs down 👎🏻Idee.

The sum of € 5,071.00 that I have already firmly capped and gradually planned to invest in this first year 2026 has already been completely written off in my mind as play money.

For the necessary diversification (ETF, ETC, individual shares and crypto) in my portfolio, I have taken further INCENTIVES and have switched from the initial €100 per month savings plan to an accumulating AllWorld ETF and have set up an additional savings plan of €40 per month on the same AllWorld ETF in distributing form in mid-January 2026.

In the meantime, I came up with the idea at the end of January 2026 and added the two existing savings plans $VWCE (-0,06%) and $VWGL additional savings plans ($AIQG (+0,76%)

$RENW (+0,04%)

$IGLN (+1,27%)

$BTC (+0,31%)

$VHYL (-0,14%)

$ISPA (-0,08%)

$FGEU (-0,18%) to a total of 9 savings plans with a monthly sum of €300.

Unfortunately, it was already too late to execute the savings plans by direct debit at Trade Republic at the beginning of 02/2026. Therefore, they will now only be executed in the middle of this month.

Yesterday I spontaneously decided to place a €50 single order in bitcoin. I just let myself be carried away by the postings. 🤑

The planned unscheduled repayment (€500 per month) for my car loan has now worked well for two months and will be prioritized in order to actually become debt-free more quickly.

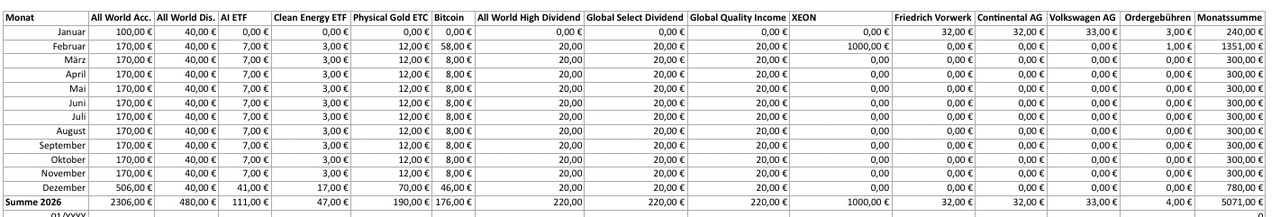

The specific amounts and items invested to date and in the future can be seen in this Excel table.

Regarding the 6 suggestions from you @Epi (Yes, you'll get the promised feedback here), I've given the following thoughts in detail, from which my plan is then based.

Deka funds:

The two savings plans of €50 per month each were already suspended by me and were actively used to service the first savings plan of €100 per month.

In addition, I am now liquidating the two sub-custody accounts belonging to the savings plans one by one and selling €100 per month in order to achieve the best possible average value in the sale.

The €100 is then immediately reallocated in the form of five savings plans per month and reinvested as follows:

Core: 65%

Satellites: 35%

of which:

Clean Energy 10%

AI: 10%

Bitcoin: 10%

ETC Gold: 5%

VWL:

I will keep the monthly €40 VWL on the third sub-deposit with Deka until I develop the motivation to inform my employer of another contract. At the moment I have no need to be in contact with the HR department any more than necessary.

Nevertheless, I have set up an additional savings plan of €40 per month for the All World ETF distributing from February 2026.

I'm keeping the three individual shares plus the Xiaomi bonus share in my portfolio to develop a feel for shares.

No further individual stocks are currently planned. This fits quite well in this respect, as I have to hold the bonus share for a year before it can be sold.

Bonus savings contract:

The premium savings contract with a term of 99 years under the "old law" has an annual investment of €150 per month at €12.50 with a guaranteed premium of 50% plus interest and compound interest. After checking the terms and conditions of the contract, switching to 0 would result in an immediate loss of the premium. For this reason, I have decided to keep the contract.

Saving & winning without savings:

Just as I was about to decide whether to cancel the savings tickets, one of the tickets won €1,000 in January 2026. For this reason, I decided to keep my 10 tickets after all.

A key point of my savings lottery tickets is that I get €480 of the €600 back at the end of the year.

These will also be distributed by me to the 5 selected savings plans in December in the same weighting as for the reallocation from the Deka Depot.

The profit from the savings lots in the amount of €1,000 goes to$XEON (+0%) for "max. interest".

Nest egg:

My real nest egg, on the other hand, I keep completely in the call money account so that it is always immediately available to me.

To give me a feel for dividends, I've also picked out three dividend ETFs that I invest €20 a month in.

In combination, these three ETFs ensure that I receive a planned dividend every month. That sounds like a lot of dopamine, at least in theory, so I really like it.

What will actually still be there in 01/2027 from the €5,071 invested is already a 100% profit for me, because after I fell for the game "WOS" 🥶(who knows it?) almost a year ago and blew around 5k on digital crap in 3 months and above all to improve my stove 🔥🪵, this is clearly the better alternative to spend my money on dopamine boosts and pass the time. And being part of a community online at the same time. What more could you want?

So, I'm already looking forward to your feedback. Be honest, I can take it! 🤞🏻

VG

QW3RTY

PS: I could not share my portfolio. The function was grayed out.

January update

Actually invested a lot this month. Not only focussing on the dividend part, but also diversifying my portfolio with some ETF's in other sectors.

Bought: $SDIP (-0,08%)

$CVC (-3%)

$IH2O (+0,2%)

$MO (+0,94%)

$DEFS (-1,2%)

$HDRO (-0,3%)

$VWCE (-0,06%)

Increasing my monthly dividend from €28,67 to €37,25

Hello everyone!

After about a year and a half as a silent reader, I'm taking the plunge today and writing my first post.

Briefly about me: I'm 20 years old, studying economics and started investing in January 2024. My goal is to build up a substantial financial base with discipline and perseverance.

My strategy: Growth & buy-and-hold

- Core: A solid foundation from which $VWCE (-0,06%) and $WSML (-0,07%) (small caps).

- Satellites: Supplemented by individual stocks and a $BTC (+0,31%) -position that is currently being built up additionally (target: 5 %) and a share in the wikifolio of @Epi (target: 10 %) in order to accelerate growth somewhat.

In the early days, I made the classic mistake of rebalancing too often. I now rely on calm and tactics. True to the motto "The journey is the reward", I want to keep learning and refining my strategy.

I am open to all tips and welcome constructive feedback on my current allocation.

Here's to a good exchange!

Commodities could be a smart addition.

Reinvesting dividends - what's the best way to do it?

I expect to receive around €3,000 in dividends this year, i.e. an average of €250 per month. 🎉

And my goal is clear: don't leave it lying around, reinvest it straight away.

But now I'm asking myself: what's the best strategy here?

How do you do it with your dividends?

Options I am considering:

A fixed ETF just for reinvesting, e.g. a dividend ETF or world ETF - and put everything in there every month, e.g $VWRL (-0,04%) or $VWCE (-0,06%)

Adjust flexibly every month and invest in a dividend stock (king or aristocrat) in which I see the best opportunity at the moment, this month it was the $ALV (-0,11%)

Collect and invest 1x/year (e.g. at the end of the year / on a dip)

I've started doing it this way now:

👉 Every month check what's coming in in dividends and then set up a savings plan for the middle of the month.

I've started with Allianz as a test - but I'm not sure whether that makes sense or whether I'd be better off putting it consistently into a dividend ETF, such as $TDIV (+0,05%)

I'm also considering starting a separate ETF for this so that I can track it closely:

What have my reinvested dividends really brought me? (I find this quite motivating from a purely psychological point of view 😄) but I would actually rather reduce my positions than build up more.

How do you do that?

- Do you have a "reinvest ETF"?

- Do you invest on a monthly basis or rather bundle them?

- Do you prefer dividend ETFs, shares, world ETFs or simply buying into the strongest positions?

Looking forward to your tips & experiences! 🙏

Intro & My path as a newcomer

Dear getquin community

Having been a silent reader here for a few months now, I would like to briefly introduce myself and my journey so far. Before I do, however, I would like to say a big thank you to everyone who regularly shares very exciting posts here and helps this community to grow. You are not only convincing in terms of content, but also create a really pleasant atmosphere in the forum with your appreciative way of writing.

My Story

Against the background and with the expectation of a substantial inheritance, I have been looking into investment opportunities as a complete newcomer to the stock market since the beginning of 2025. As I wanted to gain some experience first, I started investing my annual savings on a trial basis instead of paying off my mortgage as usual.

I started with an investment in $SPYI (-0,03%) . As I didn't like the heavy weighting of the USA, in a second step I tried to build up a 35/25/30/10 ETF portfolio with a weighting of the world regions by GDP. The result did not convince me due to the complexity (at times over six ETFs → manual rebalancing effort) on the one hand and the manageable long-term return prospects on the other. In the meantime, I had the idea of investing in slightly better-performing and riskier thematic ETFs such as $SEMI (-0,48%) and $XAIX (+0,37%) but in the end this only led to an even more complex setup.

I then decided to try a buy-and-hold approach based on individual stocks, but was quickly impressed by the return prospects of riskier stocks. So - also influenced by posts here in the forum - I went all-in at the beginning of November with $IREN (-0,86%) at a buy-in of around € 61 at the time. I now know that this impulse is called "FOMO" 🙂. When a sharp correction immediately began, I realized that return also means risk and that timing plays a role when buying individual stocks. Encouraged by posts here in the forum, however, I didn't sell in a panic, but continued to buy during the correction phase until I was able to reduce my buy-in to €45 at the end of December.

I am now slightly in the green again and the further prospects do not currently motivate me to sell my shares. I am setting myself a price target in the region of the old ATH in order to then reduce the position to a more reasonable size and restructure my portfolio. If I am satisfied with this, I will also invest the larger sum from the inheritance. At the moment, I can imagine a core of $VWCE (-0,06%) , $TDIV (+0,05%) and @Epis 3xGTAA Wikifolio Index as well as a somewhat smaller portion for selected, higher-risk stocks. There are numerous well-founded ideas for the individual stocks here in the forum, for which I would recommend, among others@Multibagger , @Tenbagger2024 , @Iwamoto and @Shiya are very grateful.

It's fun to be here.

20,000€ achieved🚀💪🏼

I would never have thought that my portfolio value would double from €10,000 to €20,000 in just five months. This rapid increase surprised me and prompted me to take a closer look at my investment strategy.

I follow a classic buy-and-hold strategy, as it is ideal for my long investment horizon of 30-40 years as a 20-year-old. My focus is on growth and steady dividends.

As a core, I have the $VWCE (-0,06%) which should always make up between 30-40% of the portfolio in order to reflect the broad market and capture the average return. I build individual quality stocks with a broad moat around this core, which serve as a yield booster and stability anchor. I also focus on dividend stocks with stable cash flows, dividend growth and growth potential.

As an Austrian $OMV (+0,41%) my local high-dividend stock in the portfolio, which not only provides me with a nice home bias, but above all a decent dividend cash flow. As the position is currently still very small, I will definitely be adding to it in the near future.

As a small hedge in uncertain times, I have 5% $4GLD (+0,98%) in the portfolio, not as a yield generator, but as a buffer in times of crisis.

With $ONDS (+0,32%) I have a small speculative share in the portfolio, which doesn't really fit into my investment strategy and has already become very large. I have already realized the first partial profits and taken out the risk, but due to the outstanding performance I am now simply letting the rest of the position continue to run at a relaxed pace. If it continues to rise, I will again realize partial profits.

The current development of my portfolio confirms that I should remain invested for the long term, even if I am aware that such market phases are not the rule.

I am open to suggestions and questions about my portfolio or my investment strategy.

You've landed some good picks. Now be careful not to overestimate yourself and leave the ETF portion at least as large as you described. Then the 30k will come faster than you can see 💪🏼

Good luck for the future!

Portfolio valuation

Hi everyone,

I started last year and would like to hear your opinions on my portfolio.

I currently have savings plans in:

I am thinking about whether I should $1810 (-0,09%) to follow up. I'm basically convinced by the brand.

Cheers

Andi

PART 2: Sold some $VWCE and bought $NBIS $IREN and $OMDA.

Hi guys, following up on my posts from last weekend. Today i sold €650,00 of my $VWCE position and bought back the following stocks to further build my undersized positions:

-> Bought +- 250 eur (3x) $NBIS (+4,93%) Making total position +- €750,00

-> Bought +- 200 eur (15x) $OMDA (-0,3%) Making total position +- €400,00

-> Bought +- 160 eur (4x) $IREN (-0,86%) Making total position +- €560,00

Slowly starting to shave off my safe $VWCE (-0,06%) position to take a little bit more risk. $VWCE (-0,06%) still represents around 35% of my current portfolio though.

Thought about still being 21, so a little bit more risk can easily be handled, and if everything goes to shit I'll still have enough time to start over a couple times ;)

@Shiya

@Multibagger

@All-in-or-nothing

@AktienAthlete

@WarrenamBuffet

Títulos em alta

Principais criadores desta semana