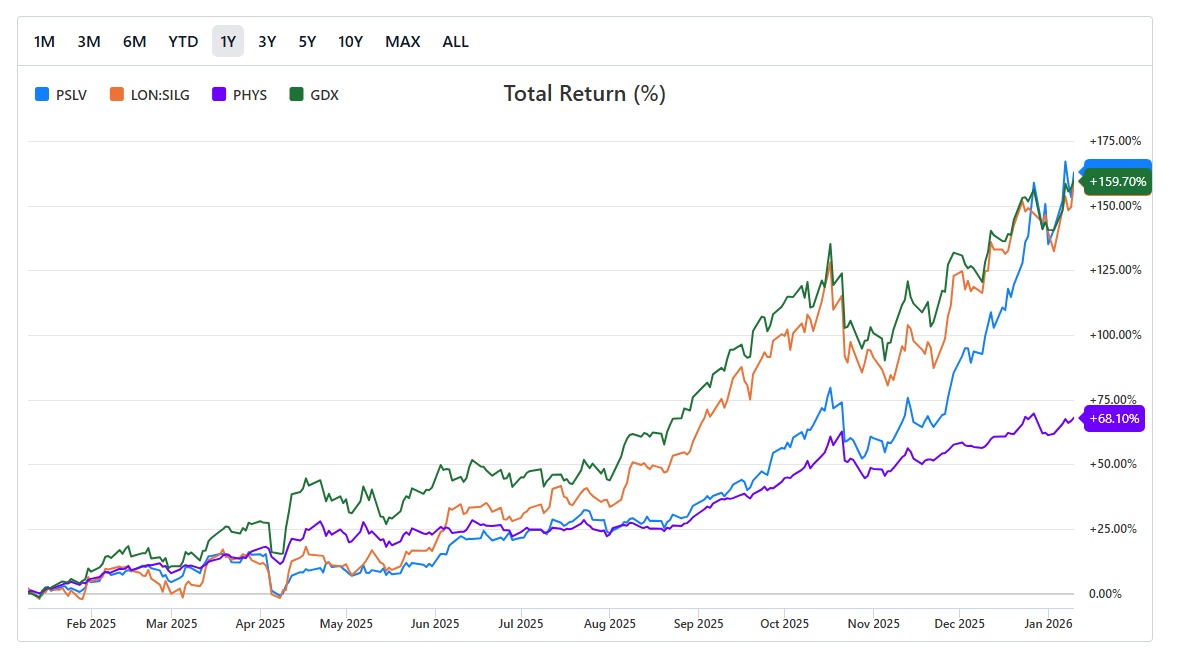

While silver $965310 (+7,52%) has been on a fantastic run this past year, the miners underperformed relative to the silver price.

$SILG (+3,91%) is up 165% this past year, while silver is up 163%. Even though this is a slight outperformance, the expected performance should be way higher.

If we compare that to the gold price (68%) and the gold miners (159%) we see the miners grew exponentially more than the comodity price.

Why silver miners should outperform the silver price:

- Production costs stayed flat at $18 an ounce.

- With silver at $84 that is a hefty profit margin!

- Profit margins improved from 20% to over 80% since 2024

- Primary silver mines have the advantage over secondary mines (lead,zinc,copper,gold) as they can scale up according to the new silver price

- Q4 results are yet to be released, while Q4 saw the great silver price surge

Why silver miners lagged so far:

- Traders expect the silver price surge to be temporary

- This would drop profit margins as quick as they rose

I expect the silver miners to rise sharply after Q4 results are released. I also expect the silver price to rise even more, improving the profit margins even further. That's why I'm expanding my position in $SILG (+3,91%)