In my opinion, you can diversify at these levels:

Local (by headquarters, by turnover)

By currency

By industry

By company size (influences volatility)

I try to have as little overlap as possible in several areas in order to keep my portfolio robust.

Example:

$DRO (-0,77%) and $PARRO (+10,46%) : Similar industry, so both are driven by the same news, but have different locations and currencies.

$CACI (-0,91%) Also has some correlation with the two, but is mainly dependent on the movements of the US military.

$8001 (-2,76%) As a boring anchor

$SL (+1,84%) As a "real" luxury play to profit from rising inequality and to have more euro/Italy in the portfolio.

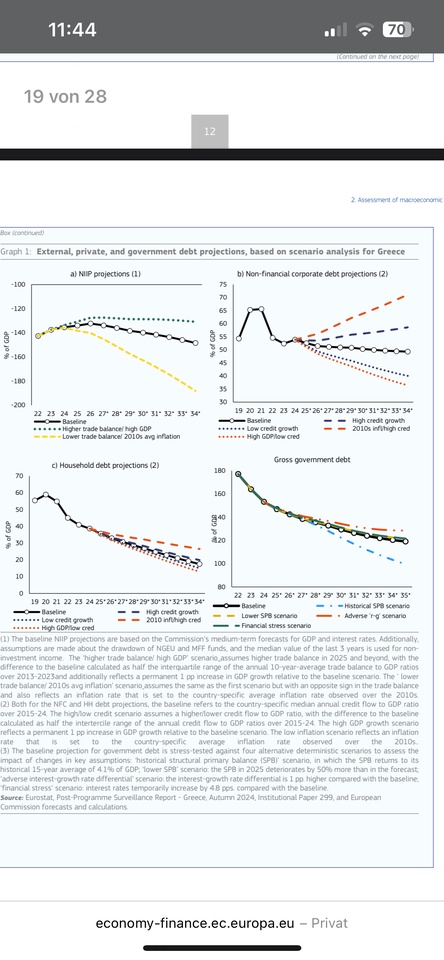

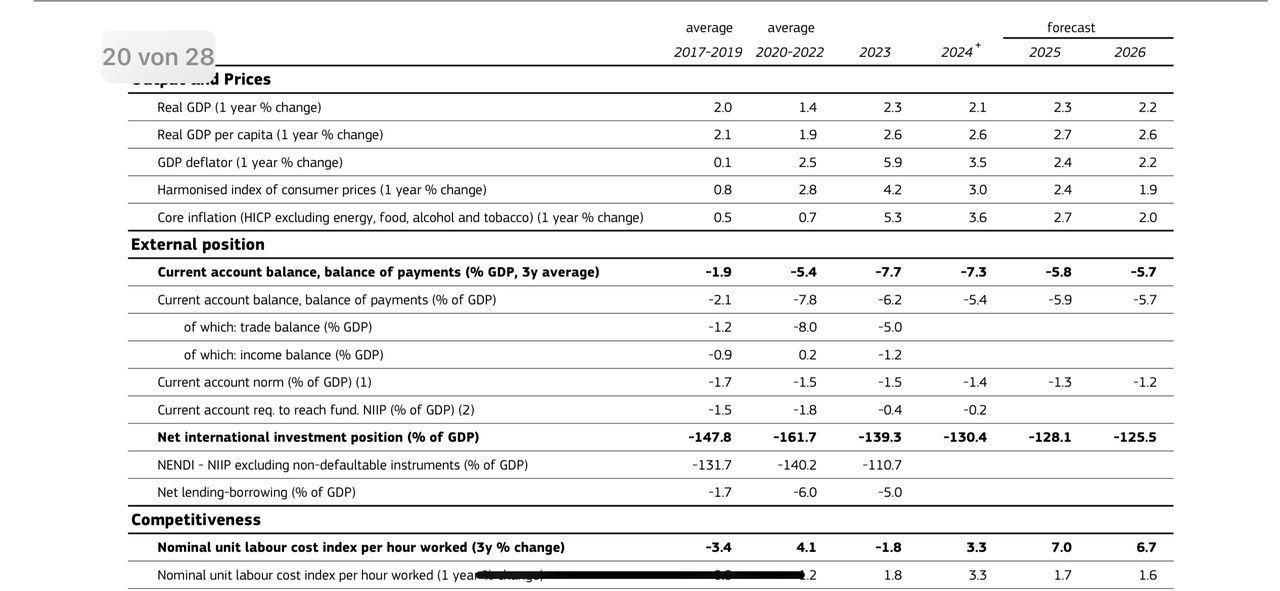

$GRE (-0,39%) Because I see great potential in Greece, see old post