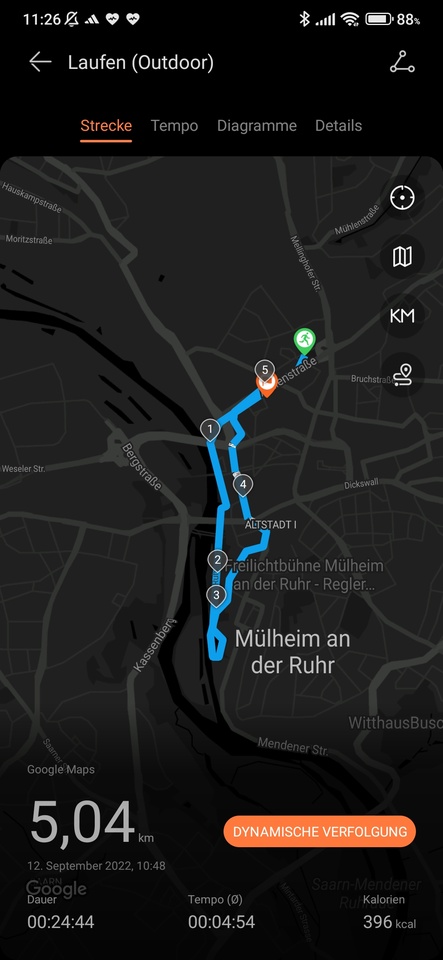

@SharkAce 3 years ago you said that when $PLTR (+2,84%) is in the plus you go running

One man- one word

have fun running

😂

(no idea why there used to be a Sport Challenge)

@getquinfuermerchverkauft "I'll take you on" where?when?

Postos

669@SharkAce 3 years ago you said that when $PLTR (+2,84%) is in the plus you go running

One man- one word

have fun running

😂

(no idea why there used to be a Sport Challenge)

@getquinfuermerchverkauft "I'll take you on" where?when?

-----Sport Challenge-----

Last time jogging months ago +

Time submitted from @TheAccountant89 =

Heart rate: 185 bpm😶🌫️

Thank you @Lorena for the encouragement, now you @getquinfuermerchverkauft and @SharkAce

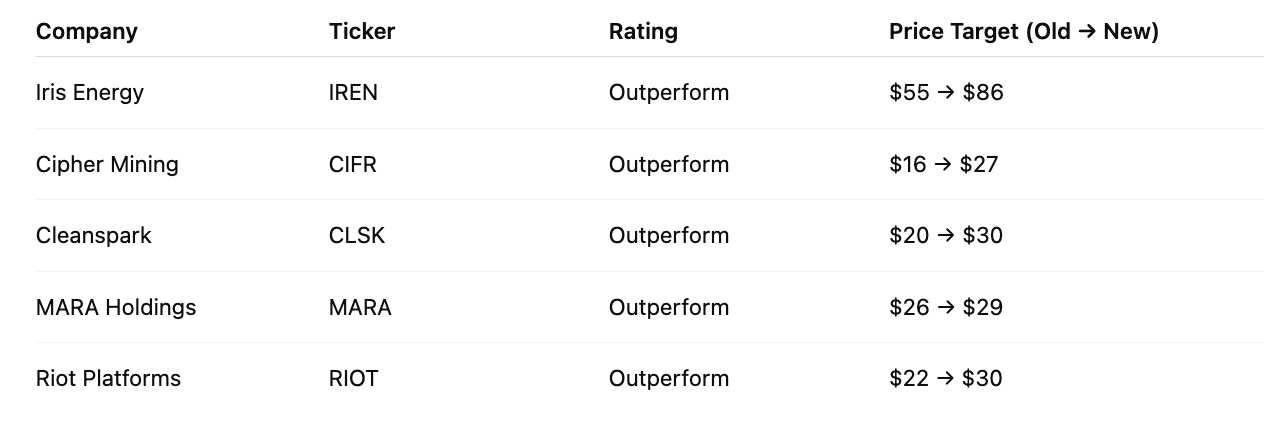

Overnight, slightly up.

Cipher Mining is attracting attention with strong institutional inflows in the last few hours. Let's see. I expect a quick multiplication. 😜

The analysts are also bullish 🥸

.

.

.

.

.

.

.

.

.

----------------------------------------------------------------------------------------

Compute:

$NBIS (+9,5%)

$CIFR (+12,99%)

$IREN (+11,88%)

$APLD (+10,82%)

Energy:

Grid:

Cooling:

Automation:

Data:

$AI

Connectivity:

$RKLB (+5,26%)

$ASTS (+0,81%)

$IRDM (-7,55%)

$VSAT (+8,15%)

Interface:

$META (+0,13%)

$GOOGL (+1,25%)

$SOUN

Security:

Now I've done it after all and taken some profits on Palantir. Part of it is still there. Now I'm looking for a new investment for 10k. Single share or rather split into my Nasdaq100 ETF and gold position 🤔

Hello everyone,

I have cleaned up my portfolio a bit and trimmed it to 30 positions (please ignore the very small positions, it is more expensive to sell them than to keep them). The different ETFs on msci, msci em, dax and NASDAQ are due to historical reasons (sub. Deposits, change from synth. To physical replication, too many taxes with complete change). At the end of the year I will sell the 2 DWS old funds and then have the tax refunded promptly --> grandfathering. I just don't know where to switch to.

I am currently saving:

$TDIV (-0,08%) 250/m

$IWDA (+0,44%) 600/m

$IEMA (+0,74%) 250/m

$EQAC (+0,87%) 250/m

$ALV (+0,06%) 50/w

$KO (-1,23%) 50/w

$PEP (-1,25%) 50/w

$UNH (-0,46%) 50/w

$V (+0,05%) 50/w

$ULVR (+1,05%) 50/w

And I reinvest the dividends from $O (+0,02%) and $MAIN (-0,96%) monthly

I try to have all positions that I want to hold long-term at 2-4 percent (exceptions: ETFs, $EWG2 (+0,5%) and $BRK.B (-0,38%) )

At the moment semiconductors ($AMD (+3,4%)

$PLTR (+2,84%)

$MU (+4,36%) and $MPWR (+6,44%) ) are my "yield positions", which I would like to sell if the price continues to rise.

But at the moment I'm lacking inspiration. What is my portfolio missing in the long term? Which themes could I "play" to achieve short-term returns. Or just leave everything as it is.

I would be grateful for any opinions.

Greetings 👋

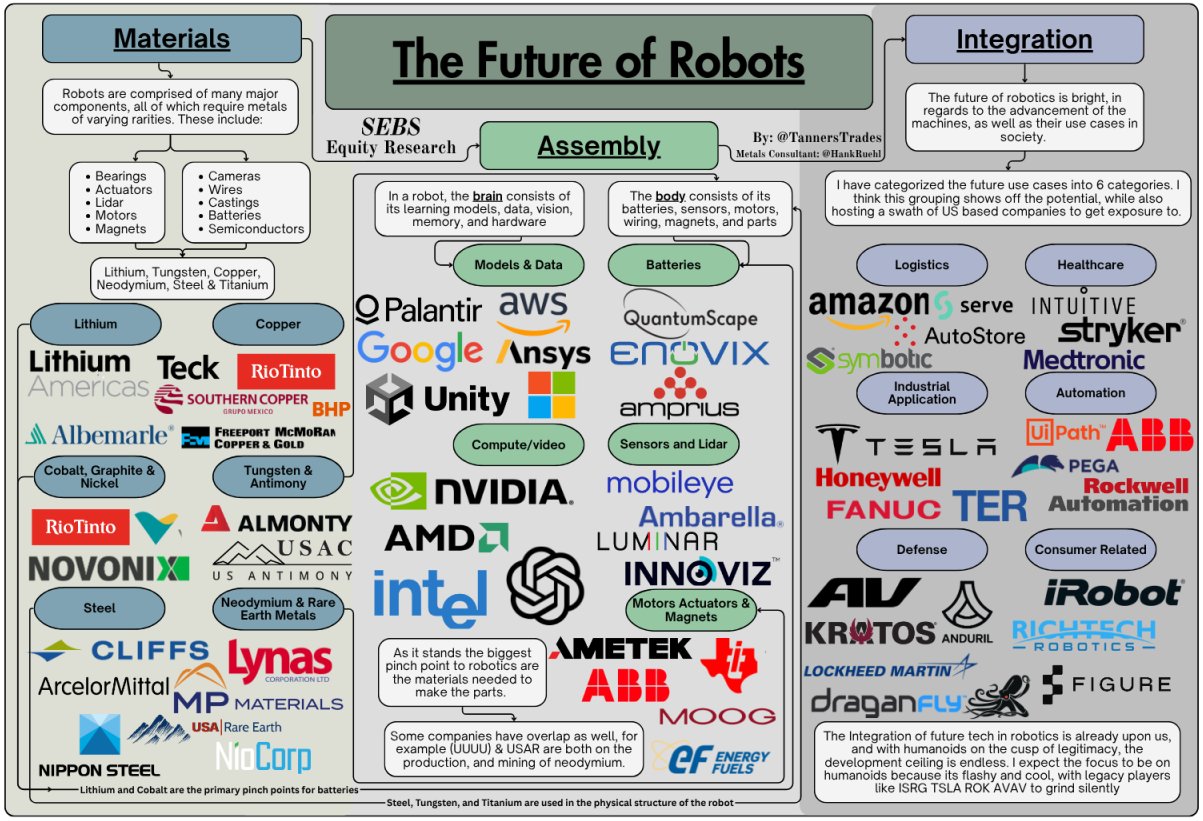

$ISRG (+4,41%)

$PATH (+2,39%)

$RR

Here is an exciting overview, for me the most attractive in terms of growth/potential of the stocks I know $RR

$PATH (+2,39%) also $ISRG (+4,41%) I would perhaps add to the portfolio again in the event of a correction. However, there are some stocks I don't know either.

What do you think are the most exciting stocks on the list, where should we perhaps take a closer look?

$AMZN (+1,02%)

$MSFT (-0,03%)

$NVDA (+1,16%)

$AMD (+3,4%)

$GOOGL (+1,25%)

$GOOG (+1,14%)

$RIO (+1,5%)

$ALB (+6,83%)

$INTC (+11,6%)

$PLTR (+2,84%)

$IRBT (+4,66%)

$SYK (-1,49%)

$MDT (-1,04%)

$LMT (+0,78%)

$DPRO (-0,69%)

So today I have directly reinvested the proceeds secured below in 2 derivatives on $BTBT (+4,22%) ( long turbo ) and on $PLTR (+2,84%) ( Inliner )

After the first half of my derivative left my portfolio 1.5 weeks ago at $APLD (+10,82%) left my portfolio with 200%, I have now also sold the second half as part of a small risk minimization.

Since I was also asked yesterday after my post on the bubble which stocks I see as most at risk in the event of a downturn and could speculate on short, I have to say that $APLD (+10,82%) would certainly be one of them, like everything in the data center sector.

So also

But also companies like

$QBTS (+16,63%) and all the other small quantum players

and also

$APP (+4,49%) I see a good short opportunity in the event of a strong correction.

But it's not that far yet and who knows if and above all when it will happen.

In my humble estimation, it will not happen before the 2nd quarter.

That's why this list is not exhaustive and cannot be changed.

But you have to be prepared.

$PATH (+2,39%) is to $PLTR (+2,84%) similar to what $AMD (+3,4%) is to $NVDA (+1,16%)

Subscribe to the podcast to keep AI rolling.

00:00:00 Market environment

00:18:14 AMD, AI bubble

00:46:00 Gold

01:21:30 Silver

01:41:00 AppLovin, Palantir, Robinhood, Crowdstrike, Uber

Spotify

https://open.spotify.com/episode/7ikqEWGJPS0GUOGeyDz1sL?si=YRcXJc8PQ5GcOow-gX8MyA

YouTube

Apple Podcast

$AMD (+3,4%)

#gold

#siöber

#silver

$APP (+4,49%)

$UBER (+2,61%)

$PLTR (+2,84%)

$CRWD (+4,14%)

#podcast

#apotify

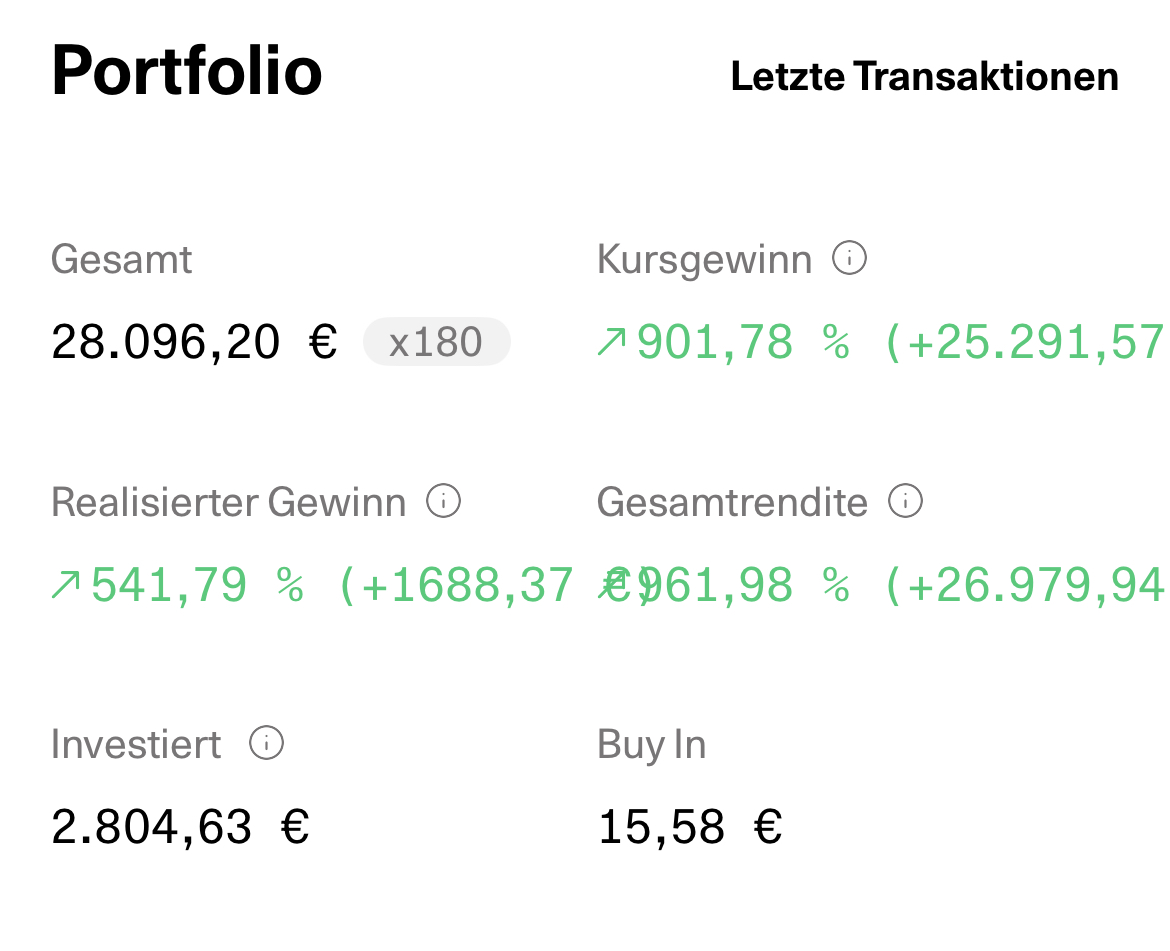

After $HAG (+2,22%) now also $PLTR (+2,84%) with a Tenbagger. Last time I had written that $HAG was faster but apparently I had overlooked the ATH of $PLTR (+2,84%) overlooked 😅

All the better that the price is picking up again.

We don't need to talk about the adventurous valuation. I'm curious to see if the company can actually grow into it.

I took out part of my stake in January at a price of €100. If things continue like this, I will probably sell another 30 shares at a price of €200. For the remaining 150 shares it's HODL.

Congratulations to all those who got in earlier and with more capital, e.g. @Techaktien

All in all, my portfolio has taken a bit of a hit due to the stock, but you have to accept that 🤗

That should be it in my portfolio with Tenbagger, no other candidates available.

Principais criadores desta semana