$ISRG (-0,71%)

$PATH (-1,19%)

$RR

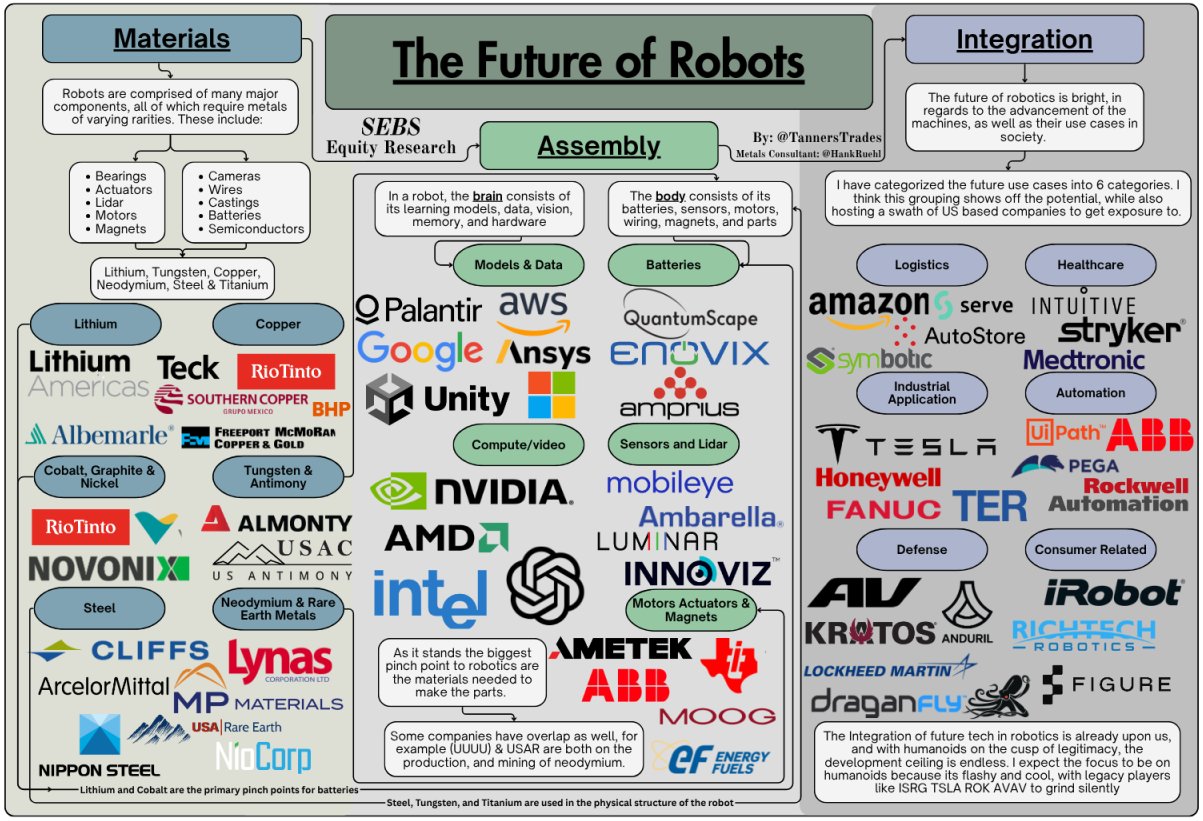

Here is an exciting overview, for me the most attractive in terms of growth/potential of the stocks I know $RR

$PATH (-1,19%) also $ISRG (-0,71%) I would perhaps add to the portfolio again in the event of a correction. However, there are some stocks I don't know either.

What do you think are the most exciting stocks on the list, where should we perhaps take a closer look?

$AMZN (-0,77%)

$MSFT (-0,43%)

$NVDA (+0,01%)

$AMD (-1,34%)

$GOOGL (+0,38%)

$GOOG (+0,36%)

$RIO (-0,42%)

$ALB (-0,44%)

$INTC (-1,2%)

$PLTR (-1,41%)

$IRBT

$SYK (-0,14%)

$MDT (-0,3%)

$LMT (-0,56%)

$DPRO (+0,38%)