I. Introduction and objectives

This report is a clear analysis of the Coinbase share ($COIN) (+0,61%) for investors looking for a very large growth potential (multiplier). We examine how Coinbase makes money, who runs the company, how it protects itself from competitors (the "moat") and how revenues are performing. The goal: A simple assessment of whether COIN is a worthwhile and forward-looking bet.

II The changing business model: from crypto trading to the financial superhighway

Coinbase began as a simple exchange where people could buy and sell cryptocurrencies. In the meantime, the company has developed into an all-round financial service provider for the entire crypto world, active in over 100 countries and serving both private customers and large companies. Today, revenue comes from two important areas.

Two revenue streams: Trading (Volatile) vs. Subscriptions and Services (Stable)

The transaction business (trading): This is the traditional main source of revenue. Coinbase earns fees here for buying, selling and trading cryptocurrencies.

Problem: This revenue is extremely volatile and depends directly on the whims of the crypto market. When prices fall and there is little trading, this turnover collapses. For example, trading turnover in the second quarter of 2025 (Q2 2025) fell sharply by 39% compared to the previous quarter to 764 million US dollars because there was less activity.

Subscriptions & Services (S&S): This is the future of the company. This revenue is recurring and more stable as it flows independently of daily trading.

Growth driver: This segment grew strongly by 64% in 2024, generating USD 2.3 billion in revenue. It includes:

Blockchain Rewards: revenue from staking (customers stake their cryptos and earn interest).

Stablecoin revenue: Interest income earned by Coinbase from the reserves of the digital dollar (USDC), which the company helped develop.

Coinbase One: Subscription services for customers.

The strategy: Coinbase wants to decouple itself from the wild trading fluctuations. This diversification is clearly reflected in the figures:

In 2021, stable subscription and services (S&S) revenue accounted for only around 6.6% of total revenue (total revenue: USD 7.84 billion; S&S: USD 0.52 billion).

In 2024, the S&S share had already risen to 35.0% (total revenue: USD 6.56 billion; S&S: USD 2.30 billion).

In the second quarter of 2025, the S&S share of USD 0.66 billion had already reached 44.0% of the quarterly revenue of USD 1.50 billion.

This shift towards stable income (such as interest income from USDC) makes the company more predictable and resilient.

III Management and Strategic Affiliation

A. Management team and expertise

Coinbase's management consists of a mix of visionaries and experienced managers who know how to run a large company.

Brian Armstrong (CEO & Founder): He has led the company since its inception in 2012. With a background in computer science and economics (Rice University) and experience as a software developer at Airbnb, he is the technical mind and strategic thinker.

Emilie Choi (President & COO): She is responsible for day-to-day operations and expansion. Her experience as a top manager at LinkedIn in corporate development is crucial for operational growth and scaling.

Alesia Haas (CFO): She is the chief financial officer.

Supervisory Board: High-profile members such as Marc Andreessen (tech investor) and Tobias "Tobi" Lütke (Shopify founder) ensure the focus on technology and broad acceptance.

B. The importance of policy and regulation

Brian Armstrong is more than just a CEO; he is a political fighter for the crypto industry. He actively advocates in Washington and globally for clear, crypto-friendly rules and supports super PACs with investments to positively influence the regulatory environment.

This political strategy is key: If crypto changes the global financial system, the company that sets the rules and infrastructure for it wins. Coinbase also strategically invests in the future via "Coinbase Ventures" (e.g. in new blockchains such as Optimism and Base, as well as in DeFi protocols ) to actively shape the crypto economy.

IV. Analysis of the moat: Trust and compliance

Coinbase's biggest competitive advantage is not only its technology, but above all its trust and compliance with complex financial rules.

Coinbase has positioned itself as the best regulated crypto player in the US. The company strictly adheres to laws such as the Bank Secrecy Act and the USA Patriot Act, which requires identity verification, the retention of transaction data and the reporting of suspicious activity. Building and maintaining this infrastructure (including tools such as Coinbase Tracer to track cash flows) is extremely expensive and difficult for new competitors to replicate.

This regulatory acceptance leads to a "profit flywheel" :

The reputation as a safe and compliant place attracts large investors and institutions.

These customers bring a lot of capital to the platform, which generates stable income from services (staking, custody).

This stable income in turn finances further compliance and product development. This makes the platform even more attractive and increases customer loyalty (high switching costs).

The expected positive outcome of the legal dispute with the US Securities and Exchange Commission (SEC announces discontinuation of civil action, as of October 2025) is a confirmation of this strategy. It cements Coinbase's role as the most important and secure gatekeeper for centralized crypto services in the US.

The stake in the stablecoin USDC is a strong buffer, as interest on the deposited US dollar reserves provides stable revenue. In addition, with initiatives such as Base (a faster and cheaper blockchain solution) and B2B payment solutions that utilize USDC , Coinbase is expanding its position as a centralized infrastructure provider for on-chain payments that aims to take market share from traditional payment networks.

Coinbase's revenues are like a rollercoaster ride. Annual revenue has fluctuated wildly. In the 2021 bull market, annual revenue peaked at USD 7.839 billion; in the 2023 bear market, it fell to USD 3.108 billion before rising again to USD 6.564 billion in 2024.

The core business has generally high gross margins (transaction costs are only around 17% of revenue in Q2 2025 ). However, Coinbase has high fixed costs, mainly for technology & development and regulatory compliance. Total operating expenses in Q2 2025 amounted to USD 1.522 billion, an increase of 37.54% compared to the previous year.

This means that when the market is booming and sales are high, profits explode exponentially (strong operating leverage). However, when the market is quiet, fixed costs quickly eat up income and can lead to losses.

The Q2 2025 results showed how important it is to look closely:

Coinbase reported an impressive total profit (net profit) of 1.43 billion US dollars . However, this profit came almost entirely from unrealized paper gains. Around 1.5 billion US dollars came from the revaluation of strategic investments (mainly in stablecoin issuer Circle) and a further 362 million US dollars from the company's crypto investment portfolio .

The adjusted net profit (i.e. the profit from pure day-to-day business), on the other hand, amounted to only USD 33 million . This discrepancy shows that The foundation of the operating business remained under pressure during quieter market phases. The real multiplier potential depends on the ability to generate stable operating income (S&S), not book profits.

VI Multiplier potential, valuation and risk profile

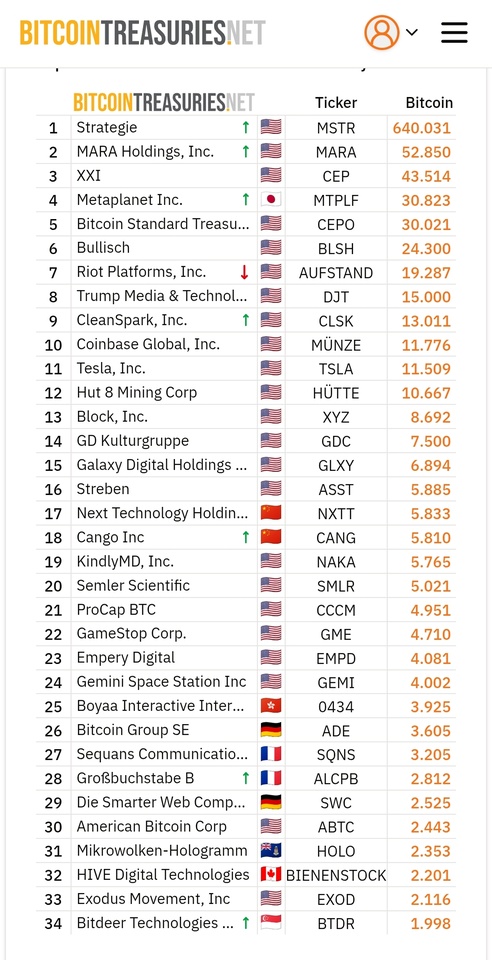

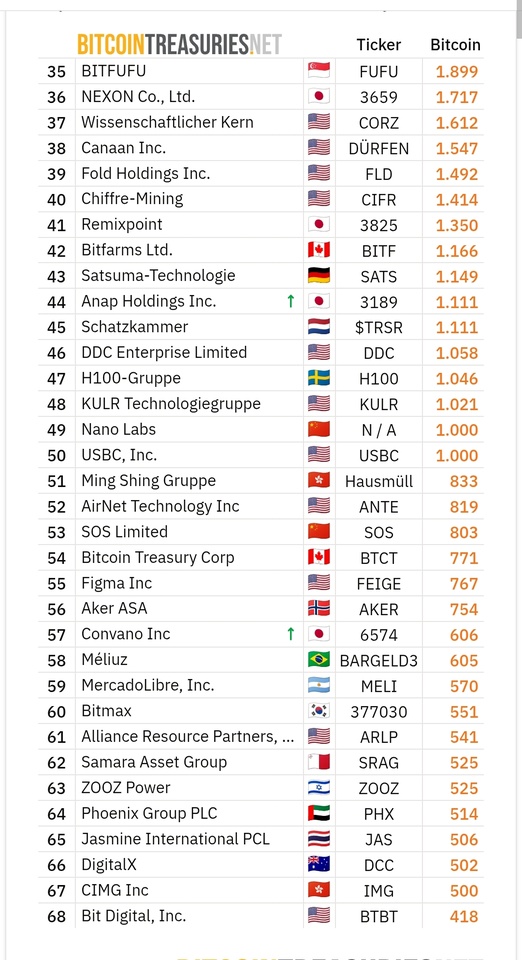

The multiplier potential of Coinbase stock is directly dependent on the belief that cryptocurrencies and blockchain will indeed replace or greatly transform global financial systems. Coinbase aims to be the most important "starting point" and service provider in this new economy.

Morningstar analysts estimate that the total market capitalization of cryptocurrencies could reach USD 5.25 trillion by the end of 2029. On this basis, Coinbase is expected to see average annual revenue growth of 12.5% over the next five years.

The bet on the multiplier is a bet on two scenarios:

Massive adoption: regulatory clarity leads to a huge influx of capital, resulting in growth well in excess of conservative forecasts.

Infrastructure monopoly: Proprietary ecosystems (USDC, Base) establish themselves as global standards for payments and crypto-economy, providing the stable S&S segment with unexpectedly high profits.

Valuation is difficult. Conservative estimates (Morningstar) put the fair value at USD 205 per share . The general analyst consensus is more bullish at USD 394.71.

At the current level (around 290-330 EUR/USD), the share seems to have already priced in much of the expected success.

Main risks:

Revenue remains vulnerable to long crypto bear markets that wipe out trading volumes. Decentralized exchanges (DEXs) often offer cheaper trading alternatives.

Even if things get better in the US, global regulatory changes remain a constant threat, especially for services such as staking and lending.

VII Summary and investment conclusion

Coinbase is the leading regulated player in the disruptive crypto sector. Its strength lies in trust, the regulatory shield (moat) and in actively shaping the crypto future (base, USDC).

The multiplier potential is real, but it is a high risk, high reward bet on the full adoption of cryptocurrencies as a true global financial system.

If crypto disrupts the global financial world as Coinbase expects, and the company manages to hedge its stable S&S business against the volatility of trading, then the stock has the potential for a significant multiple. It is an investment for investors who are willing to endure the high volatility and who share the confidence in the management's long-term vision. The fundamental opportunity lies in the hedging provided by the growing S&S segment.