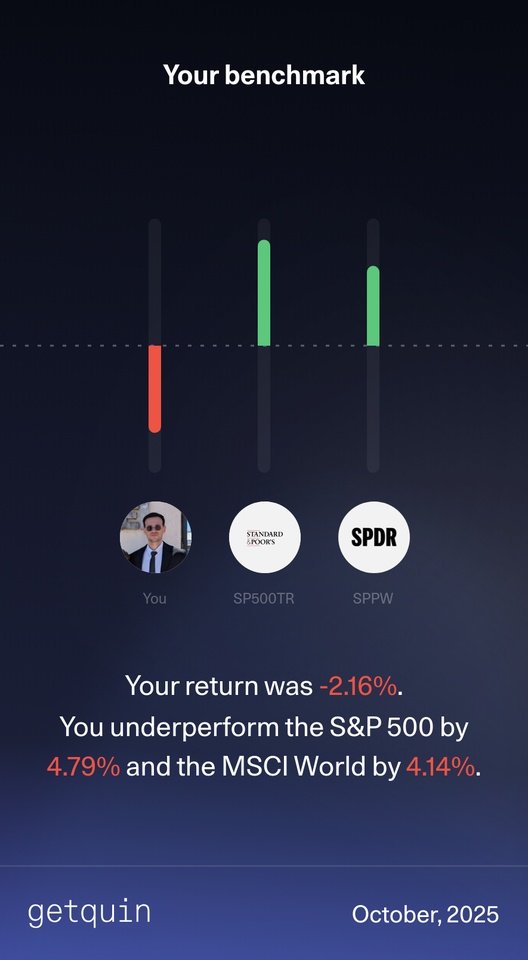

My portfolio showed a decline of -2.16% this month. I took advantage of dips in $HAUTO (+0,56%) and $BNP (+1,18%) to add to my positions. I’m invested in $CMCSA (-0,11%) and have opened positions there because they are shifting their focus towards entertainment and streaming, which I believe is a big part of the future.

The best performers this month were:

Qualcomm $QCOM (+1,33%)

CN Railway $CNR (+0,59%)

CIBC $CM (+1,22%)

Chevron $CVX (-0,5%)

On the downside:

Höegh Autoliners $HAUTO (+0,56%)

Novo Nordisk $NOVO B (-2,32%)

UnitedHealth Group $UNH (-0,11%)

Bitcoin $BTC (-4,63%)

Ethereum $ETH (-4,95%)

Since Novo Nordisk and UnitedHealth are my largest positions, their weak performance had a significant impact on my portfolio.

It was a cautious month with mixed results. I’m staying patient and ready for better opportunities ahead.