》CATL subsidiary Era Electric is becoming the next important player after Nio《

At the end of January, Contemporary Amperex Technology $3750 (-0,87%) held its annual partner conference "Choco-Swap" in Xiamen.

The event went off without much media coverage or an extensive press campaign. However, in footage released later via the official video channel, familiar names appeared among the participants: Sinopec, Gresgying Digital Energy and Xiaoju Charging from Didi.

In purely formal terms, some of these companies appear to be competing with CATL's subsidiary Era Electric Service Technology, but on the ground, executives shook hands, smiled and made plans for collaboration in the coming year.

In China's new energy sector, competition and cooperation often overlap, and CATL is expanding its partner network to create a shared energy ecosystem rather than operating in isolation.

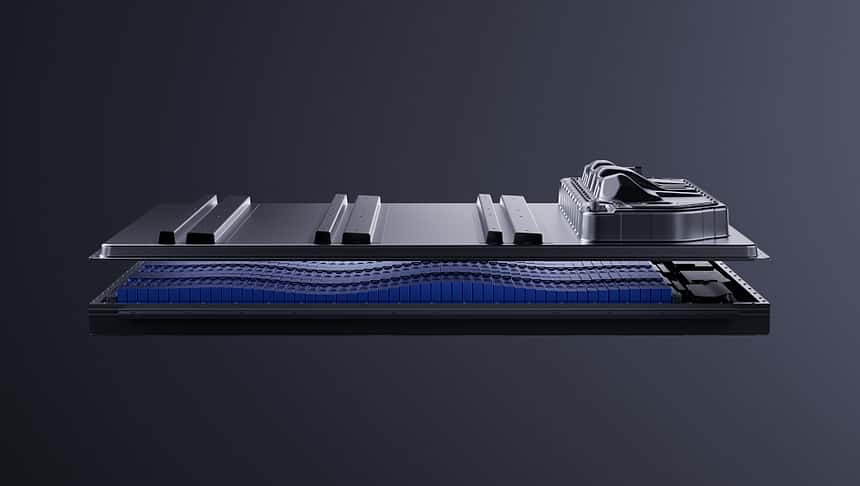

CATL has continued to build its electric vehicle traction battery business and the next target is charging infrastructure, although the company seems to recognize that it cannot achieve this alone.

》The plan is taking shape《

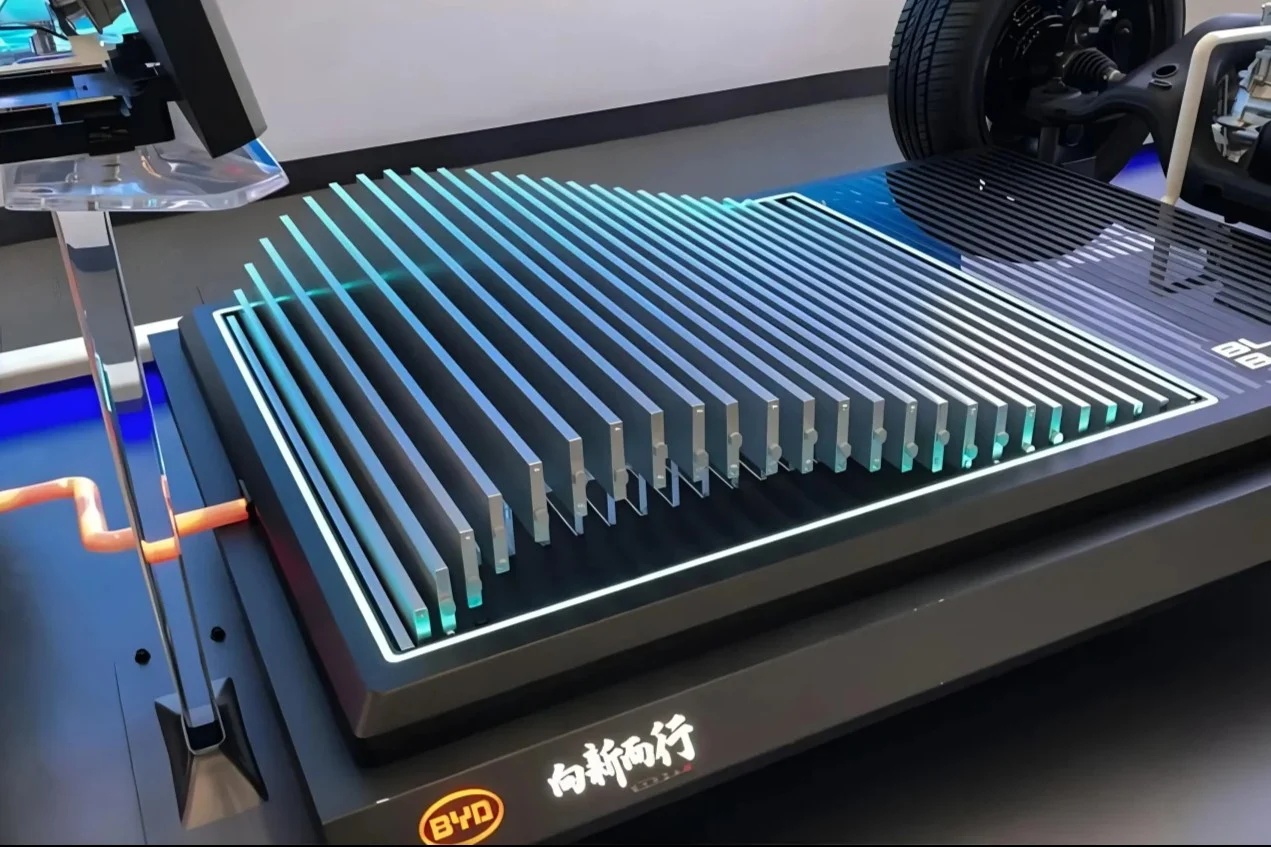

At the end of 2024, CATL's subsidiary Era Electric began the mass construction of Choco Swap stations. By the end of 2025, over 1,000 stations in 45 cities were already in operation.

By comparison, China has more than 100,000 filling stations nationwide. CATL has set itself the long-term goal of building 30,000 battery swap stations across the country.

Now that the first 1,000 stations are in operation, the pace is accelerating. Era Electric plans to open a further 2,000 Choco Swap stations in 2026, bringing the total number to over 3,000.

》What does 3,000 stations mean in concrete terms《

Nio $9866 (+3,08%)the car manufacturer most closely associated with battery swapping, currently operates around 3,700 such stations.

Building this network, which underpins the brand's premium positioning with a tank-like user experience, has required almost a decade of continuous investment.

Era Electric aims to reduce this timeframe to around a quarter.

》The infrastructure is complex《

Site selection, approvals and construction require time and capital. Qu Guojun, Head of Energy Development at Era Electric, explained that even the selection of suitable sites was a major challenge. "Over the course of 2025, we examined over 10,000 plots of land and ultimately secured around 1,000 sites," he said.

Charging and swapping infrastructure has become a focus for electric vehicle manufacturers. Tesla $TSLA (-0,19%), Li Auto $LI (-0,64%) and Xpeng $9868 (-0,95%) have each set up their own large-scale fast charging networks.

Nio, for example, has invested massively in exchange stations and, in addition to financial and human capital, such projects require outstanding implementation.

The construction of 1,000 Choco-Swap stations within a year demonstrates a high level of operational efficiency and organizational capability in this context.

Internally, this enabled Era Electric to establish mature operating systems and teams on site. Externally, it signaled commitment and removed doubts among industry partners, car manufacturers and consumers.

At CATL's 2024 Choco Swap Ecosystem Conference, Yang Jun, General Manager of CATL's battery swap business and CEO of Era Electric, outlined a phased plan: CATL would finance the first 1,000 stations and later work with partners to build 10,000 more. In the long term, the aim is to reach 30,000 stations through broader industry participation.

CATL wants to prove two things with Choco-Swap: that battery swapping is feasible on a large scale and that a shared ecosystem can be successful.

According to Deng Xu, Vice President of Era Electric, partnership requests are increasing and more and more vehicle models are compatible with Choco-Swap.