Yesterday was a rough one for the tech crowd. $ORCL (+0,05%) took a proper hit after The Information

(https://www.theinformation.com/briefings/oracles-ai-cloud-business-razor-thin-16-gross-profit-margin-new-data-show) shared some figures showing its shiny new AI business is running on margins of just 14% – and that’s before counting some potential losses on $NVDA (-0,3%) Blackwell chips.

That’s miles away from what everyone expected. The idea that “AI = easy profit” suddenly doesn’t look so bulletproof anymore.

$ORCL (+0,05%) stock dropped around 5%, and the whole cloud/AI sector followed it down. Nasdaq 100 slid roughly half a percent, but some individual names fell much harder – $SNOW (+0,45%)

$ZS (+0,21%)

$ZM (+0,47%)… and yeah, even $BILL (+0,62%) (which I’m holding myself 👀)

What’s behind the noise?

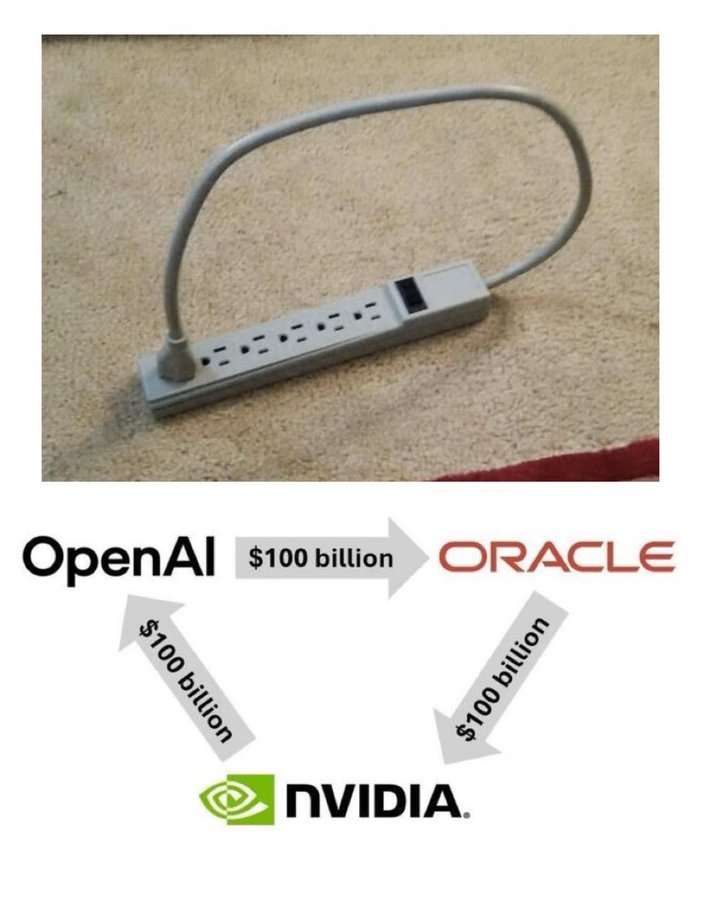

Turns out the costs of running massive AI infrastructure – chips, data centres, energy, staff – are chewing through profits faster than expected.

There’s also this slightly dodgy-sounding “circular funding” triangle going on between $ORCL (+0,05%) - OpenAI - $NVDA (-0,3%) basically money looping around the same players, propping up each other’s revenues.

Feels a bit like déjà vu from the early 2000s, doesn’t it?

About BILL

Funny thing is, $BILL (+0,62%) has also been in the news lately, but for something much healthier. They’ve teamed up with $ORCL (+0,05%)

NetSuite to improve B2B payments processing for US companies.

It’s a smart move, really. While $ORCL (+0,05%) AI margins look shaky, partnerships like this one show they’re still pushing to build value in the more “real-world” parts of the business stuff that actually saves companies time and money.

And for $BILL (+0,62%), it means tapping into $ORCL (+0,05%) huge client base and integrating deeper into enterprise systems proper long-term potential there.

My take. What do you think?

Yesterday’s dip felt more like a wake-up call than a meltdown.

AI’s not dead, but maybe it’s due for a reality check – not every company can print money just by slapping “AI” on the label.

Still holding my $BILL (+0,62%) position. It’s volatile, sure, but I reckon the fundamentals are sound and this partnership could age well once the market calms down a bit.

Was this just a short-term shakeout, or are we starting to see the first cracks in the AI hype cycle?

#Oracle

#BILL

#AI

#Cloud

#Investing

#TechStocks

#GetquinCommunity