IREN Limited, formerly Iris Energy Limited, is an Australian-based company that owns and operates data centers powered by 100% renewable energy. Its facilities are optimized for Bitcoin mining, artificial intelligence (AI) cloud services and other power-intensive computing. The mining data centers are located in Canal Flats, Mackenzie, Prince George and Childress. Bitcoin Mining provides security for the Bitcoin network. Al Cloud Services provides cloud compute for Al customers, 1,896 NVIDIA H100 and H200 GPUs. The Canal Flats facility is located in the Canadian Rocky Mountains, 100 kilometers (km) from Cranbrook Regional Airport and 500 km east of Vancouver. Its facility is located in Prince George, the city in northern British Columbia, 500 km north of Vancouver. The facility is located in Childress County, Texas, more than 250 miles northwest of Dallas and in close proximity to several wind and solar power plants in the region. The company operates 200 MW of data centers in Childress.

I have put together a few interesting graphics here and I would be interested in your opinion of the company.

@stefan_21

@Testo-Investor Have you already dealt with the miners, what do you think of $IREN (+2,38%) ? I would be interested to know ✌️

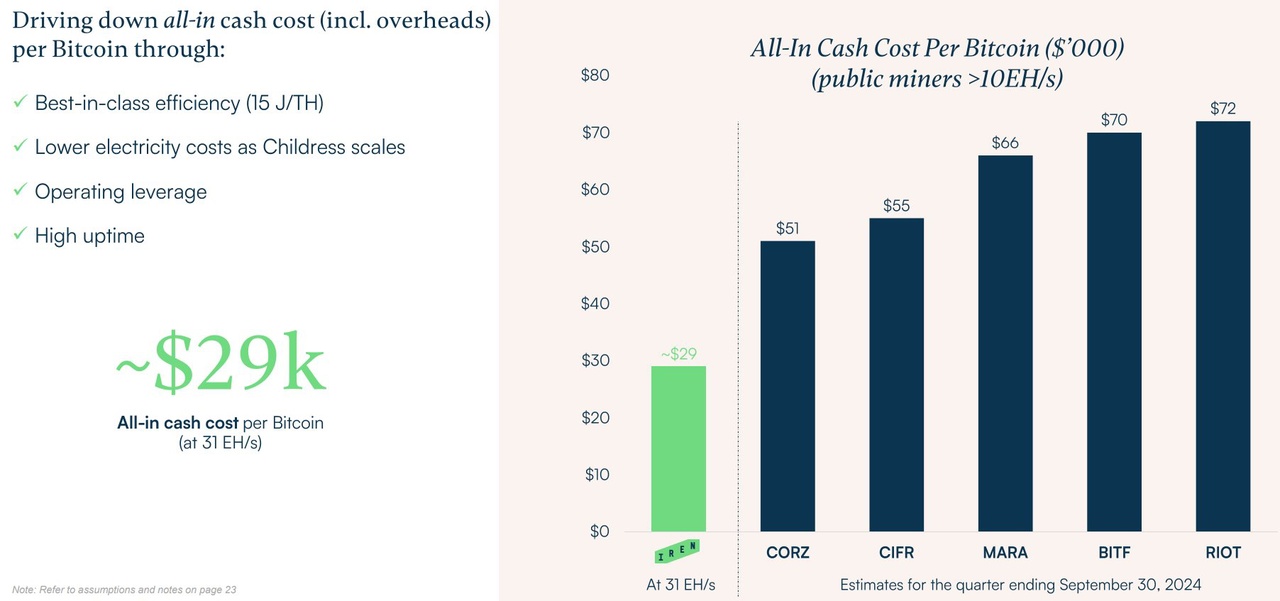

All- In Cash Cost per $BTC (-1,19%) :

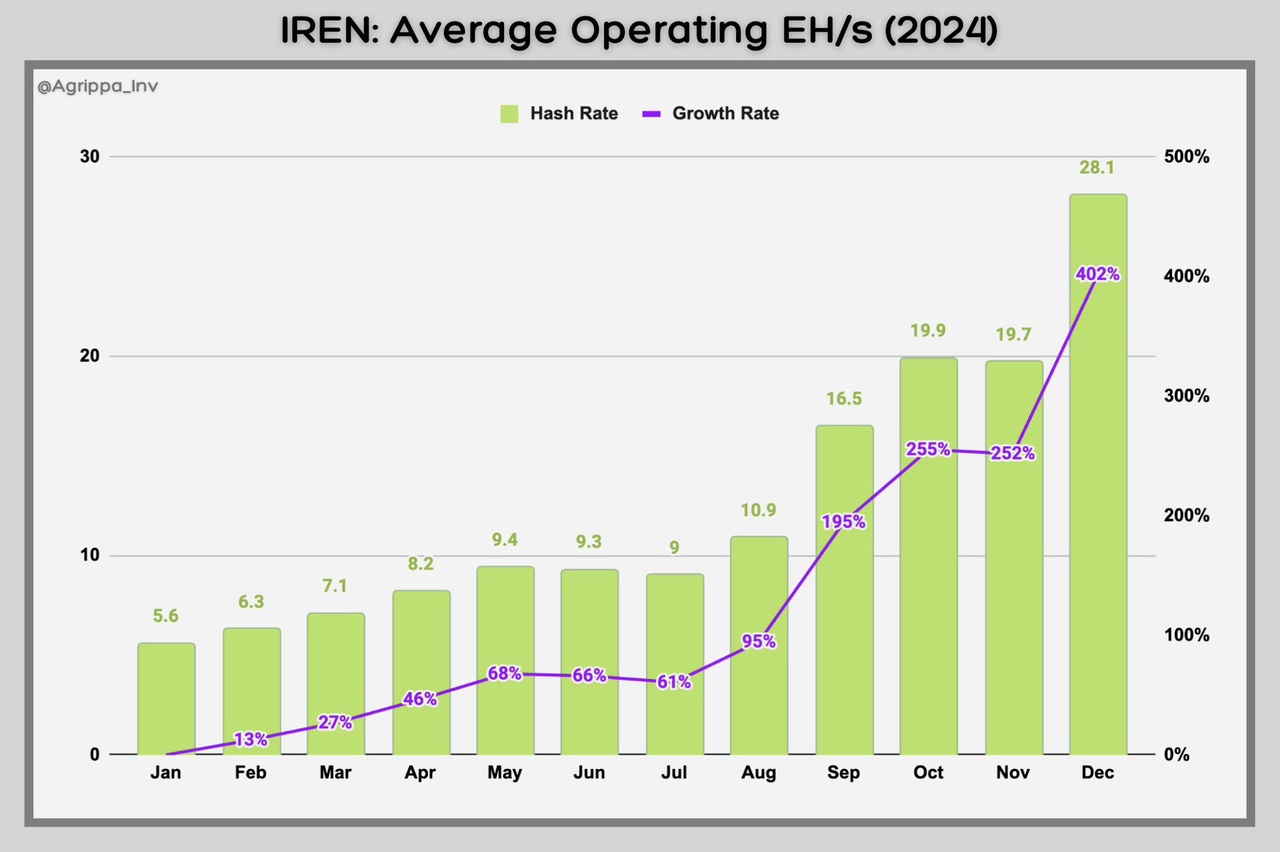

$IREN (+2,38%) Record-breaking growth in hash rate

In the year 2024 $IREN (+2,38%) set a new industry record for the fastest growth in operating hash rate (EH/s) in a single year among the $BTC (-1,19%) -miners, surpassing 400%.

$IREN (+2,38%) also held the previous single-year growth record of 350% in 2023.

Graphic: @Agrippa_Inv from 𝕏

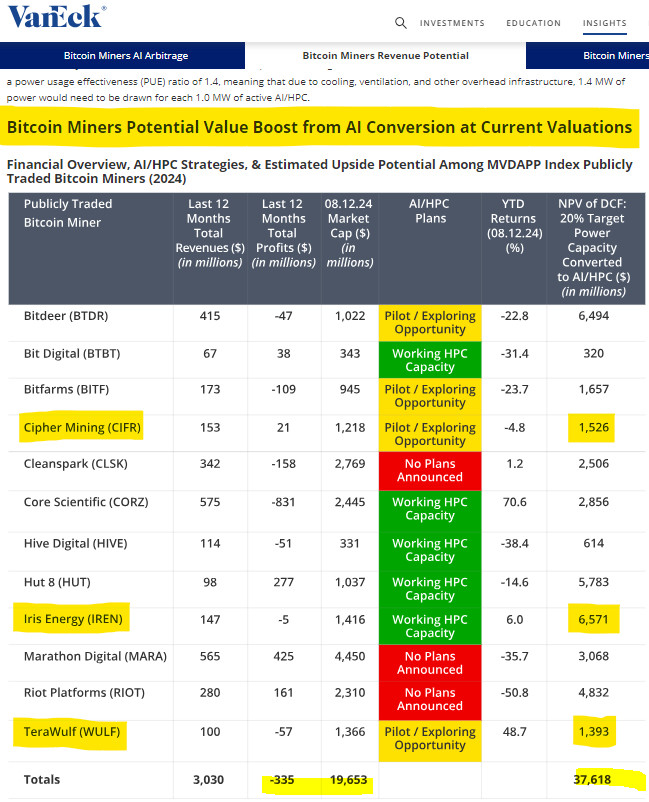

According to VanEck, switching from BTC mining to an AI data center of just 20% for $IREN would be worth a capitalization of $6,571,000,000.

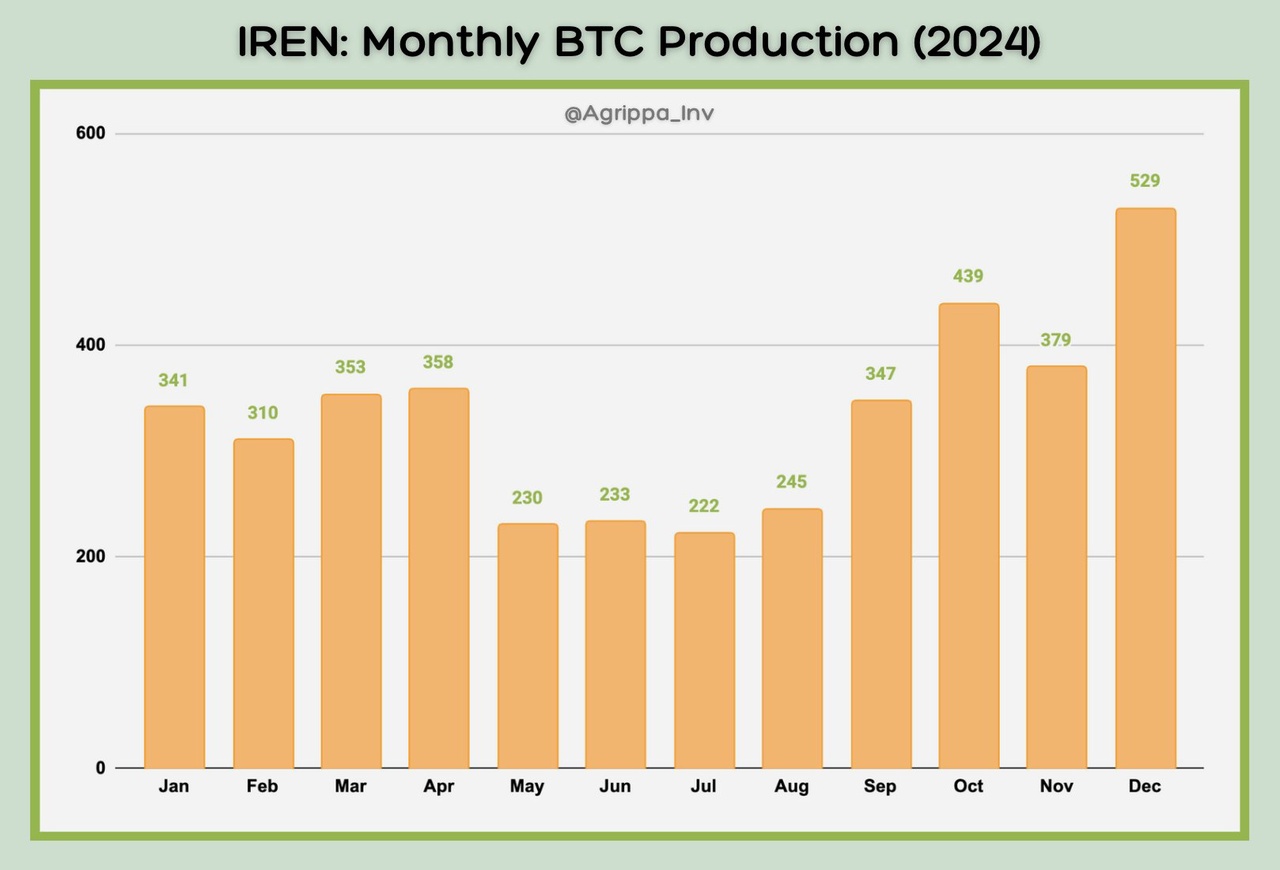

Despite $BTC (-1,19%) halving , $IREN achieved an impressive annual production growth of 55% - the highest growth rate among all public $BTC miners in 2024.

Graphic: @Agrippa_Inv from 𝕏

$CORZ (+1,87%) , $MARA (-0,16%) , $RIOT (+1,13%) , $BITF (+14,88%) , $CIFR (+12,64%) , $CLSK (+4,2%) , $WULF (+4,83%) ,