Discussione su GOOG

Messaggi

369"Be the Bottom you want to see"

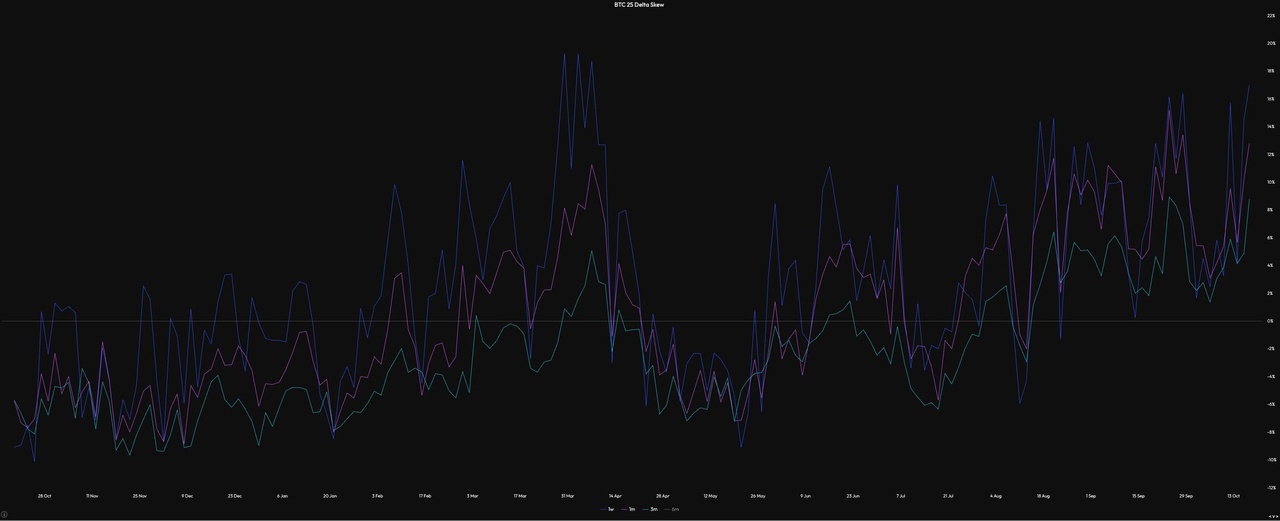

My $BTC (+1,17%) Thesis: Swing Long.

At the beginning of October, I sold around 20-25% of my BTC spot position at around $124,000. The reason for this was my system, which among other things consists of an order flow algorithm that generated a bearish reversal signal on a high timeframe (HTF).

After we saw an open interest unwind (liquidation of leveraged positions) on October 10, I have now bought back the first €20,000 in BTC. I have placed a further €50,000 via scaled limit orders up to $96,000. This is where the 365d rVWAP is located, which serves as multi-year support.

In this bull market, you rarely get both:

1) Price within 10% of the 350d MA

2) Drawdown of more than -10 % within the last 10d

→ Currently we see both.

Fear and Greed Index: (even though I am not a fan of it, it reflects, among other things, option skew, i.e. the current sentiment):

Options Skew (buying panic puts): at a level we last saw on April Low or September 2024 (both marked the bottom).

Bullish Key Points:

- post deleveraging event

- Extreme Fear on F&G

- BTC skew to multi-year highs

- Commodities look topped

- Q4 seasonality

- FED about to pause QT

- Rate cuts in stocks ATH - $NVDA (+2,31%)

$TSLA (-3,07%)

$MSFT (+0,63%)

$META (+0,46%)

$AMZN (+1,56%)

$AAPL (+1,23%)

$GOOG (+1,83%)

Basic knowledge: Think long-term, invest globally - The world ETF as a basic building block in the core portfolio

Reading time: approx. 10 minutes

The last article was about leveraged daily ETFs - in other words, about momentum, short-term market movements and strategies where timing is crucial. Today it will be much quieter. It's about what remains when markets fluctuate and hypes fade: the fundamentals.

This article is aimed primarily at beginners and is intended to help them find their way through the ETF jungle - to understand which products are truly global, how they differ and how to build a stable core portfolio.

After all, long-term wealth accumulation does not start with the search for the highest return, but with a solid core. In my case, this core consists of three pillars:

- $ISAC (+0,48%) (iShares MSCI ACWI UCITS ETF) - as a global equity building block

- $BTC (+1,17%) (Bitcoin) - as a diversifying, asymmetric building block with its own risk profile

- $SEGA (-0,34%) (iShares Core Euro Government Bond ETF) - as a defensive counterbalance on the bond side

These three positions form the backbone of my portfolio. The rest - i.e. rotation strategies, thematic investments or leveraged products - complement the foundation.

Why an ETF comparison is important

"World ETF" sounds like global diversification. In practice, however, many of these funds only cover industrialized countries. The difference between $XDWD (+0,46%) (iShares MSCI World UCITS ETF), $ISAC (+0,48%) (iShares MSCI ACWI UCITS ETF) and $VWCE (+0,39%) (Vanguard FTSE All-World UCITS ETF) is not a marginal detail, but crucial for your own investment strategy.

Anyone who understands these differences quickly realizes how much the selection of the index determines the actual distribution in the portfolio - and how much "world" is actually in your own ETF.

The $ISAC (+0,48%)

(iShares MSCI ACWI UCITS ETF)

The $ISAC (+0,48%) tracks the MSCI All Country World Index - around 2,800 stocks from 47 countries, covering around 85% of global market capitalization.

Regional breakdown (as at October 2025):

- USA: approx. 65 %

- Europe: approx. 15 %

- Asia (incl. Japan & China): approx. 10%

- Emerging markets: approx. 10 %

This combines the $ISAC (+0,48%) industrialized and emerging markets in one product - exactly what many investors replicate themselves with two ETFs (MSCI World + MSCI Emerging Markets).

The total expense ratio (TER) is currently 0.20% p.a. - extremely favorable for a global fund of this breadth.

I use it as a core building block because it combines global diversification with simplicity: one ETF, one decision, global participation.

$ISAC (+0,48%)

vs. $XDWD (+0,46%)

(iShares MSCI World)

The $XDWD (+0,46%) (iShares MSCI World UCITS ETF) only tracks 23 industrialized countries - no emerging markets, no China, no India. It contains around 1,500 stocks and is heavily dominated by the USA.

The $ISAC (+0,48%) (iShares MSCI ACWI UCITS ETF) expands this base to include 24 emerging markets and thus has around 2,800 stocks. This means:

- $XDWD (+0,46%) is more focused, somewhat more stable, but limited to mature markets.

- $ISAC (+0,48%) is broader, more future-oriented and contains more growth markets.

In recent years, the MSCI World has been slightly ahead because the emerging markets have underperformed. In the long term, these phases tend to even out - and this is precisely where the ACWI shows its strength: It automatically grows with the global economy, even if the regional focus changes.

$ISAC (+0,48%)

vs. $VWCE (+0,39%)

(Vanguard FTSE All-World)

The $VWCE (+0,39%) (Vanguard FTSE All-World UCITS ETF) is the best-known alternative to the $ISAC (+0,48%) . It also combines industrialized and emerging markets, but according to the FTSE index methodology and with around 4,000 shares - i.e. somewhat broader.

Both funds fulfill the same purpose: global coverage in a single product. The differences lie in the details - for example in the country classification (e.g. South Korea is listed as an industrialized country in FTSE, but as an emerging country in MSCI).

The performance is also almost identical. The TER of the $VWCE (+0,39%) at 0.19% p.a. is even slightly lower than that of the $ISAC (+0,48%) . Both funds therefore offer an almost equivalent opportunity to invest globally over the long term.

Concentration in the $ISAC (+0,48%)

Despite its breadth, the ACWI is also concentrated on a few heavyweights. The top 5 positions account for around 18% of the fund (as at October 2025):

- $NVDA (+2,31%) (NVIDIA)

- $AAPL (+1,23%) (Apple)

- $MSFT (+0,63%) (Microsoft)

- $GOOG (+1,83%) & $GOOGL (+1,8%) (Alphabet)

- $AMZN (+1,56%) (Amazon)

This shows how strongly the US technology sector shapes the global markets. This weighting is not a disadvantage, but a true reflection of global market capitalization. I consciously accept this structure, but balance it out with my other core components: $BTC (+1,17%) (Bitcoin) as an uncorrelated asset and $SEGA (-0,34%) (iShares Core Euro Government Bond ETF) as an anchor of stability.

Five-year performance (as at October 2025)

- $XDWD (+0,46%) (MSCI World): + 90 %

- $ISAC (+0,48%) (MSCI ACWI): + 84 %

- $VWCE (+0,39%) (FTSE All-World): + 83 %

The differences are manageable. The MSCI World benefited more from the dominance of the USA, while $ISAC (+0,48%) and $VWCE (+0,39%) are more broadly based. This global diversification can lead to more stable returns in the long term because it is less dependent on individual markets.

What newcomers can take away from this

In my opinion, an ETF is often sufficient. A global fund like the $ISAC (+0,48%) covers almost all markets - ideal for getting started.

Keep an eye on costs. A TER of 0.20 % is very favorable for this breadth.

Global means USA-dominated. Around two thirds of the fund comes from the United States - and that is currently the market reality.

Simplicity is an advantage. Those who manage fewer products remain more consistent in the long term.

Time beats actionism. The compound interest effect unfolds its power over years - not months.

The $ISAC (+0,48%) (iShares MSCI ACWI UCITS ETF) is the centerpiece of my portfolio. It stands for breadth, simplicity and global participation - and realistically reflects the global economy.

Together with the $BTC (+1,17%) (Bitcoin) - which not only brings potential returns but also diversification to the portfolio - and the $SEGA (-0,34%) (iShares Core Euro Government Bond ETF) as a defensive counterpart, a robust core setup is created that covers all dimensions: Growth, stability and risk diversification.

The rest - thematic or individual investments, rotation strategies or leveraged ideas - completes the foundation.

Questions at the end:

- How do you structure your core?

- Do you use an all-in-one ETF like the $ISAC (+0,48%) or do you prefer to combine your own with $XDWD (+0,46%) and emerging markets?

- And what role does $BTC (+1,17%) diversification, return or both play for you?

Otherwise, I'm with you all the way.

However, I form my core with solid, fundamental individual stocks.

📊 Market Update (October 17, 2025)

🇺🇸 USA

$SPX500 — Futures are moving in a decisive drop, indicating a strong negative open due to renewed regional bank stress.

$DJ30 — Futures in a sharp decline, dragged down by financial and cyclical stocks.

$NSDQ100 — Futures are markedly lower, with weakness in tech stocks solidifying.

💻 Tech & Growth Snapshot

$NVDA (+2,31%) — Up in pre-market, holding strong against the general weakness thanks to robust AI demand.

$GOOGL (+1,83%) — Under strong pressure, aligned with the overall Nasdaq decline.

$AVGO (+1,78%) — Aggressive profit-taking in the semiconductor sector.

$META (+0,46%) — Stable in pre-market, showing relative strength against its peers.

$MSFT (+0,63%) — Slight dip, following the market's bearish trend.

$QBTS (+3,39%) — Down again, volatility remains extreme in this sector.

$RGTI (+3,78%) — Down, the quantum computing sector is highly sensitive to the risk-off mood.

🛍️ Retail & Commerce

$AMZN (+1,56%) — Down in pre-market, negative sentiment weighs on consumer confidence.

$BABA (+1,49%) — Stable, counter-trending thanks to Asian positive sentiment.

$CVNA (+3,03%) — Down, the stock struggles to find a stable support base.

$SHOP (+3,64%) — Correcting some of its recent gains.

⚕️ Health & Pharmaceutical

$LLY (+0,54%) — Stable/Up slightly, the defensive sector offers timid refuge.

$HIMS (+1,27%) — Profit-taking in pre-market despite recent catalysts.

$INSM (-0,36%) — Mixed, the biotech sector moves disconnectedly, but with caution.

🇪🇺 Europe

STOXX 600 — Opening solidly up, boosted by defensive sectors and positive earnings reports.

GER40 — Up slightly, showing resilience despite US banking worries.

$LDO.MI — Up, the defense sector continues to outperform.

$IBE.MC — Stable, utilities confirm their defensive asset status.

$OKLO — Stable, the nuclear tech stock awaits concrete catalysts.

🏦 Banking & Finance

$$UCG (-2%) — Under strong pressure, the financial sector is generally affected by contagion fears.

$$ISP (-0,36%) — Markedly lower, negative sentiment dominates.

$$BAMI (+0%)

$CE (-0,45%) , $BPE (+1,74%) — Widespread selling on Italian banks.

$$BBVA (-0,12%) — In strong increase, counter-trending the sector due to positive corporate news or insulation from US regional bank stress.

$AXP (+0,56%) — Down in pre-market, facing consumer slowdown concerns.

$V (+0,08%) — Essentially flat, confirms its more defensive status.

🌏 Asia

$JPN225 — Close down, weighed by Wall Street losses and trade uncertainty.

$KOSPI — Close flat/slightly down, the market remains in a holding pattern.

$HK50 — Sharp fall, due to regional bank pressures and China's plenum anticipation.

$CHINA50 — Weak, caution dominates.

💱 Forex

$EURUSD — Down, the Euro loses ground against the haven Dollar.

$GBPUSD — Down, the Pound is under pressure.

$USDJPY — Falling sharply, the Yen is rallying as the Dollar loses momentum on Fed rate-cut hopes.

$DXY — The Dollar Index is showing strength, acting as a safe haven.

💎 Commodities & Precious Metals

$GLD (-0,34%) — Strong rally, gold hits new record highs on strong safe-haven demand.

$CDE (-1,6%) — Up sharply, following the explosive trend of gold.

$BRENT — Down slightly, global demand fears persist.

$WTI — Losing ground, affected by negative macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (+0,68%) — Tracks the negative S&P 500 futures.

$VGT (+1,34%) — Down, reflecting weakness in the technology sector.

$CSNDX (+0,82%) — Tracks Nasdaq futures in negative territory.

$VWCE (+0,39%) — Stable/Down, reflects the mixed global trend.

$BND (-0,02%) — Up, as bond yields fall due to safe-haven demand.

💰 Crypto

$BTC (+1,17%) — Down slightly, aligned with the general risk-off mood.

$ETH (+2,81%) — Following Bitcoin, showing broad weakness.

$CRO (+4,28%) — Flat/Down slightly, in line with the rest of the market.

$TRX (-1,64%) — Down slightly, the sector struggles to find significant support.

🚀 Space & New Tech

$RKLB (+1,36%) — Weak in pre-market, aligning with other growth stocks.

🔎 Deep Dive: Gold & Banking Stress

The day is polarized: the strong safe-haven demand for Gold ($GLD) is the dominant theme, hitting new all-time highs due to persistent US regional bank stress. While European markets, specifically $BBVA.MC, show resilience and an isolated uptrend, the US futures and Italian financial stocks are struggling. The overall takeaway is a heightened sense of systemic risk, forcing investors into traditional havens while penalizing US high-beta stocks. The strength of $NVDA remains a key structural theme resisting the general decline.

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

Sale for the loss account pot

This time I made a conscious decision to sell. On the one hand, Alphabet has done really well recently and, on the other, I would like to balance out my loss pot a little at the end of the year.

I'm not yet sure how clean and easy the transition at Scalable will be. This is another factor why I made the sale now.

Edit: Just to be clear again. The loss calculation head was only a minor factor. I just asked myself the question. What happens if the loss account header is not transferred properly when the securities account is transferred? This has happened to me before.

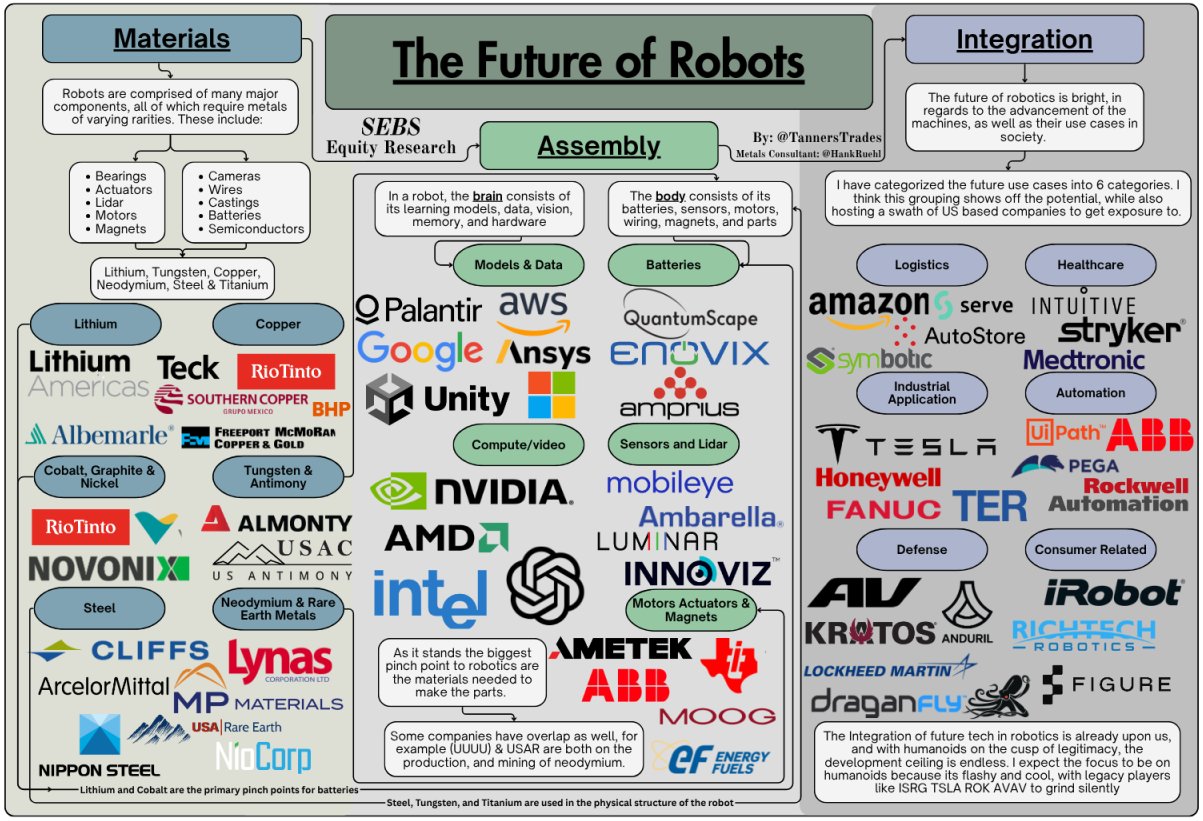

The Future of Robots 🤖🦾🦿

$ISRG (-1,06%)

$PATH (+6,86%)

$RR

Here is an exciting overview, for me the most attractive in terms of growth/potential of the stocks I know $RR

$PATH (+6,86%) also $ISRG (-1,06%) I would perhaps add to the portfolio again in the event of a correction. However, there are some stocks I don't know either.

What do you think are the most exciting stocks on the list, where should we perhaps take a closer look?

$AMZN (+1,56%)

$MSFT (+0,63%)

$NVDA (+2,31%)

$AMD (+6,32%)

$GOOGL (+1,8%)

$GOOG (+1,83%)

$RIO (-0,48%)

$ALB (+8,64%)

$INTC (-7,3%)

$PLTR (+2,29%)

$IRBT (+16,58%)

$SYK (-1,03%)

$MDT (-1,09%)

$LMT (-0,76%)

$DPRO (+12,89%)

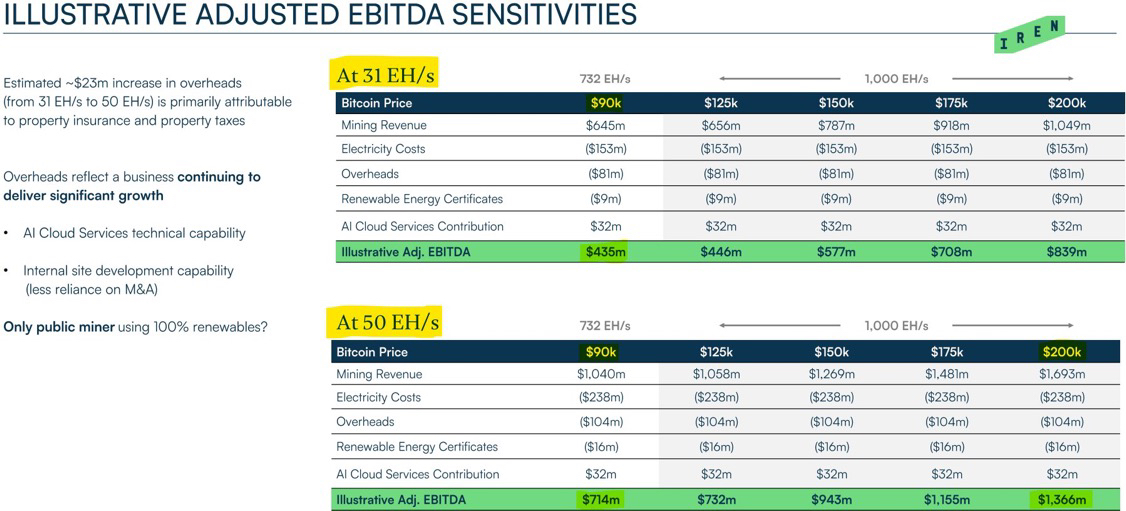

Incredible potential from Iren 👌

$IREN (+11,25%) started earlier than its competitors. The potential is incredible in the truest sense of the word.

"We own the entire stack - land, electricity, substations, data centers and computers. We don't lease anything. This means lower costs, higher performance and long-term reliability. Currently, GPUs consume less than 2% of our total energy portfolio."

CEO & Founder Daniel Roberts

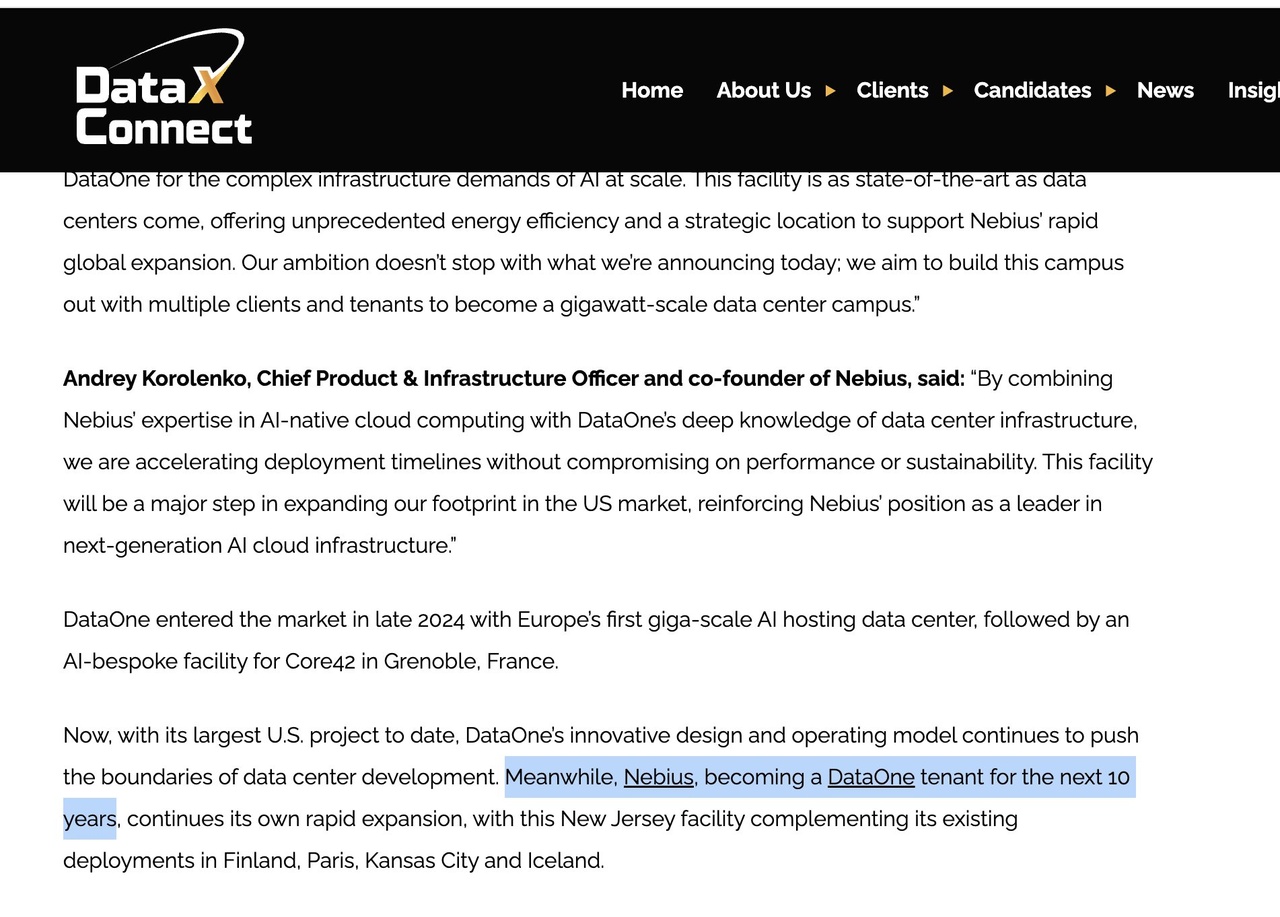

$IREN (+11,25%) Vertical DC integration

What does the vertical integration of data centers mean for $IREN (+11,25%) ? We take a look at this article from DataXConnect: " $NBIS (+9,49%) will be a DataOne tenant for the next 10 years" (1). $NBIS (+9,49%) provides the designs for the construction by DataOne. DataOne owns power, land, substations, transmission infrastructure, backup power generation and facility operations!

$NBIS (+9,49%) pays colocation to DataOne! The 3.7 billion that Google/Fluidstack $WULF (+6,05%) pays for 200 MW (2)? The 3 billion that Google/Fluidstack pays $CIFR (+17,08%) pays for 168 MW (3)?

$NBIS (+9,49%) DataOne is paying around 5.45 billion for their 300 MW. It is probably more, as DataOne has significantly more influence than $WULF (+6,05%) / $CIFR (+17,08%) as DataOne/BSO operates 240 data centers worldwide; for comparison: $EQIX (+0,56%) (75 billion mcap) has 270 data centers. In addition, DataOne has additional capital expenditures for gas turbines behind the meter and will likely pass at least some of the costs on to $NBIS (+9,49%) pass on. For $IREN (+11,25%) which has already paid most of these costs at lower prices, this is largely pure margin!

From the Neoclouds $ORCL (+1,12%) , $CRWV (+6,79%) , $NBIS (+9,49%) , $IREN (+11,25%) . Is $IREN (+11,25%) the only ones who own their own land, power, data centers and electrical infrastructure! $CRWV (+6,79%) was lucky and signed a contract with $CORZ (+5,14%) when $CORZ (+5,14%) was on the verge of bankruptcy. He also secured $ORCL (+1,12%) Crusoe's electricity when Crusoe failed at Bitcoin mining. $CRWV (+6,79%) at least recognizes the weakness and tries to $CORZ (+5,14%) to buy up.

$CIFR (+17,08%)

$CRWV (+6,79%)

$NBIS (+9,49%)

$GOOGL (+1,8%)

$GOOG (+1,83%)

$MSFT (+0,63%)

$META (+0,46%)

$ORCL (+1,12%)

$NVDA (+2,31%)

$WULF (+6,05%)

IREN Limited the most efficient Bitcoin miner with enormous potential ?

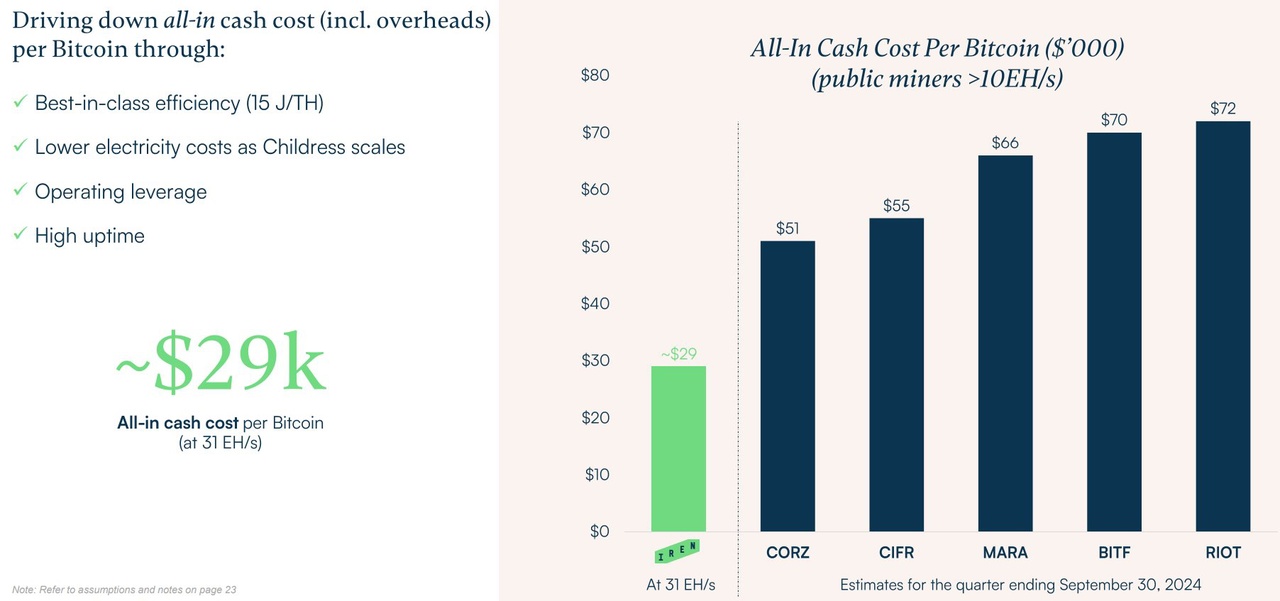

IREN Limited, formerly Iris Energy Limited, is an Australian-based company that owns and operates data centers powered by 100% renewable energy. Its facilities are optimized for Bitcoin mining, artificial intelligence (AI) cloud services and other power-intensive computing. The mining data centers are located in Canal Flats, Mackenzie, Prince George and Childress. Bitcoin Mining provides security for the Bitcoin network. Al Cloud Services provides cloud compute for Al customers, 1,896 NVIDIA H100 and H200 GPUs. The Canal Flats facility is located in the Canadian Rocky Mountains, 100 kilometers (km) from Cranbrook Regional Airport and 500 km east of Vancouver. Its facility is located in Prince George, the city in northern British Columbia, 500 km north of Vancouver. The facility is located in Childress County, Texas, more than 250 miles northwest of Dallas and in close proximity to several wind and solar power plants in the region. The company operates 200 MW of data centers in Childress.

I have put together a few interesting graphics here and I would be interested in your opinion of the company.

@stefan_21

@Testo-Investor Have you already dealt with the miners, what do you think of $IREN (+11,25%) ? I would be interested to know ✌️

All- In Cash Cost per $BTC (+1,17%) :

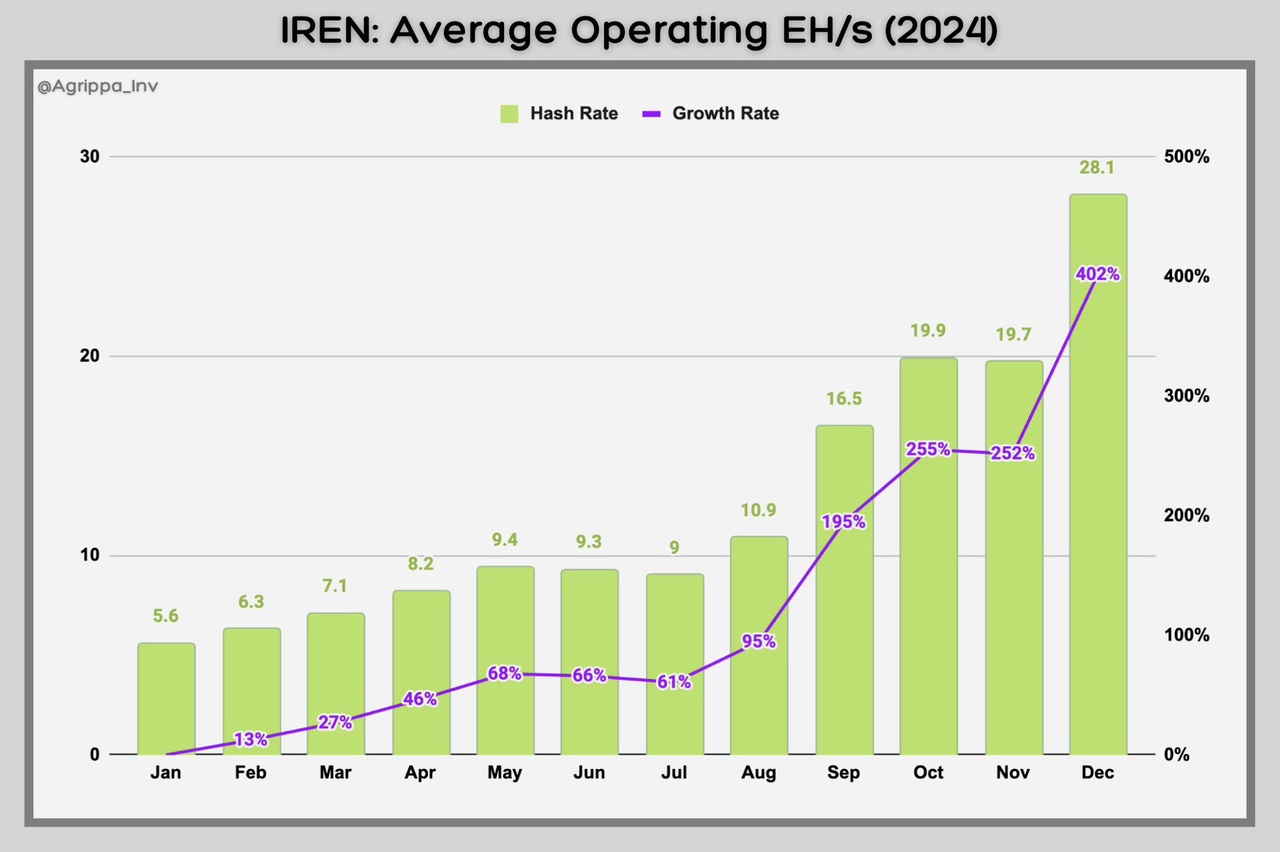

$IREN (+11,25%) Record-breaking growth in hash rate

In the year 2024 $IREN (+11,25%) set a new industry record for the fastest growth in operating hash rate (EH/s) in a single year among the $BTC (+1,17%) -miners, surpassing 400%.

$IREN (+11,25%) also held the previous single-year growth record of 350% in 2023.

Graphic: @Agrippa_Inv from 𝕏

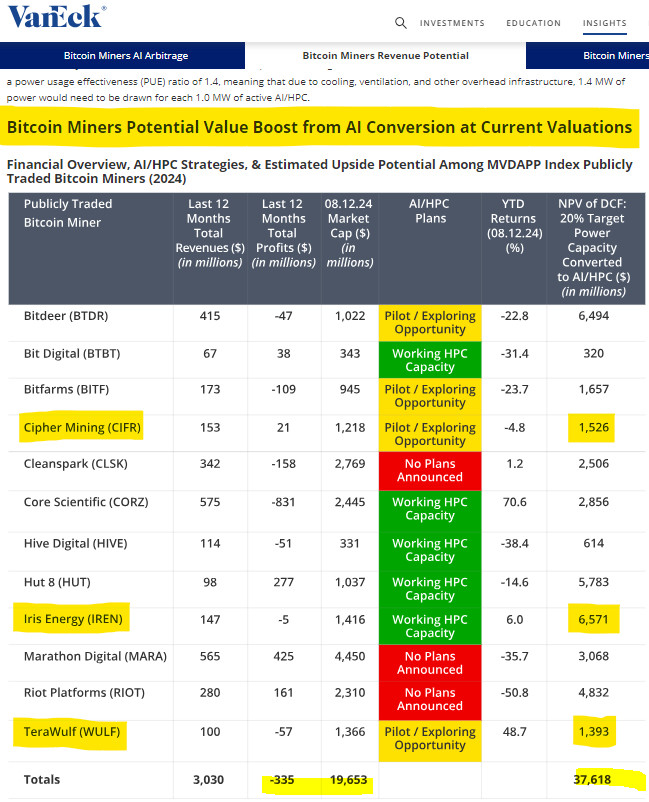

According to VanEck, switching from BTC mining to an AI data center of just 20% for $IREN would be worth a capitalization of $6,571,000,000.

Despite $BTC (+1,17%) halving , $IREN achieved an impressive annual production growth of 55% - the highest growth rate among all public $BTC miners in 2024.

Graphic: @Agrippa_Inv from 𝕏

$CORZ (+5,14%) , $MARA (+1,14%) , $RIOT (+5,14%) , $BITF (+11,33%) , $CIFR (+17,08%) , $CLSK (+8,7%) , $WULF (+6,05%) ,

+ 2

Depot presentation

A silent reader for a long time, now my first post asking for feedback on my portfolio.

# Investment strategy

- Core-Satellite with MSCI World $IWDA (+0,51%) , $SPPW (+0,45%) and SP 500 $CSPX (+0,63%) , $I500 (+0,64%)

- Monthly investment: € 3,000-6,000 (fluctuates seasonally/because of bonuses and vacations).

- Current monthly savings plans: $VFEG (+0,3%) Emerging Markets 1000€, MSCI World 1000€, Euro Stoxx 600 $MEUD (+0,01%) with 600 € + $EWG2 (+0,43%) Gold and $BTC (+1,17%) -purchases on top without a fixed savings plan.

- Individual shares: US Hyperscaler $GOOG (+1,83%), $MSFT (+0,63%), $AMZN (+1,56%) due to professional proximity, US share deliberately reduced by other stocks, etc. $DTE (-1,36%) , $NOVO B (+0,13%) , $ASML (-0,02%) ,

- Target weighting for alternative investments (gold/BTC) at least 10%.

- S&P 500 savings plan currently suspended as valuations appear too high.

- In future possibly: Max. 10% in speculative individual stocks (max. 2% per security). There are always interesting ideas here in the community

# Targets

1. remaining amount from house loan: due in 5 years € 35k (currently € 600/month charge) + in 10 years € 217k (currently € 1,600/month charge). Due to favorable interest rates (1.3%), I do not make any early unscheduled repayments.

2. building up retirement provision & financial freedom.

# Notes

- I have 2x SP500 and 2x MSCI World because I switched due to high gains and lower TER. It was recommended somewhere because of the FIFO principle for payouts. In retrospect, I would solve this at ING with a 2nd custody account.

- I have my BTC with Bitvavo and am satisfied

- Child custody account: In $TDIV (+0,07%) invested, dividends (~600 €/year) are reallocated to MSCI World to use the exemption order, current custody account value for the 4-year-old: 4,900 €.

- Both employed (41/36 yrs.), gross household income ~€185k/year, wife works 32 hours/week.

- Property value house (new build 5 years ago in a medium-sized state capital), rented and paid-off condominium (600e/m net rent), occupational pension, Riester ETF are not included here.

My tip to the getquin community: Don't forget to live your life while investing :-)

For me:

- Own house -> quality of life is priceless, I can only recommend it to everyone, even if I had to almost completely liquidate my portfolio 5 years ago

- Road trips in the USA/Canada (before child and before Trump) -> countless great experiences

- Ford Mustang GT Convertible (6th gen) -> :-)

* Have you set yourself a specific allocation of ETFs / regions?

* How do you see your US weighting?

Without seeing it exactly, I suspect a larger US and tech overweight (S&P500, individual stocks and MSCI World).

On the other hand, you could split the portfolio from the "core" into two parts:

a) MSCI + EM

b) SP500 + Stoxx600 + EM

All in all, a portfolio with structure and a roadmap 💪 Keep it up!

Shovel manufacturers - why I rely on the enablers

Reading time: 2-3 minutes

On the stock market, the spotlight is usually on the companies that sell their products directly to customers. However, I find the companies in the background more exciting - the shovel manufacturers who make the actual operation possible in the first place. That's where I see the more stable opportunities in the long term.

A prime example is $ASML (-0,02%) (ASML Holding). Their lithography machines are the backbone of the semiconductor industry. Without them, there would be no chips for smartphones, AI models or e-cars. With a gross margin of over 50% and a virtually unrivaled market position, they are the epitome of a shovel manufacturer for me. Of course, the share price is not cheap, but I see a long-term fundamental investment here.

Then $GOOG (+1,83%) (Alphabet). Many label Alphabet as an advertising company, but for me they are the digital infrastructure par excellence. Billions of people access Google Search and YouTube every day. What I find even more exciting is the Google Cloud, which is now growing by over 30% and is a key driver for future AI applications. There are also exciting projects and topics such as quantum computing and autonomous mobility. Anyone scaling into the internet or AI can hardly avoid Alphabet - and that's exactly what makes it a shovel manufacturer in the digital age.

And last but not least $INOD (+2,8%) (Innodata). Much smaller, but interesting for precisely that reason. They supply data processing and training pipelines for AI - the raw material that big tech companies urgently need. The share price has risen massively in the last month, so I have reduced the position. But the story remains exciting: Innodata makes data usable and thus provides the shovels in the AI gold rush.

For me, the pattern is clear: shovel manufacturers benefit from major trends because they provide the tools without having to bear the risks of individual end products themselves. They often have a technological edge that makes them difficult to replace, and it is precisely this combination of stability and growth that makes them attractive in the long term.

How do you see it - do you tend to focus on the enablers in the background or on the companies that are directly at the forefront of new trends?

My New Investing Approach (investing in monopolies). Sold all my All World ETF

One week ago, I decided to sell my $VWCE (+0,39%) shares, Why? Because I just decided to pursue what i do best and I like the most: holding a high-conviction portfolio with the companies that have the widest moats on earth, combined with network effects, high barries to entry, high switching costs and truly high ratios. Inspired by Dev Kantesaria and Joseph Carlson. And I aim to buy them cheap when they are surrounded by a bad narrative.

New additions:

$FICO (+3,16%) A monopoly in credit scoring, heavily protected by regulations as Freddie Mac and Fannie Mae require a FICO Score to buy the mortage from the banks to then make it a MBS (Mortage-Backed Security). Today up +19% as they have eliminitaded the credit bureau intermediaries ($EFX (+1,01%)

$TRU (+2,08%)

$EXPN (-0,48%) ), making its Score cheaper for banks, and aswell increasing their margins.

$INTU (+1,64%) monopoly in medium and small companies accounting and consumer taxes payment in the USA and Canada. Astronomically high switching costs, and nobody wants to mess with their taxes or their accounting.

$DUOL psychology-based monopoly, built on network effects and habits. Largest language-learning database on earth, with hundreds of millions of MAU (Monthly Active Users) and more than 10million DAU (Daily Active Users), who do not wanna break their +1000days streak. Its subscription-based model is top-tier for fundamentals. Furthermore they are growing their TAM (Tota Addressable Market) with the addition of math, music and chess lessons., aswell as expanding the high-margin revenue stream form the DET (Duolingo English Test) worlwide.

I divide my investments in three types:

- Moat type 1 (just irreplaceable companies): ($ASML (-0,02%) , $GOOG (+1,83%) , $FICO (+3,16%) ) from 70% to 80% of the portfolio

- Moat type 2(the best in their segment, hold most of the market share): ($INTU (+1,64%) , $DUOL ) 20% to 25%

- $BTC (+1,17%) (no explanation, just investing in the perfect monetary policy)

Titoli di tendenza

I migliori creatori della settimana