My $BTC (-3,59%) Thesis: Swing Long.

At the beginning of October, I sold around 20-25% of my BTC spot position at around $124,000. The reason for this was my system, which among other things consists of an order flow algorithm that generated a bearish reversal signal on a high timeframe (HTF).

After we saw an open interest unwind (liquidation of leveraged positions) on October 10, I have now bought back the first €20,000 in BTC. I have placed a further €50,000 via scaled limit orders up to $96,000. This is where the 365d rVWAP is located, which serves as multi-year support.

In this bull market, you rarely get both:

1) Price within 10% of the 350d MA

2) Drawdown of more than -10 % within the last 10d

→ Currently we see both.

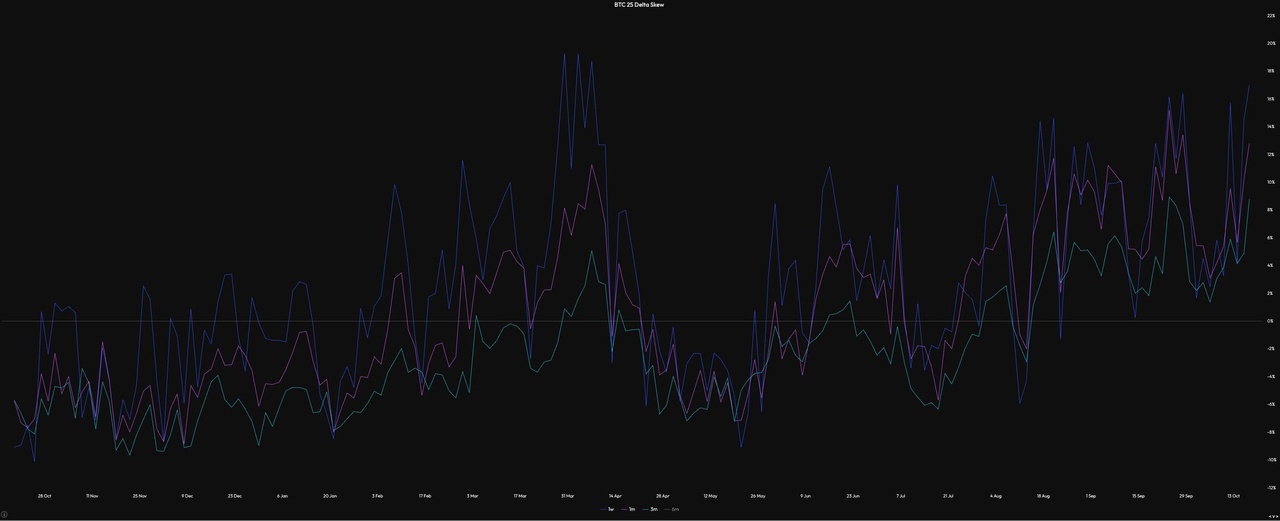

Fear and Greed Index: (even though I am not a fan of it, it reflects, among other things, option skew, i.e. the current sentiment):

Options Skew (buying panic puts): at a level we last saw on April Low or September 2024 (both marked the bottom).

Bullish Key Points:

- post deleveraging event

- Extreme Fear on F&G

- BTC skew to multi-year highs

- Commodities look topped

- Q4 seasonality

- FED about to pause QT

- Rate cuts in stocks ATH - $NVDA (-1,17%)

$TSLA (-0,77%)

$MSFT (+0,65%)

$META (+0,33%)

$AMZN (-1,75%)

$AAPL (-1,77%)

$GOOG (+0,51%)