Early May 2025 finds the dry bulk market at a pivotal moment. Capesize vessels maintain strength on iron ore and bauxite flows, Panamax softens under holiday disruptions, Supramax/Ultramax struggles with muted activity, and Handysize battles persistent oversupply. U.S. tariff policies and Chinese steel export probes cast shadows, while Indian iron ore imports and rerouted pulp trades offer glimmers of opportunity. This sector is a freighter navigating turbulent seas—let’s chart its path.

⏬ Capesize Market: Anchored by Iron Ore Demand

Rate Stability

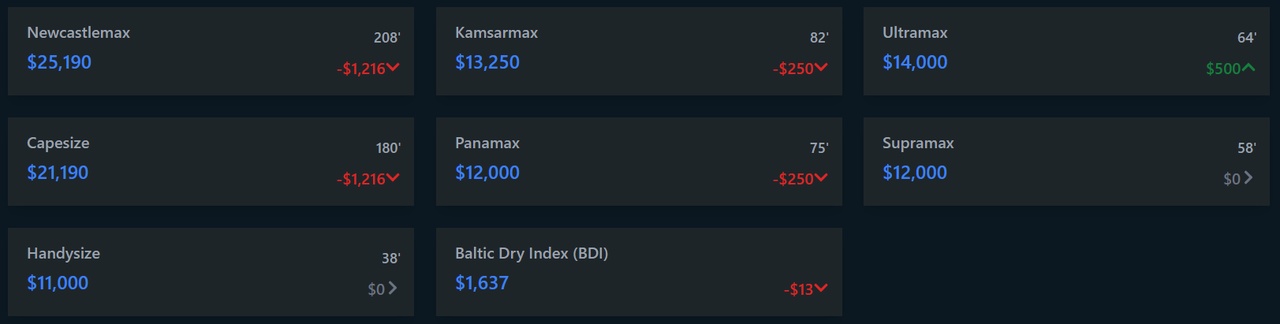

Capesize vessels, the behemoths of iron ore and coal transport, hold a steady course. The Baltic Capesize Index (BCI) 5TC reaches $17,241 per day, up 10% week-on-week, with average rates at $16,408 by April 29, a 19% seven-day gain. The Western Australia-to-China (C5) route hovers around $8.005 per tonne, with 170,000-tonne iron ore cargoes from Dampier-to-Qingdao fixed at $8.05 and Port Hedland deals at $8.00. Brazil-to-China (C3) slips to $19.345 per tonne by May 2 (from $19.695), though mid-May fixtures hit $19.00. North Atlantic fronthaul routes shine, with the C9 index jumping $1,126 to $38,719, driven by a 181,319-dwt vessel fixed at $39,000 from Rotterdam via Port Cartier—steady demand underpins this resilience.

Cargo Currents

West Australia sees robust enquiries for mid-to-late May cargoes, with miners and operators active, while Pacific volumes rise modestly. Brazil and West Africa-to-China routes focus on second-half May and early June, with a 170,000-tonne cargo from Puerto Drummond-to-Iskenderun at $13.25 per tonne. Pacific tonnage tightens as spot vessels in the Far East dwindle, though ballaster lists remain lengthy. Guinea’s bauxite shipments (up 12.3 million tonnes in Q1) bolster Atlantic demand, offsetting Australian iron ore losses (down 13.7 million tonnes due to Port Hedland weather disruptions). Brazil (down 2.0 million tonnes) and Canada (down 1.5 million tonnes) add pressure, but Indian iron ore imports (2.3 million tonnes in Q1, up from 0.8 million) support Capesize—cargo flows sustain market firmness.

Global Influences

U.S. port fees ($18-$33 per net tonne by 2028) exempt bulkers under 80,000 dwt, minimally impacting Capesize. U.S.-China tariff hikes (affecting 4% of dry bulk tonne-miles) and anti-dumping probes into Chinese steel by Mexico, South Korea, and others threaten minor bulk trades, particularly flat steel for construction. China’s steel export surge (115 million tonnes in 2024, up 25%) faces uncertainty, but rerouting to ASEAN markets supports tonne-miles. India’s 6-7% steel output growth drives iron ore imports, boosting Capesize demand from Oman and Australia. A low orderbook (10.3% of the fleet) and Q1 demand losses (down 11.3 million tonnes) temper optimism—seasonal demand and supply constraints keep Capesize buoyant but cautious.

The logo of Australia's Fortescue Metals Group (FMG) can be seen on a bulk carrier as it is loaded with iron ore at the coastal town of Port Hedland in Western Australia, November 29, 2018 - For illustrative purposes

⏳ Panamax Market: Holiday-Induced Softness

Rate Pressures

Panamax vessels, versatile grain and mineral carriers, face headwinds from holiday disruptions. Rates weaken as U.S. and Canadian grain exports decline seasonally, with transatlantic fixtures holding steady at $17,750 for an 82,000-dwt scrubber-fitted vessel from the Spanish Mediterranean via North Coast South America-to-Far East. South America sees pressure for end-May Asia arrivals, with few fixtures emerging. Indonesian coal round trips drop to $10,850 by May 2 (from $11,500), and an 82,000-dwt vessel in China secures $12,000 for an 8-10 month period. The Baltic Panamax Index reflects softening trends, with limited upside—holidays and oversupply dim Panamax’s spark.

Regional Dynamics

Atlantic markets see minimal fresh demand, but tight tonnage counts stabilize transatlantic and fronthaul routes. North Coast South America supports activity, while South America remains quiet amid the Geneva Dry conference. Mediterranean tonnage builds, yet sentiment holds cautiously firm. Pacific markets falter as oversupplied tonnage lists and slow cargo replenishment weigh on NoPac and Australian trades. Indonesian and Australian coal demand rises, but high Chinese inventories cap gains. East Coast South America grain volumes provide stability, but holiday slowdowns (e.g., May Day) curb momentum—Panamax navigates a fragmented market.

External Pressures

U.S. port fee exemptions for sub-80,000 dwt bulkers shield Panamax, with only 4% of tonne-miles affected by U.S.-China tariffs. Anti-dumping probes into Chinese steel (hot-rolled coils) by Brazil, India, and others risk curbing minor bulk flows, particularly to ASEAN markets. China’s property sector crisis and coal demand drop (down 2-3% in 2025) weaken Panamax cargoes, per Bimco’s outlook. Rerouting U.S. coal to Asia and potential Indian steel growth (6-7% in Q1) offer upside, but holiday disruptions and trade uncertainties cloud prospects—Panamax treads cautiously, leaning on Atlantic stability.

⏱️ Supramax/Ultramax Market: Muted Momentum

Rate Stagnation

Supramax and Ultramax markets lack clear direction, with subdued activity across basins. South Atlantic rates hold steady, with a 63,000-dwt vessel fixing Recalada-to-SE Asia at $13,750 plus a $375,000 ballast bonus. U.S. Gulf rates weaken, with a 55,000-dwt ship at $9,750 for Mississippi-to-North Coast South America. In Asia, Indonesian demand wanes, with a 57,000-dwt vessel fixing Indonesia-to-China at $9,250. Indian Ocean routes fare better, with a 63,000-dwt ship at $18,000 from Fujairah-to-Bangladesh and a 57,000-dwt vessel at $10,000 from Mormugao-to-China. Baltic Supramax indices show marginal movement—oversupply and holiday slowdowns stifle progress.

Tonnage Trends

South Atlantic remains positional, supported by steady transatlantic cargo flows, but U.S. Gulf and Continent markets falter with minimal enquiries. Asian markets stagnate as Indonesian cargo demand weakens and tonnage builds in Southeast Asia. North Pacific routes see some activity, with a 63,000-dwt vessel fixing West Canada-to-India/Bangladesh at $13,250 plus a $370,000 ballast bonus. India’s iron ore export slump (down 5.9 million tonnes in Q1) hits Supramax hardest, though rising imports (2.3 million tonnes) offer partial relief. The Geneva Dry conference and May Day holidays curb activity—Supramax/Ultramax drifts in a cautious market.

Broader Forces

U.S. port fee exemptions ease Supramax/Ultramax concerns, but U.S.-China tariffs and Chinese steel probes threaten minor bulk trades, particularly flat steel. China’s steel export growth (115 million tonnes in 2024) faces risks from anti-dumping actions, potentially redirecting flows to ASEAN. India’s steel output rise supports inbound Supramax demand from Oman and Australia, but domestic ore absorption curbs exports. Bimco forecasts stagnant iron ore shipments and a 2-3% coal demand drop in 2025, pressuring rates. Rerouting and low fleet growth (1.5-2.5% in 2025) offer hope—Supramax/Ultramax awaits fresh impetus.

For illustrative purposes

⏸️ Handysize Market: Oversupply Challenges Persist

Rate Weakness

Handysize vessels, the smallest bulk carriers, face ongoing struggles. Rates soften across regions, with a 36,000-dwt vessel fixing North Spain-to-Dakar/Tema at $9,000 for gypsum. South Atlantic holds firmer at $17,000 for a 36,000-dwt ship from Paranagua via Recalada-to-Algeria. U.S. Gulf rates weaken as tonnage builds, while Pacific rates stagnate at $14,700 for a 38,000-dwt vessel from East Australia-to-Japan with clean cargo. Q1 time-charter equivalent (TCE) earnings lag at $10,252 per day (down from $12,150 in Q4 2024), though outperforming benchmarks by 21%. The Baltic Handysize Index shows minimal movement—oversupply casts a long shadow.

Market Sentiment

South Atlantic remains the strongest region, driven by transatlantic cargoes, but Continent and Mediterranean markets flatten with limited cargoes against rising tonnage. U.S. Gulf sentiment sours as vessel counts grow, and Asian markets stall with increased tonnage in Southeast Asia and North Pacific. India’s iron ore export decline (down 5.9 million tonnes) impacts Handysize, though rising steel imports offer some support. The Geneva Dry conference and May Day holidays dampen activity, with owners and charterers cautious—Handysize seeks stability amid challenging conditions.

Influencing Factors

U.S. port fee exemptions for sub-80,000 dwt vessels shield Handysize, but U.S.-China tariffs and Chinese steel probes risk disrupting minor bulk flows. China’s property crisis and coal demand decline (down 2-3% in 2025) weaken Handysize cargoes, while India’s infrastructure push (absorbing domestic ore) curbs exports. Rerouted wood pulp trades (e.g., U.S.-to-Europe, Brazil-to-China) provide new opportunities, per G2 Ocean’s insights. Low fleet growth (1.5-2.5% in 2025) and potential scrapping offer long-term upside—Handysize perseveres, eyeing new trade lanes.

🌐 What’s Moving It: Commodities and Trade Policies

Commodity Shifts

Iron ore volumes face pressure, with Australian exports down 13.7 million tonnes in Q1 due to Port Hedland weather, compounded by Brazil (down 2.0 million tonnes) and Canada (down 1.5 million tonnes). Guinea’s bauxite surge (up 12.3 million tonnes) supports Capesize, while India’s iron ore imports (2.3 million tonnes in Q1) bolster demand from Oman and Australia. China’s steel exports (115 million tonnes in 2024) drive minor bulk trades, but anti-dumping probes threaten flows to ASEAN. Coal demand drops 2-3% in 2025, per Bimco, though Indonesian and Australian coal cargoes rise. Rerouted wood pulp (U.S.-to-Europe, Brazil-to-China) and Syrian wheat imports (6,600 dwt) signal new Handysize trades—commodity dynamics steer the market.

Trade and Policy Pressures

U.S.-China tariffs (affecting 4% of tonne-miles) and anti-dumping probes into Chinese steel by Mexico, Brazil, and others risk curbing minor bulk flows, particularly flat steel. U.S. port fee exemptions for sub-80,000 dwt vessels ease costs, but trade policy uncertainties (e.g., Trump’s erratic policies) deter operators like Klaveness from U.S. trades. China’s property crisis and renewable energy push weaken iron ore and coal demand, while India’s 6-7% steel growth absorbs domestic ore. Rerouting (e.g., U.S. pulp to Europe) and a shrinking orderbook (10.3% of the fleet) support tonne-miles—trade tensions and commodity shifts shape the horizon.

For illustrative purposes

🌐 Market and Stocks: Navigating Uncertainty

Stock Performance

Dry bulk stocks face mixed fortunes amid trade uncertainties. Norden $DNORD (-0,71%) reports a $33 million Q1 net profit (down from $62 million), beating expectations at $25 million, with its dry operator unit earning $112 per vessel day. Golden Ocean $GOGL and CMB.Tech , both cut to “hold” from “buy” by Arctic Securities, trade at $7.77 and $9.14, respectively, post-merger (0.95 share exchange). The merger’s 69% loan-to-value ratio signals debt reduction over dividends, with Golden Ocean at 0.75 times its $12.20 net asset value. Norden sells 12 ships, raising its 2025 profit guidance to $50-$130 million. Clarksons Securities praises Norden’s transparency, maintaining a “buy” rating at DKK 250—stocks tread cautiously but show resilience.

Investor Insights

Capesize rates may hold firm into mid-May, with FFA contracts reflecting seasonal iron ore support, but oversupply of prompt ballasters caps upside. Bimco trims 2025-2026 demand growth by 0.5% due to U.S. tariffs, with Panamax weakest due to coal exposure (over 50% of cargoes). Low Capesize fleet growth (10.3% orderbook) supports higher rates relative to other segments. Norden’s cautious approach—redelivering costly charters, focusing on short-term deals—reflects market uncertainty, but its long-term 5% annual growth target remains. Decarbonization pressures (e.g., IMO’s carbon cost platform) and an aging fleet (needing fuel changes by 2040) signal 2030 supply tightness—investors eye fundamentals amid volatility.

Sector Outlook

U.S. tariff wars and Chinese steel probes risk softening minor bulk demand, but rerouting (e.g., pulp from Brazil-to-China) and Indian steel growth offer opportunities. Low orderbooks (1.5-2.5% growth in 2025) and potential scrapping (driven by lower rates) point to 2026 tightness. Secondhand prices may weaken, with newbuilding prices falling, per Bimco. Capesize leads with stable rates, while Panamax, Supramax/Ultramax, and Handysize lag due to oversupply and coal weakness. Stocks like Norden trade at discounts to asset values (DKK 372 per share), offering value if demand rebounds—investors weigh trade risks against supply-driven potential.

🌐 Outlook: Sailing Toward 2026

Market Projections

Capesize ranges $16,000-$18,000 daily—iron ore and bauxite flows sustain strength—steady. Panamax at $10,000-$17,000—holiday softness and coal weakness limit upside—cautious. Supramax/Ultramax at $9,000-$18,000—South Atlantic outperforms, but oversupply caps gains—mixed. Handysize at $9,000-$17,000—oversupply and weak demand persist—challenged. Rerouting and tight supply signal volatility—2026 could peak if trade stabilizes.

Strategic Horizons

Capesize benefits from Indian iron ore imports and Guinea’s bauxite surge, but Panamax risks further softening without coal demand recovery. Supramax/Ultramax’s South Atlantic strength offers resilience, while Handysize relies on new trades like pulp and wheat. Trade policy risks (e.g., steel probes, tariffs) and decarbonization costs (e.g., fuel changes by 2040) challenge margins, but low orderbooks and scrapping provide long-term upside. Investors must balance near-term uncertainties with 2030 supply constraints—strategic bets will shape dry bulk’s future.

Your Call

Will Capesize’s iron ore strength lead the rally, or can Handysize find new trade winds? Drop your take—let’s conquer the markets! 🚢

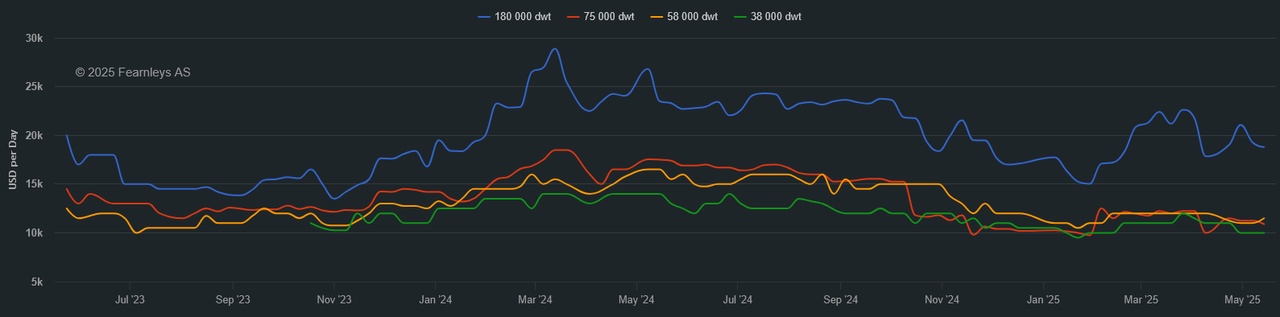

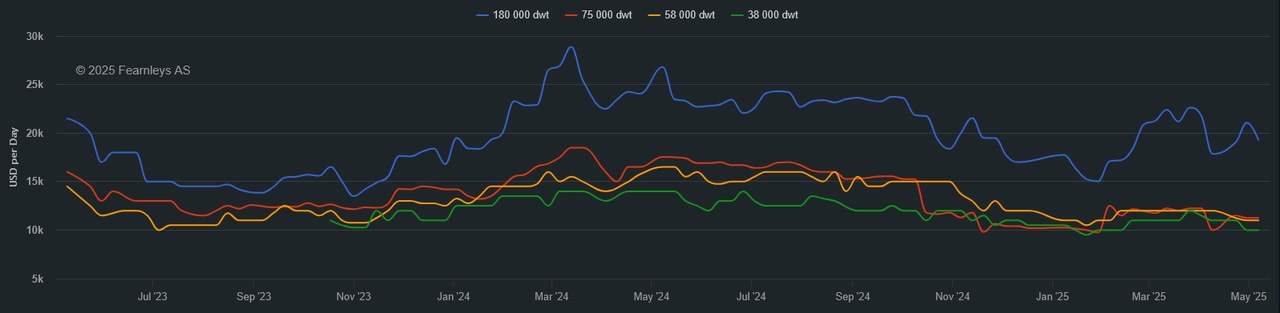

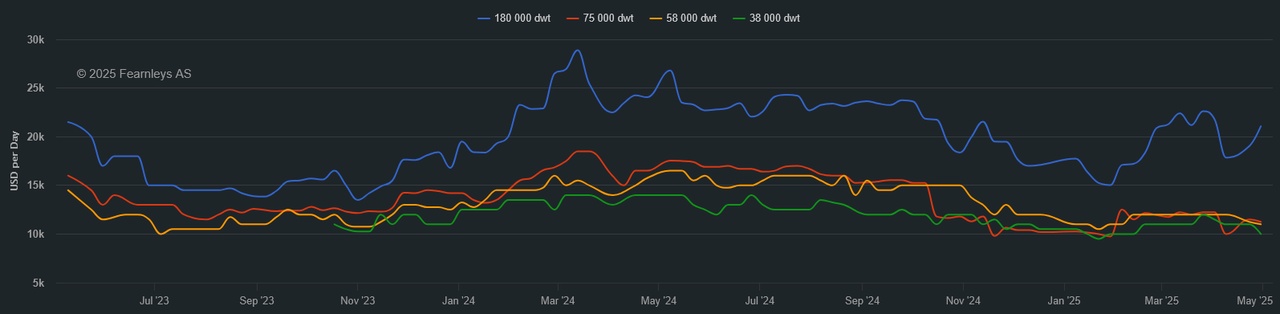

1 Year T/C Dry Bulk - April 30th

$NMM

$SBLK (-3,89%)

$SB (-4,61%)

$PANL (-4,17%)

$GNK (-3,38%)

$HSHP (-6,15%)

$GOGL

$2020 (+0,62%)

$9104 (-2,34%)

$KCC (+2,92%)

$WEST (-1,52%)