The year is not quite over yet, but experience shows that not much happens for me in the last two weeks before Christmas. After that, it tends to be quiet on the trading front until mid-January. If you read less from me in the next few weeks: don't worry, I'm not gone and I'm not a fake account, I'm just taking a vacation.

A few statistics for interested followers of my trading posts.

My last trades

$ADBE (+1.39%)

$UBER (+1.25%)

$TWST (-4.17%)

$KD (-1.45%)

$IREN (+0.53%)

$DECK (+0.17%)

.

Trading Statistics YTD

- Number of transactions: 544

- Loss trades: 16,6 %

- Winning trades: 83,4 %

Performance of the trading portfolio: +58.19 % gross (before KEST) / +41.66 % net

In total, a mid five-figure net amount. A nice additional family income. Not a path to becoming a millionaire, but for a few hours of effort per week, a strong ROI for me.

Performance distribution

- 90% of the trades: between 0 % and 10 % profit

- 10 % of the trades: over 10 % profit

👉The key lies not in individual "bull run trades" with +100% or +200%, but in the frequency, consistency and a functioning setup. If you stay true to your strategy, you will fare better in the long term than with FOMO and looking at other traders.

Personal thoughts

For me, trading is a hobby, a means to an end.

Important: Don't let the stock market and investing dominate your life. It should never become an "addiction" that determines your daily mood.

My milestone 2025

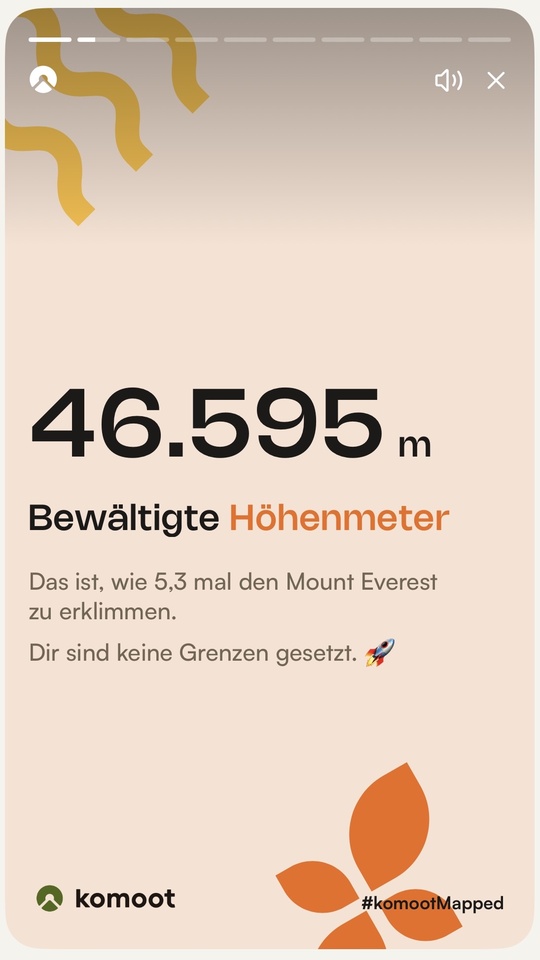

Besides trading, I am a passionate mountaineer & mountain biker (hardtail without motor!). According to Komoot, this year I have climbed Everest 5.3x this year, I am a a "peak chaser" whatever that means 😂.

Even more important: lots of valuable experiences with my family in the mountains. That's what counts in the end.

PS: Speaking of fake accounts: my trades were recently audited by the tax office & tax consultant. If anyone in Austria needs tips on the proper documentation of trades with non-tax-simple foreign brokers in foreign currency.