A large part of the investment thesis of $IREN (-6,41 %) is linked to the company's ambitious expansion into the fast-growing AI/HPC sector.

While $IREN (-6,41 %) Bitcoin mining yields remain exceptional, performance in this segment is heavily influenced by factors outside of the company's control - namely price, network difficulty and ASIC prices. $BTC (-0,88 %) -price, network difficulty and ASIC prices.

Today's demand for AI computing power is only a fraction of what will be needed.

The reasons are:

- AI switches from text to real-time video, 3D and full scene understanding

- AI co-pilots integrated into every productivity and development tool

- Autonomous robots, vehicles and smart factories

- AI-generated content on a large scale: ads, movies, virtual worlds

- Constant retraining of boundary models, 100 times more computationally intensive

Access to AI computing power and related infrastructure will be critical for major tech companies to defend and grow their multi-billion dollar valuations. These players are outbidding each other, not only to secure capacity, but also to prevent others from obtaining it. Whoever controls the most computing power capacity and supporting infrastructure will gain a massive advantage over the other.

We have already seen this in the race for $NVDA (+1 %) chips, the biggest bottleneck in the AI value chain today. But this bottleneck is shifting as computing capacity becomes increasingly constrained by access to AI-optimized energy infrastructure.

And here, in my opinion $IREN (-6,41 %) that has more than 3 GW of AI-optimized infrastructure will benefit. It takes time to build, contracts for infrastructure and power connection contracts are becoming more difficult, and the land and locations required are becoming more expensive, $IREN (-6,41 %) has recognized this early on.

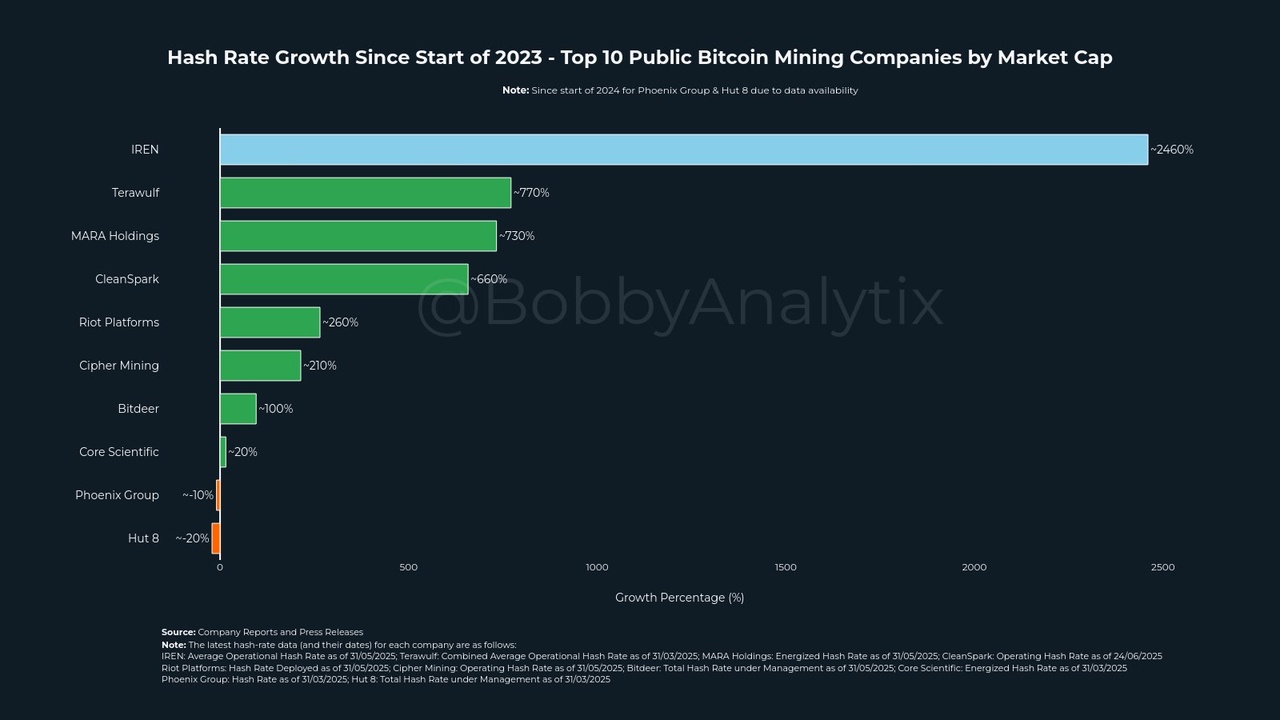

Increase in hash rate since 2023:

$IREN (-6,41 %) available today with $IREN (-6,41 %) AI Cloud has $NVDA (+1 %) H100 and H200 GPU clusters.

These clusters are powered 100% by renewable energy.

$MARA (+0,14 %)

$CLSK (-1,33 %)

$BTC (-0,88 %)

$MSTR (+1,9 %)

$RIOT (-3,62 %)

$CRWV (-9,31 %)

$META (+1,59 %)

$AMZN (+2,51 %)

$GOOGL (+3,81 %)

$NVDA (+1 %)

$MSFT (-0,3 %)

$WULF (-2,68 %)

$CIFR (-6,57 %)

$CORZ (-3,77 %)

$BTDR (+0 %)