Reading time: 7 minutes

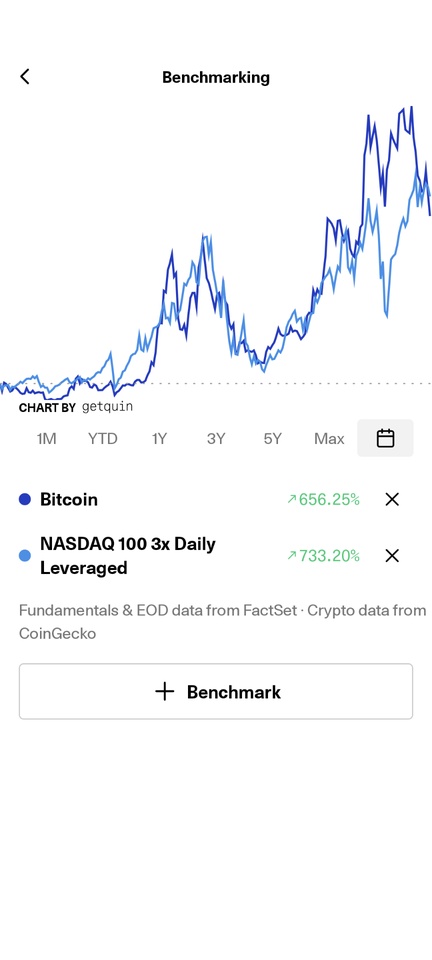

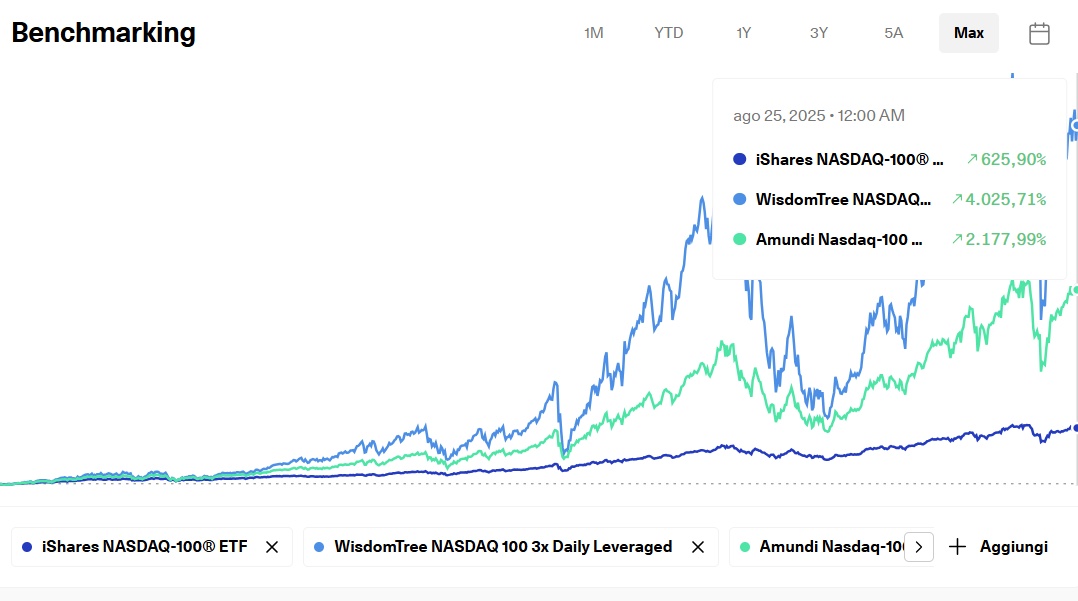

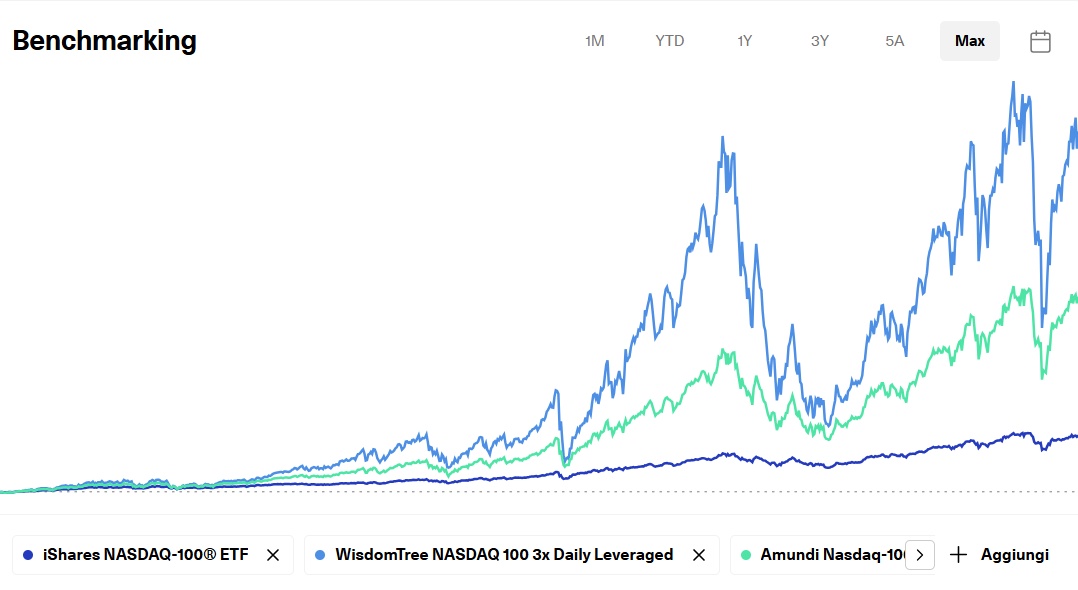

The commodity rotation approach I am currently working on is still under revision - after valuable feedback from the community here on @getquin especially from @Thunderbolt1978 , @Simon_n and @Epi . Some rules will probably change before it is finalized (or not :)). Nevertheless, I would like to introduce a central element of this approach right now: the use of daily leveraged ETFs. These so-called daily leveraged ETFs track the daily movements of an index with a fixed factor - usually double or triple. They are the tool with which momentum can be selectively amplified, but only as long as the direction is clear. Used correctly, they can significantly increase the results of a structured strategy. If used incorrectly, they can quietly and gradually destroy capital.

The decisive factor is the word "daily". These products are not designed to work over weeks or months, but to multiply the percentage change in an index for a single trading day only. After each market close, the position is automatically reset to the new index level and the derivatives in the fund are rebalanced. This daily reset principle ensures that gains and losses do not continue linearly over several days. So if you hold a 3x ETF for longer, you will not end up with three times the index return - but the result of a chain of daily rebalancings that readjust with every market movement.

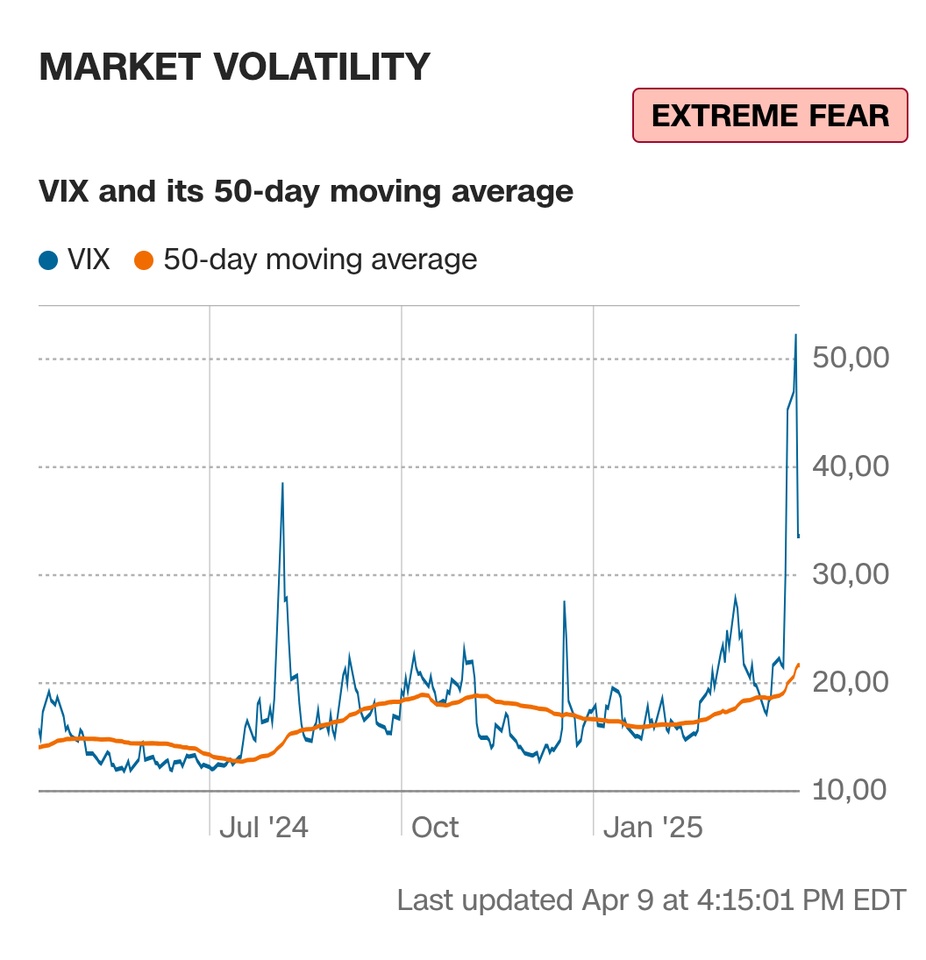

This becomes a problem when markets fluctuate. If an index rises by ten percent one day and falls by ten percent the next day, it stands at 99% of its initial value. The 3x Daily ETF, on the other hand, is already at around 91%. This deviation is not a mistake, it is built in. The higher the volatility, the more the effect - known as volatility decay - eats into the return. In sideways phases, it is not the market that works against the investor, but the math.

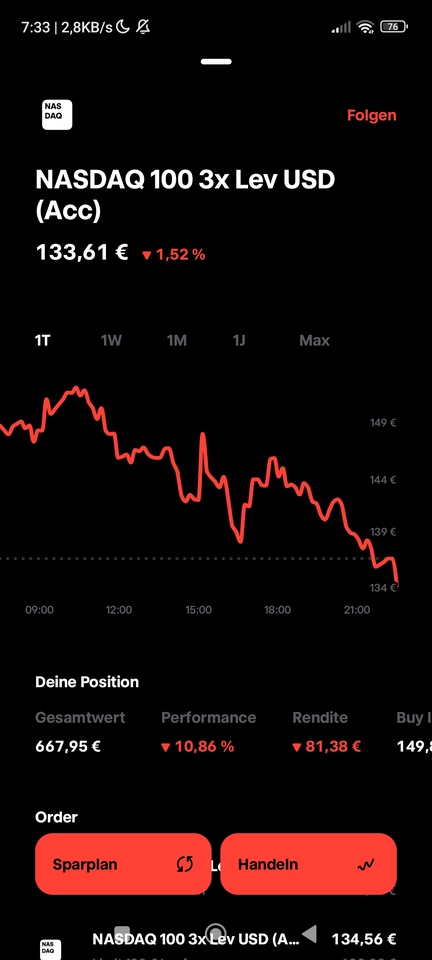

Examples show this very clearly. The $QQQ3 (-2,66 %) (Direxion Daily Nasdaq-100 Bull 3x Shares) multiplies the daily movement of the Nasdaq 100, but can deviate strongly from the index performance in fluctuating phases. The situation is similar with the $GUSH (Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares), which tracks the daily movements in the energy sector. In the commodities sector, the $JNUG (Direxion Daily Junior Gold Miners Bull 3x Shares) is a prime example of extreme path dependency: within a few weeks, daily movements can build up - both upwards and downwards.

It is important to note that these products always refer to a single day. A 3x ETF does not multiply the monthly or annual return of an index, but only the daily change. If it is held over longer periods, the deviation from the real index performance can be dramatic. This is why daily leveraged ETFs are not classic buy-and-hold products, but tactical instruments.

In addition, there is the invisible loss limit. If the underlying falls by around 33% in one day, a 3x daily ETF is practically worthless because the underlying swap contract falls to zero. This threshold has almost been reached several times in extreme market phases - for example in commodity or technology indices. Those who do not understand the daily reset only see the potential upside, but not how narrow the line between gain and destruction really is.

Ongoing costs also work against holders. Derivatives have to be purchased on a daily basis, interest and fees have to be booked to financing costs. Over weeks or months, these charges add up to a constant loss of performance. Even in stable uptrends, a 2x daily ETF is often well below its theoretical doubling.

This does not mean that daily leveraged ETFs are dangerous per se. They are justified - just as precise tools, not as long-term investments. Anyone using them needs a clear plan, a defined time frame and consistent stop-loss discipline. In trend phases or as a short-term vehicle as part of a momentum strategy, they can deliver strong results. However, as soon as the trend falters, the mechanics turn negative.

The parallel with commodity rotation is interesting: there, the market is regularly reviewed, rules limit the risk, signals determine the entry (regardless of possible adjustments to the approach). If this principle is applied, daily leveraged ETFs can also be managed in a targeted manner - not by feel, but by structure. Those who hold passively, on the other hand, are relying on an engine that restarts every day but loses energy in the long term.

In the end, the conclusion is sober: daily leveraged ETFs are amplifiers. They react disproportionately to movement - both upwards and downwards. Their benefit does not depend on the product, but on the investor's behavior. Those who understand momentum and act in a disciplined manner can use them tactically. If you leave them in your portfolio like a normal ETF, you will see how the math slowly works against you.

Questions for you:

How would you classify leveraged ETFs - as a legitimate tool for momentum strategies or as a ticking time bomb in your portfolio?