Thanks to the inspiration from @Epi and a few months of reflection, I have built up my individual momentum all-world strategy and would like to refine it further for 2026 over the next few weeks.

Start allocation as of 11.07.2025:

50% ACWI $SPP1 (-0,67 %)

15% Europe$SMEA (-0,83 %)

10% SPYTIPS-Cool S&P500x2 $DBPG (-2,51 %)

10% EM $EIMI (-0,69 %)

10% Gold 2x $LBUL (+2,87 %)

5% Bitcoin $BITC (-4,02 %)

Cash Management

Cash investment: $XEON (+0,03 %)

Basically, I check my positions at the end of the month (30/31/1) using the SMA or SPYTIPPSCooldown (Discord, thanks @SemiGrowth).

50% SPDR MSCI All Country World UCITS ETF EUR Hdg Acc (currency-hedged) $SPP1 (-0,67 %)

Currency hedging rule:

- Condition: USD/EUR above SMA200 of the currency pair

Action: Switch to $NTSG (-1,4 %)

15% iShares Core MSCI Europe UCITS ETF $SMEA (-0,83 %)

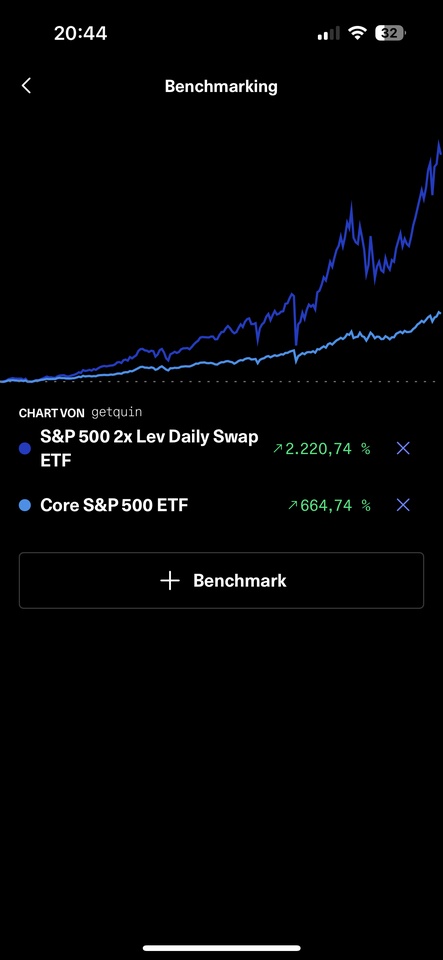

10% SPYTIPS-Cool = S&P 500 2x Leveraged $DBPG (-2,51 %)

Buy conditions (all must be met):

- S&P 500 (SPX) via SMA150

- iShares TIPS Bond ETF (TIP) above SMA200

- At least 15 days since last sell

Sell conditions (one is enough):

- SPX below SMA150 OR

- TIP below SMA200

Waiting period: 15 days after sale before new buy test Review15 days after purchase, then daily

10% iShares Core MSCI EM IMI UCITS ETF $EIMI (-0,69 %)

10% Gold 2x Leveraged $LBUL (+2,87 %)

5% CoinShares Physical Bitcoin ETP $BITC (-4,02 %)

Cash Management

Cash investment: $XEON (+0,03 %)

Sounds like a bit of effort at first, in fact I currently need max. 10 minutes a month for the audit itself.

Bitcoin left here at the beginning of December. I am currently invested in the rest. Due to the fact that silver (as a momentum commodity) convinced me in conjunction with @Multibagger (thank you), I added two shares on 23.10.25 and a further two shares on 22.12.25

WisdomTree Silver 3x Daily Leveraged $3LSI (+6,94 %) were added to my portfolio. The purchase was FOMO, yes of course, emotion, yes too. I'm being completely honest with you here. However, I am more interested in finding a solution for implementing certain assets in my strategy in a certain percentage (up to max. 5%) depending on momentum and risk. (A rotational modification of the 3xGTAA)

For silver $3LSI (+6,94 %) I currently follow the following trading principle:

- Test every Friday: SMA200

- SMA200 rises visibly

- Stop/Limit set

@Epi

@Multibagger

@Tenbagger2024 and of course all others too!

(1.) For silver (3x) I would like your advice on which stop/limit or which trailing stop might be a good fit.

(2.) Gold (2x) currently stands at +62.66% for approx. 40% of my profits. Now the question arises for me: Is a simple monthly check still sufficient in my momentum strategy or should I use an additional stop/limit/trailing stop to limit the downside in addition to rebalancing?

(3.) I can invest the same amount of money in the portfolio again today, i.e. double the investment amount. How would you proceed here? Invest the full amount directly and carry out the rebalancing?

(4.) With the 50% SPDR MSCI All Country World UCITS ETF EUR Hdg Acc (currency-hedged) $SPP1 (-0,67 %) I am currently considering whether the Amundi MSCI World (2x) Leveraged UCITS ETF Acc $LVWC (-2,38 %) might be a (better) fit for this strategy. I am aware of the increase in risk and a tightening of the rules for this position would be necessary. Due to the tendency for the USD to weaken next year as well, I am torn as to which makes more sense.

Adjustments for 2026 that are currently on my plan:

- [ ] Refine exit strategy for leveraged commodities/products

- [ ] First pool for rotation conversion for the 5% position (silver, bitcoin, etc...)

- [ ] S&P500 (2x) - increase SPYTIPPS-Cool in the allocation to 20% (+10%) and reduce the ACWI by 10%. I deliberately wanted to start with a lower level in the SPYTIPPS-Cool in the first year.

- [ ] ACWI position determination of which product(s) to continue investing in.

Finally: The portfolio itself stands at +17.38% from 11.07.25 to 31.12.2025.

Getquin gives me the following additional parameters:

Internal rate of return: 37.05

True time-weighted rate of return: 16.54 %

PS: THANK YOU ALL for your active participation! And a happy new year!