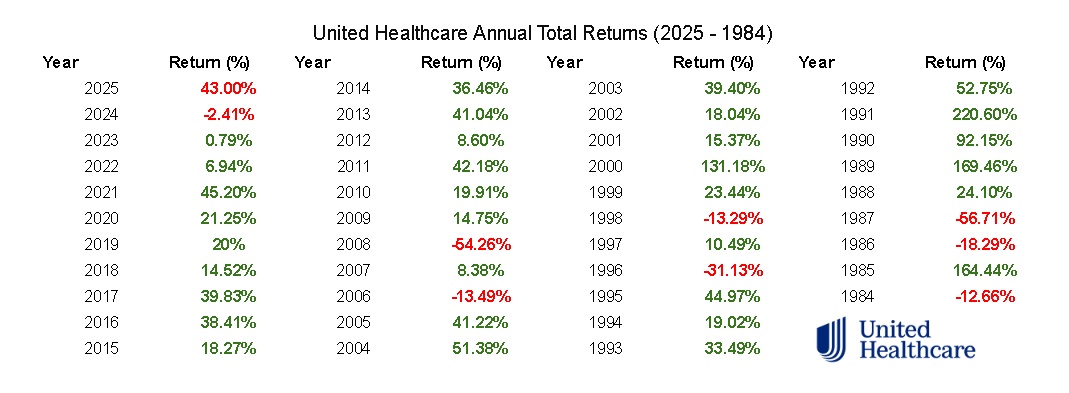

$UNH (-5,78 %)

$BRK.B (-2,44 %)

$BRK.A (-1,94 %)

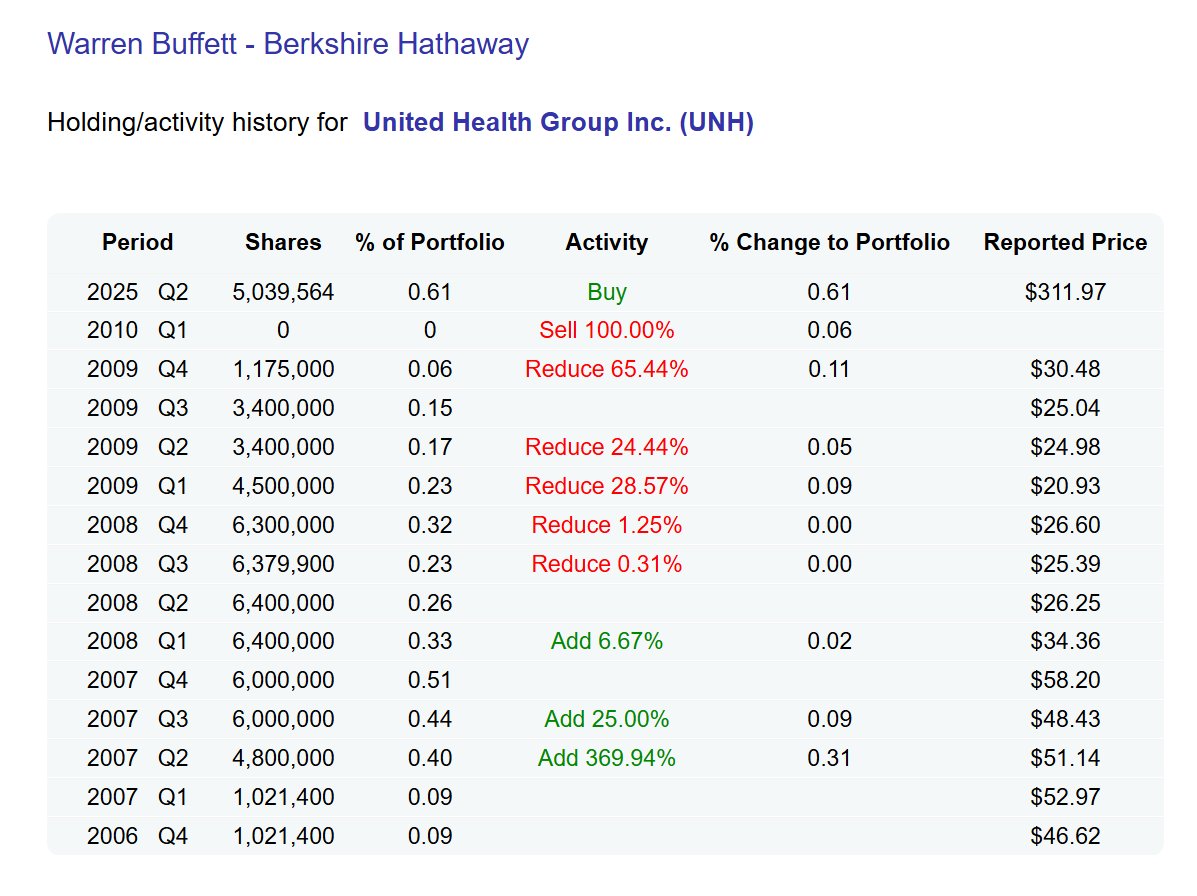

Buffett has probably bought far more than the stated 5 million shares of $UNH (-5,78 %) probably much more.

This can be concluded from the fact that Berkshire Hathaway no longer requires a confidentiality note for the current quarter.

Today's 13F only covers transactions through June 30, we don't know how much he bought after that.

The closing price on this day for $UNH (-5,78 %) was $311.97.

In between there are another 45 days where the price has mostly fallen further.

Therefore, confidential treatment of $BRK.B (-2,44 %) is no longer necessary.

We will find out exactly how much he has collected in 3 months, but I believe that he was not satisfied with the initial purchase with the share price continuing to fall and so much cash on hand 💪

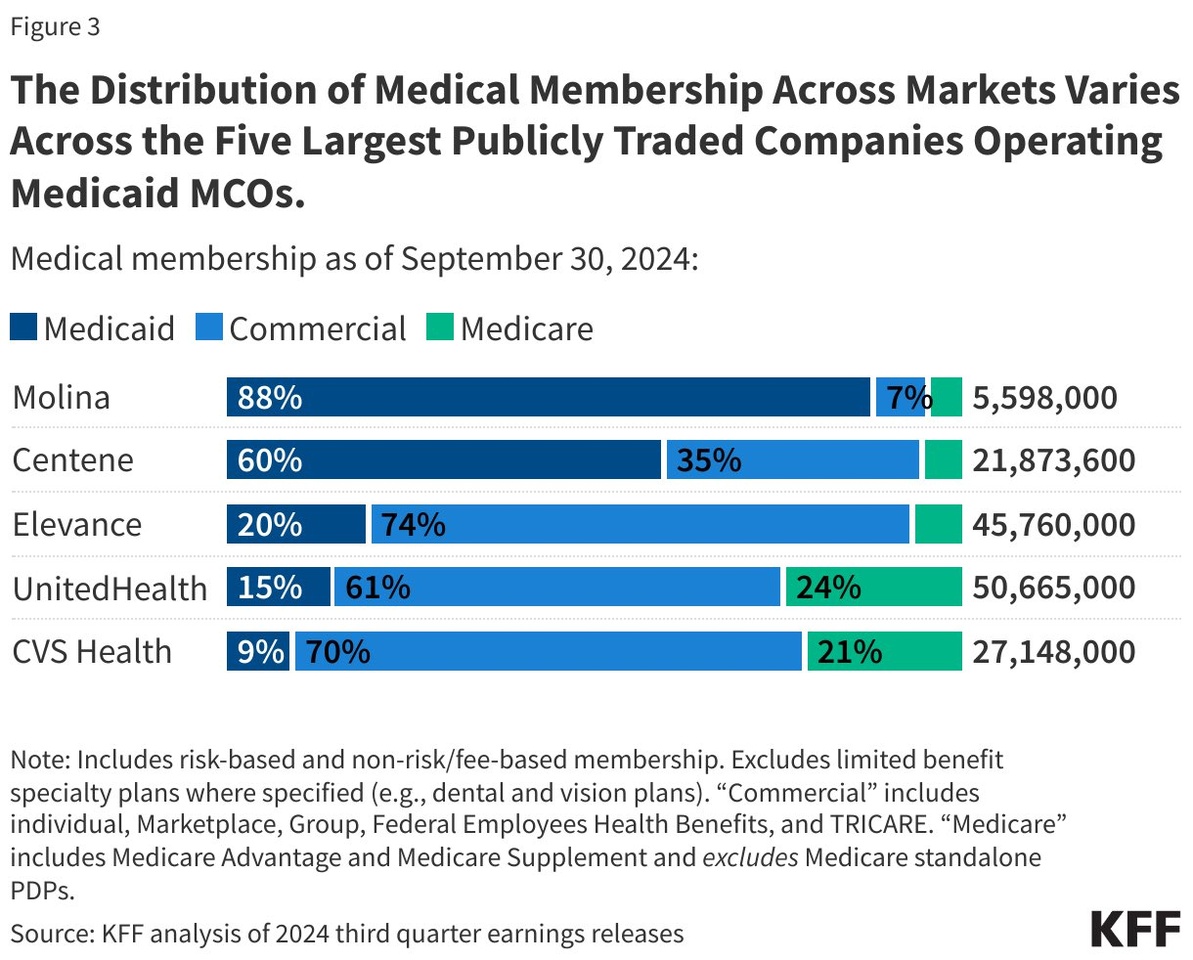

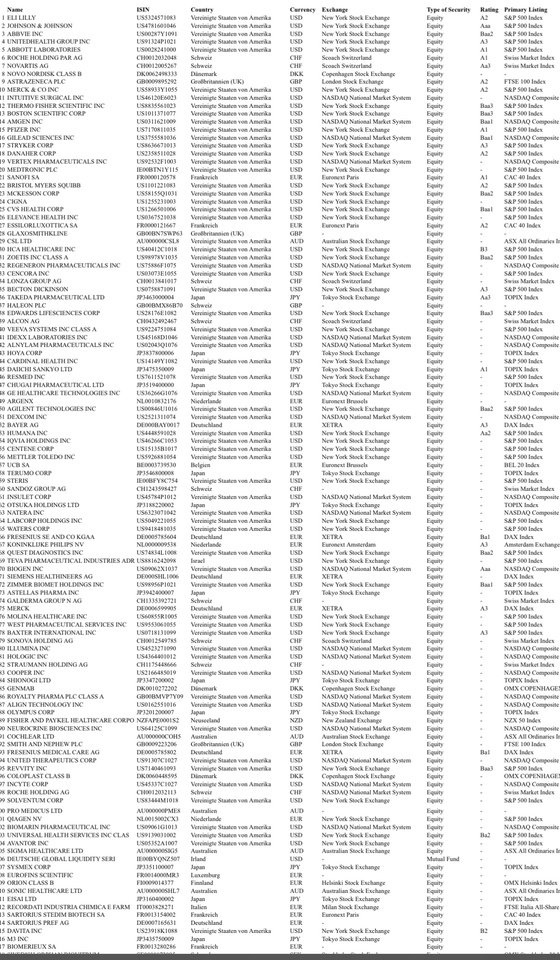

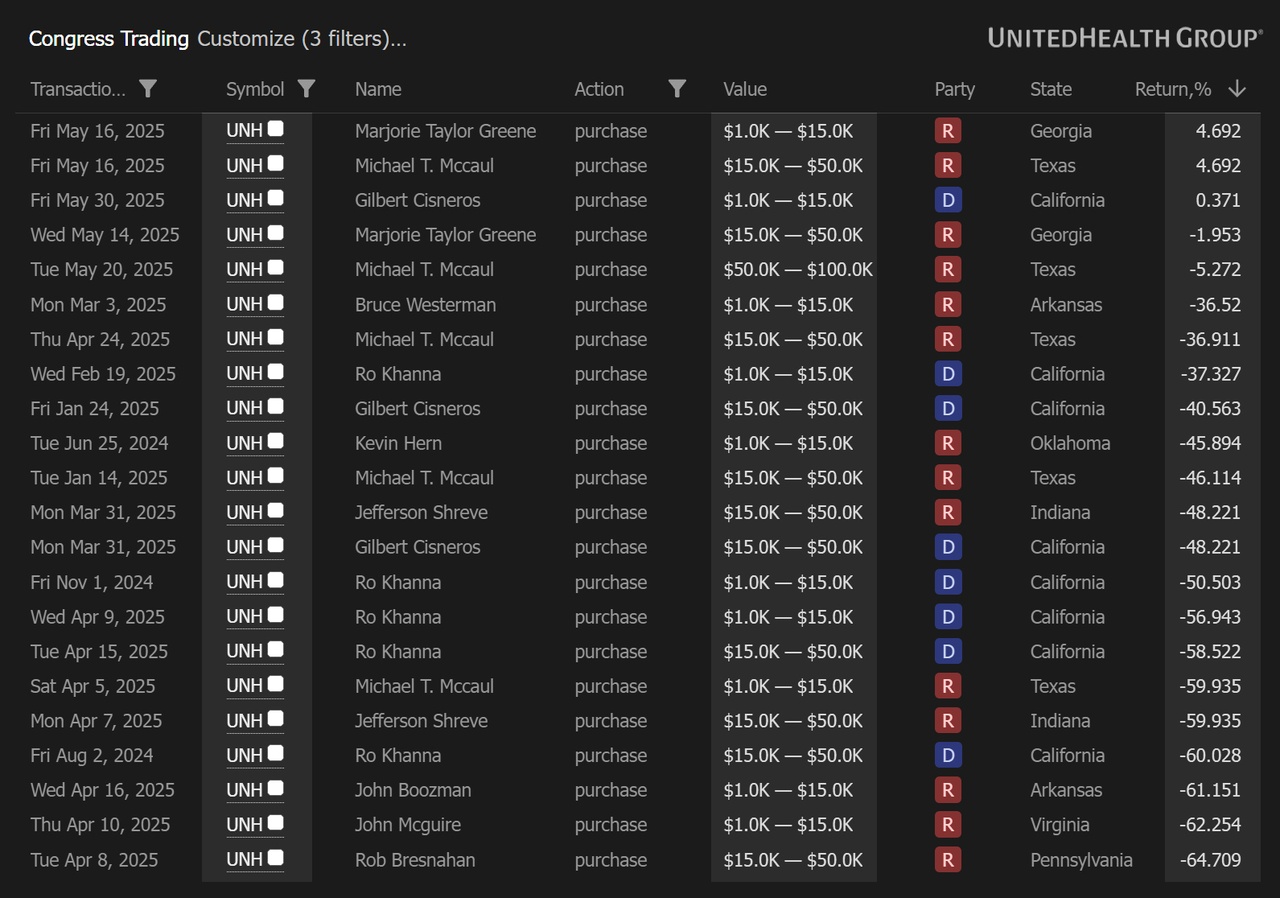

Other buyers:

- Tepper

- Burry

- Simons - Renaissance

$CNC (-6,52 %)

$OSCR (-4,92 %)

$CVS (-0,22 %)

$CI (-2,28 %)

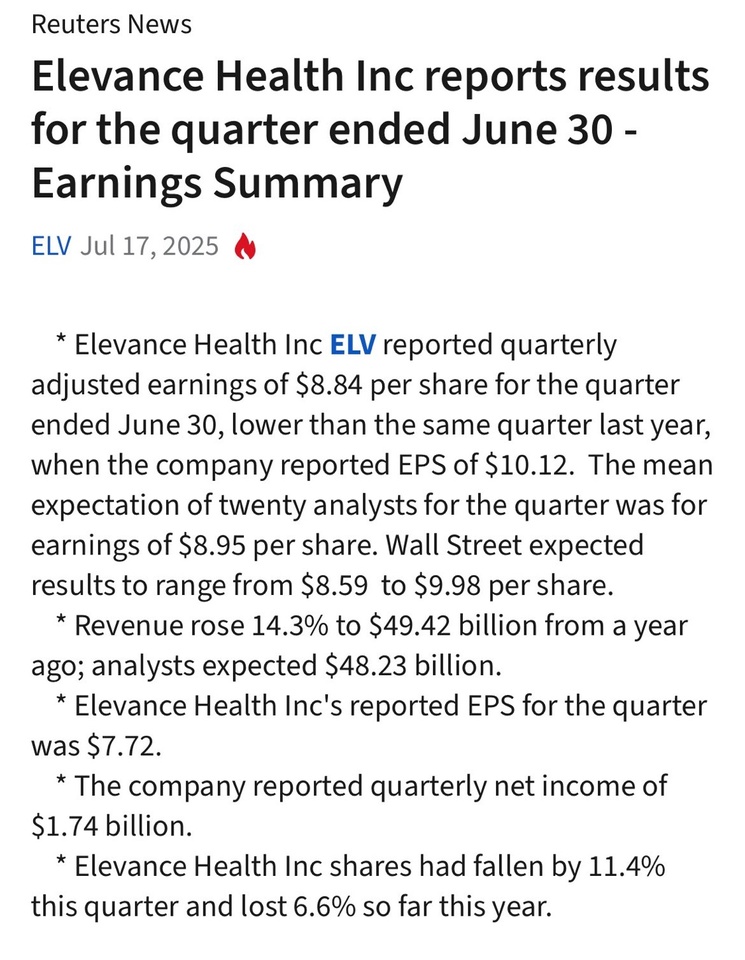

$ELV (-2,36 %)