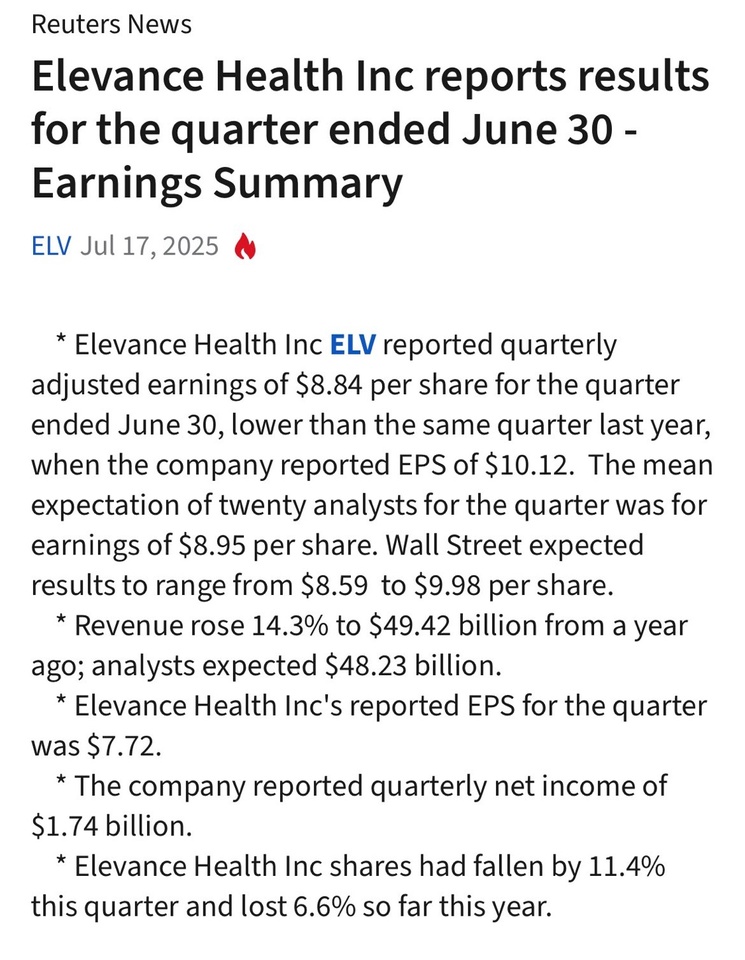

- EPS: $8.84 vs $9.07 expected ❌

- Revenue: $49.4 billion vs $48.14 billion expected ✅

- FY25 EPS guidance: $30.00 vs $34.48 consensus ❌

- Benefit cost ratio: 88.9%; increase of +260 basis points compared to the previous year

- Operating expense ratio: 10.1 %; decrease of -160 basis points compared to the previous year

The second-largest health insurer reported its profits. Although these were below consensus, they were not too bad given the panic in the industry.

The benefit cost ratio was 88.9%, an increase of 260 basis points from the previous year, reflecting the trend toward higher medical costs, particularly in the Medicaid business and ACA health plans.

CEO Comment:

- "In the second quarter, Elevance Health made significant progress in delivering a simple and personalized experience for our customers while advancing our efforts to improve efficiencies across the health system ... With the embedded earnings power of our diversified Health Benefits and Carelon businesses, we remain confident in our ability to deliver at least 12% compound annual growth in adjusted diluted earnings per share over time." - Gail K. Boudreaux

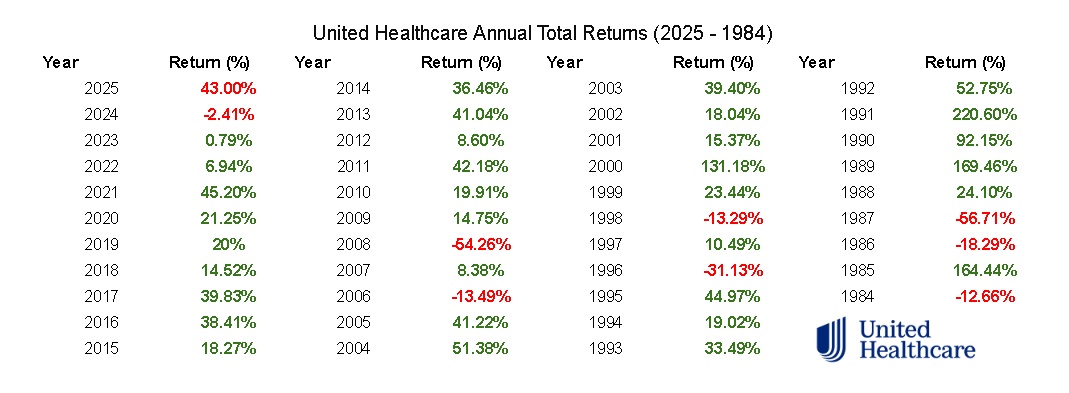

$UNH (-5,78 %)

$CNC (-6,52 %)

$US60855R1005 (-3,02 %)

$CVS (-0,22 %)

$OSCR (-4,92 %)