$XDWH (-0,5 %)

$XLV (+0 %)

$CSPX (-0,32 %)

$VUSA (-0,33 %)

$UNH (-0,42 %)

$OSCR (-1,33 %)

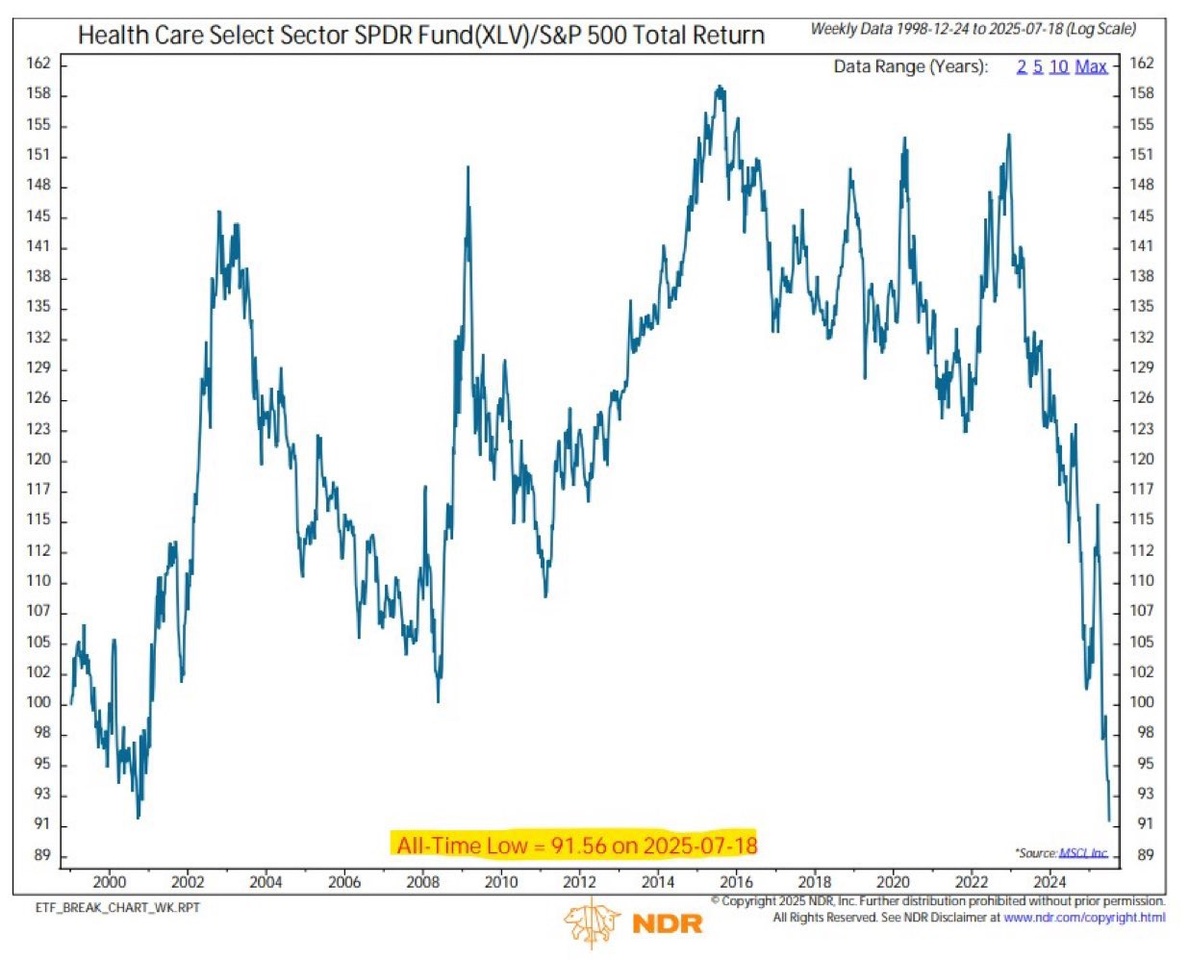

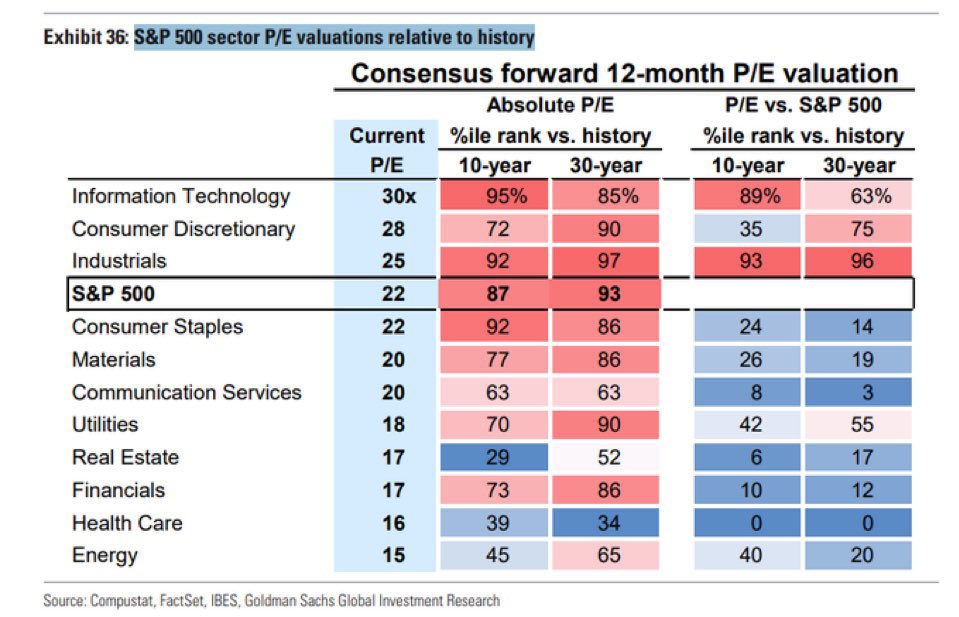

According to Goldman Sachs, healthcare is the only sector in the S& P 500 that is cheaper than the 10- and 30-year averages.

This is an extremely attractive risk/reward ratio and the coming months will be exciting.

$ELV (-0,34 %)

$CNC (-0,54 %)

$DHR (-1,14 %)

$SRT (-2,27 %)

$LLY (+3,88 %)

$NOVO B (-15,84 %)

$NVO (-15,69 %)

$ISRG (-0,82 %)

$JNJ (-1,45 %)

$ABBV (-0,26 %)

$PFE (-0,19 %)

$SAN (+0,58 %)

$MRK (+0,29 %)

$BMY (-0,09 %)

$TMO (-0,48 %)