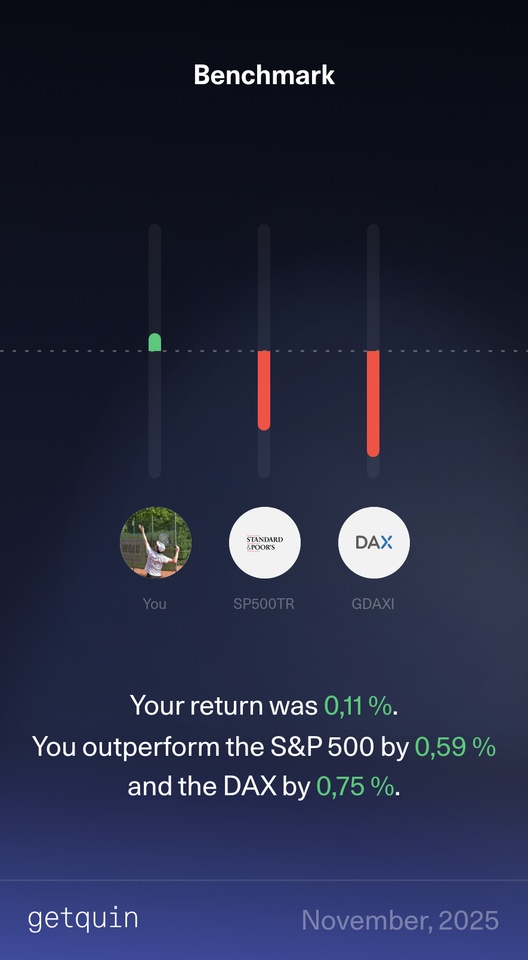

At least it was just about in the green, even if it is of course average compared to the community.

Tops:

$ALCRB (+2,74 %) +31,8%

$MTM (-1,25 %) +27,5%

$BMW (+0,52 %) +9,3%

Flops:

$NVDA (+1 %) -13,7%

$AMZN (+2,51 %) -6,2%

Postes

9At least it was just about in the green, even if it is of course average compared to the community.

Tops:

$ALCRB (+2,74 %) +31,8%

$MTM (-1,25 %) +27,5%

$BMW (+0,52 %) +9,3%

Flops:

$NVDA (+1 %) -13,7%

$AMZN (+2,51 %) -6,2%

Hello dear community,

I'm sure some of the readers here have already noticed that some in $IPX (-0,7 %) or $MTM (-1,25 %) are invested. Both specialize in recycling rare earths and raw materials. The first mentioned focuses on titanium, which is indispensable for many applications.

The second, Metallium, is developing an FJH technology (FJH = Flash Joule Heating), which is a potentially revolutionary application. (Processing and recovery of mine concentrates, magnetic scrap and refinery residues) --> patented worldwide and new technology.

Now the NASDAQ listing is coming, I think that's a really good sign (From the current issue of "Der Aktionär":

Buy, buy more, hold and just forget about it for a few years, despite volatile phases.

I'm not letting any of it out of my hands and keep buying more.

It's a bet on independence from third parties such as China for critical raw materials.

What Europe is doing,....pff too many bureaucrats who check far too little

I became aware of the company here in the forum $MTM (-1,25 %) here in the forum, as some people have made positive comments about the company and have invested in it. The story initially sounded like an exciting investment opportunity. However, after doing some research, a questionable picture emerged.

The story that $MTM (-1,25 %) spread:

Chemist Doctor James Tour and his research team at Rice University have developed a process called Flash Joule Heating. Using short pulses of electricity, the pulverized material to be recycled is heated to temperatures of over 3000 degrees Celsius. Materials such as:

with relatively little effort. The promising aspects of this approach are the energy efficiency, the speed of the process and the small space requirement.

The results achieved in the laboratory $MTM (-1,25 %) now wants to commercialize these laboratory results and has secured the licenses for the Flash Joule Heating technology.

A first system is currently being developed in Texas and, following successful implementation, further systems are to follow at other locations in the USA.

The company is also carrying out exploration in Australia.

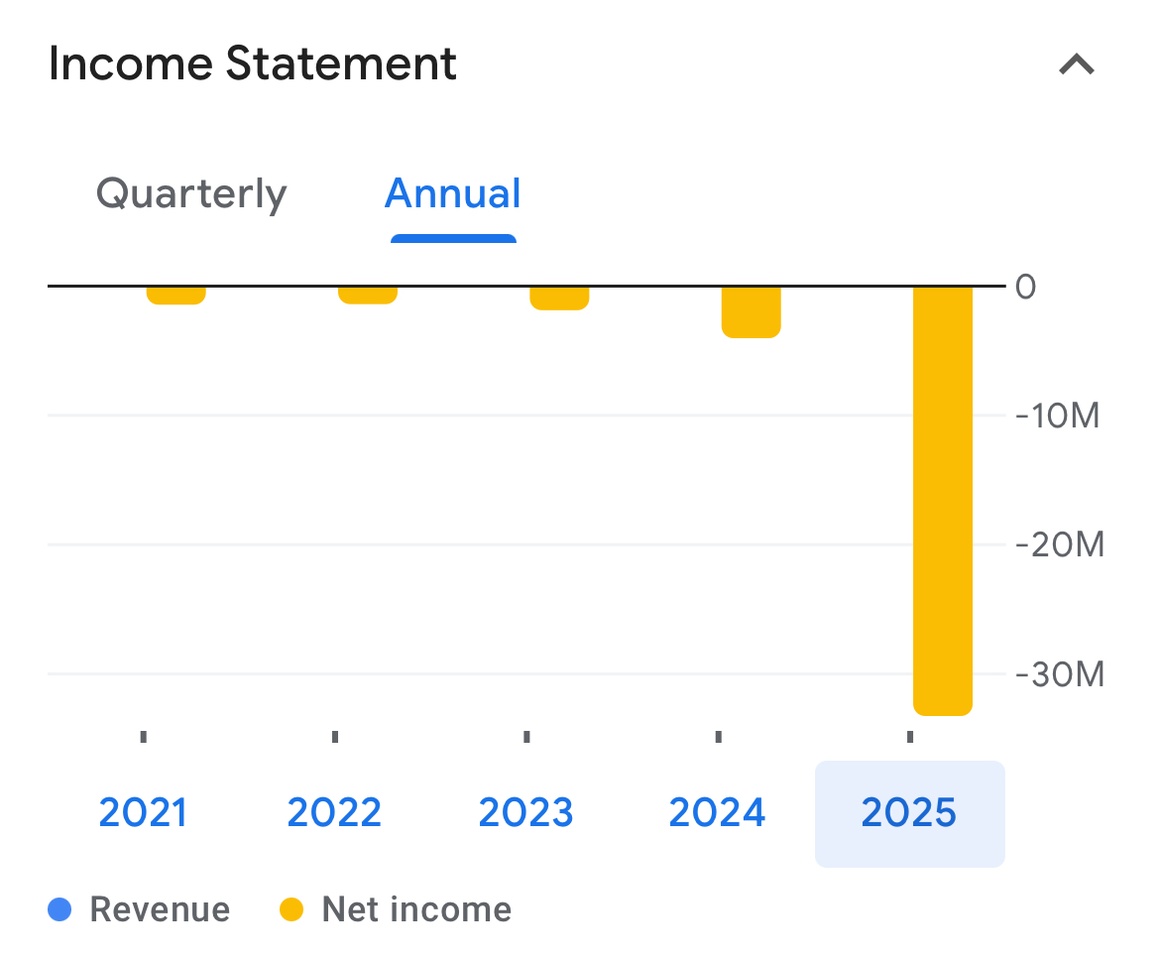

So far so good. Now let's take a look at the figures:

The currency is the Australian dollar (AUD), which is currently quoted at EUR 0.57.

We see a sharp rise in expenditure for the last financial year.

This expenditure of AUD 33 million was probably spent on the development of the plant in Texas and on research and development of the Flash Joule Heating technology, right?

The Annual Report gives us some information:

AUD 17 million went into the pocket of CEO Michael Walshe and a further AUD 6 million into that of Steve Ragiel (President of subsidiary Flash Metals). The payment was made in the form of shares and both sold a large part directly. It is also interesting that the legitimization for the bonuses was the achievement of milestones such as 1-year-employed or share-price-trading-above-price-x. That says a lot about the ambitions of the management...

Also, just under half of the AUD 2 million in annual salaries goes to Michael Walshe and Steve Ragiel.

Expenditure on research and development, on the other hand, only amounts to AUD 800,000. That is less than the combined expenditure on travel and marketing.

Expenditure on property, plant and equipment was even less than AUD 400,000. Nevertheless, according to the company, intangible assets amounting to AUD 7 million were created. How reassuring ...

The report is consolidated. This means that it includes all activities of the subsidiaries.

Development or investment expenditure cannot therefore be "outsourced" or booked separately - they are already included in the overall result.

To summarize:

This contrasts with a valuation of AUD 480 million (= EUR 270 million)

Everyone has to decide for themselves whether this sounds like a fair valuation...

Personally, I wouldn't trust this company and its management in particular with a single cent.

Hello everyone,

In this post I would like to talk a bit about my portfolio and my journey so far.

I started investing through Oskar when I was 16, when I started my apprenticeship as a chef. At the beginning of this year, I finished my apprenticeship and decided to take the whole thing into my own hands - away from Oskar and towards my own research and portfolio.

I'm currently 20 years old and save €1,000 a month for my portfolio.

I bought a motorcycle in the summer, which set me back a bit financially. As a result, my portfolio value is currently below €20,000 again.

My strategy is currently a classic buy-and-hold strategy consisting of gold, Bitcoin, an all-world ETF and a few individual shares in which I have long-term confidence.

About my portfolio:

40 % $SPYI (+0,68 %)

30 %$BTC (-0,79 %)

30 % $EWG2 (+2,08 %)

(@Epi thanks for your tips on gold allocation)

I also hold "smaller" positions in:

$GLXY (-2,18 %) - 2.126 €

$NBIS (-9,32 %) - 500 €

$MTM (-1,25 %) - 471 €

$IREN (-6,41 %) - 188 € (after partial sale)

My plan is a partial sale of $GLXY (-2,18 %) in the first quarter of 2026, depending on how the share reacts to Helios. At $NBIS (-9,32 %) and $MTM (-1,25 %) I will set a trailing stop loss after a good run. $IREN (-6,41 %) I will let it continue to run, as my original position has already been realized.

In the long term, I plan to acquire a property or similar investment for rental purposes. I recently considered taking over a self-service car wash, but this failed due to the current owner's lack of interest.

A home of my own is not currently on my list, as there are no plans to have children in the near future.

My retirement is still a long way off, so I'm not thinking too much about a final portfolio structure at the moment. At the moment, my focus is on investing continuously, learning and growing my capital over the long term.

I invest because I started early on to make my money work for me. Mistakes are part of the process, but the long-term goal remains clear: building wealth with a focus on independence and personal responsibility.

I welcome feedback and am happy to accept tips or suggestions for improvement - especially from those who have been investing for a while or are pursuing similar strategies.

~Philipp

Morning community, I am planning to invest in companies that deal with precious metals. Would you say it is still worthwhile after the small boom or would you rather wait for the dip? Examples: $MP (-5,53 %)

$SSW (+3,25 %)

$MTM (-1,25 %)

$LYC (+0 %)

Greetings

My best month so far since I started actively investing in January 🙌🏼

Decisive factors were:

$GLXY (-2,18 %) +55%

$IREN (-6,41 %) +71%

$MTM (-1,25 %) +74%

$NBIS (-9,32 %) +80%

as some of you here already know. These stocks have played a large part in the good performance of my portfolio.

Today, after $UUUU (-3,01 %) , $MP (-5,53 %) and $PPTA (+1,59 %) with $MTM (-1,25 %) the next stock cracked the 100% mark. It took a little longer here at 3 months, but I can live with that.

After I posted again last week about commodities in general and rare earths in particular, I would like to take stock of the stocks I have in my portfolio today.

$MP (-5,53 %) The next stage is being ignited again today. This is the largest position in this area, as a savings plan is running there. So far + 65%

https://de.tradingview.com/news/reuters.com,2025:newsml_L8N3T70NZ:0/

$SCZ (+3,56 %) with 15% in 2 weeks a solid start

$PMET (+1,52 %) 20% in the first two weeks also good

$MTM (-1,25 %) good start, today a setback of 9%, resulting in a loss of approx. 10%

$UUUU (-3,01 %) with 8% + also after 2 weeks.

In addition, savings plans are still running $PPTA (+1,59 %) so far + 53% and

$CDE (+1,9 %) + 24%.

So I think commodities should not be missing from any portfolio as an admixture, and not just for dividend reasons.

Meilleurs créateurs cette semaine