Hello my dears,

As promised, I'll start the new year with a look back and a brief analysis of the year 2025.

I am always happy to receive suggestions for improvement and ideas.

In the 5-year chart you can see an outperformance against popular and strong ETFs.

You can see the resulting higher volatility

Apart from 1% Bitcoin ETP, my portfolio consists exclusively of individual stocks.

I do not trade in certificates.

In the 2025 chartwe see a synchronization with the ETFs until the April crash.

In April, I was lucky enough to receive cash from my former employer. And so I was also able to take advantage of the price reduction 🍊.

Perhaps as a result of clever additional purchases and new purchases, there was a good outperformance compared to the ETFs.

In August, there were good figures for some companies (apart from Elf and Chipotle).

In addition, however, I spent a little more time with momentum stocks in the summer @Krush82 . In the end, I filtered out momentum stocks with good fundamental figures.

Something like

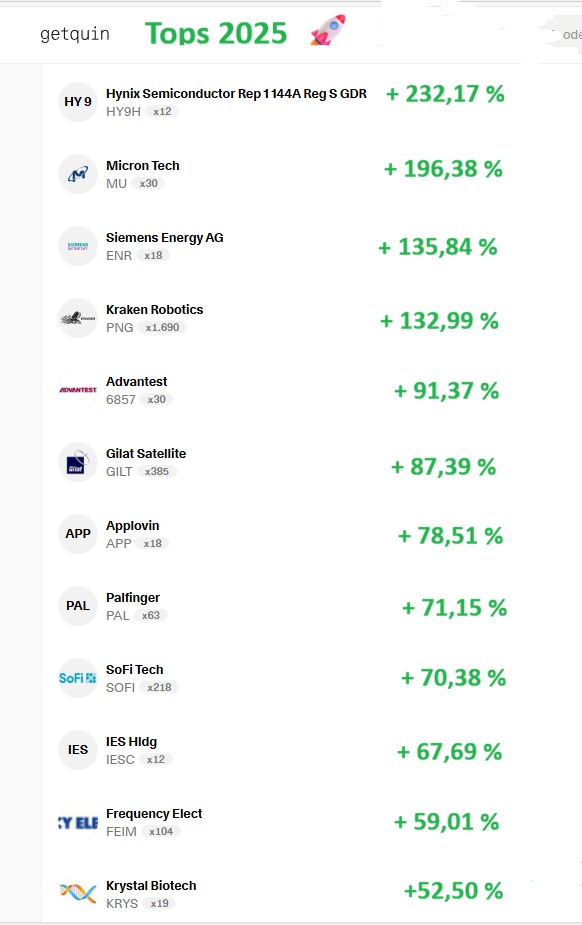

-Gilat $GILT (-0.68%)

-AeroViroment $AVAV (+3.91%)

When 🍊had once again pushed down the pharma sector, there was an additional purchase at

- Krystel $KRYS (-0.74%)

Good figures for

- Micron $MU (-3.66%) and SK Hynix $HY9H (-14.29%)

and a new entry due to good momentum at

- Frequency $FEIM (-0.64%)

then gave me a small year-end rally.

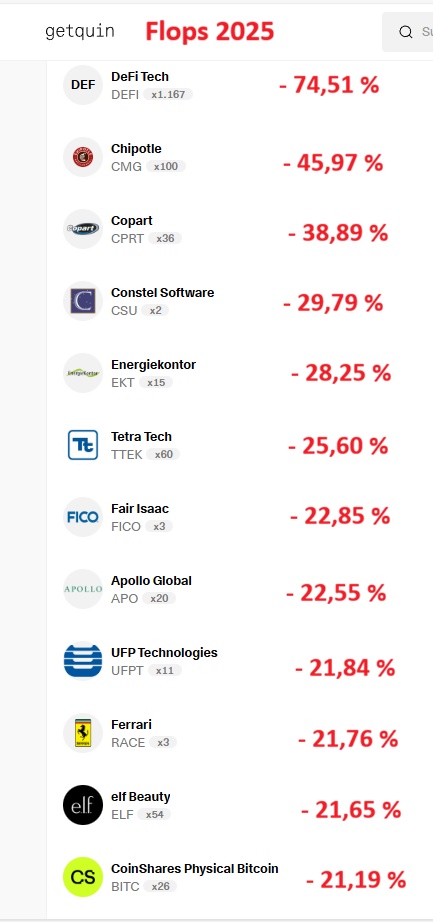

Flops 2025

But of course not everything is positive on the stock market.

And there are also rotten potatoes in a broadly diversified portfolio.

In contrast to an ETF, I have the option of sorting out the rotten potatoes in my portfolio. Which should ultimately lead to outperformance.

But sorting them out is not that easy.

Because some of the underperformers in 2026, such as

- Chipotle $CMG (-0.43%)

- Constel Software $CSU (-1.74%)

- Copart $CPRT (+0.16%)

- Tetra Tech $TTEK (-1.29%)

- UFP Tech $UFPT (-1.14%)

- FICO $FICO (-1%)

- Apollo Global $APO (-1.34%)

- Ferrari $RACE (-2.63%)

are less speculative quality stocks, which should actually hedge my portfolio.

My dears, I need your help here. help.

Which values would you stick to and where do you see a comeback?

My analysis would be:

- Eleven Beauty as a growth stock still has potential, and has been quite impacted by the China tariffs

- Chipotle continues to expand and grow.

- Constel. Software is a long term compounder which has suffered from CEO resignation and AI uncertainty. See a recovery here.

- FICO the monopoly has been partially broken. But still sees a moat.

- Copart, has been a steady performer so far. But difficult to assess how autonomous mobility will affect the business model. (eternal Selling)

- Ferrarisimilar to Copart. Is facing a major transformation with challenges (eternal sale). Sell)

- Tetra Tech, profiteer of AI and expansion of data centers. Tainted by the Trump administration. Because some public contracts in developing countries. But should benefit from climate change and may even be an insider tip in the election year.

- UFP Technology Growth sector with a moat. Fundamental figures are right, expect comeback (eternal). Buy later)

- Defi Technology the child has fallen into the well 😭. Eternal comeback due to rising Bitcoin.

Tops 2026

I continue to hold on to almost all stocks here.

I am particularly positive about the biotech sector.

- Krystel Biotech

- Applovin is now performing very well for the second year in a row. And some analysts also count the share among the favorites for 2026. @Semos25

- micron and sk Hynix were completely ignored by investors for a very long time despite their favorable valuations. I bought more shares several times during this period. Both shares are also among the favorites and AI profiteers in 2026

- Frequency moat in the niche. Profiteers from rising interest in quantum technology. Could benefit from the Spaxe X IPO and NASA's plan to travel to the moon.

- Kraken Robotichas been written about a lot in the last few days (thanks @Klein-Anleger ). I remain invested.

- Sofi, IES Holding, I remain invested.

- Palfingersurprise of the year, fundamentals fit, good dividend yield, profiteer from expansion in renewable energy, increase in defense spending. Chart-technically in a very exciting situation, hanging on to the old high. Watch and help @TomTurboInvest (Watch / Sell).