Ho ho ho you beautiful Christmas time...

...here again the monthly look in the rear-view mirror on my part 🔎

The first thing that surprises me is the fact that the Getquin Rewind is more positive than my monthly benchmark at the end of the month 🤔

According to Rewind, I ended the month with + 1.07%...

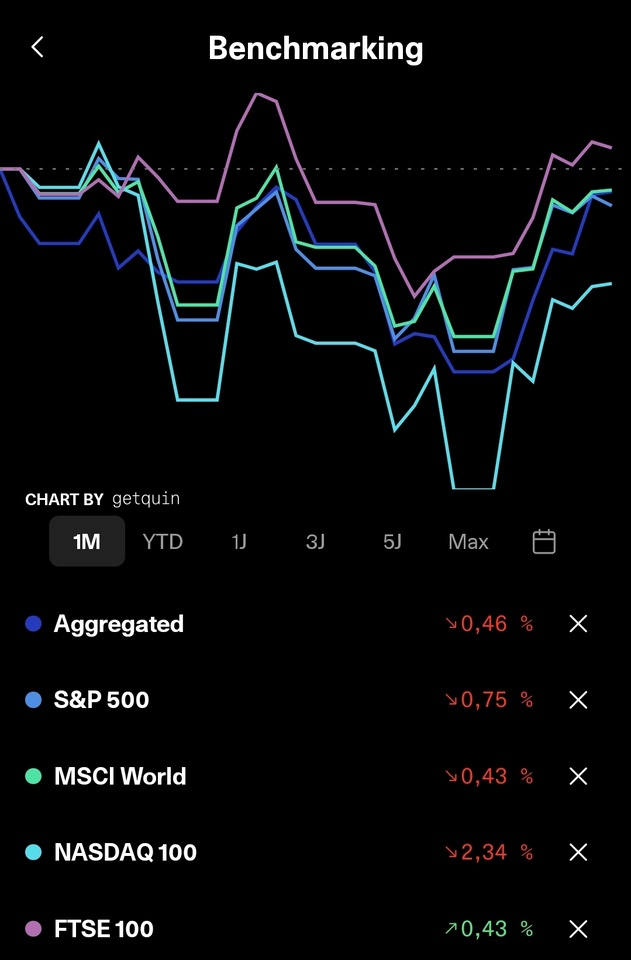

...whereas my benchmark closed the month at -0.46% as at 30.11.2025 🤷🏻♂️

I can't quite put this together yet, but I assume that the cut-off date for the calculation was a different date to 30.11. or that gross dividends are also partly used here 🤷🏻♂️

Be that as it may, for me the benchmark is the measure of all things and this month ended with -0.46% 📉

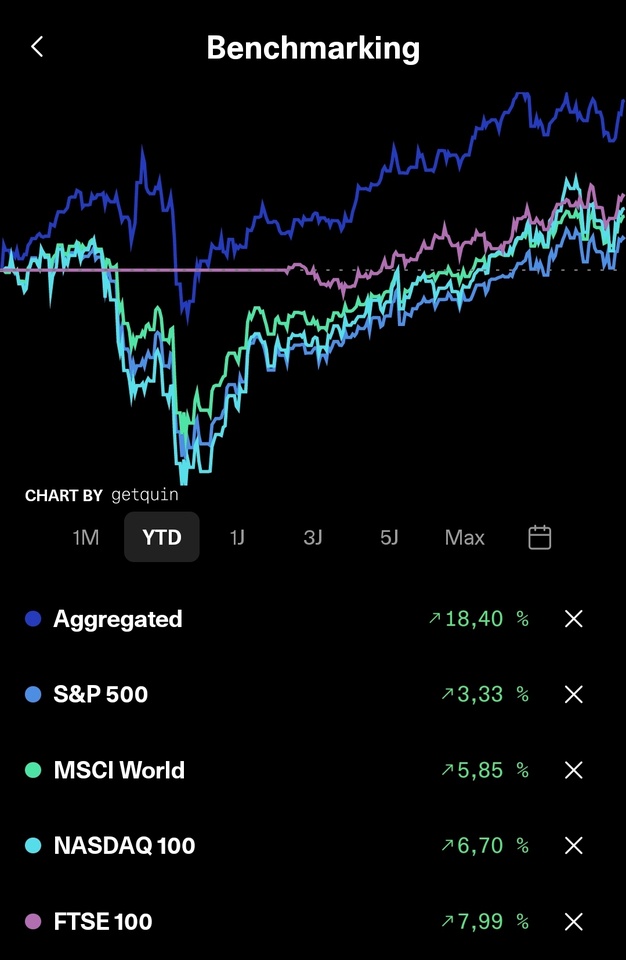

Year-end rally actually looks different to me, but all in all I am quite satisfied with the annual results so far and am close to the lower range of my targets, which have been raised twice so far...

...I'm also quite satisfied with the overall performance so far and am on a par with the Nasdaq, although my portfolio is anything but tech/growth-heavy 😅

If things continue like this, I see myself continuing on course for the first 100k 💪🏻

And if things go well, even during the term of office of the Orang(e)-Uta 🍊

But as we all know, things often turn out differently than you think, so keep spitting in your hands and keep going...

In terms of dividends, the month looked a little better again:

》Gross: € 217.01

》Net: € 176.09

》Yield (TTM): 6.033%

》YOC (TTM): 6.928%

The values would also be a little higher, but with every further purchase without dividends received, it naturally falls again a little, but still fits so far 😉

》Total net dividend: € 1479.94

》CAGR: 495.30%

All in all, I think this is bearable after a good 2 1/2 years and will rise steadily.

》My top 3 this month:

🟢 $BATS (-0,9 %) +14,16% (+100,07%)

🟢 $DTE (-1,11 %) +1,35% (-1,57%)

🟢 $WINC (-0,11 %) +1,30% (+5,31%)

》My flop 3 this month:

🔴 $3750 (-0,19 %) -16,35% (+47,92%)

🔴 $YYYY (+0,33 %) -7,34% (+3,70%)

🔴 $VAR (+2,05 %) -5,49% (+1,01%)

》Disposals:

none

》Additions:

none

》Increased:

Apart from that, there wasn't really much else new, except that my CT in November also turned out well and the next check-up is due in 1 week.

With this in mind, I wish us all a wonderful pre-Christmas period and a good end to the year...stay tuned 📈👋🏻