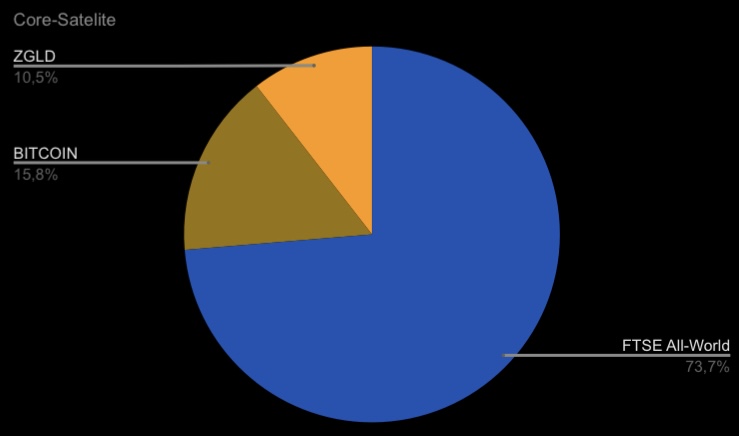

In the world of investing, structure and weighting are crucial, especially if you want to build a sustainable and high-yielding portfolio. The following chart shows my target weighting

target weighting, based on the core-satellite principle. This model combines stability with targeted growth potential, a balance between risk and opportunity.

The portfolio structure at a glance:

1. core component - 73.7% (between 70-80%) FTSE All-World (blue) $VWRL (+1,7 %)

and $FWRG (+1,85 %) The majority of my portfolio is made up of the FTSE All-World ETFwhich tracks over 4,000 companies worldwide. This broad diversification is the basis for long-term asset accumulation and protects against individual risks.

Advantages:

- Worldwide diversification in industrialized and emerging countries

- Automatic access to the world's largest companies

- High stability with moderate risk

- Automatic rebalancing if, for example, America loses economic power.

2. satellite components - 26.3% (max. 30%) opportunity-oriented additions

These components increase the return potential through targeted investments outside the broad market index:

- 15.8 % Bitcoin (brown) $BTC (+7,86 %)

I see Bitcoin as a promising but volatile investment. As a decentralized store of value and possible "digital gold", it can benefit greatly in the long term, especially if demonetization continues or institutional acceptance grows.

- 10.5 % gold ETF (orange) $ZGLD

This is a physically deposited gold ETFa classic safe haven with digital access. Gold has historically provided reliable protection against inflation, geopolitical uncertainty and currency risks. ZGLD combines these advantages with the efficiency of an ETF.

(Currently: portfolio still has too little gold and All-World monthly savings plan runs on the FWRG and weekly savings plan on the ZGLD.

Bitcoin is more of a lump sum if more fallen and aligned to 4-year cycle.

Otherwise just a small gamble on Take-Two $TTWO (+2,02 %) with the GTA 6 hype going on but will then be sold shortly before release and regrouped).

Why this portfolio?

The core-satellite model offers me several advantages:

- Stability through the core share (FTSE All-World)

- Flexibility & innovation through satellites (Bitcoin and gold)

- Risk control through clear weightings

It is a portfolio that is designed for the long term, i.e. not a short-term speculative portfolio, but a well thought-out structure with a strategic focus on the next 10-40 years.

Possible further developments

Of course, no portfolio is set in stone or perfect. Here are a few considerations for possible further development:

- Further satellite ideasEmerging markets, AI ETFs, small caps, dividend stocks

- Rebalancing strategy: Review the weighting once a year and adjust if necessary

- Hedging strategiesE.g. through cash quota or bonds for times of crisis

And now it's up to you:

- What does your portfolio weighting look like?

- Are you more interested in stability or do you take more risk?

- What role do crypto or precious metals play in your strategy?

- Do you also use the core-satellite model or do you take a different approach?

I look forward to your input, your experiences and your questions in the comments!

Your Lord Vader!