Hello Community,

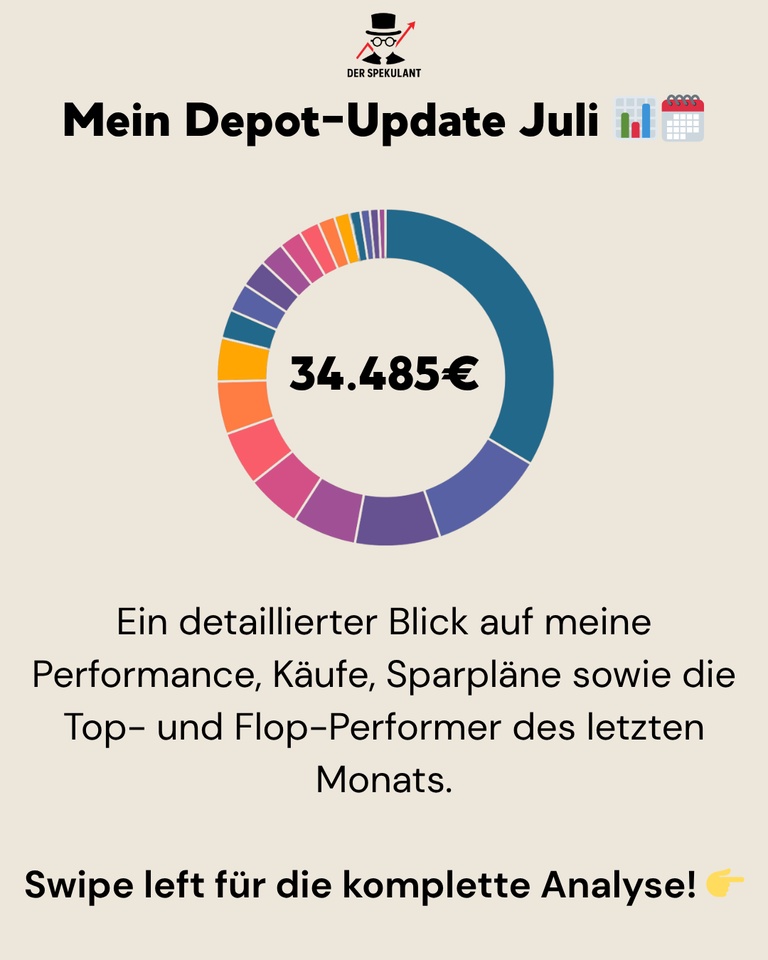

July is history and here is my usual transparent monthly review directly from the portfolio, which has now reached a value of €34,485. It was a month that perfectly demonstrated the importance of a clear strategy and a steady hand.

📈 1. the performance: solid in a turbulent environment

I am satisfied with a monthly performance of +1.54%. As the chart shows, I was able to outperform the DAX (+0.57%), but was slightly behind the S&P 500 (+2.20%) and the strong NASDAQ100 (+6,35%). The result reflects my portfolio: a high tech component, which benefited from the strength of the US indices, but also positions in Europe and China, which held back in some cases.

2. my purchases: anti-cyclical & quality focus

💸 I made three targeted purchases in July:

- Keyence (501 €) & Novo-Nordisk (526 €): Here I built up my positions in two absolute quality champions at the beginning/middle of the month.

- Ferrari (101 €): Following the exaggerated share price fall of over 11% after the quarterly figures, I took the opportunity to buy a small, disciplined tranche. For me as a long-term investor, such irrational market movements are clear buying opportunities in excellent companies.

3. my savings plans & dividends

🏦 The basis of my asset accumulation continued as usual:

- Alibaba (404 €): I continue to use the savings plan to consistently expand my anti-cyclical bet on the Chinese e-commerce giant.

- BYD (19 €): Here, the dividend received was reinvested directly back into new shares. This is how the compound interest effect works optimally.

4. tops & flops: a reflection of the market

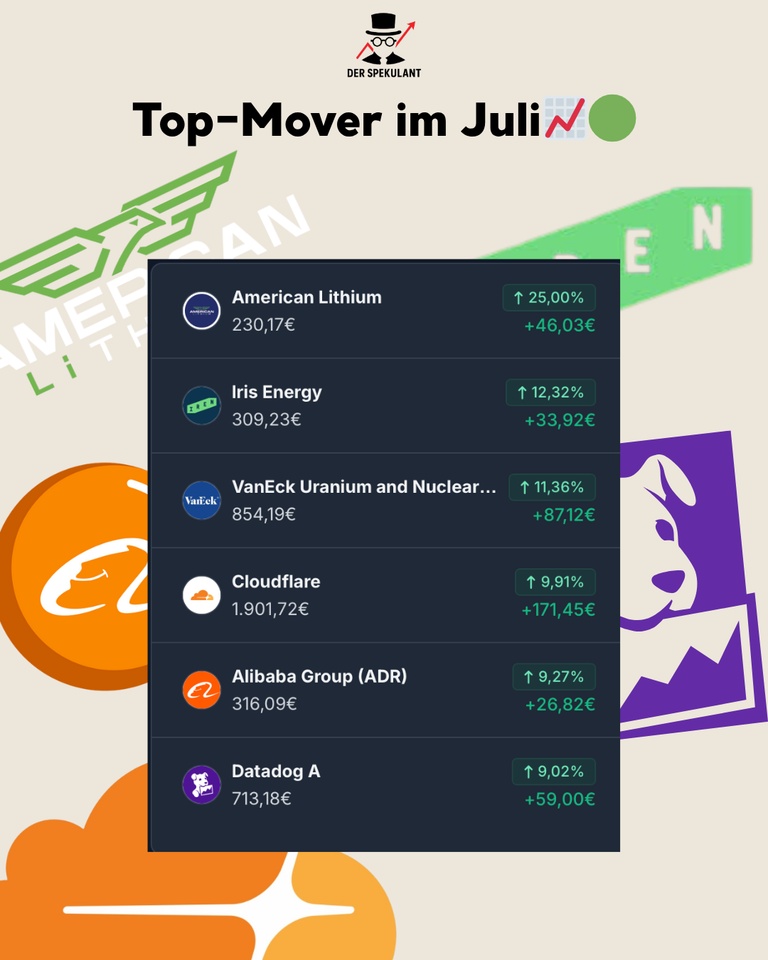

🟢 Top movers:

The list was topped by my speculative stocks American Lithium (+25.00%) and Iris Energy (+12.32%) and the Uranium & Nuclear Technology ETF (+11,36%). This shows that risk appetite in niches is increasing again in an uncertain market environment. My tech stocks such as Cloudflare and Datadog also performed strongly.

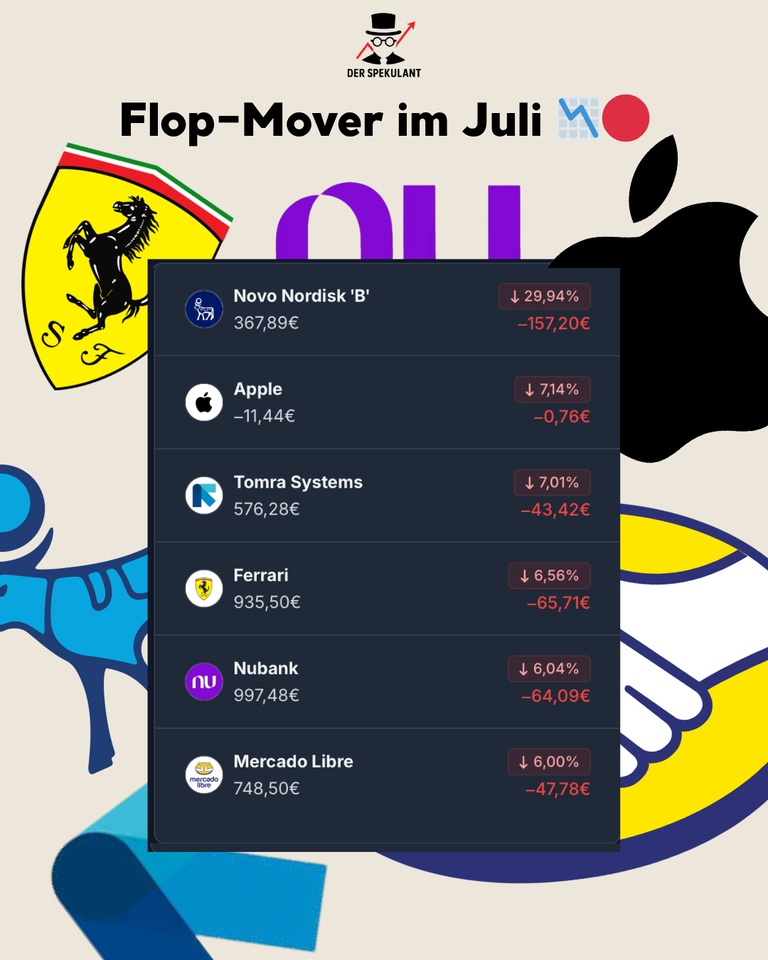

🔴 Flop mover:

Here were the losers of the month Novo-Nordisk (-29.94%) and Ferrari (-6,56%). These defensive stocks underwent a strong correction in July, which I, as with Ferrari as shown in the case of Ferrari.

🧠 Conclusion:

July was a month of contrasts. While the overall market performed solidly, there were strong rotations beneath the surface. My strategy of focusing on a mix of a solid ETF core, quality stocks and targeted speculative bets proved successful.

How did your July go? Did you also use the correction in some stocks to buy more? I look forward to hearing from you!

$NOVO B (-15,64 %)

$1211 (+1,35 %)

$RACE (-1,95 %)

$IREN (+4,77 %)

$NET (-9,79 %)

$BABA (-1,07 %)

$DDOG (-11,35 %)

$NUKL (-2,78 %)

$TOM (-3,42 %)

$NU (-7,06 %)

$MELI (-6,75 %)