What has happened so far and what should happen:

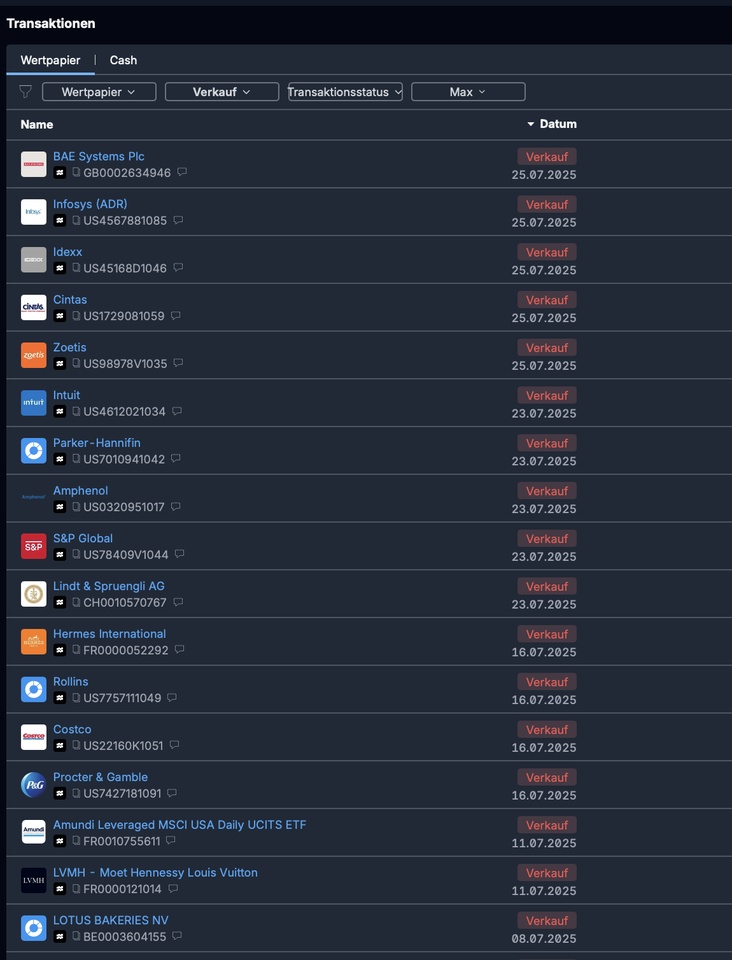

Parting ways is always hard, but here are the sales I completed in July:

Next to the $VWRL (+0,01 %) and $EQQQ (+0,69 %) there were also a few subsequent purchases. (No one is perfect) According to the memory log, these are only $GOOGL (-0,16 %) and $III (+1,32 %) maybe there were a few more.

Here are the purchases:

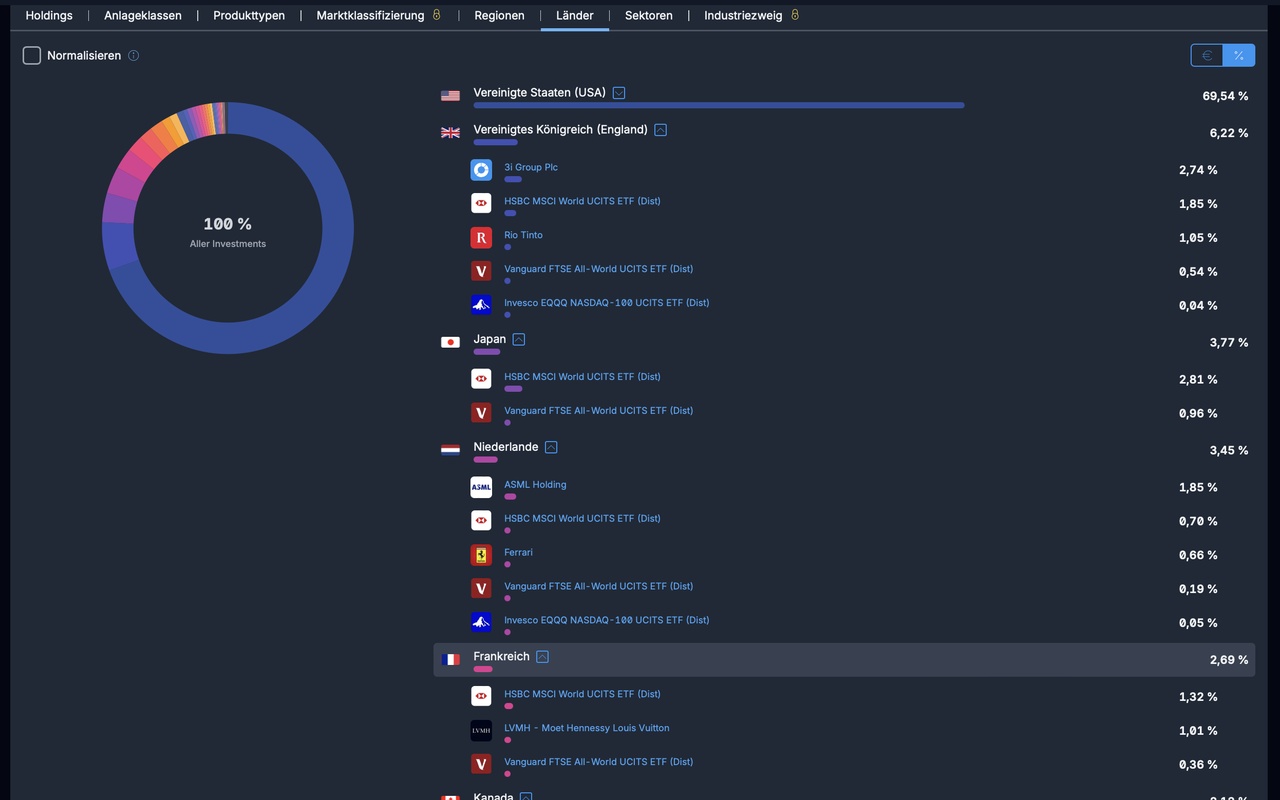

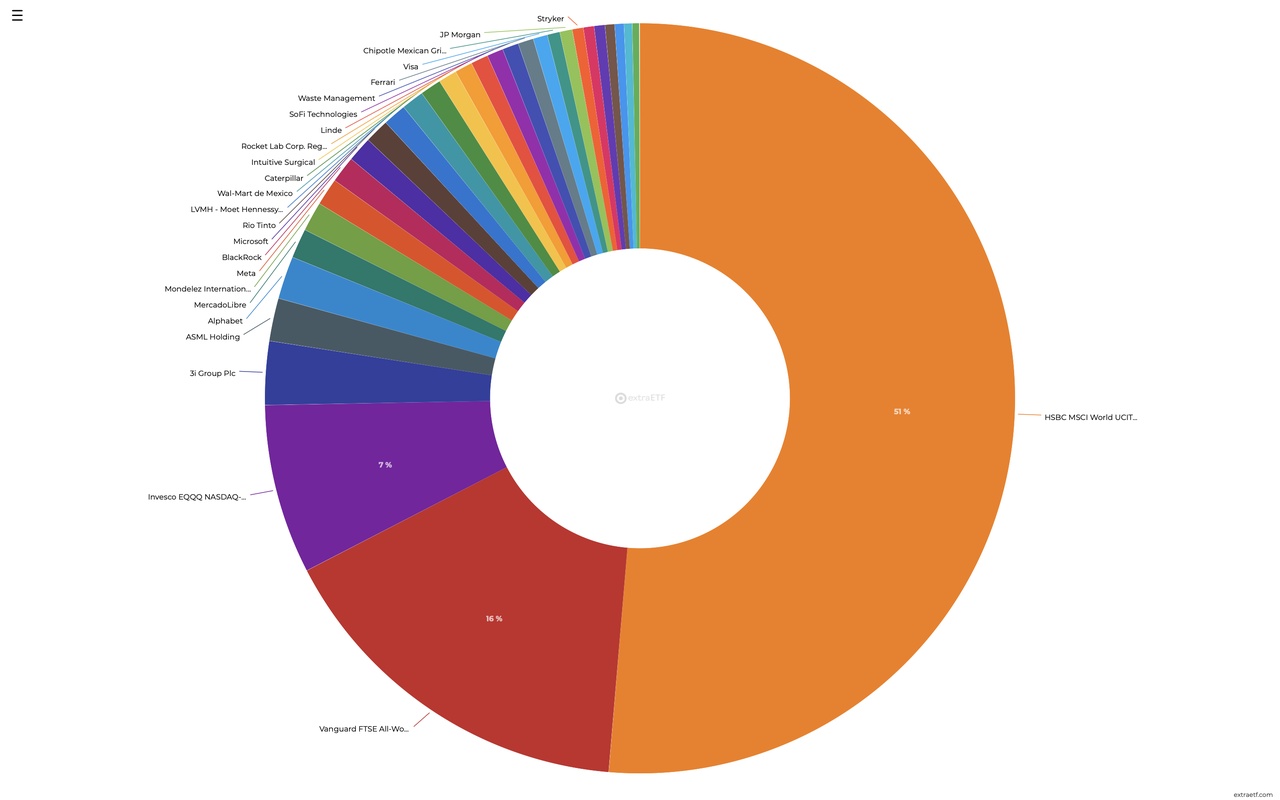

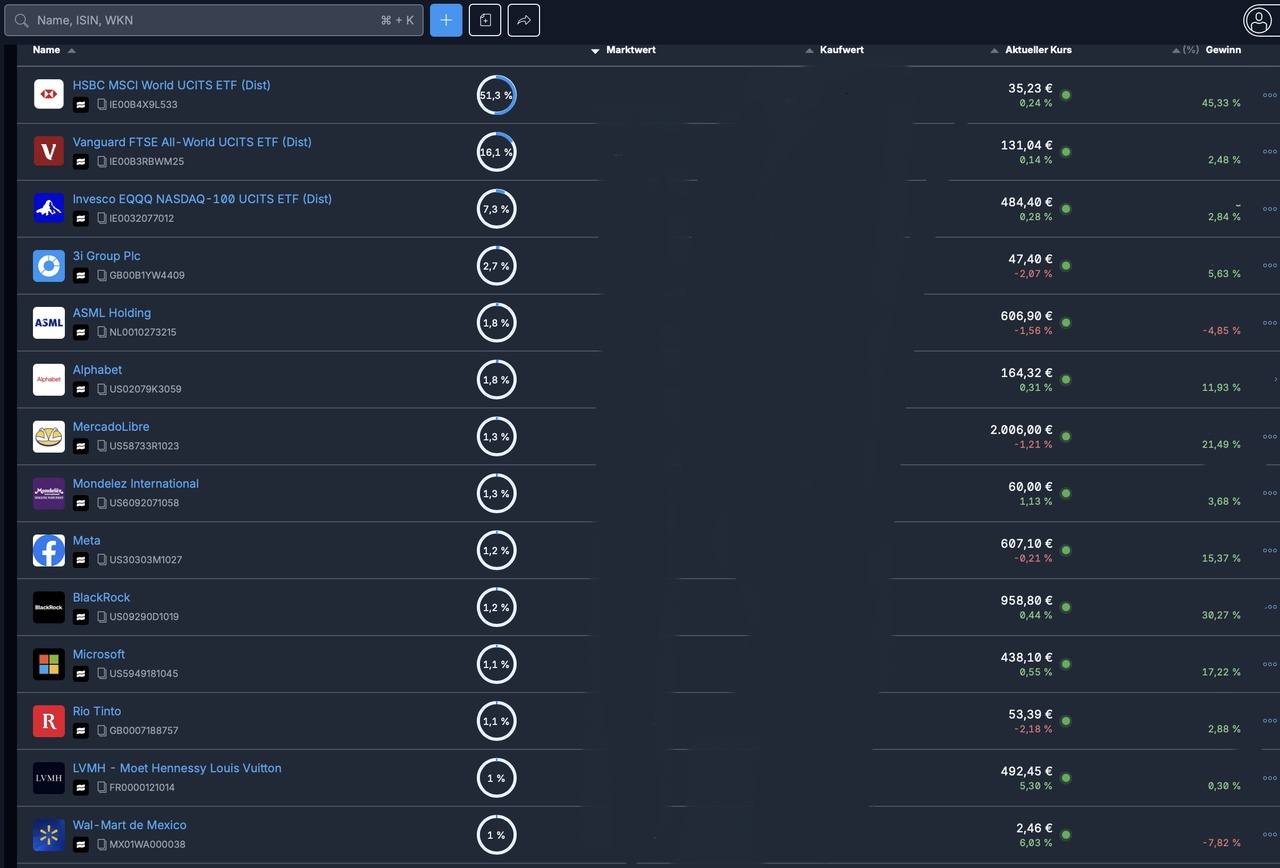

In any case, this is what the portfolio looks like today:

There are now "only" 32 positions left 😅

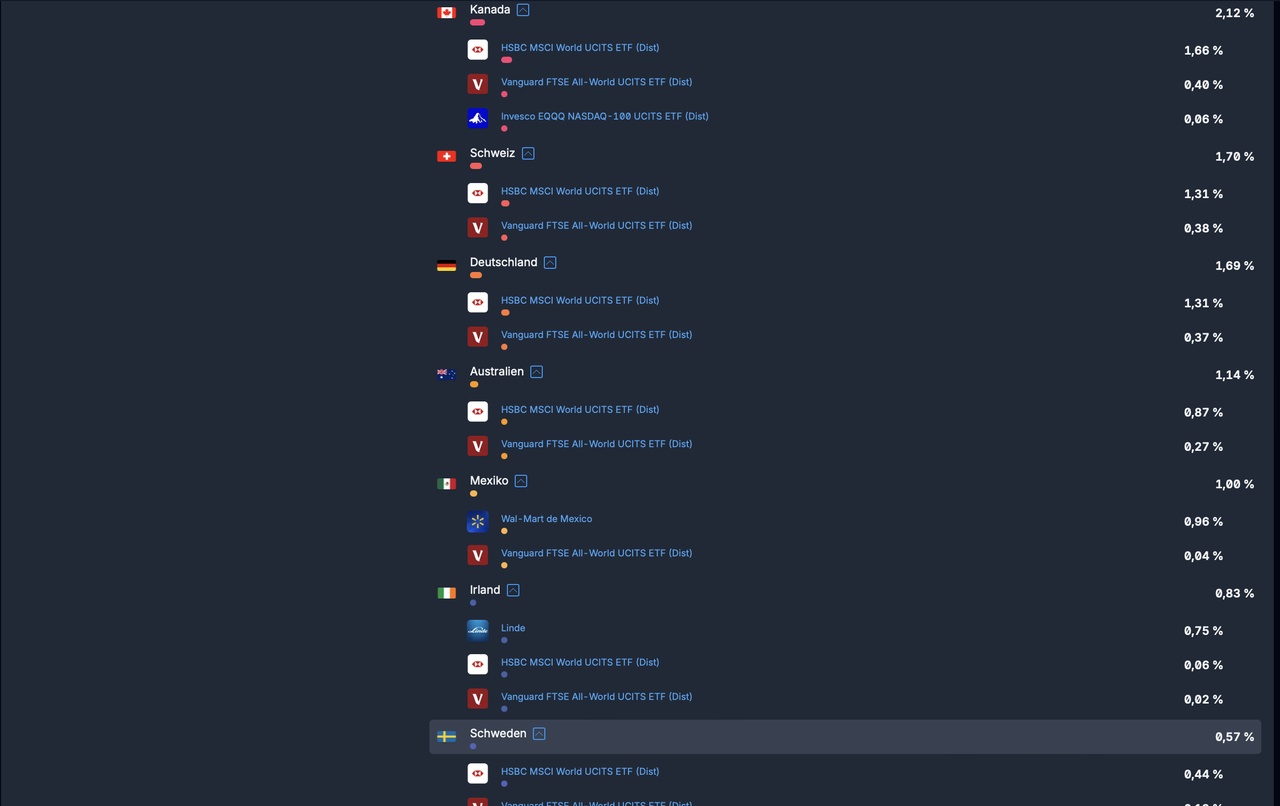

Here is the country breakdown.