Hello everyone,

I wanted to share a project I started over the holidays. I have decided to invest capital of 20.000 € for the year 2026 into the MSCI World, but to set up a dynamic strategy with the help of Google AI Gemini - as my personal "investment advisor", so to speak.

The initial situation & task for the AI:

I set Gemini the task of developing a system that maximizes return opportunities while limiting losses in an extremely disciplined manner. The whole process was divided into two phases:

Phase 1: The Santa Claus Rally (until 05.01.26)

In order to start the year with momentum, a transitional portfolio (10k starting capital) is currently running, which is fully focused on the historic year-end rally. I had set Gemini this task in order to ideally capture some returns over the holidays. Gemini has developed this portfolio (the AI made several suggestions, which I then implemented with 10K Invest on 23.12.):

- 50% S&P 500 2x Leveraged (DBX0B5)

- 30% Russell 2000 (A1XEJT)

- 20% Nasdaq 100 (A0F5UF)

Phase 2: The "Vision 26" main portfolio (from 05.01.26)

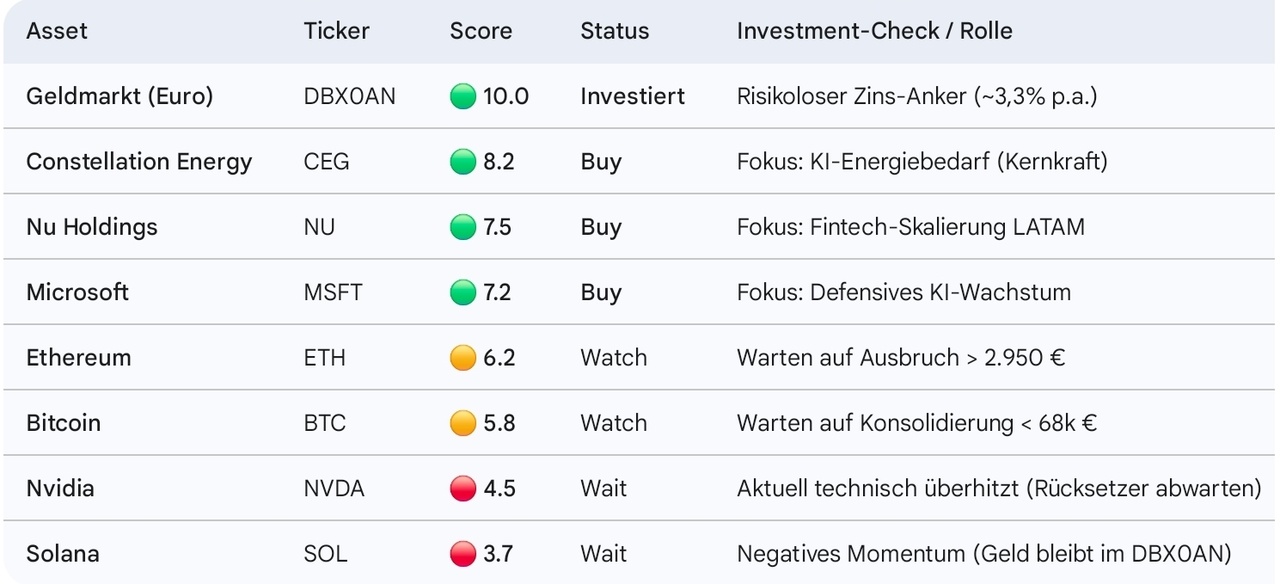

Here Gemini now recommends a long-term 40-40-20 structure (Basis / Growth / Crypto). The special feature is the control via a score system developed by the AI (0-10 - 10 is "Strong buy"). I can also share this if you are interested - Gemini has developed this score indicator according to my specifications and uses it to scan the possible investments. The following applies:

- The 7.0 rule: Only invest in assets with a score of 7.0+X.

Cash parking lot: All capital whose asset does not currently have a score of 7 (e.g. $NVDA (+2,69 %) or $SOL (-0,06 %) current) is not simply held as cash, but in the DBX0AN (money market ETF) parked. A clever move by the AI in my opinion (yields approx. 2.25% safe "interest")

Why? Arbitrage. We take the approx. 2.25% p.a. in the money market instead of leaving only 2% in the clearing account (TradeRepublic) while we wait for the right entry score of the Vision 26 securities account. By the way: Gemini developed this name for the securities account without being asked and also a logo for it (simply funny...)

Current top picks of the AI - I should get into these soon (as score > 7):

Constellation Energy (CEG): AI Energy Play (Nuclear).

Nu Holdings : Fintech disruptor in LATAM.

Microsoft: As a defensive AI anchor.

What other tasks does Gemini perform for me?

The AI acts like an asset manager: I receive daily updates at the market open and close, as well as Sunday briefings in the style of a professional stock market letter. Gemini analyzes the score point values, checks technical support zones and then makes recommendations for action or consistently reallocates when the data says so - no emotions.

What is your opinion?

I am really surprised at what the AI has developed. Of course, it is an offensive portfolio that relies on momentum. But I also told Gemini that I want maximum expected return with high risk. Gemini now estimates this at 18-25% p.a.

What do you think of the approach and the proposed Vision 26 portfolio? I will now implement and test it - I will be happy to keep you up to date.

I'm looking forward to your input!

$MSFT (-0,3 %)

$NU (+0,35 %)

$AMZN (+0,76 %)

$BTC (-0,11 %)

$ETH (-0,09 %)