What a start to the new year - everything from high spirits to geopolitical tensions to a historic correction - and it seems to be continuing just as turbulently as it began...

...but despite the events and the fact that there were only 2 small additional purchases last month, these circumstances don't really seem to bother my portfolio and so a new ATH was reached on the penultimate trading day and closed just below it on the last day.

I am quite satisfied with the 4.70% achieved under the circumstances and it shows me that my selection (.oO dividends do not hurt) is not so bad at all in order not to get under water even in such waters.

In the long term, my strategy continues to pay off positively and there is no reason for me to really change anything here...

...except that this year there will be a little more focus on growth in addition to dividends.

Which brings us directly to the next topic...

...after a good +3804.58% dividend growth in 2024, it was another +148.57% last year and, with the +40.37% forecast so far this year, should easily be enough to achieve my basic target of €2000 net dividend.

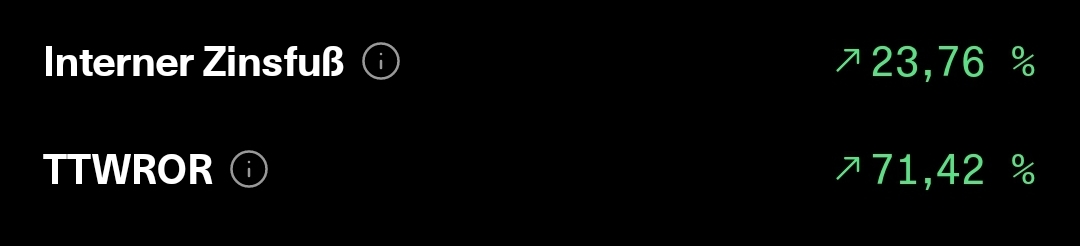

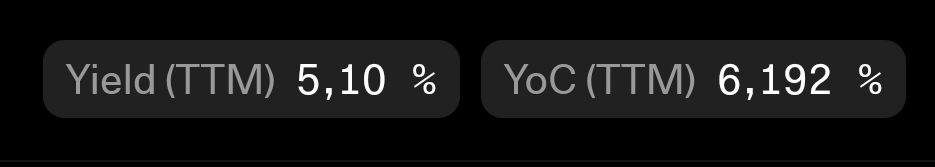

In my view, the overall rate of return is also suitable for the time being and will of course change somewhat over the course of the year...

...it is also fitting that January is a somewhat weaker dividend month, but still tastes good with a net dividend of € 104.16.

》Single stocks top 3《

$HAUTO (+7,71 %) +11,28% (+35,55%)

$RIO (+3,26 %) +10,28% (+41,03%)

$VAR (-0,24 %) +9,50% (+10,20%)

》 Individual stocks Flop 3《

$YYYY (+1,4 %) -7,96% (-4,27%)

$3750 (+0,7 %) -2,58% (+46,54%)

$VICI (-3,31 %) -0,84% (+17,41%)

》Additions/departures 《

none

》Increased《

$VICI (-3,31 %) (10x)

$1211 (-0,74 %) (10x)

Apart from that, there were 2 other pieces of positive news in my private life...firstly, the next check-up is still without findings and secondly, I now have confirmation from the pension provider that I can continue my further training as an accounting specialist (IHK) this year, which was interrupted by the operation. What's more, this will now be taken a little further and I'll also be taking the certification in DATEV and DATEV payroll accounting at the same time...can't hurt 🤫👍🏻

And so I wish us all continued good luck, a nice rest of the Sunday and maximum profits ✌🏻