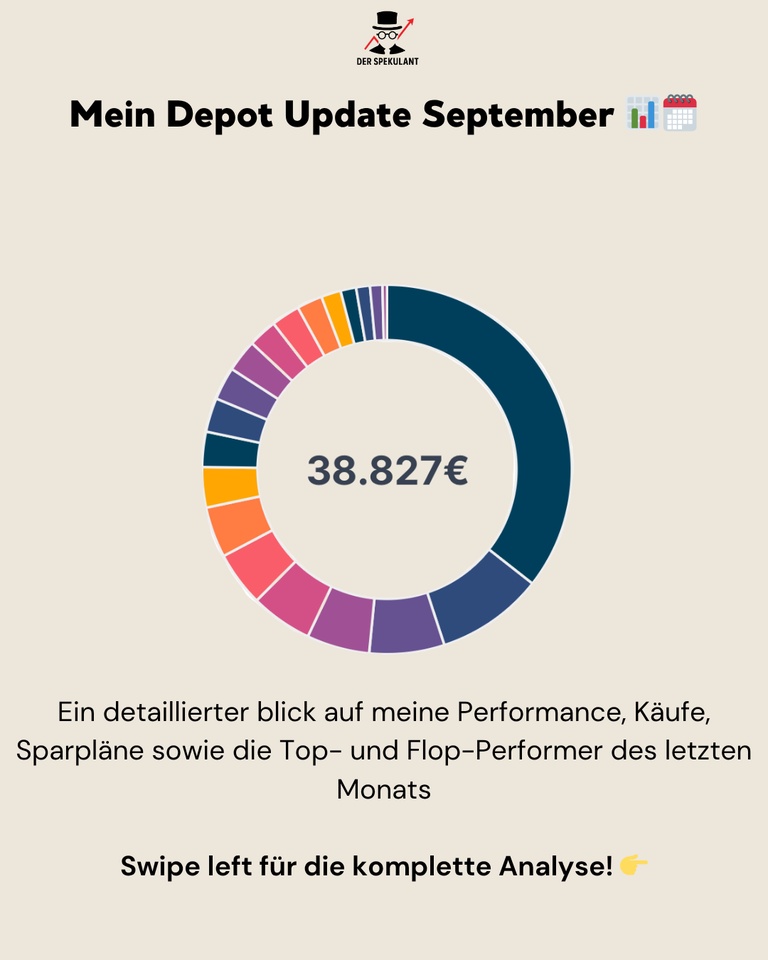

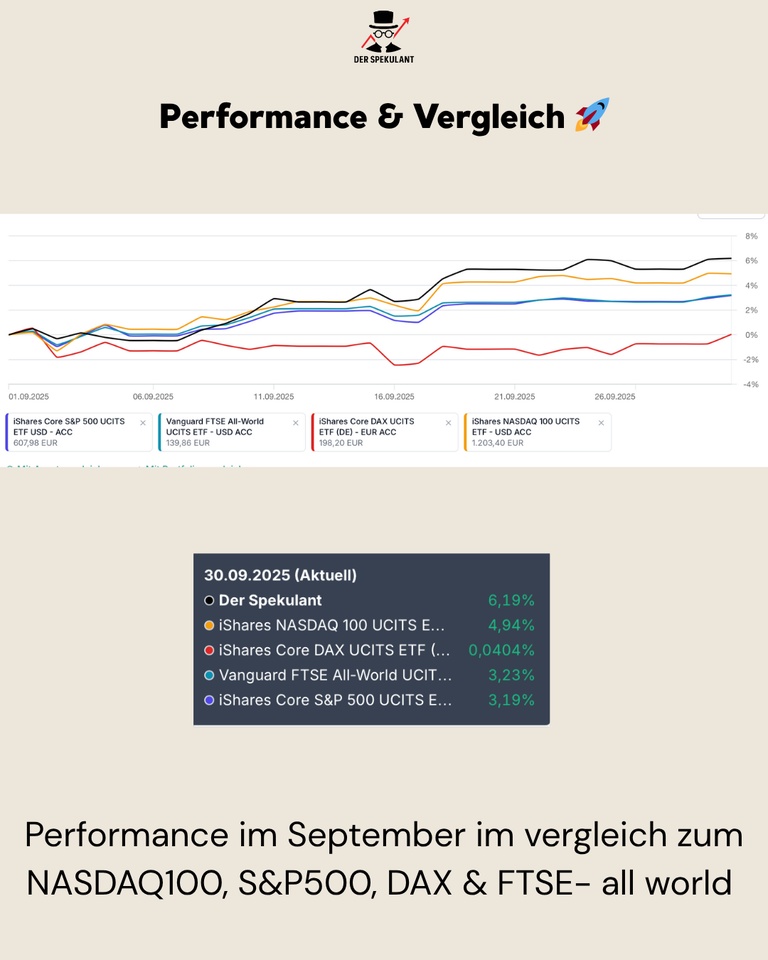

September was a successful month - my securities account climbed to 38.827 € and gained +6,19 % significantly more than the major benchmarks (NASDAQ100: +4,94 %, S&P500: +3,19 %, FTSE All World: +3,23 %). I was thus able to clearly beat the market again. 🚀

1. performance & comparison 🚀

My portfolio benefited from a balanced mix: while individual techs performed well, other sectors provided additional stability. Particularly striking: the outperformance compared to the DAX & S&P, which were comparatively weak in September.

2. my savings plans & allocation 💶

As usual, my ETF savings plans continue to run consistently - with a focus on the solid foundation of MSCI ACWI $ACWI and World Small Cap $WSML (-0,82 %). In addition, capital flows monthly into Berkshire Hathaway (B) $BRK.B (-0,79 %) as a flexible, defensive allocation with optional cash flow leverage in a crash scenario.

In addition to the securities, I also invested € 180 in an original oil painting by Luciano Torsi in September - a small but deliberate step into alternative real assets. I am thus adding an aesthetic, real asset with long-term value retention potential to my allocation.

3rd top mover in September ✅

The list was headed by IREN $IREN (+4,77 %) (+76%), which benefited from the strong demand for AI data centers. Also American Lithium (+36 %) also showed strength. Alibaba $Baba (+35 %) made significant gains thanks to cloud growth, in-house chip development and the rejection of NVIDIA chips. Rheinmetall $RHM (-2,33 %) (+17 %) continued to benefit from high defense demand, while the uranium sector (+16 %) and Crowdstrike $CRWD (-10,15 %) (+14 %) also performed well.

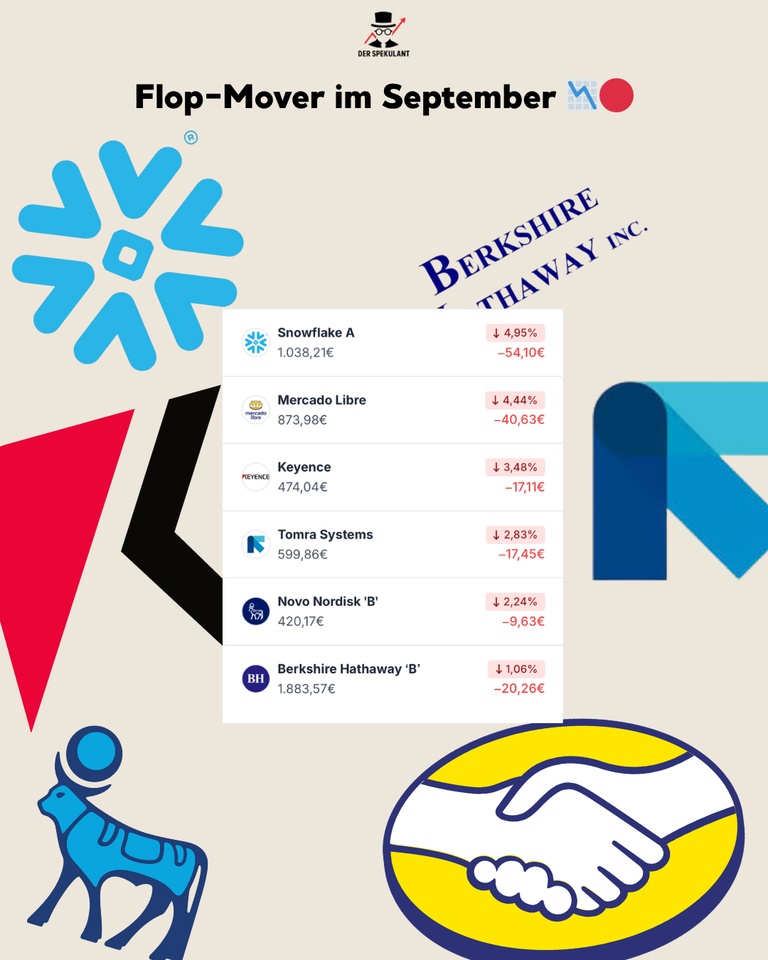

4th flop mover in September ❌

On the opposite side Snowflake

$SNOW (-8,84 %) (-5%) lost some ground as investors became increasingly critical of its high valuation - despite solid figures. Also Mercado Libre

$MELI (-6,75 %) (-4 %) also suffered from profit-taking after a strong summer rally. Keyence $6861 (-0,75 %) (-3 %) and Tomra Systems $tomra (-2.8 %) corrected slightly without the fundamental picture deteriorating. The month was somewhat weaker for Novo Nordisk

$NOVO B (-15,64 %) (-2.2 %), which continues to struggle with political risks and patent concerns in the GLP-1 segment. Even Berkshire Hathaway fell slightly (-1 %).

5. conclusion 💡

My September shows: Diversification pays off. Individual techs like Snowflake are correcting, but satellites like IREN and Alibaba are more than compensating for this. With the savings plan on Berkshire, I remain defensively prepared should volatility increase in Q4.

❓ Question for the community:

Which value surprised you the most in September - positive or negative?