Most investors believe that successful investing means choosing the right shares to find the right stocks.

The truth is that it is about thinking correctly.

What separates successful investors from the crowd is not a secret information advantage

but the ability to to think beyond the first level.

This is called: Second-Order Thinking.

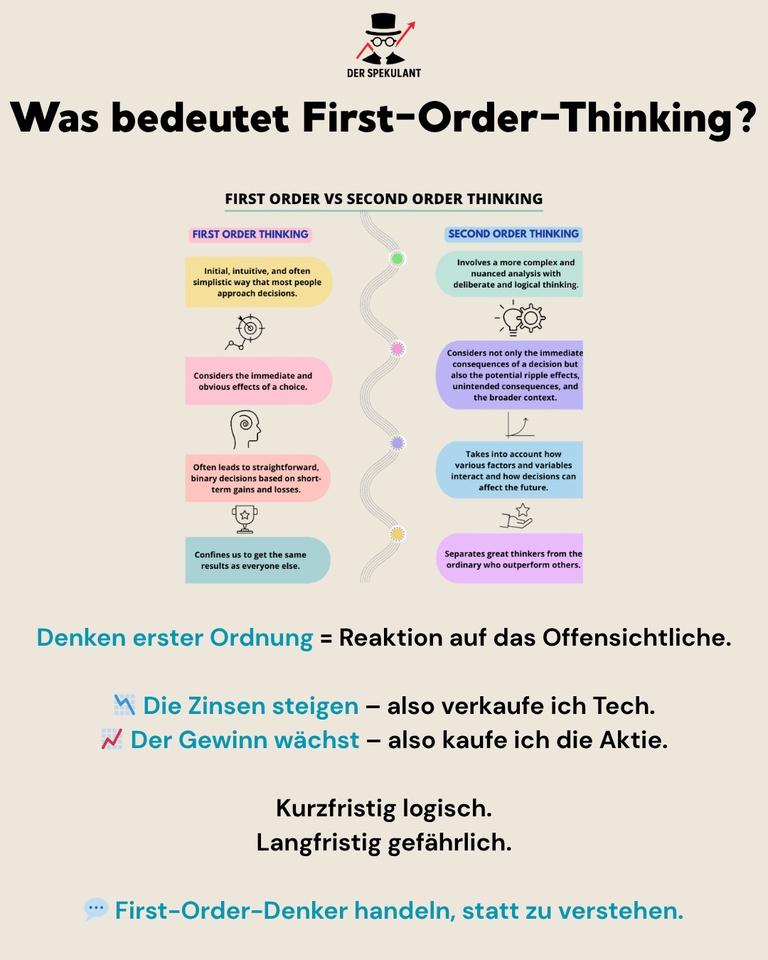

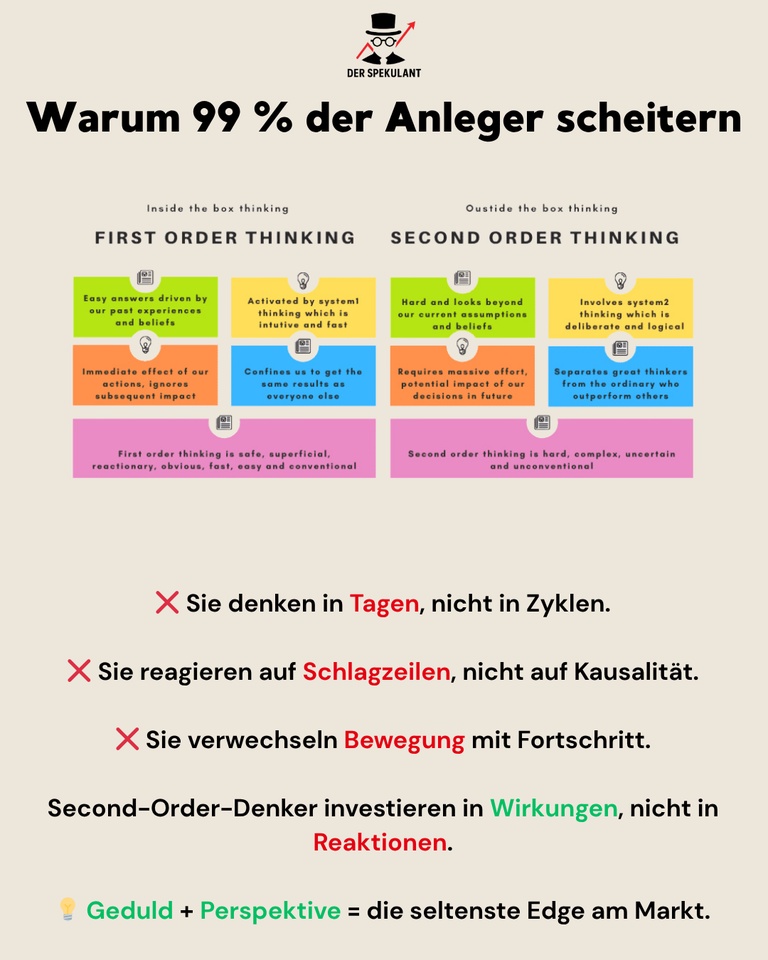

🩺 First-order thinking - the reflex

Most market participants act according to the obvious:

➡️ "Interest rates are rising - so I'm selling tech."

➡️ "Profits are falling - so the stock is bad."

➡️ "The company is growing - so I have to buy."

This is first-order thinking - linear, reactive thinking.

Logical in the short term, dangerous in the long term.

Why?

Because the stock market is not a math problem, but a dynamic system.

What seems "logical" today is already priced in tomorrow.

First-order thinkers trade according to headlines.

Second-order thinkers think in causalities.

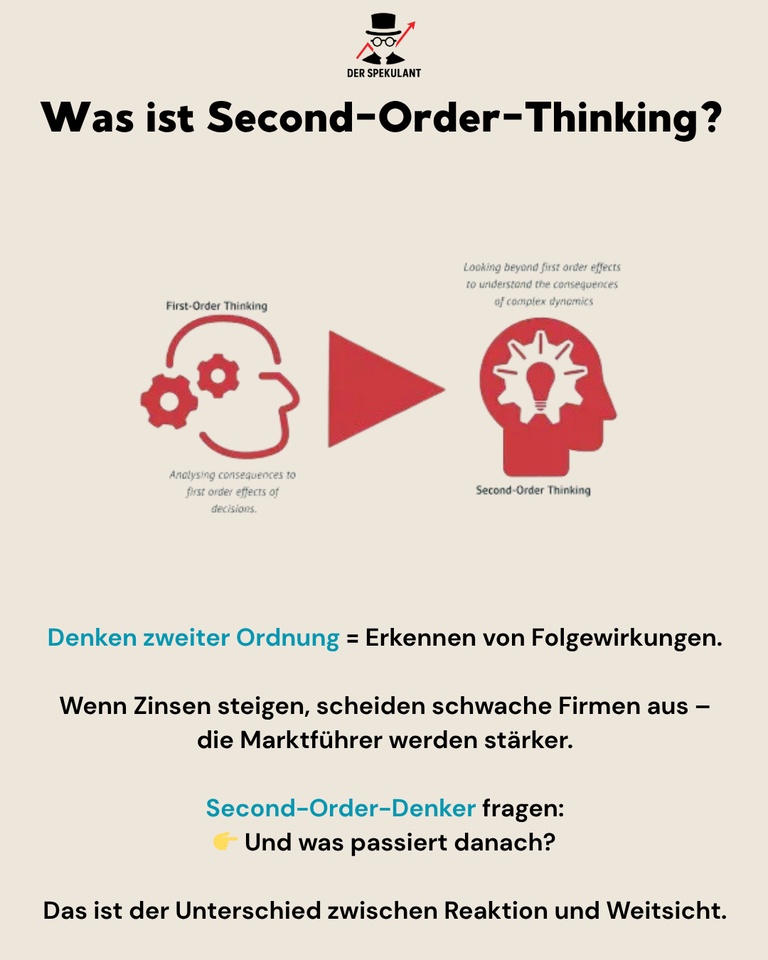

🔁 Second-order thinking - the difference

Second-Order Thinking asks:

👉 "And what happens after that?"

👉 "How does the system change as a result of my assumption?"

👉 "What are the side effects if everyone makes the same decision?"

It is thinking in second-level consequences - not in effects, but in subsequent effects.

When interest rates rise, first-order thinkers think:

"Bad for tech - rates are falling."

Second-order thinkers think:

"In the short term, yes - but in the long term, inefficient competitors disappear.

Market leaders survive, become more profitable and their moats grow."

This way of thinking requires patience, scenario competence and intellectual humility.

You don't know what will happen will - but you understand what can happen.

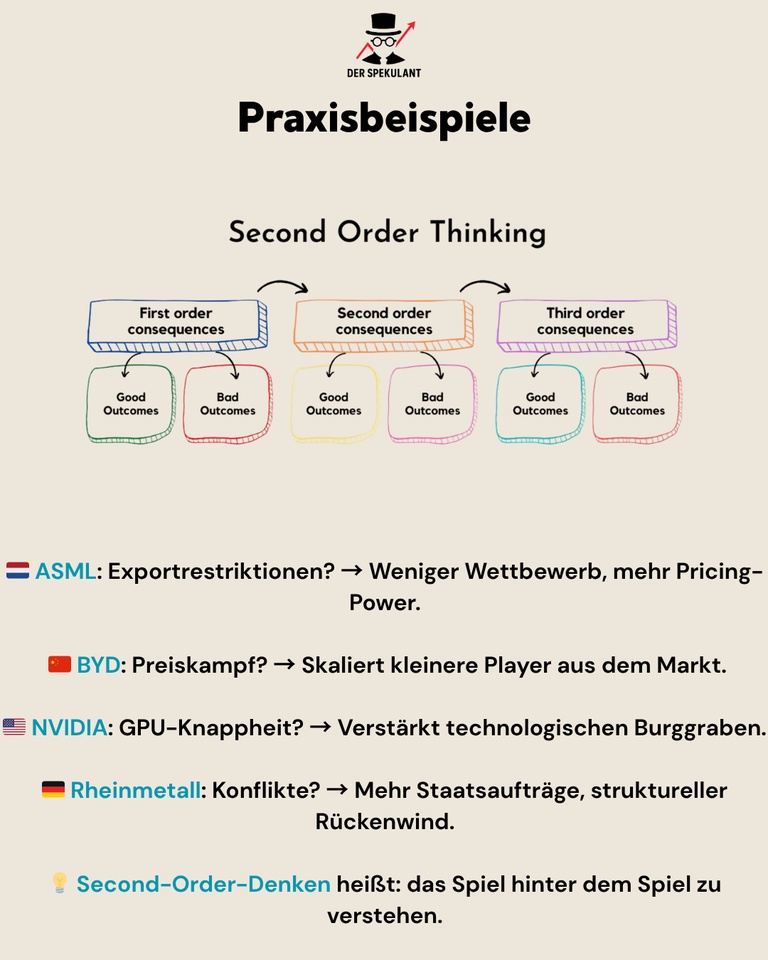

📈 Practical examples from the real world

🇳🇱 ASML

First Order: "Export restrictions harm demand."

Second order: "Less competition → pricing power increases."

🇨🇳 BYD

First Order: "Price war destroys margins."

Second Order: "Economies of scale eliminate weak manufacturers. Market shares increase."

🇺🇸 NVIDIA

First Order: "GPU shortage jeopardizes growth."

Second Order: "Shortage strengthens technological supremacy. Competition loses out."

🇩🇪 Rheinmetall

First Order: "Geopolitical crises = short-term boom."

Second Order: "Structural armament + defense budgets for decades."

Second-order thinkers recognize:

Market mechanisms are feedback loopsnot one-way streets.

🧩 The psychological dimension

Second-order thinking contradicts human intuition.

Our brain looks for quick answers and clear connections.

But markets are systems with feedback loops.

Actions generate effects that trigger new actions.

Those who think in the first order act on the basis of emotion:

⚠️ FOMO, fear of loss, seeking confirmation.

Those who think in the second order act on the basis of structure:

🧠 cause, effect, consequence.

That is the reason why Patience and perspective are the rarest but most valuable edges on the market.

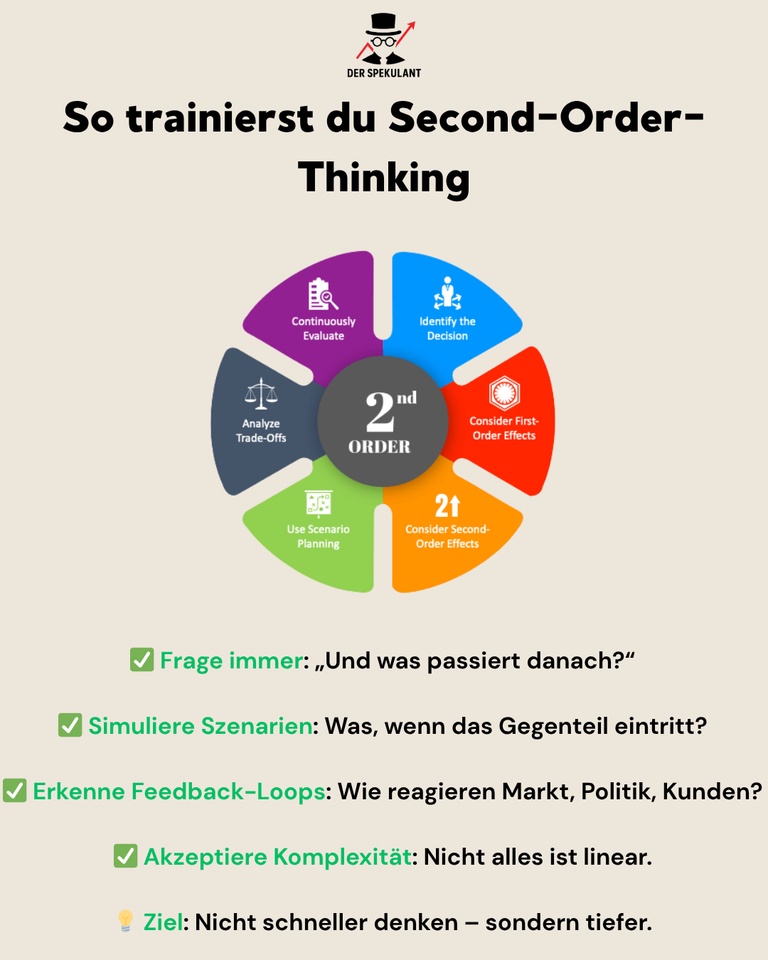

⚙️ How to train second-order thinking

✅ Ask yourself: "And what happens after that?" Not what the market knows today - but what it does not yet understand.

✅ Simulate counter-scenarios: What if the opposite happens? What would that mean?

✅ Analyze reactions: How do customers, competitors, politicians, central banks react to events?

✅ Accept complexity: Not everything is linear. Sometimes a negative impulse leads to growth in the long term.

✅ Observe market feedback: Recognize how narratives evolve - not just data points.

Second-Order Thinking is not a method -

it is a mental attitude.

📊 Conclusion

The best investors don't think, what happens -

but what happens next.

They see cycles where others see headlines.

They understand cause and effect - not emotion and noise.

Second-Order Thinking is the art,

not being smarter than others,

but thinking differently than the majority.

💬 Community question:

When was the last time you talked about the second level level of your decision -

and how has the result changed?

$ASML (+1,36 %)

$1211 (+0,05 %)

$NVDA (-1,46 %)

$RHM (+0,49 %)