Financial Performance of $3679 (+0 %)

Revenue: ¥6,759M (+9% YoY, record Q1)

EBITDA: ¥1,801M (+1% YoY)

Operating Income: ¥1,416M (-2% YoY) – impacted by one-off M&A costs (~¥35M)

EPS: ¥9.69 (+2% YoY)

All major indicators at 24% progress toward FY forecast; guidance unchanged.

Segment Trends

Vertical HR: ¥2,929M revenue (+10% YoY) – strong growth in “Ties” and M&A additions.

Living Tech: ¥1,694M (+29% YoY) – boosted by insurance & reuse acquisitions, cross-selling gains.

Life Service: ¥2,136M (-3% YoY) – travel sector strong in business travel, leisure moderated; non-core businesses still a drag.

Strategic & M&A Progress

Achieved “Z Core” (¥10B revenue) in Vertical HR ahead of schedule via multiple M&As.

Recent deals:

AnyCareer (Pharma HR) – ¥2.92B acquisition (Sep 2025).

USAEL (Travel DX) – ¥325M acquisition (Jun 2025).

URG (RPO & job placement) – ¥400M acquisition (May 2025).

14 M&A deals in 2nd mid-term plan (~¥6.6B invested); larger deals (Ties, TSD) made biggest impact.

Shareholder Returns

Buyback: Up to ¥700M (1.49% of shares); ~¥400M already repurchased.

Dividend: Increase to ¥11/share (prev. 10.5).

Treasury stock cancellation: 1.7M shares (1.52% of shares) in May 2025.

Shareholder benefit program: Up to 4.03% yield in benefits; total potential yield ~6.38%.

Financial Position

Equity ratio: 56.5%; goodwill-to-equity: 0.6x.

Cash & equivalents: ¥10.6B; total loans down to ¥2.8B.

Operational Initiatives

AI adoption across divisions to improve efficiency (resume/job post automation, scouting optimization, AI quotes in travel).

Portfolio rationalization: downsizing/combining low-margin businesses (e.g., Sanko Ad, MIRAxS).

Outlook & Risks

Inflation and weak yen affecting renovation, leisure travel, overseas real estate.

Tariff concerns in some HR clients but manageable.

Continued M&A focus across multiple domains with “roll-up” strategy in Vertical HR.

As the intention for this 🦆is to hold long-term, its natural to wonder if these are good results…

Yes — these are solid results overall, though not without some caution flags.

Why they’re good:

Record Q1 revenue & EBITDA despite some headwinds.

Revenue growth +9% YoY with strong momentum in Vertical HR (+10%) and Living Tech (+29%).

EPS growth (+2%) and steady margins suggest operational stability.

Guidance unchanged with 24% of annual targets already achieved in Q1 (on track).

Healthy balance sheet – low debt, strong equity ratio (56.5%), good cash reserves.

Active capital returns (buyback, dividend hike, benefit program) show confidence in future performance.

Continued M&A success — “Z Core” milestone reached ahead of plan in Vertical HR.

Caution points:

Operating income down (-2%) due to one-off M&A costs — not a structural issue, but worth tracking if integration expenses pile up.

Life Service segment still struggling (-3% revenue) due to non-core drag and macro headwinds (weak yen, inflation).

Inflation is weighing on renovations, leisure travel, and overseas real estate demand.

Heavy reliance on M&A for growth — organic growth needs to keep pace to avoid overdependence.

Bottom line:

✅ Strong top-line growth, healthy margins, and aggressive shareholder returns make this a good set of results.

⚠️ The main watchpoints are Life Service recovery, inflation impacts, and ensuring M&A integration delivers sustained profitability.

The market reacted with a -4% though…

That reaction isn’t too surprising — even “good” results can trigger a drop if:

1. Expectations vs. Reality

The market may have been pricing in stronger growth (especially in operating income and margins).

Operating income was down 2% YoY, and Life Service is still in decline — this can sour sentiment even if revenue is at record levels.

Heavy M&A focus can make investors cautious if they worry about integration risk or overpaying.

2. Forward-looking Concerns

Guidance was unchanged, not raised — so while results are on track, there’s no upside surprise.

Macro commentary mentioned inflation, weak yen, and demand declines in some areas — investors might see a risk to hitting full-year targets.

3. Profitability Mix

Growth is being driven heavily by acquisitions (Vertical HR, Living Tech), but organic growth may be less exciting.

Margins in Living Tech are around 25% (below target 30%), which might make analysts cautious.

4. Technical/Market Factors

The stock may have been overbought into earnings — a “sell the news” move is common if traders were front-running a beat.

Broader market conditions (sector sentiment, macro jitters) can magnify the drop.

Patito’s Take:

Fundamentally, this was a healthy quarter, but not a “blowout” quarter. The lack of a guidance raise + soft spots in Life Service + one-off costs likely made investors lock in profits.

Since we are holding for the long-term, the growth strategy (especially M&A in Vertical HR) still looks intact — but if we were to be trading short-term, this drop could continue until the price finds support, especially if volume is heavy.

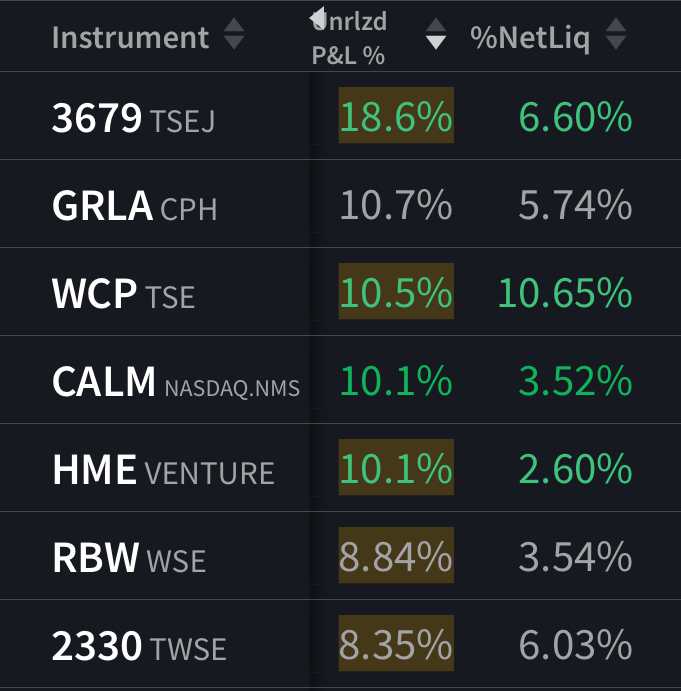

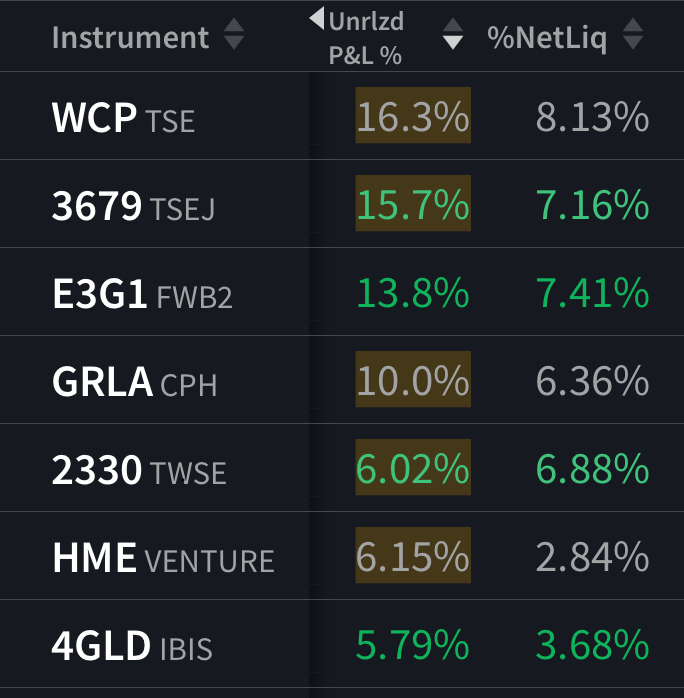

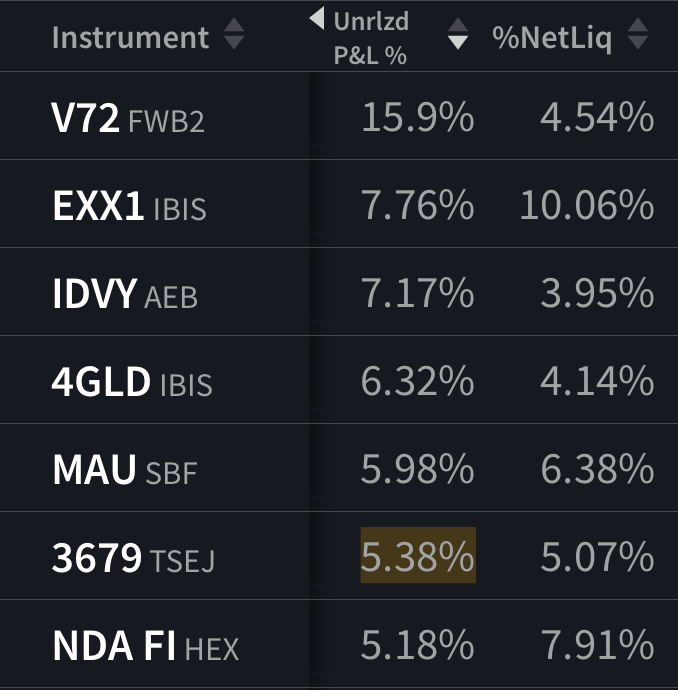

For now Zigexn $3679 (+0 %) is still boasting a Patito Score of 97 and a WB score of 9A ranking it in the top of our~3200 scored stocks and staying in the nest.

ps. Yes its fiscal year 2026 for Zigexn uses a March year-end 💡