What do you think of when you think of Fujifilm? Cameras, printers or maybe just nothing at all? Behind the scenes, the Japanese company that grew up with film and cameras has produced one of the most remarkable metamorphoses in industry history. The moment they realized that their business model was on the brink of collapse due to the rise of the smartphone, they radically rethought their approach. They thought very clearly about where their strengths lay and used these, combined with targeted acquisitions, to reinvent themselves.

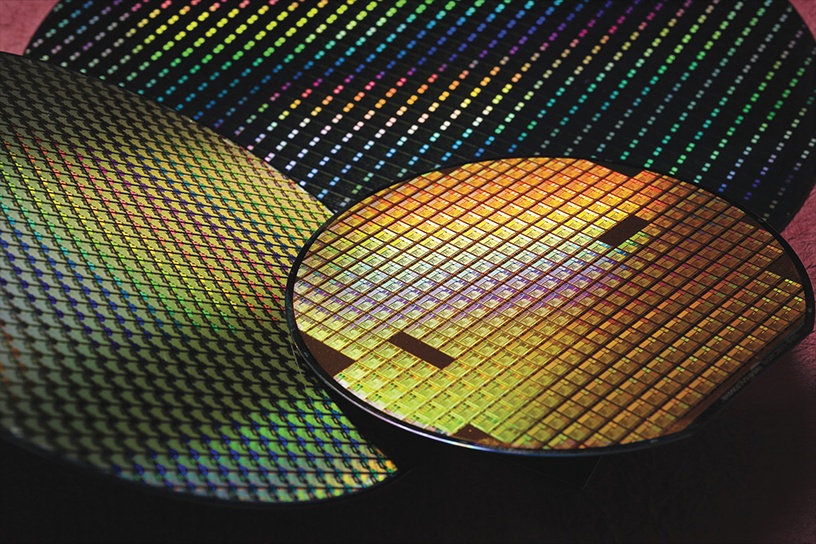

Today, Fujifilm is an essential supplier of specialty chemicals for the semiconductor industry. They hold a dominant market share, particularly in the high-end sector. There are hardly any alternatives to their EUV photoresists and they are strong in polyimides for new growth markets such as advanced packaging. Fujifilm has thus built up an advanced, globally relevant and steadily growing segment for semiconductor materials. Two weeks ago, they opened a new advanced facility for those materials in Shizuoka. They are also planning to invest in Rapidus, which is currently the most ambitious semiconductor project in the world. Of course, this is also a bit about honor, but it is also a gigantic customer in the not-so-distant future, so it makes a lot of sense to get involved or at least make direct contact.

But the big story is actually a different one. It's about organic CDMOs. About two decades ago, there was a radical change in the semiconductor industry - no more in-house production, instead production is outsourced to so-called foundries. This model has long since become established and players like TSMC are worth billions. But what does this have to do with it? A similar trend has been gaining ground in the pharmaceutical industry for some time now. Production is being taken over by CDMOs (Contract Development and Manufacturing Organizations). Bio-CDMOs are by far the fastest-growing sub-sector and could be described as the elite. Many CDMOs produce simple molecules and chemicals, while bio-CDMOs produce complex organic structures and biologics. This is much more difficult. The current trend in the pharmaceutical industry is moving strongly in this direction. mRNA, specific antibodies, ADCs, cell therapies, ever more advanced but also ever more complicated approaches are emerging.

The four major bio-CDMO companies worldwide include Lonza $LONN (+1,02 %) Fujifilm $4901 (+1,05 %) Samsung Biologics $207940 and WuXi Biologics $WXXWY (-4,02 %) . What can be said about the market? A few aspects are that it is growing at double-digit rates per year, the barriers to entry are high, the business is very "sticky" (customers hardly change) and it is regulatory sensitive.

But what is Fujifilm's position? Fujifilm can create synergies in research between its bio and chemistry division (e.g. knowledge for working on a microscopic level or cleanrooms can be applied not only for semiconductor materials but also for the bio-CDMO division). They are focusing on more complex processes instead of entering into a price war with Samsung Biologics for standard products. In addition, they have produced decisive innovations in production itself. Fujifilm builds its bioreactors modularly and in the same way all over the world, which is a great advantage for customers. They have also managed to build a continuous process (in a figurative sense, a kind of assembly line) instead of working with large boilers like their competitors, which costs efficiency. They also pursue a vertical approach in which they produce the individual components (such as cells, "feed", etc.) themselves. Once in the platform, it is almost impossible to switch away from Fujifilm. Existing customers include Novo Nordisk, Eli Lilly $LLY (+0,27 %) Regeneron $REGN (+0,24 %) or Merck $MRK (-0,48 %) .

On the financial side: Fujifilm's Bio-CDMO division is expected to grow by around 20% per year, twice as fast as the industry as a whole. They expect sales of around €3 billion in 2030. With investments of over €7 billion, particularly in plants in Denmark and the USA, the company's focus is clearly defined. Most of these plants will be in full operation from 2028. When they are fully utilized, the margin is typically a high 30%. So today's investments are tomorrow's cash flow. I also believe that this is just the tip of the iceberg compared to what is coming in the next few years to decades.

Fujifilm's timing is also perfect. WuXi Biologics is losing more and more market share due to the new US regulation ("Biosecure Act"), which plays heavily into the hands of Fujifilm with its production facilities in the western hemisphere (+ western value community with Japan). In addition, a potential competitor of Novo Nordisk was recently $NOVO B (+2,87 %) for part of its own requirements.

I assume that by 2035 around 60% of sales will come from the healthcare division (30% today), which also includes modern medical imaging devices. However, the focus will clearly be on bio-CDMOs. The Electronics division will also develop very well by then and increase its share. The Imaging division (cameras and co.) will continue to exist as a professional and lifestyle product and produce permanent cash, which will, however, be invested in other areas. The Business Innovation division (laser printers and co.) will become increasingly insignificant and slowly shrink, while remaining profitable and generating cash. In due course, it may be sold or spun off if no other solution can be found. A five- to seven-fold increase in profit by 2035 seems plausible. From 300 billion yen (about €1.8 billion) today to 1.5-2 trillion yen (€9-12 billion), driven by the high margins in the fast-growing Bio-CDMO segment, which is definitely the most relevant business area for the future.

You could almost call Fujifilm an infrastructure play in two system-relevant areas, semiconductors and biopharma. They make money on every blockbuster drug and every high-end chip without having to bet on anyone specific. They are the shovel manufacturers of these super trends. At the moment, everything is going in the right direction for them. Technological foundation, strategic brilliance and perfect geopolitical timing. They definitely have the momentum.

This entire story is available for a P/E ratio of 15!!! A classic "conglomerate discount" is priced in here, but this completely ignores the momentum and growth potential. In my opinion, the company is absolutely undervalued and if the entire roadmap is implemented, I see a significantly higher valuation in 2035. With an earnings estimate of €5 billion (super conservative) and a P/E ratio of 25 (a reasonable level for the realignment of the business), that would already be a valuation of €125 billion (>5x). If we assume a realistic-optimistic profit estimate, i.e. around €9 billion, we would already be at €225 billion (≈tenbagger).

What do you think of the company? An impressive comeback story from an almost hopeless situation. An investment for you?