- Markets

- Stocks

- Beyond Meat

- Forum Discussion

Discussion about BYND

Posts

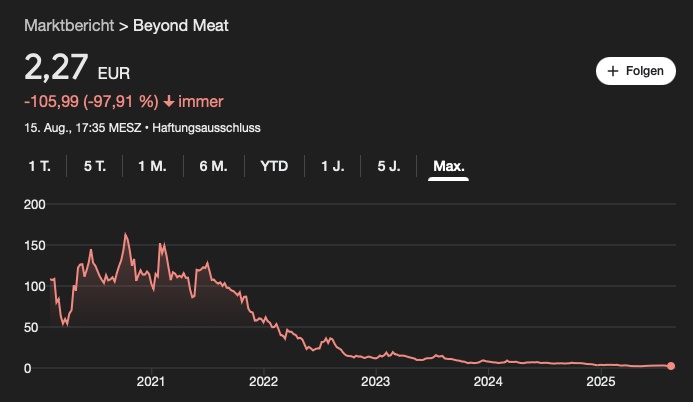

31Insights from the Beyond Meat analyst conference - What happened to the once hype stock?

As a listener at the Beyond Meat ($BYND (-1.13%) ) analyst conference, I was able to gain deep insights into the company's current situation and future strategy.

Ethan Brown, the founder, president and CEO of Beyond Meatopened his remarks by pointing out that 2024 was a turning point for the company. After two years of declining sales, Beyond Meat achieved two consecutive quarters of sales growth in the second half of the year. sales growth in the second half of the year. This was particularly notable as the entire category and the brand itself had faced significant challenges, including widespread consumer confusion about the value proposition of the products.

Brown emphasized that the team has tackled these challenges head-on, from product development to marketing and partnerships. He said he was particularly proud of the launch of Beyond IVthe Sun Sausage line and the expansion of the Beyond Steak platformall of which have received various awards from the American Heart Association, the American Diabetes Association and the Clean Label Project.

A key aspect of Beyond Meat's success is a sustainable business sustainable business model. In 2024, the company was able to operating costs were reduced by over 50 million US dollars and the adjusted EBITDA was significantly improved. The net sales for the full year amounted to USD 326.5 million, a decrease of 4.9% compared to 2023, but growth in the last two quarters shows a significant slowdown in the decline. The gross margin reached 12.8% for the full year.

The following highlights were mentioned for the fourth quarter of 2024

- A Net sales of 76.7 million US dollarswhich corresponds to an increase of 4 % compared to the previous year.

- An improved gross margin of 13.1 %which was boosted by higher prices, lower advertising expenditure and lower COGS per pound.

- A reduction in operating costs by 29.1 million US dollars to 47.8 million US dollars.

With a view to 2025, Brown formulated the clear goal of positioning the company in such a way that achieve an adjusted EBITDA of zero by the end of 2026. To achieve this, four key targets have been defined for 2025:

Comparable net sales compared to the previous year.

Improvement of the gross margin to around 20% with the aim of exceeding 30% in the long term.

Further reduction in operating costs in the years 2025 and 2026.

Strengthening the balance sheet by examining options to improve liquidity and optimize the capital structure.

Lubi Kutua, CFO & Treasurerwent into more detail on the financial results for the fourth quarter of 2024 in more detail. Net sales increased 4% to $76.7 million primarily due to a 6.3% increase in net sales per pound, partially offset by a 2.1% decrease in product volume. In the US, retail sales increased by 5.7%, while foodservice sales decreased by 2.1%. Internationally, retail sales fell slightly by 1.7%, while sales in the food service sector rose by 9.2%. The gross profit margin improved significantly to 13.1% compared to -113.8% in the same quarter of the previous year. The net loss amounted to USD 44.9 million, compared to USD 155.1 million in the previous year. Adjusted EBITDA amounted to minus USD 26 million, compared with minus USD 125.1 million in the previous year.

For the full year 2025, Beyond Meat expects net sales net sales of between 320 and 335 million US dollars and a gross margin of around 20%. The operating costs are expected to be between 160 and 180 million US dollars, and capital expenditure are estimated at 15 to 20 million US dollars.

In the subsequent question-and-answer part of the conference, various topics were addressed by analysts.

Ben Theurer from Barclays asked about the perception of consumers and the market dynamics. Brown replied that the message of offering clean and simple products at a higher price seems to be working. Regarding the impact of the suspension of activities in China on the sales forecast, Brown explained that the conservative forecast was mainly based on the desire not to distract the team with short-term sales generation activities that would work against the goal of positive EBITDA.

Kaumil Gajrawala from Jefferies inquired about the core consumer and whether this had changed. Brown replied that the company is increasingly focusing on health-oriented consumers who are able to see through the misinformation spread by the established industry.

Ken Goldman from JPMorgan asked in more detail about the drivers for the expected gross margin improvement in 2025. Brown explained that the consolidation of the production network and targeted investments in automation and equipment are the main factors. Kutua added that price increases in the US and further rationalization of the production network would also play a role.

Robert Moskow from TD Cowen asked about the sales forecast for the first quarter and the new customersthat the company would like to win. Brown explained that there are some temporary challenges due to the consolidation of the network and the loss of distribution channels with a major customer. Kutua clarified that it was not about acquiring new customers, but about expanding its presence in various areas of the retail tradewhere Beyond Meat was previously underrepresented.

Alexia Howard from Bernstein asked about the price points and whether Beyond Meat was satisfied with the price gaps to animal meat. Brown replied that the company had already achieved this goal on one particular product in one particular market and that this continues to be a goal, particularly in the foodservice sector. She also asked about the relative growth relative growth rates of the markets in Europe and the USA. Brown explained that Europe is not homogeneous and that there are also headwinds in some European markets. He emphasized that the key to the category's growth lies in educating consumers about the simplicity and purity of the products.

Peter Saleh from BTIG asked whether the decline in the proportion of consumers who see plant-based meat as a healthy alternativehad stopped. Brown replied that the company is seeing a change within its own brand and that working with nutrition experts and emphasizing the health benefits of its products is helping to regain consumer confidence.

Overall, the analyst conference conveyed a picture of Beyond Meat as a company in a phase of transition and realignment. Despite the challenges facing the category as a whole, management is confident that through a combination of cost reductions, margin improvements and targeted innovation, Beyond Meat will be able to achieve positive EBITDA by the end of 2026, achieve positive EBITDA by the end of 2026.

A key success factor will be the educating consumers about the about the health benefits and simplicity of the products in order to regain trust in the brand and gain market share.

Emphasizing the scientific basis and cooperation with recognized institutions such as the American Heart Association and the American Diabetes Association should help to strengthen Beyond Meat's credibility and set it apart from misleading campaigns by the established meat industry.

What are the top 3 worst investments you have ever made? I'll start:

Virgin Galactic $SPCE

Beyond Meat $BYND (-1.13%)

WisdomTree Cloud Computing ETF $WCLD (-4.73%)

Let me know your investments 👀

Beyond Meat: A smart investment in an impending bird flu pandemic?

Imagine a bird flu pandemic breaks out. Millions of chickens and possibly cows have to be killed to stop the spread. Meat production collapses and the government is under pressure to find replacement solutions quickly. This is where Beyond Meat comes in.

Why Beyond Meat?

Rising demand: Given the health risks, consumers may increasingly turn to plant-based meat alternatives. Beyond Meat could benefit from this surge in demand.

Government intervention: In a crisis, governments could support plant-based alternatives to secure food supplies. Beyond Meat would be well positioned to fill this gap. 🏛️

Climate hysteria as an additional driver: In times of "climate change" and the associated "climate hysteria", such a pandemic could be used by political actors to promote the consumption of meat alternatives and get people used to substitute products for the "future".

What do you think, could Beyond Meat be a wise investment in such a crisis?

Stay critical🐑

Beyond Meat tastes the best to me compared to the other products in the range. 🤷🏼♂️

Two shares in short check: ⬇️

The first company we are talking about is Canadian Solar. ☀️ $CSIQ (-16.79%)

What is Canadian Solar and what does it do?

Canadian Solar is a solar energy and battery company. The company is a provider of solar power products, services and system solutions with operations in North America, South America, Europe, Africa, the Middle East, Australia and Asia. The company designs, develops and manufactures solar ingots, wafers, cells, modules and solar power products.

Canadian Solar segments:

Its segments include CSI Solar and Global Energy.

The CSI Solar segment primarily involves the design, development, manufacture, and sale of a range of solar energy products, including solar modules, solar system kits, battery storage solutions, power, and other materials, components, and services. The Global Energy segment consists of global solar and energy storage projects, operations and maintenance services and asset management, power, and other development services. The company's products include a range of solar modules for use in residential, commercial, and industrial solar power systems.

How many employees does the company have: 🙋🏽♂️🙋🏻♀️

Currently, Canadian Solar employs a total of approximately 13,500 people.

P/E RATIO:

Canadian Solar is valued at a P/E ratio of approximately 12.60.

Foundation: 🏦

Canadian Solar was founded in 2001.

Market capitalization: 💰

Currently, the company has a market capitalization of around €2.1 billion.

Dividend yield:

The company does not yet pay dividends to its shareholders.

Strengths of the share: 📈

- The company usually announces numbers that are above analyst consensus and with percentages that generally surprise on the upside.

- For the past year, analysts have regularly revised their revenue expectations for the company upward.

- The company has an attractive valuation when looking at the multiple of the company's earnings. With a P/E ratio of 13, the company is among the lowest valued in the market.

- Analysts predict strong growth in business activity. This is expected to continue for several years.

Weaknesses of the share: 📉

- The estimates of analysts following the company drift widely. The difference between estimates suggests either a difficulty in predicting results or a fundamental difference in interpretation on the part of analysts.

- The company does not pay a dividend to its shareholders, this is where other companies in the industry are ahead of the company as it is more attractive to many shareholders

How does the stock look chart-wise? (USD converted into euros) 📈📉

Currently, the share price is just under 33.50€. Here we have recently bounced 2 times at the support zone at just under 32.50€ and the bears could not break through this support zone. If this zone is approached again and the bears break through this zone, there would be a lot of room at the bottom and the next support would be at 26.80€.

Currently, the first resistance is at 34.50€. This must be overcome so that the share can continue to rise. The next resistance would be at 36.50€. If this is also sustainably overcome, we have the next thick resistance at just under €40. There it would be very exciting, because the price did not get through there several times.

The second company we are looking at is Beyond Meat: ⬇️ $BYND (-1.13%)

What is and does Beyond Meat: 🤔

Beyond Meat is a food company that offers plant-based meats. The company's product offerings include Beyond Burger, Beyond Sausage, Beyond Beef, Beyond Meatballs, Beyond Breakfast Sausage Patties, Beyond Breakfast Sausage Links, Beyond Beef Crumbles and Beyond Italian Sausage Crumbles. The company markets a range of plant-based products across its three main meat platforms of beef, pork and poultry. The company's products are available in approximately 122,000 retail and foodservice outlets in grocery stores, merchandisers, clubs, convenience stores and natural food stores, as well as other food-away-from-home channels, including restaurants, foodservice outlets and schools. The company also offers its products through an e-commerce website.

How many employees does the company have: 🙋🏽♂️🙋🏻♀️

Currently, Beyond Meat has a total of around 1400 employees.

Foundation: 🏦

Beyond Meat was founded in 2009.

Market capitalization: 💰

Currently, the company has a market capitalization of around 930 million euros.

Dividend yield:

The company also does not pay dividends to its shareholders yet.

Strengths of the share: 📈

- The company has very well-known customers.

Weaknesses of the share: 📉

- The price targets of the analysts included differ considerably. This indicates different assessments and/or difficulties in valuing the company.

- As a percentage of sales and excluding provisions and depreciation, the company has relatively low margins.

- The company shows insufficient profitability.

- With a high level of net debt and relatively low EBITDA, the company has a weak financial situation.

How does the share look from a chart perspective? (USD converted to euros) 📈📉

Currently, the price here is about 14.30€. We recently had an important support zone here at €14.50, which is currently slightly undercut. If we do not come the share slowly back over here, the target would be the first support zone at 13.60 €. If this does not hold either, there is a lot of room to the downside. The next support would be at 10.50 €. If the share wins back the support zone at 14.50€, the first resistance would be at just under 15.80€. If this resistance is sustainably taken out, the next target is the resistance at 17.60€. After this mark, the resistance zone at 18.80€ is very important, as it was approached several times, but then the share was sold off directly.

My opinion:

As always, I find both stocks very very exciting. I couldn't say now which one would interest me more, as I find both segments extremely exciting. I will now continue to look at my mentioned zones and possibly enter in the short or long term. 👍🏽

Depending on that possibly also with leverage.

Your opinion:

Now, of course, I would like to hear your opinions again in the comments about these two stocks.

What do you think of Canadian Solar and Beyond Meat and did you already know these companies? 🤔

Do you guys have one or both of these stocks maybe already in your portfolio?

Feel free to let me know in the comments.

This is of course not investment advice but just my own opinion that I want to share with you!

Plant based foods - Is the hype already over?

Every year, the world's population grows by about 66 million people, resulting in increasing resource depletion.

Foods that can also be produced artificially are becoming interesting. Vegan meat and milk substitutes are therefore becoming increasingly popular.

However, for some time now, not only energy but also foodstuffs have become significantly more expensive for end consumers. Artificial meat substitutes were already twice as expensive as meat products on average before the inflation, so that the inflation lowers the demand for such expensive products even more.

Even if the share prices and corporate developments of some plant-based manufacturers are currently rather clouded, they have steadily growing potential due to the rising world population.

What is your opinion and which company has the greatest potential for you?

...

Economy on 24.02.2023...

Next week professionally in Egypt, more dazu⤵️

Yesterday, I really hardly noticed anything from the market. Next week it goes for me professionally to Egypt. Many of you know that I work as a purchasing manager in the shipbuilding industry. For almost 2 years now, I have ships built there and now I would like to have a look at it myself. We also have a few meetings on site, because it is about some more ships in the next few years. So it's an exciting trip for me. So yesterday I first got myself a few things. A tropical overall, helmet with ventilation and so on. In the evening I had some calls with people from Instagram. That's why I really did not notice yesterday, and the numbers that I now post, I see even for the first time (except for MüRück, there I have already luschert). Next week I will not post here either. Maybe if I'm bored, I'll look for a nice picture out, which I could make there, and take you times a piece with. But maybe I end up in the evening in some bar... who knows :D. I am curious about Egypt Air. But now back to the stock market:

$MAIN (-4.69%)

Main Street Capital:

Missed analyst estimates of $0.89 in the fourth quarter with earnings per share of $0.13. Revenue of $113.88 million beat expectations of $104 million.

$BYND (-1.13%)

Beyond Meat:

Beats fourth-quarter analyst estimates of -$1.20 with earnings per share of -$1.05. Revenue of $79.94 million beats expectations of $75.8 million (shares up 17%)

$SQ (-8.11%)

Block:

Missed analyst estimates of $0.30 in the fourth quarter with earnings per share of $0.22. Revenue of $4.65 billion exceeded expectations of $4.62 billion (stock still up 6%!!!)

$WBD (-4.31%)

Warner Bros Discovery:

Missed analyst estimates of -$0.29 in the fourth quarter with earnings per share of -$0.86. Revenue of $11.01 billion below expectations of $11.23 billion (sold it all this week)

$ADSK (-3.77%)

Autodesk:

Beat analyst estimates of $1.81 in the fourth quarter with earnings per share of $1.86. Revenue of $1.32 billion above expectations of $1.31 billion (Also a WEB3 favorite for me)

$INTU (-2%)

Intuit:

Second-quarter earnings per share of $2.20 beat analyst estimates of $1.47. Revenue of $3 billion beat expectations of $2.91 billion.

$BKNG (+0.36%)

Booking Holdings:

Beats fourth-quarter analyst estimates of $22.00 with earnings per share of $24.74. Revenue of $4 billion beats expectations of $3.9 billion.

$AMT (+0.44%)

American Tower Corp:

Missed analyst estimates of $1.04 in the fourth quarter with earnings per share of -$1.47. Revenue of $2.71 billion exceeded expectations of $2.68 billion.

$MRNA (-4.23%)

Moderna Inc:

Missed analyst estimates of $4.70 in the fourth quarter with earnings per share of $3.61. Revenue of $5.1 billion exceeded expectations of $5.05 billion.

$IRM (-3.43%)

Iron Mountain Inc:

Hits fourth-quarter analyst estimates with earnings per share of $0.43. Revenue of $1.28 billion below expectations of $1.31 billion (The LUNE really tops my list!!!).

$HOT (-3.57%)

HOCHTIEF:

Will pay dividend of €4 per share for 2022 (PY: €1.91, analyst forecast: €4.06); 2022 sales at €26.2 billion (PY: €21.38 billion (forecast: €24.9). For 2023, Hochtief targets net profit (adjusted) of €510 million to €550 million (forecast: €490 million).

$MUV2 (-0.74%)

Munich Re:

Will achieve gross premiums of €67.13 billion in 2022 (PY: €59.56 billion, forecast: €67.3 billion), an operating result of €3.582 billion (PY: €3.517 billion, forecast: €3.035 billion), an investment result of €4.903 billion (PY: €7.156 billion), and a net profit after minorities of €3.432 billion (PY: €2.933 billion). In the outlook for 2023, the company expects a net profit of around €4.0 billion (analyst forecast: €4.022 billion). (I have 30% of my shares still sold at € 237.90, to take some profit and pressure out. The share was in the portfolio, by the high performance in recent times, the largest position with me. Therefore somewhat reduced!)

$AG1 (-4.88%)

Auto1:

Reaches 2022 revenues of €6.5 billion according to preliminary figures (PY: +36.8%, analyst forecast: €6.6 billion), sales of 649,709 vehicles (forecast: around 660,000) and Ebitda (adjusted) of -€165.6 million (forecast: -€174 million).

$DTE (+0.17%)

Deutsche Telekom:

Reports Q4 revenue of €29.8 billion (PY: €28.65 billion, analyst forecast: €30.00 billion), Ebitda AL (adjusted) of €40.2 billion (PY: €37.3 billion, forecast: €40.1 billion) and net profit (adjusted) of €1.99 billion (PY: €1.23 billion, forecast: €1.18 billion). In the outlook for 2023, the company expects Ebitda AL (adjusted) of +4% to around €40.8 billion (PY: €39.3 billion).

That's enough now, otherwise it will be too much. I'd like to get some feedback on this, because otherwise I always end up with the values that interest me. Maybe they are not the same ones that interest you. But otherwise the post will be too big and then no one reads it anymore. Still briefly to the economic dates. DAX changes, I have already announced in yesterday's post. Here again to look:

https://app.getquin.com/activity/VpjwppEQfv?lang=de&utm_source=sharing

Economic data (shortened version)

08:00

- DE: GDP (2nd release) 4Q calendar and seasonally adjusted yoy PROGNOSIS: -0.2% yoy 1st release: -0.2% yoy 3rd quarter: +0.5% yoy calendar-adjusted PROGNOSIS: +1.1% yoy 1st release: +1.1% yoy 3rd quarter: +1.4% yoy

- DE: GfK Consumer Climate Indicator March PROGNOSIS: -30.2 points previous: -33.9 points

08:45

- FR: Consumer confidence February PROGNOSIS: 81 previously: 80

14:30

- US: Personal Spending and Income January Personal Spending PROGNOSE: +1.4% yoy previously: -0.2% yoy Personal Income PROGNOSE: +1.2% yoy previous: +0.2% yoy PCE price index / core rate PROGNOSE: +0.5% yoy/+4.4% yoy previous: +0.3% yoy/+4.4% yoy

16:00

- US: Consumer Sentiment Index Uni Michigan (2nd survey) February PROGNOSIS: 66.4 1st survey: 66.4 previously: 64.9

- US: New home sales January PROGNOSIS: +0.6% yoy previous: +2.3% yoy

Untimed:

- EU: rating review for Netherlands (Fitch); North Rhine-Westphalia (S&P); Austria (Moody's); Austria (S&P); Sweden (Moody's);

Quarterly figures / corporate dates Europe

07:00 BASF | Holcim annual results

08:00 International Consolidated Airlines

10:00 Metro AGM (virtual)

No time stated: VW: Detmold Regional Court, ruling in proceedings against Volkswagen on end of production of vehicles with internal combustion engines by 2030

#quartalszahlen

#boerse

#börse

#aktien

#news

#newsroom

#community

#communityfeedback

#nachrichten

#täglich

#investieren

#wirtschaft

#politik

#inflation

#fed

#rezession

#mitverstandzumkapital

#krypto

#kryptowährung

#kryptos

#cryptos

#nvidia

#etsy

#ebay

#münchnerrück

#deutschetelekom

#bookingcom

#bookingholdings

#beyondmeat

#moderna

#ironmountain

What happened tonight at $BYND (-1.13%) happened?

Beyond Meat shorten bei 18,16€ pro Share? $BYND (-1.13%)

#short

getquin Daily Summary 17.10.2022

Hello getquin,

have a nice monday to all of you!

America🌏:

1. Beyond Meat lays off 19% of employees

Beyond Meat plans to cut 19% of its workforce, or about 200 employees, the company said in a regulatory filing Friday. The company also said several executives will be leaving the company. The current layoffs follow initial layoffs in August. The cuts are expected to be completed by the end of the year and aim to be cash flow positive in the second half of 2023.

Read more: https://cnb.cx/3ELNhMo

🟥 $BYND (-1.13%) 13,85€ (🔽 -2,82%)

2. nikola founder Trevor Milton was found guilty

Trevor Milton, the founder and former chief executive officer of electric truck maker Nikola, was found guilty Friday in federal court on three of four counts of fraud for making false statements to inflate the value of Nikola stock. The sentence will be announced Jan. 27.

Read more: https://cnb.cx/3S4gDIR

🟩 $NKLA 3,14€ (🔼 +4,11%)

3. Goldman Sachs plans reorganization

Goldman Sachs chief executive David Solomon is again imposing a major reorganization on the Wall Street house. Central to Solomon's plan is to combine the investment banking and trading businesses into one division. Asset and wealth management are also to be combined.

Read more: https://on.wsj.com/3MCQlwc

🟥 $GS (-2.43%) 312,00€ (🔽 -1,55%)

Asia🌏:

4. U.S. government launches investigations against Samsung, TSMC and Qualcomm.

The USITC will investigate certain semiconductors manufactured by Samsung and TSMC, as well as certain integrated circuits manufactured by Samsung and Qualcomm, after New York-based Daedalus Prime LLC filed a complaint last month.

Read more: https://reut.rs/3yOak5z

🟩 $SMSD (+1.7%) 1.005,00€ (🔼 +0,50%)

🟥 $TSM (-6.55%) 65,80€ (🔽 -0,45%)

🟥 $QCOM (-8.32%) 113,28€ (🔽 -0,93%)

Stocks of the day:

🟩 TOP $NET (-4.51%) 52,37€ (🔼 +12,62%)

👍 Cloudflare shares rise to "Overweight" after Wells Fargo upgrade

🟥 FLOP Borussia Dortmund 3,41€ (🔽 -2,68%)

👎 Defeat against Union Berlin is also punished by investors

🟩 Most searched $UKW (+0.4%) , 1,67€ (🔼 +3,74%)

🟩 Most traded $TSLA (-6.86%) , 222,40€ (🔼 +2,49%)

🟩 S&P500, 3,677.69 (🔼 +2.64%)

🟩 DAX, 12,654.24 (🔼 +1.74%)

🟩 bitcoin ₿, 19,885.21€ (🔼 +0.50%)

Time: 17:50 CEST

Trending Securities

Top creators this week