Hello my dears,

As you may have seen, I have sold two European companies. That's why I've spent the last few days looking for small growth stocks in Europe again.

Not only did I find a growth stock, but also a great dividend stock with an acceptable P/E ratio.

It is Instabank $INSTA (+0.79%) .

I already discussed this stock on Friday with my friends from the @SAUgut777 , @Dividendenopi Holding on Friday. And I think it has aroused the holding company's interest.

During my further research, I came across a current analysis by Philipp Haas, which I can adopt 1 to 1. That's why I'm simply adding the assessment to make my work easier. At the end, I'll simply add the multiples for you.

Instabank - the Nordic neobank with a classic core

Digital banks have long been more than just a short-term trend. More and more neobanks around the world are succeeding in becoming profitable - a point at which it becomes clear whether a business model is sustainable. One exciting representative of this model is Instabanka Norwegian fintech with ambitions that is digitally rethinking traditional banking services.

A hybrid of start-up and traditional bank

Instabank was originally founded in Norway and positions itself as a "Nordic challenger bank". It combines the agility of a neobank with the stability of an established financial institution. The company has since relocated its headquarters to Finlandto obtain a European banking license and thus facilitate market access in other countries - including Germany. Germany Instabank is already active in Germany with its own credit card.

Its focus is on credit cards, consumer loans and construction financingi.e. profitable yet scalable banking products. Another special feature is a digital rental deposit accountwhich is operated in partnership with other providers - a practical product that facilitates entry into the German market.

Attractive business model with many sources of income

The Neobank model is considered attractive because it offers multiple sources of income: Interest margins, fees from credit cards, cross-selling in wealth management and other additional services. In addition, customers rarely change their bank account - which ensures a high level of customer loyalty.

Instabank makes clever use of this advantage: it dispenses with expensive branch networks, operates completely digitally and can therefore achieve a low cost ratio (cost-to-income). low cost ratio (cost-to-income ratio). ratio. In addition to consumer loans, the construction financing segment also plays an important role - the bank generates around 40% of its operating profit here.

It is interesting to note that Instabank also also buys up portfoliosin order to grow faster. For example, it recently acquired a real estate financing portfolio worth around NOK 370 million (approx. EUR 40 million).

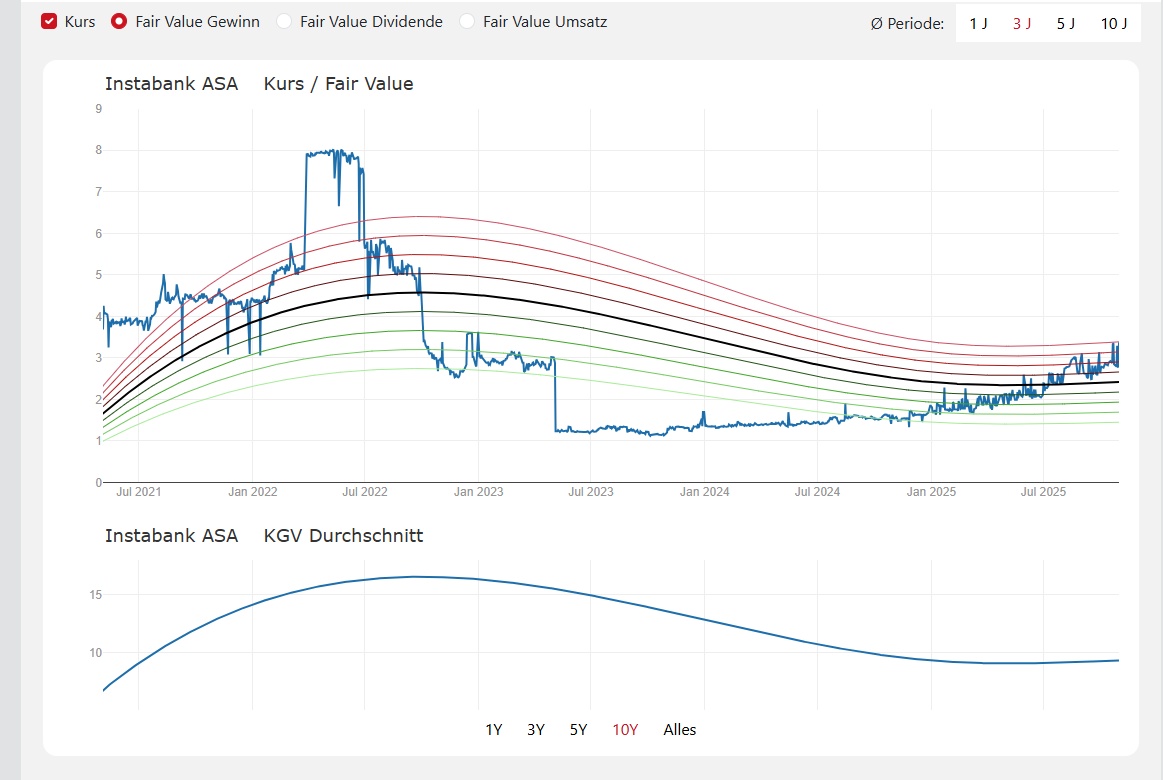

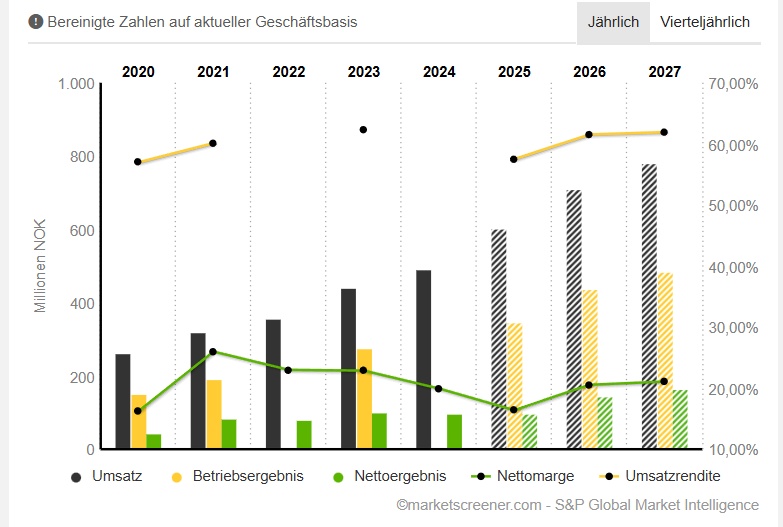

Solid key figures and ambitious targets

With a market capitalization of around EUR 120 million and a P/E ratio of less than 10 the share is valued favorably at first glance. The bank's turnover is rising steadily, although profitability has recently fluctuated somewhat. Nevertheless, the goal is clear: the return on equity (ROE) should rise to over 15 % and in the medium term the management is aiming for NOK 200 million profit in the medium term.

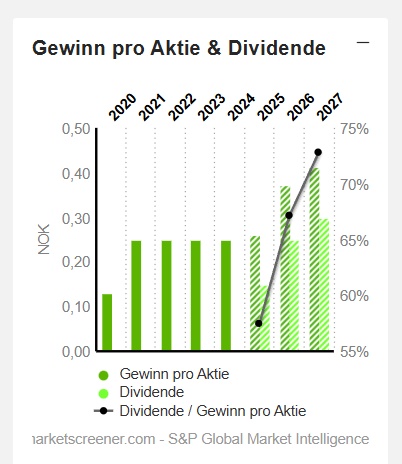

Particularly attractive for investors: Instabank already pays a decent dividend. decent dividend and thus offers a mixture of growth story and earnings component - a rather rare profile among European neobanks.

Growth beyond the Nordics

With the move to Finland, Instabank is opening up to other European markets. The move is intended to enable economies of scale and standardize the regulatory framework. Thanks to partnerships with platforms such as Check24 the company can also acquire new customers cost-effectively - a clear advantage over many fintech competitors.

Conclusion: An underestimated neobank with potential

Instabank is a prime example of the new generation of profitable digital banks. It combines conservative banking discipline with digital efficiency - and offers investors an interesting risk-return profile.

Instabank – die nordische Neobank mit klassischem Kern

Instabank ASA achieves record profit and accelerates European growth

Instabank ASA reports record profit before tax of

Instabank ASA reports record pre-tax profit of NOK 40.5 million for the third quarter of 2025, an increase of 11.6 MNOK compared to the previous quarter. The

result is the bank's strongest quarter to date, driven by solid loan growth

growth, strong cost control and consistent profitability in all segments.

Gross lending increased by MNOK 368, the second consecutive quarter of record growth

. The lending volume amounted to NOK 8.2 billion, reflecting a strong performance in both

performance in both commercial lending and the German credit card portfolio.

Business lending increased to NOK 858 million and now accounts for 10% of total lending, with

an attractive yield of 17.7%, confirming the strength of Instabank's B2B strategy.

The German credit card portfolio continued its rapid growth, driven by

AI-driven customer service and fully digital onboarding - a milestone in the scaling of the bank's European operations.

of the bank's European activities.

After the end of the quarter, Instabank successfully completed a private placement

raising NOK 186.6 million and securing capital for further growth in the Nordic and European markets.

growth in the Nordic and European markets.

The bank has also made significant progress in its strategic transition to

Finland, with the ongoing application for a banking license marking a decisive step in the establishment of a pan-Nordic

establishment of a pan-Nordic platform under EU regulation. The merger of Instabank

ASA with Instabank Finland is expected to take place after approval by the

Finnish Financial Supervisory Authority in the first half of 2026.

With record profitability and strengthened capital, Instabank is ready to accelerate its European journey and turn technology into a sustainable competitive advantage.

to

into a lasting competitive advantage. The bank is now targeting total loan growth of NOK 1.8 to 2.0 billion in 2025

and expects an annual profit after tax of around NOK 117 to 120 million, depending on market

market conditions and the pace of new lending.

Robert Berg, CEO, explains:

"Q3 is another strong step forward for Instabank. We continue to combine

profitable growth with disciplined execution, proving that technology and simplicity win in a complex banking

simplicity win in a complex banking landscape. Our expansion in Germany

demonstrates the scalability of our digital model, while the upcoming transition to Finland lays the

to Finland lays the foundation for a fully EU-regulated banking platform that will enable Instabank

compete across Europe with unrivaled agility. The strength

of our results and the confidence our investors have placed in us through the recent

capital increase give us both momentum and flexibility to accelerate growth in 2026.

accelerate growth in 2026. We are proving that Nordic banking is scalable - profitable, digital and cross-border.

cross-border. Instabank is not only growing; we are redefining what a digital bank in Europe

bank can be in Europe."

For further details, please refer to the full Q3-2025 interim report attached to this release

Instabank ASA erzielt Rekordgewinn und beschleunigt europäisches Wachstum

Key valuation figures

NOK in million estimates

Market value 1,496 (EUR 128.76 million)

Year P/E ratio

PEG

2025 13x + 0,29

2026 9,07x + 0,82

2027 8,21x

Year

Dividend yield 🚀

2025

4,44 %

2026

7,4 %

2027

8,88 %

Year

Earnings per share

2025 0,2608

2026 0,3725

2027 0,4118

Year

Turnover

Change in

2025 601,6 + 22,24 %

2026 711,8 + 18,32 %

2027 781,7 + 9,82 %

Year

Net result

Change in

2025 98,64 + 0,52 %

2026 146,3 + 48,32 %

2027 164,7 + 12,61 %

Year

EbiT Margin

ROE

2025 57,51 % 9,95 %

2026 61,53 % 13,44 %

2027 61,92 % 13,92 %