With $PPTA (+0.39%) good news is on the horizon. That's why I'm staying invested.

- Markets

- Stocks

- Perpetua Rsrcs

- Forum Discussion

Perpetua Rsrcs

Price

Discussion about PPTA

Posts

11Stay on the ball!

With a return of 265% so far despite the savings plan, I remain invested. $PPTA (+0.39%) was my first long-term share. I bought the first shares at €3.48.

The share of Perpetua Resources Corp (PPTA) reached a new 52-week high of USD 31.69, marking an important milestone. This success is the result of an impressive share price performance: Within the last year, the share has gained 173.8%, reflecting growing investor confidence and positive market sentiment towards Perpetua Resources. With a current ratio of 42.25, the company has a solid financial base and high liquidity. An analysis of InvestingPro suggests that the stock may be overvalued at current levels, as technical indicators are signaling an overbought condition. Investors looking for comparable momentum opportunities can consult the Liste der meistüberbewerteten Aktien view.

In other recent news, Perpetua Resources Corp. announced the terms of a public offering. The sale of 2,938,000 common shares at a price of $24.25 per share is expected to raise approximately $71.2 million. In addition, Agnico Eagle Mines Limited plans to participate in an accompanying private placement that could raise an additional $7 million. Furthermore, Perpetua Resources is cooperating with the Idaho National Laboratory in the development of a modular pilot processing plant. This will be used to extract critical minerals such as antimony from the company's Stibnite gold project. The plant will be operated by trained personnel and will process samples from the Idaho site.

In addition, the Company has strengthened its management team with four new senior executives as early works progress at the Stibnite Gold Project. In a further announcement, BMO Kapital raised its price target for Perpetua Resources to C$44.00 and reiterated its "Outperform" rating. This adjustment follows the announcement of a $255 million private placement involving key investors such as Agnico Eagle and JPMorgan. The latest developments reflect Perpetua Resources' strategic initiatives to advance its projects and strengthen its financial position.

My way to €100,000! Deep Dive Part 3!

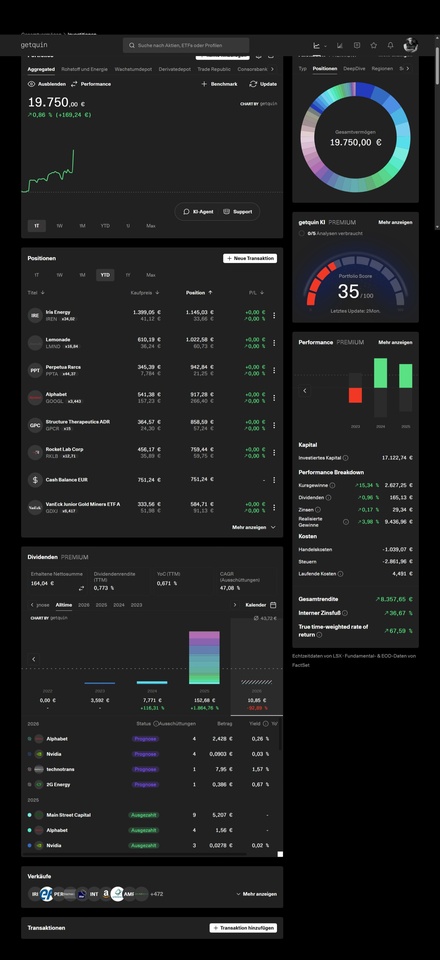

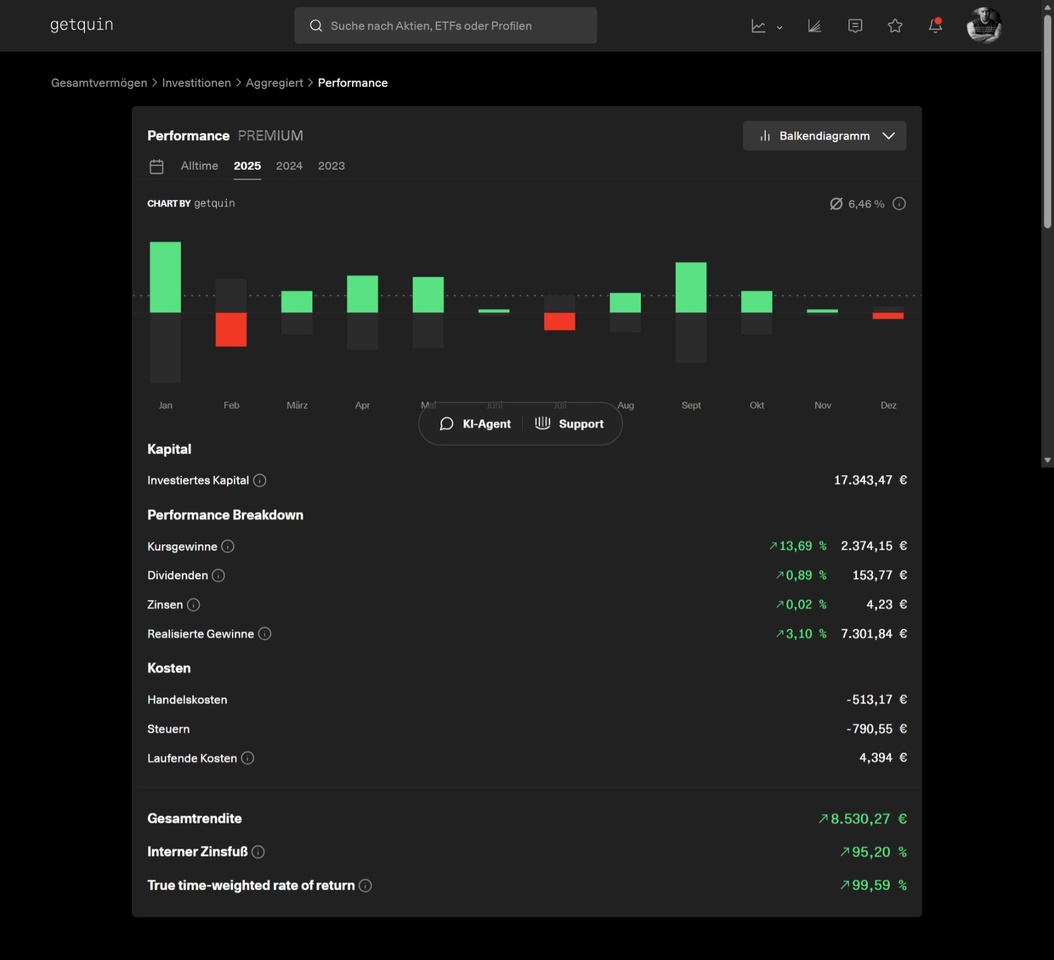

Hello dear community, hello followers and, of course, anyone else who is interested. Here comes my review of 2025, which you've been waiting for so long. What has crazy Chris actually achieved?

Well, first of all, my monthly overview doesn't really look any different from that of many others here.

There were good and bad months. For me with 9 to 3 it was more positive than last year. The best and worst months in terms of returns were

January + 26.7%

September + 19%

April actually +14%

February - 12.8%

July - 6.6%

December -2.3%

Incidentally, January was also the best month last year and July and December were among the worst.

That reads rather harmlessly here. I would therefore like to show you what impact my strategy can have. At the start of my vacation on 01.09. I had a TTWROR of around 65%. This rose to 123% by mid-October and then fell back to 87% by mid-November. At the time of the GQ Rewind it was back to 99% as you can see above. This was of course disappointing as it was less than last year's 107%! But that is of course complaining at a very high level and not really meant seriously.

In €, and this is what most people here are interested in, it means the following.

Here are the facts that were already in part 2. the calculated target according to the original plan was

8,435 at the end of the calendar year 2025 (does not correspond to my investment year which ends on 31.03.).

13,340 was the multibagger target based on the performance of the previous year.

And this is the result as of today:

19.750,-- € a very good result in my opinion!

This means that as of today (yes, it is only a snapshot of my risk) I have already reached the calculated level for my project of € 3,000 to € 100,000 in 10 years by 31.03.2028, i.e. I have built up a buffer of a good 2.25 years. To be honest, I'm a bit proud of that.

You can disregard the total maturity figures you see in the chart, as I have only been tracking the portfolio with GQ since the beginning of 2025.

Next, I would like to tell you a bit more about how I achieved this outperformance. I have already explained my approach in Part 2.

Top trades were stocks:

$IREN (+4.77%) with +450% does not appear in Rewind because GQ only takes into account the stocks that are still in the portfolio at the time of creation.

$GPCR with + 188%

$PPTA (+0.39%) with + 160%

The flop 3 stocks were:

$BNTX (-0.03%) with - 20%

$IREN (+4.77%) with -19% after new purchase

$PATH (-6.2%) with -13%

all 3 loss positions are still running!

Now, of course, many people will think: And this is how he achieves such an excess return? Definitely not. As has already been mentioned several times, the majority of the excess return comes from the derivative trades. In my opinion, these returns cannot be achieved with shares over a period of 10 years. Of course, like me with $IREN (+4.77%) and some others, but that is the exception rather than the rule.

So now we come to the evaluation of the derivatives:

298 derivative trades were concluded.

Of these

11 x total loss

21 x greater than 100%

4 x greater than 200

2 x greater than 300%

The rest somewhere in between!

But to make you aware of the great risk, I have also taken the trouble to look up the holding period for the top returns. If you then extrapolate the returns achieved to 1 year, this often results in several 1000%!

This requires strong nerves, high leverage and the best possible entry time. So here are the pot flyers:

Derivative on €/SFR 390% in 48 days

United Health 320% in 4 days

Silver 280% in 21 days

App Lovin 216% in 2 days

Novo 186% in 3 days

Vossloh 170% in 6 days

Apple 185% in 13 days

Although the derivatives section only accounts for around a third of my portfolio, it is responsible for at least 60% of the performance.

Outlook for 2026

Calculated target 31.03.26 according to plan: € 9,145

Target multibagger 31.03.2026: € 22,000

Calculated target for calendar year 2026: € 12,230

Target multibagger 31.12.2026: € 29,000, because round figures are simply nicer, I would prefer 30,000, but let's not get cocky.

In addition to the pure figures, I see the following opportunities and risks in 2026. This is purely my subjective assessment, which I will also use as a basis for my investments. In my opinion, it will make sense to achieve a large part of the planned return in the first half of the year, as I see more opportunities there. Why? Because the effects of the new US interest rate and economic policy will not yet be as fully felt in the first half of the year as in the second half.

I therefore see good opportunities in the R-categories next year.

First and foremost commodities. Why? I believe that the escalation in the Caribbean will increase tensions between the USA and China again. The majority of Venezuelan oil exports go to China. The tightening of exports by China announced last week for silver, for example, will continue and rare earths will be the next to come back into play. The US will therefore continue to spend a lot of money to reduce its dependency, as otherwise it will be vulnerable to blackmail in all conflicts with China.

I therefore see great opportunities with $LYC (+1.61%) and also with $SSW (+4.2%) both of which I see as possible candidates for US entry.

But my price target of USD 5,000 for gold and above all my price target of USD 120-150 for silver in 2026 also offer excellent opportunities.

The next topic I see is armaments continues to be promising. Regardless of whether there will be peace in Ukraine. (I assume that the war will end soon if Ukraine is defeated) as there is a great danger that the USA will end its intelligence and satellite-based support. Donald Trump has elections next year and urgently needs successes.

However, an end to this war would not change the need for rearmament. The Europeans in particular are not even in a position to implement the security guarantees that are on the table. My best assessment here is in the area of drones and satellites.

I am also confident about data centers (also with their energy supply) and robotics.

As a longer-term tip, I would then focus on the biotechnology sector. For me, this is the area that has the greatest advantage through AI, as the evaluation of study data and thus the timeframe for approval will be massively accelerated. Some interesting candidates have already emerged here recently. For long-term ETF investors, this would also be worth considering.

Let us now turn to the overall economic outlook, which I expect. Even if it is said that political stock markets have short legs, this is more of a good opportunity for traders like me, as volatilities are rising.

I expect a very loose monetary policy in the USA. There will be significantly more than 1 interest rate hike and inflation will not play a role in the decisions. I strongly expect a yield curve control under the new Fed chief in the second half of the year. This will lead to a sharp fall in the US$. I think we will see an exchange rate of at least 1.25 to the euro in the course of the year. This is what the US government wants because it will make it more difficult for European countries, for example, to export to the US. I therefore anticipate below-average growth for export-oriented stocks in Europe. This trend will continue. The upcoming midterms in the USA in November will bring further uncertainty to the market in the second half of the year. There is a threat of a deadlock in the chambers. The foretaste of this will be felt again at the end of January when the next shutdown in the US threatens again.

Finally, I would like to mention a very important situation, which for me primarily affects Danish companies that have a high proportion of US business. First of all, I see the very popular $NOVO B (-15.64%) . In my opinion, there is a great danger that they will become a pawn in the battle for Greenland. Donald Trump will not go to war with Denmark, but maximum economic pressure to push through his wishes for a deal on Greenland seems very likely to me. In the end, Greenland will continue to belong to Denmark, but the USA will be granted extensive extraction rights there. Everyone should keep an eye on this and find out which US companies could benefit from exploiting the mineral resources there.

So that's it for the review and outlook from my point of view. Nobody knows whether this will happen.

Even if I will still be active here and comment a little, that's it for detailed posts. Of course, the evaluation of the Performance Challenge and the announcement of the winners will follow in the other post.

But to everyone I won't be speaking to, I'd like to wish you a happy new year 2026 with good health and, most importantly, as many personal highlights as possible. Don't forget that enjoying life can also be a great resolution.

With this in mind: All the best, Chris

Multiplier despite savings plan?

Difficult, but possible! I am $PPTA (+0.39%) well on the way to achieving this. I bought my first shares in March 24 at €3.60. The average buy-in is now €7.89, which means a gain of around 220% after today's rise. At the moment, however, no further savings are being made.

A selection of possible TEN BAGGER 🚀

For all those interested, here is a list of possible upcoming TEN BAGGER or half or similar or future bankruptcies 🔮 📣🔊

🔸 Hims & Hers $HIMS (-4.35%)

🔸 Palantir $PLTR (-3.31%)

🔸 ExlService Holdings $EXLS (-5.29%)

🔸 IES Holdings $IESC (-2.94%)

🔸 Jabil $JBL (-3.87%)

🔸 RadNet $RDNT (-2.1%)

🔸 Robinhood $HOOD (-6.01%)

🔸 RocketLab $RKLB (-2.07%)

🔸 Toast $TOST (-6.88%)

🔸 Whitefiber $WYFI (-5.3%)

🔸 Figure Technology $FIGR

🔸 Circus SE $CA1 (-6.41%)

🔸 Voyager Technologies $VYGR (+2.74%)

🔸 Perpetua Resources $PPTA (+0.39%)

🔸 Lightbridge Corp. $LTBR (-2.93%)

🔸 Oklo $OKLO

12 months, 5 years, 10 years?

I'm a fan of raw materials

as some of you here already know. These stocks have played a large part in the good performance of my portfolio.

Today, after $UUUU (-1.33%) , $MP (+0.32%) and $PPTA (+0.39%) with $MTM (-2.33%) the next stock cracked the 100% mark. It took a little longer here at 3 months, but I can live with that.

Silver is a critical raw material for the first time

Today we are not talking about rare earths in the commodities sector. Yesterday, the USA declared silver a critical raw material. This will give an additional boost to companies active in this sector in the USA.

Before anyone asks me, no, I am currently invested in silver apart from a long derivative on silver and in $PPTA (+0.39%) I am not invested in this area.

Silver has been a "critical commodity" since yesterday. Specifically, the USA has placed silver, a classic precious metal, on the list of critical commodities for the first time. The list of critical minerals serves as a guide for the US government's strategy, capital deployment and approval procedures for domestic extraction, recycling and processing. The update is part of efforts to strengthen economic and national security by reducing dependence on foreign supply chains and accelerating production and innovation in the US.

I've been long silver for some time with just under 3.5% of my portfolio.

There is still a lot of potential, especially if the 1980 and 2011 highs are broken 🚀

There he is!

The next value has reached the 100% mark. And again it is $PPTA (+0.39%) a commodity stock. With a buyin of €7.65, it is just under 110%. This is very good for a savings plan value, as the buyin increases monthly. I made my first investment at €3.60 in March 24 at the start of my project. Since then, the value has more than quadrupled.

As this is a savings plan, I am unfortunately unable to post the transaction here.

Rare earths

After I posted again last week about commodities in general and rare earths in particular, I would like to take stock of the stocks I have in my portfolio today.

$MP (+0.32%) The next stage is being ignited again today. This is the largest position in this area, as a savings plan is running there. So far + 65%

https://de.tradingview.com/news/reuters.com,2025:newsml_L8N3T70NZ:0/

$SCZ (+16.46%) with 15% in 2 weeks a solid start

$PMET (-0.6%) 20% in the first two weeks also good

$MTM (-2.33%) good start, today a setback of 9%, resulting in a loss of approx. 10%

$UUUU (-1.33%) with 8% + also after 2 weeks.

In addition, savings plans are still running $PPTA (+0.39%) so far + 53% and

$CDE (-0.48%) + 24%.

So I think commodities should not be missing from any portfolio as an admixture, and not just for dividend reasons.

Here I was hoping for an agreement with China and no longer dared to enter the market. 😭😭

Hello dear community

I would like your help, especially those who have a custody account with Smartbroker or Scalable. I'm thinking of moving my securities account from Consors because the costs are really exorbitant. The only reason I still have it is because I have a few share savings plans there that are not tradable at TR and there are none at Flatex. I would therefore be very grateful if someone who is there could check for me whether they can be traded there as a savings plan and whether I can also transfer fractions. A sale and new purchase in a new custody account is out of the question due to the high costs. Specifically, it is about

Many thanks for your help. If you have any other suggestions for depots with other providers where this is possible at a reasonable price, I would also be interested in them.

And according to the AI support, fractional transfers are possible

Trending Securities

Top creators this week