Digital asset products saw the largest outflows since mid-November 2025, totaling USD 1.73 billion, reflecting a similar bearish sentiment typically seen in market downturns. Diminishing expectations of interest rate cuts, negative price momentum and disappointment that digital assets have not yet participated in the "debasement trade" movement are likely to have further fueled these outflows.

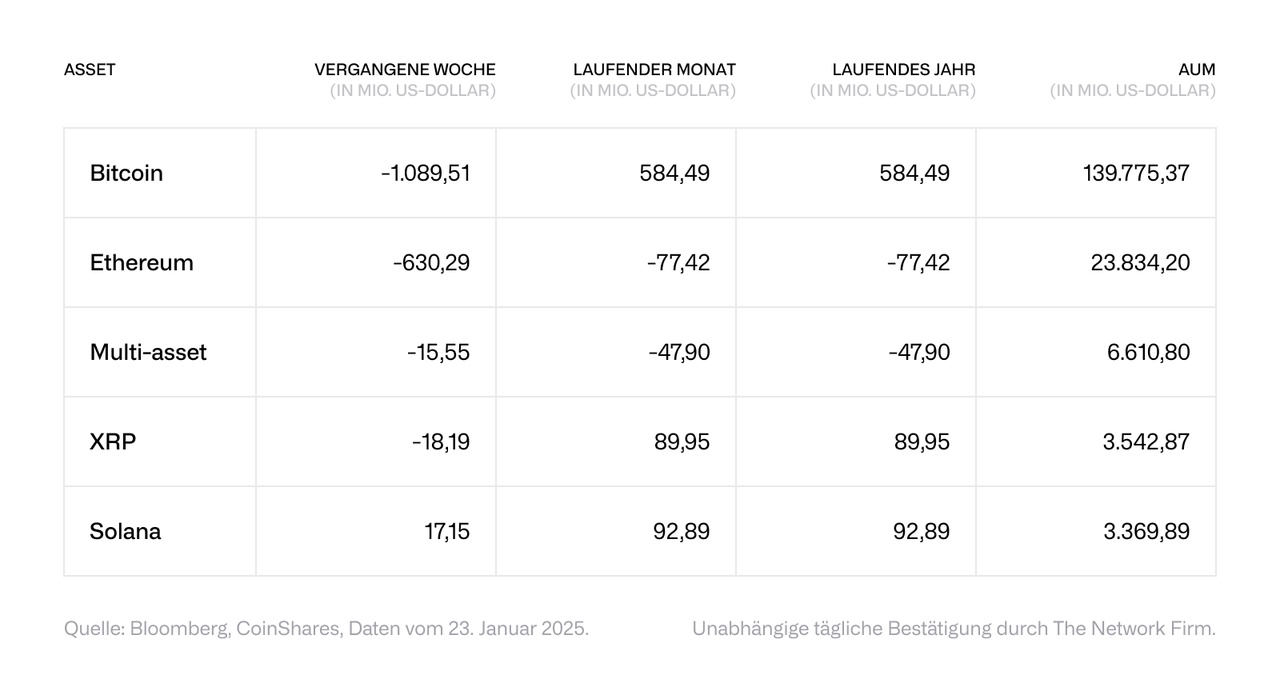

$BTC (-1.41%) The market recorded outflows of USD 1.09 billion, the largest since mid-November 2025, while there were small inflows into short Bitcoin products totaling USD 0.5 million. Overall, however, it is clear that sentiment has not yet improved since the price collapse on October 10, 2025.

$ETH (-1.97%) and $XRP (-1.58%) recorded outflows of USD 630 million and USD 18.2 million respectively, which shows that the negative sentiment was broad-based. $SOL (-2.16%) The fund "The World" bucked this trend and saw inflows of USD 17.1 million. Other assets saw smaller inflows, particularly Binance (USD 4.6 million) and Chainlink (USD 3.8 million).