Everyone perceives risks individually. Everyone tries to independently assess the risk of a share or the current economic situation on the stock market.

In portfolio theory, risk is primarily measured using the standard deviation. In simple terms, this is the extent to which a share price moves. If this movement is correlated with the "market", this results in a beta. If this is < 1 bedeutet das, dass der Kurs einer Aktie geringer als der Markt schwankt. > 1, the result is a disproportionate fluctuation. The "market" is an elastic term. For example, an MSCI World, S&P 500 or the DAX can be used as a reference. The result is different betas depending on the index. However, I do not want to go into this topic any further at this point.

Why beta is not relevant for me

- Price fluctuations are not a problem in my current life situation (24 years old; student).

- Every share that grows faster than the market has a beta > 1. As my portfolio is set to grow, a high beta is desirable.

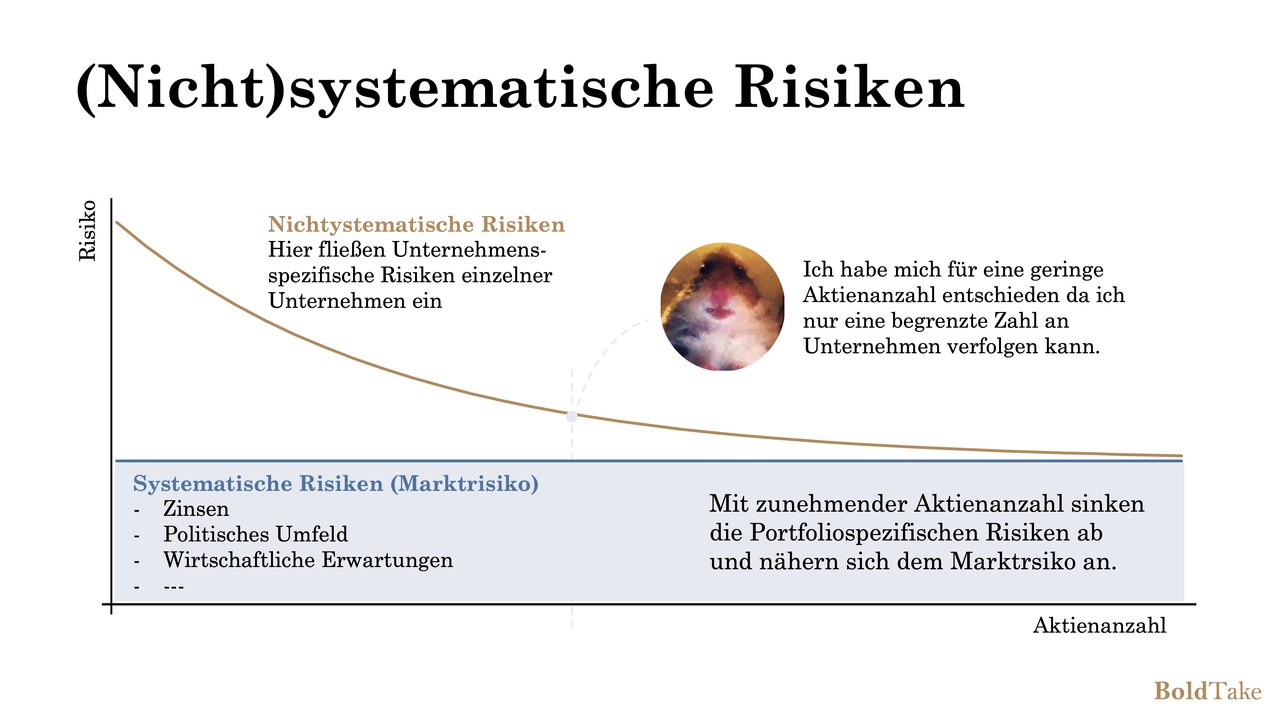

Diversification as a risk?

I often see portfolios with 30+ companies on Getquin. The aim behind this is to minimize risk. In my view, however, what gets lost in the process is the overview - or leisure time, because every share in the portfolio should be tracked and scrutinized.

I have therefore opted for a clearly structured portfolio. There are currently 11 companies (but the number is not set in stone). There are two reasons for this:

I want to know and follow each company in my portfolio well

The impact of a price increase should be significant

My strategy for less drawdown despite fewer shares

- Cover as many sectors as possible

- Consider regional sales distribution

- Know a company as well as possible

Why these companies?

- Heidelberg Materials $HEI (+0.44%). Local monopolies with strong pricing power

- Medpace$MEDP (+1.56%). Enabler of small research/pharma teams. Enables research outside of Big Pharma

- Hims and Hers$HIMS (-0.67%). Generics seller with "cool brand". Enables better margins in the long term.

- MercadoLibre $MELI (-0.16%). The Amazon and bank of Latin America. To benefit from the rise of emerging markets.

- Meta Platforms$META (+1.59%). Monopoly in communication/social media.

- Prada$1913 (+3.48%). One of the few luxury companies that is constantly growing (and not highly valued). More on this in my last post.

- BATS$BATS (+2.33%). Non-cyclical business model. Bought at the time due to significant undervaluation. Now I hold the share to stabilize the portfolio somewhat.

- Sanlorenzo$SL (+1.84%). Yacht manufacturer and thus part of the luxury sector, which I find attractive due to its high margin and low cyclicality.

- Solaria $SLR (+0.55%). My conservative bet on rising energy demand through AI.

- Metaplanet $3350 (+3.5%). Bitcoin gamble with play money.

My criteria for buying shares

Basically, I hardly set myself any limits when investing. I like to invest in shares that are rather unpopular at the time of purchase. The sector doesn't matter, although I prefer high-margin business models.

I like to buy cheap - high P/E ratios put me off (even if FOMO sometimes kicks in). I don't feel comfortable with it because of the potential drop.

Wow. Thank you for reading this!

Now that you know my strategy, I would really appreciate some stock tips tips, that could fit my strategy.

By the way, can you see the portfolio? Because it's my own post I can't check it👀