- Graphics from Bernstein

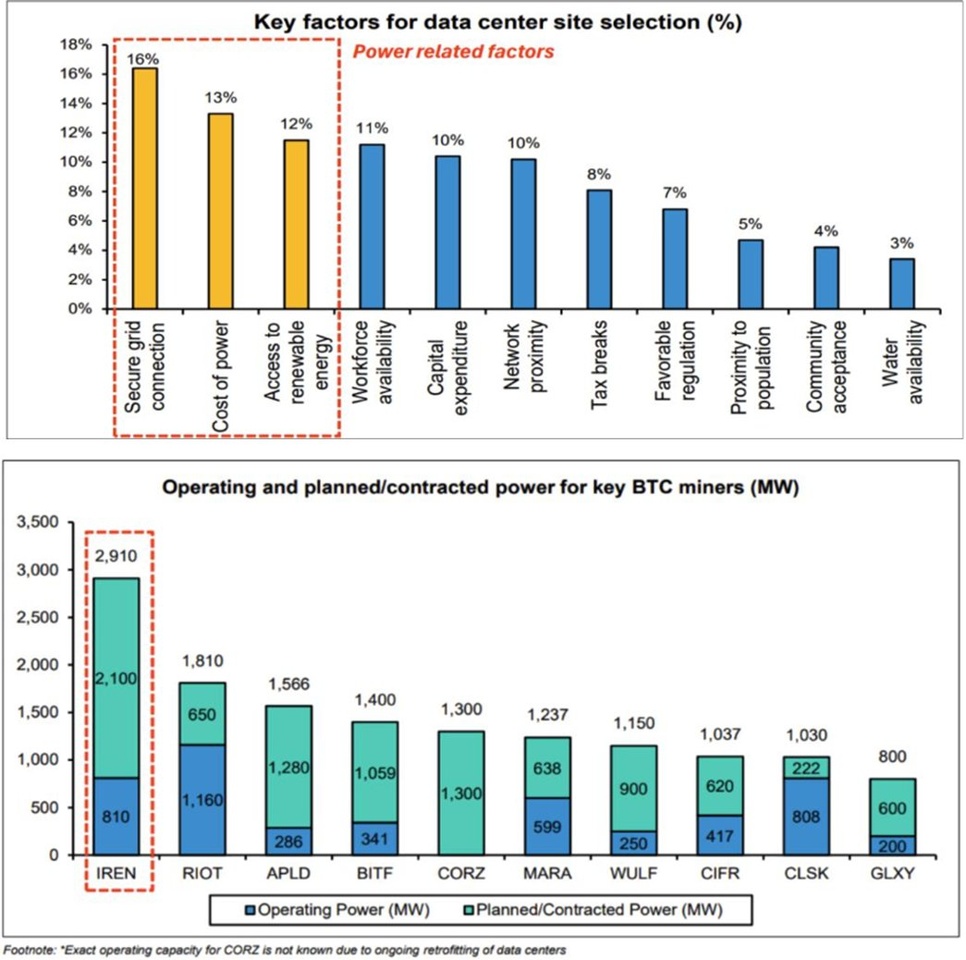

Analysts at research and brokerage firm Bernstein said Bitcoin miners are becoming the unexpected winners of the artificial intelligence infrastructure boom thanks to their access to pre-secured, high-density power capacity.

In a new report on Friday, analysts led by Gautam Chhugani argued that this power advantage makes miners key partners for AI cloud providers facing long connection delays and increasing network congestion. Bernstein named the leading listed Bitcoin miner by market capitalization IREN as its top recommendation, rated the stock as "outperform" and reiterated its recently raised price target of USD 75.

The report points out that Bitcoin miners have collectively secured access to more than 14 gigawatts of grid-connected power - much of it in regions with surplus renewable energy. This infrastructure could reduce the time it takes to deploy AI data centers by up to 75%, according to the analysts. This gives miners an edge over greenfield developers who face multi-year queues to connect to the grid. "Access to the power grid has become a very scarce resource in the US," the analysts write, emphasizing that miners are now attractive strategic partners for hyperscalers and AI infrastructure providers due to their early expansion.

$IREN (-6.41%) The company controls around 3 gigawatts of operational and in-development power capacity in North America alone and has been the fastest to capitalize on the opportunity, according to analysts. The company has also acquired more than 23,300 GPUs - including the latest Blackwell models from $NVDA (+1%) - and expects its AI cloud business to exceed $500 million in annual revenue by the first quarter of 2026. The upcoming 50-megawatt liquid-cooled data center from $IREN (-6.41%) and a 2-gigawatt Sweetwater hub in Texas are key components of this expansion.

$CIFR (-6.57%)

$BTC (-0.5%)

$BTBT (+0%)

$BITF (-1.14%)

$CLSK (-1.33%)