Hello everyone, with Donald Trump and Elon Musk in office, I'm expecting volatile times ahead. I have therefore carried out a check on my portfolio to determine how solid my foundation (core) still is.

The following criteria were used for the check

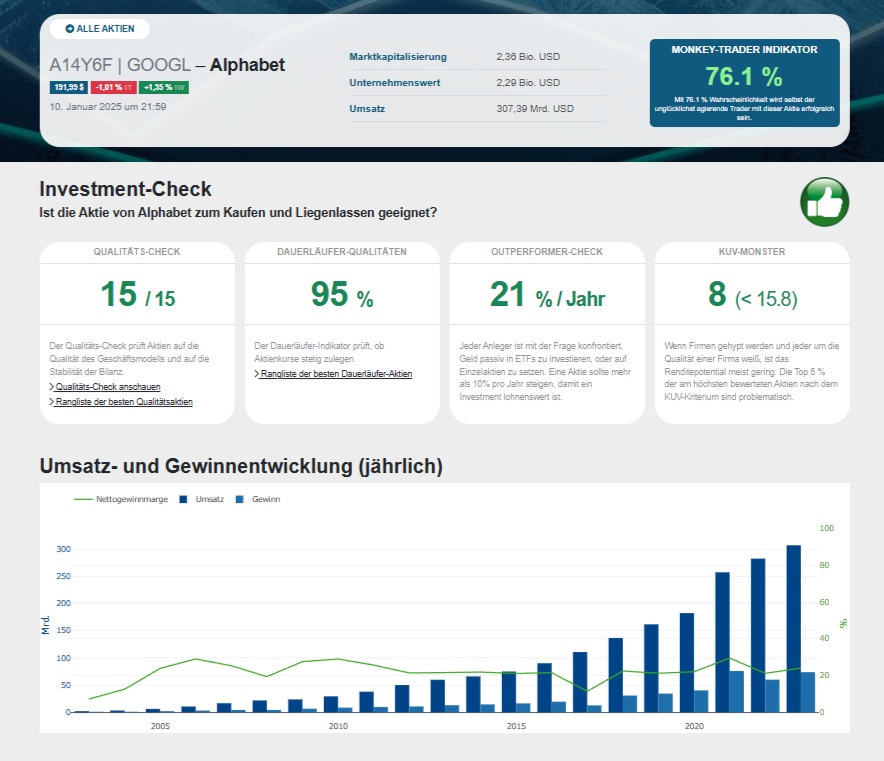

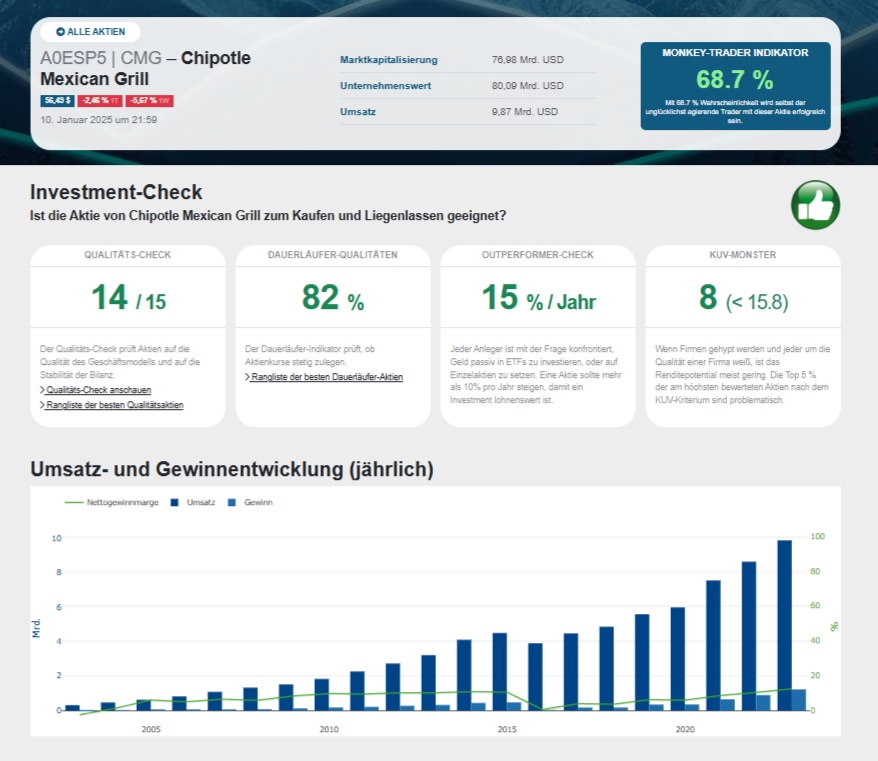

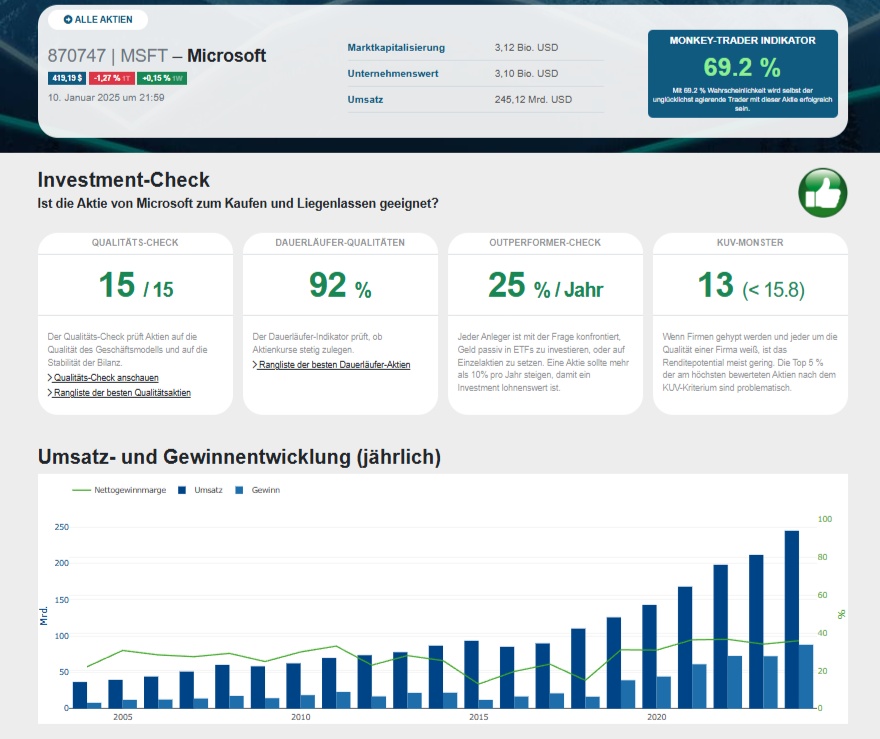

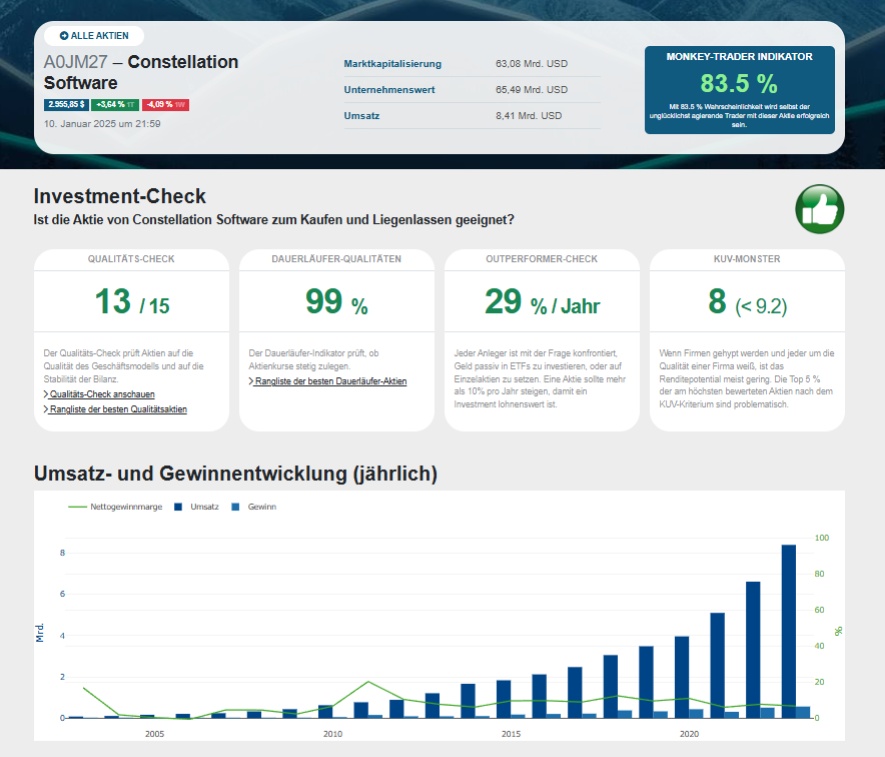

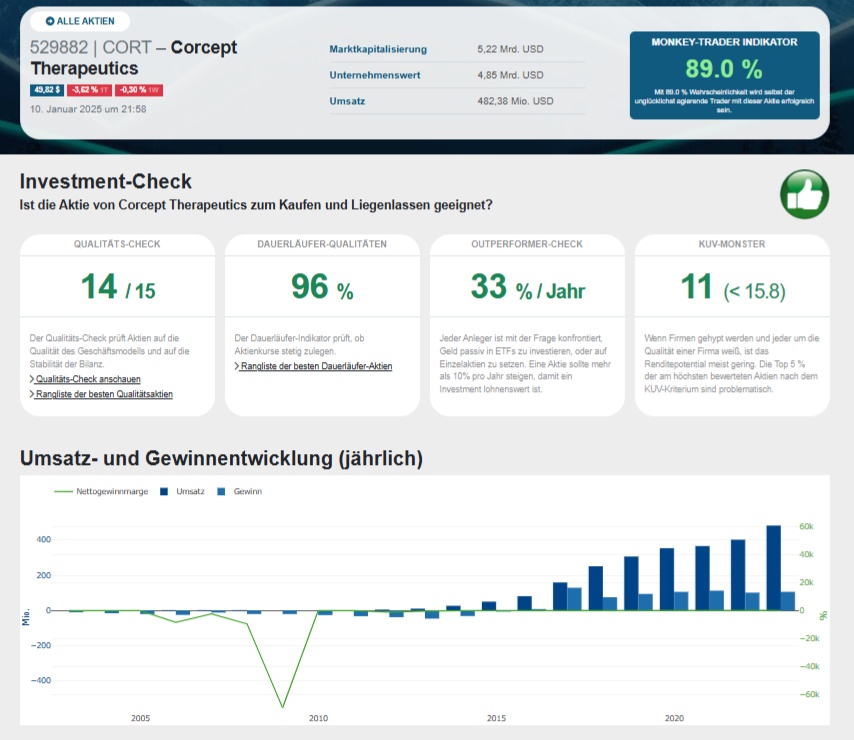

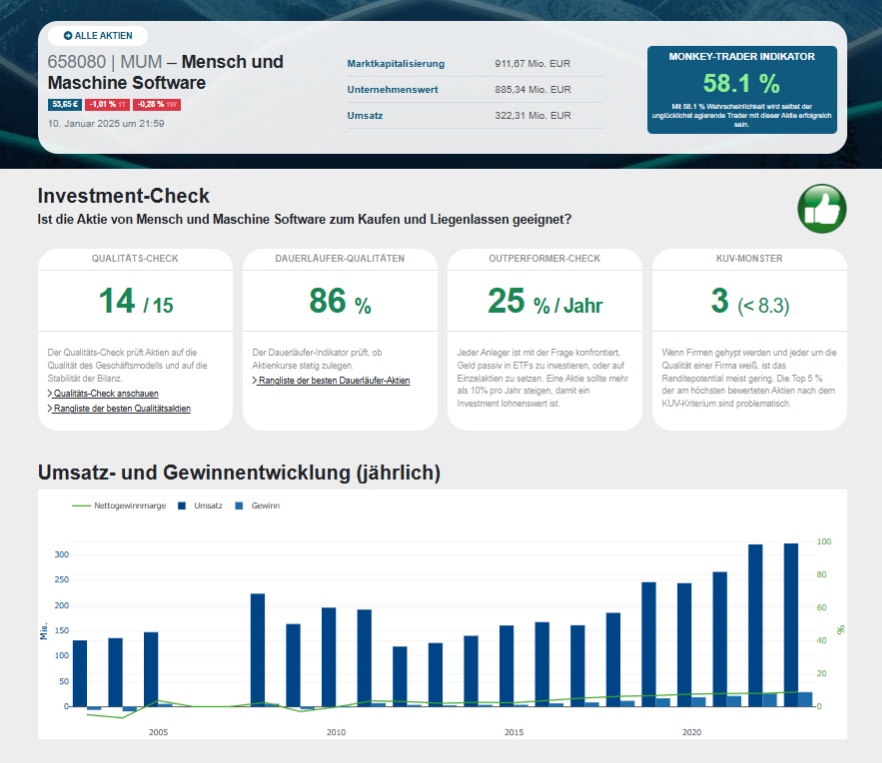

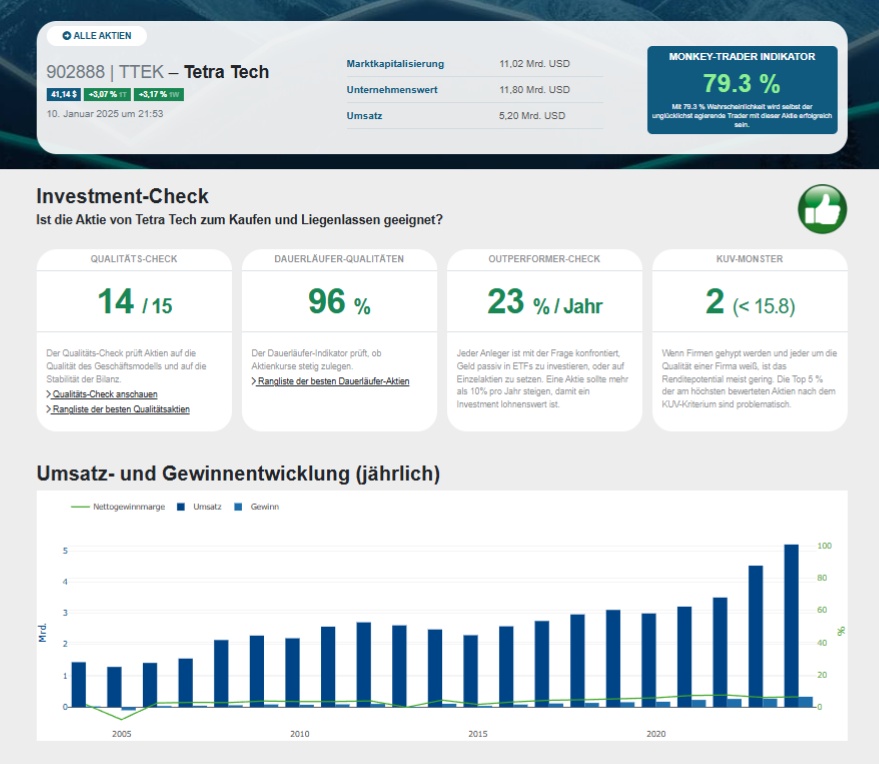

Quality check

The quality check examines shares for the quality of the business model and the stability of the balance sheet

Enduring qualities

The long-term indicator checks whether share prices are rising steadily.

Outperformer check

Every investor is confronted with the question of whether to invest money passively in ETFs or in individual shares. A share should rise by more than 10% per year for an investment to be worthwhile.

KUV monster

When companies are hyped and everyone knows about the quality of a company, the return potential is usually low. The top 5% of the most highly valued shares according to the KUV criterion are problematic.

The following companies from my portfolio turned out to be

buy and leave.

Alphabet $GOOG (+0.89%) Modine Manuf. $MOD (+3.94%) Chipotle $CMG (-2.5%)

Microsoft $MSFT (-0.33%) Copart $CPRT (-0.75%) Vertex $VRTX (+0.1%)

Constellation Software $CSU (-0.16%) Man and machine $MUM (-2.37%)

Corcept Therap. $CORT (-0.55%) Tetra Tech $TTI (-0.36%) TransDigm Group $TDG (-1.86%)

IES Holding $IESC (+1.77%) ASML $ASML (+2.2%)