Having Charlie Munger in your profile picture doesn't mean you're as successful as him.

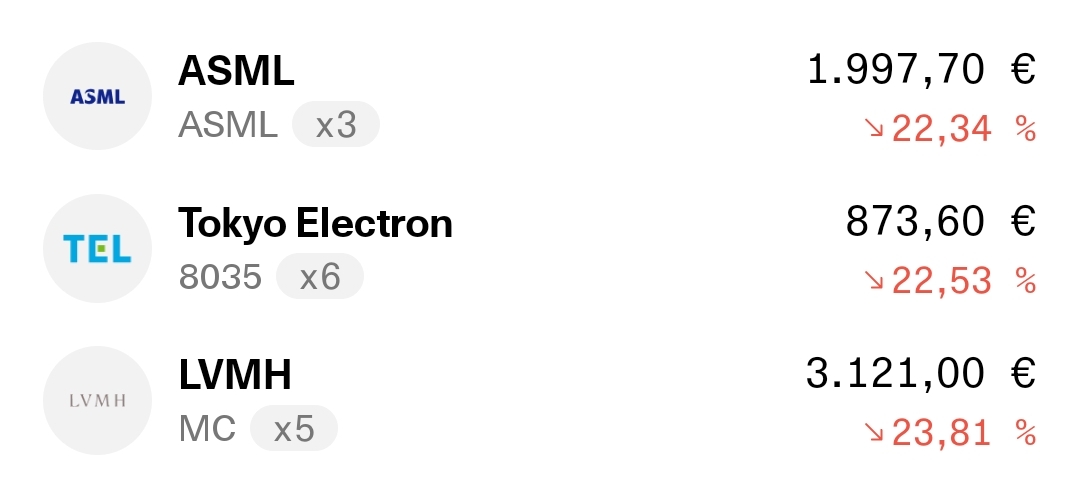

A look at the end of my portfolio shows the weaknesses and mistakes that were made.

You might say Fallen Angel.

LVMH $MC (-0.45%)

Bought on 30.05.2023 after bad news and a fall in the share price.

In the back of my mind sayings like

"Luxury always works" and "LVMH is a long runner"

Suddenly, every influencer at the time had

had the share on their buy list and so on

28.09.2023 was bought again.

However, there was no shortage of bad news, the share disappointed and an exit was missed.

Tokyo Electron $8035 (-6.59%)

Due to US sanctions against China, there were considerations that China would obtain high technology from Japan.

And due to the AI hype, on 8.02.2024

Tokyo Electron and Advantest $6857 (-5.43%) were bought at a high P/E ratio.

Nevertheless, Tokyo Electron was quickly up over 30% and the joy was great. And a stop loss was not set either.

And so it was that an interest rate hike in Japan caused the stock market to crash. And of course the first to be hit were the overvalued hype stocks.

Incidentally, Advantest is already well up again after good figures and I am optimistic about Tokyo and fortunately the position is only very small.

ASML $ASML (-3.69%)

History repeats itself. Here, too, we bought after the market correction on 31.07.2024.

Again it was influencers "ASML has a monopoly"

and it won't get any cheaper.

But things turned out differently. The last quarterly figures proved me wrong.

This now raises the question for me

BUY UP ?

or will it be an LVMH story?

My dears,

Of course I am aware that in the long term I will be smiling about this in a few years' time.

And a diversified portfolio keeps such things in check.

But as a clever investor, I could have invested LVMH's money better over a year.

Please tell me your opinion on this, do you set stop losses and where do you set them?

What strategy do you use?

When do you buy?

etc.

You are the best community, and I would especially like to mention that the tone has changed for the better in the last few weeks.

Thank you my dears 😘🌹