DLocal $DLO has developed from a local payment service provider from Uruguay to a global infrastructure provider for emerging markets in just a few years. With over 900 integrated payment methods and customers such as Amazon $AMZN (+2,51%) and Google $GOOGL (+3,81%) the company is positioning itself as a key player for international expansion.

Incidentally, the company is currently led by the former CEO of MercadoLibre $MELI (-0,16%) at the moment. (There was also a great presentation of @Iwamoto).

History

The company was founded in Uruguay out of the personal frustration of co-founder Sebastián Kanovich. He recognized a problem: in Latin America, international online payments were almost impossible without local credit cards.

- Beginnings: Kanovich left Santander Bank and joined two partners. The team started small with a kiosk model in Uruguay, which initially only offered a specific solution for a single customer.

- Breakthrough with "Boleto": The first major success was the digitalization of the Brazilian Boleto-system (a cash-based payment slip system). dLocal made it possible to create these slips directly during online checkout, which massively simplified the process.

- Expansion and scaling: Originally focused on Brazil, the team quickly recognized the need throughout Latin America, Africa and Asia. dLocal evolved into a provider that now bundles over 900 local payment methods through a single interface.

- Strategic turning point: A pivotal moment was the collaboration with the first major US customer, GoDaddy. dLocal then moved away from trying to build its own end-customer brand (B2C) and switched to a pure B2B model as an infrastructure provider. This enabled global scaling for giants such as Google $GOOGL (+3,81%) and Facebook $META (+1,59%) .

Current operating business

dLocal's mission is to enable global merchants to seamlessly connect to billions of users in emerging markets. The company provides payment solutions for some of the world's largest corporations, including but not limited to Amazon, Uber, Microsoft, Shopify, Google, Spotify, Tencent, Shein, Salesforce, Nike, Booking and Shopee. By simplifying the complex payment landscapes in emerging markets, dLocal helps companies expand into high-growth regions without the usual friction associated with cross-border transactions.

How dLocal makes money

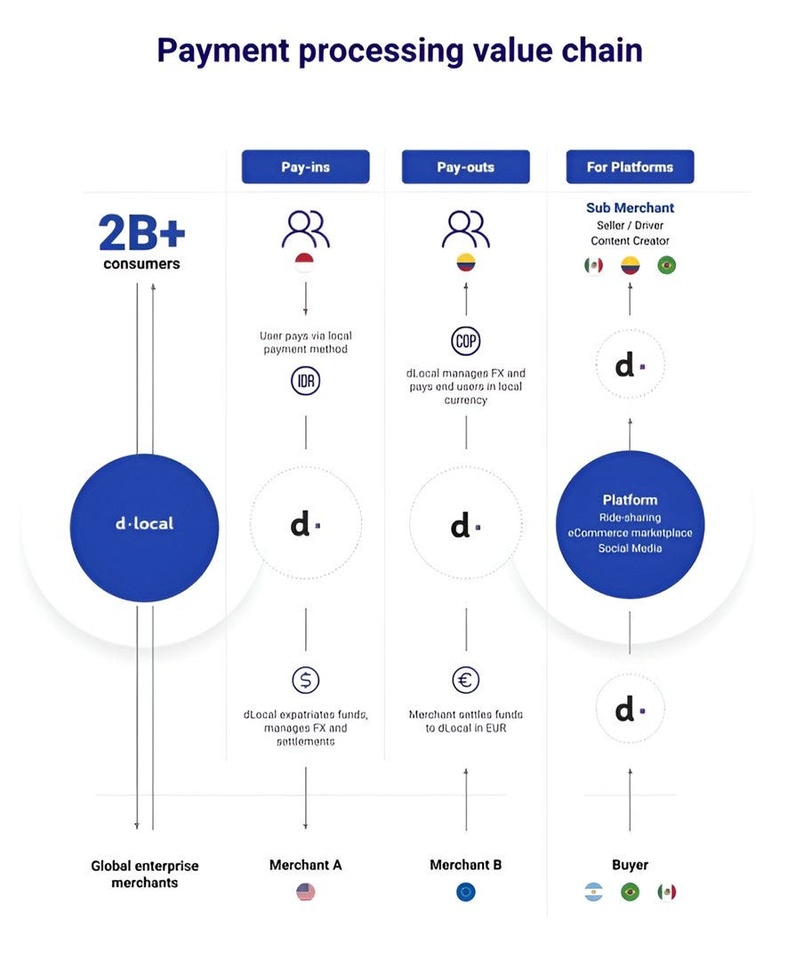

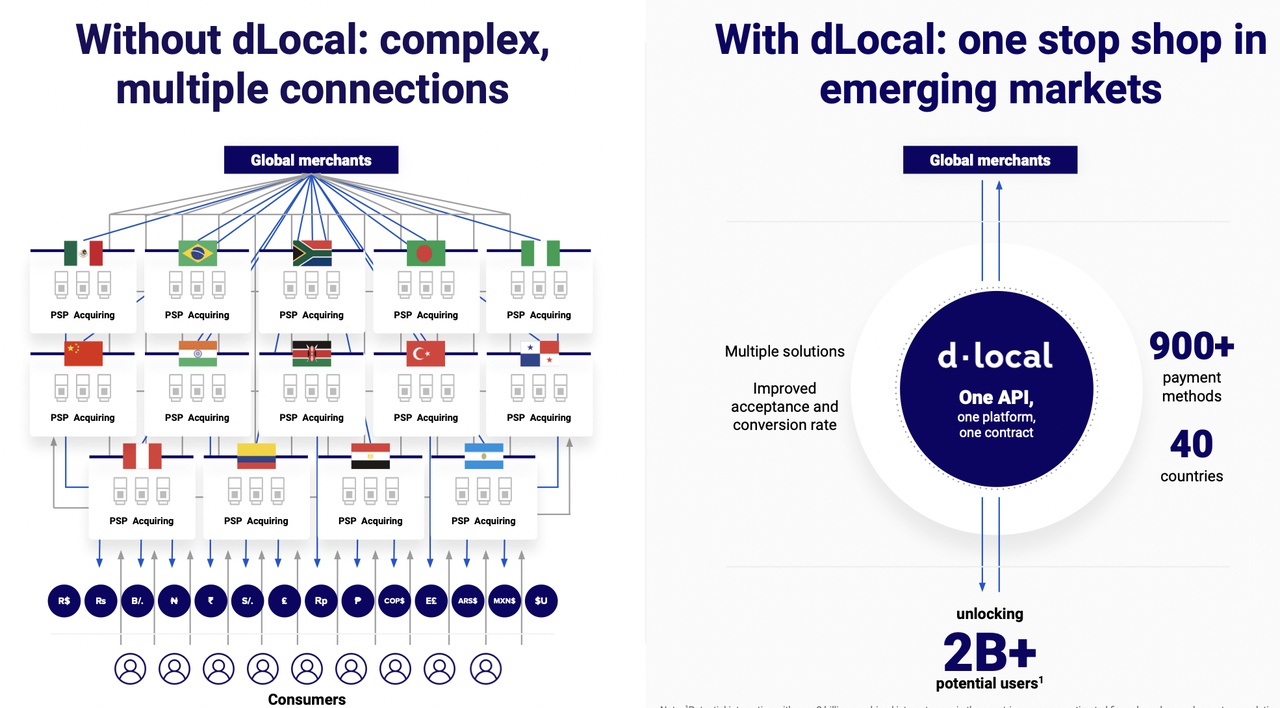

dLocal operates a high-margin, scalable business model based on direct integrations with global merchants. Once connected, businesses can access the full range of dLocal's payment solutions through a single interface and contract, eliminating the need for multiple legacy providers. This direct connection serves as both a competitive advantage and a barrier to entry, making any additional transaction volume highly accretive.

The company generates revenue primarily through transaction fees for pay-in (customer payments) and pay-out services (payouts to merchants). These fees can be a percentage of the transaction value, a fixed fee per transaction or a spread for currency conversions. dLocal also charges fees for services such as chargeback management and installment payments, which contribute additionally to the revenue stream.

Revenue breakdown:

- Processing fees: Charged as a percentage of the transaction value or as a fixed fee per approved transaction.

- Installment fees: Fees for transactions where consumers choose to pay in installments.

- Foreign exchange (FX) fees: A spread on currency conversion for cross-border transactions.

- Other transaction fees: Includes fees for chargebacks and refunds and ancillary services.

- Other income: Set-up fees, maintenance fees and other minor service charges.

Cost structure

dLocal's cost of sales (COGS) consists primarily of fees paid to financial institutions such as banks and local acquirers for processing payments. These costs vary depending on the billing period and payment method. Other expenses include infrastructure costs, salaries for operational staff and the amortization of internally developed software.

One of the main risks in dLocal's model is the currency riskas transactions often involve multiple currencies. However, the company mitigates this risk through hedging strategies by using derivatives to offset currency fluctuations.

Apart from cost of sales, dLocal's main costs fall into two categories:

- Technology & Development: This includes salaries for tech teams, infrastructure costs, information security expenses, software licenses and other technology-related investments.

- Selling, general and administrative (SG&A) costs: These are the regular operating costs required to run the business.

Since the new CEO took office, dLocal has increased spending on technology infrastructure and back-end capabilities to enhance its solutions and maintain its position as an innovator with a long-term mindset. While these investments initially put pressure on margins, they are strategically important for long-term value creation.

Overall, dLocal's business model is highly scalable with minimal marginal costs, enabling the company to unlock significant operating leverage as it continues to grow.

Key figure: TPV growth

The Total Payment Volume (TPV) (i.e. the total payment volume) is probably the most important key figure for assessing the relevance and implementation of dLocal in recent years.

- From 2016 to 2024, the company grew from just USD 136 million to 17.7 billion USD TPV - an annual growth rate (CAGR) of over 100%.

With a huge untapped market ahead, the company still has significant room to scale.

1. superiority over global giants (Adyen, Stripe)

Although Adyen and Stripe dominate the global market, dLocal differentiates itself through a niche strategy:

- Focus on emerging markets: While the big players are optimized for developed markets, dLocal is built from the ground up for the complex regulatory and technical hurdles in regions such as Latin America, Africa and Asia.

- "One dLocal" model: Merchants can connect via a single technical interface (API) to over 40 emerging markets. dLocal takes care of all the local complexity (regulations, taxes, banking infrastructure).

- Specialized partnerships: dLocal offers access to over 900 local payment methods (Alternative Payment Methods), resulting in significantly higher payment success rates than standardized global providers.

2. superiority over local providers (EBANX, PayU)

Compared to regional specialists, dLocal scores above all through Size and efficiency:

- Cost advantages through scaling: Due to the enormous transaction volume, dLocal can bundle payments (e.g. currency conversions in a package), which lowers the costs per transaction. This enables more competitive pricing.

- Financial strength: dLocal is debt-free and has high cash reserves, providing security and enabling acquisitions in a consolidating market.

- Value-added services: The offering goes far beyond just settlement; it includes AI-powered fraud prevention, tax compliance tools and dynamic routing (choosing the best local banking partner in real time).

The "flywheel effect" (self-reinforcing growth)

The business model benefits from a cycle:

More volume lowers the costs per transaction.

Lower costs enable more attractive prices for merchants.

More merchants (such as Amazon or Google) further increase the volume.

Conclusion: Merchants are willing to pay higher fees for dLocal than in industrialized countries, as the savings in legal and operational costs from the "all-in-one" solution far justify this surcharge.

Massive market opportunities

dLocal operates in some of the fastest growing digital economies in the world, giving the company long-term access to a trillion dollar market. This is not a "winner-takes-all" industry. Instead, several key players will emerge and dLocal is well positioned to be one of the market leaders.

Global reach in high-growth markets

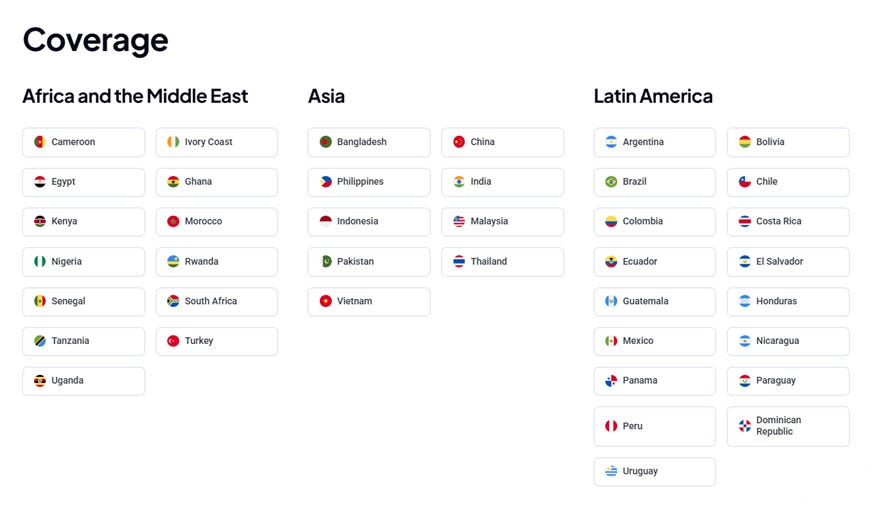

dLocal is deeply rooted in the emerging markets of Latin America, Africa, the Middle East and Asia - regions with a combined population of over 2 billion peoplewhich are still at an early stage of digital adaptation. The company currently operates in over 40 countries, including:

- Africa & Middle East: Nigeria, South Africa, Egypt, Kenya, Turkey, Morocco and more.

- Asia: India, Indonesia, Pakistan, Vietnam, Thailand and the Philippines.

- Latin America: Argentina, Brazil, Mexico, Colombia, Peru, Chile and others.

A "pure play" on the digitalization of emerging markets

While tech giants are expanding into emerging markets, these regions often account for only a tiny fraction of their overall business. For global giants such as Amazon, Google or Microsoft, sales generated in Latin America, Africa or Southeast Asia barely move the needle in their consolidated results.

dLocal, on the other hand, is a "pure play"that focuses exclusively on these high-growth regions. It therefore offers a direct opportunity to invest in the explosive growth of internet penetration, digital commerce and the introduction of fintech solutions.

Strong tailwinds for long-term growth

- The digitization of payment transactions is accelerating in emerging markets, where cash still accounts for more than 50% of transactions in many countries.

- The market for cross-border payments is expected to reach 65 trillion USD by 2030, with dLocal positioned to capture a significant share of this growth.

- Africa and Asia are rapidly gaining importance within dLocal's revenue mix and are growing significantly faster than Latin America, which has traditionally been the strongest region.

dLocal is pursuing a five-stage plan to expand its market leadership in emerging markets and to open up the "Global South" in terms of payment technology:

- 1. "Land and Expand" (existing customers): dLocal grows with its giants. If a customer such as Amazon is already using dLocal in Brazil to accept payments (pay-in), the aim is to win this customer for payouts (pay-out) or to expand the cooperation to new regions (e.g. Africa).

- 2. acquisition of new customers: The company focuses on global "blue chip" merchants. As onboarding is complex (up to 2 years), dLocal scores with excellent references, high security and better payment approval rates than the competition.

- 3. geographic expansion: dLocal follows the needs of its customers. If a major partner opens up a new market (e.g. Egypt), dLocal rolls out its infrastructure there. The aim is to cover all relevant high-growth markets worldwide.

- 4. product innovation: The portfolio is constantly being expanded. Following the success of payout solutions and platform tools, CEO Pedro Arnt is planning to launch 4 to 5 new solutions to penetrate even deeper into the merchant value chain.

- 5. strategic acquisitions (M&A): For 2025 important acquisitions have been made. dLocal intends to use the market consolidation to purchase technological additions that can be seamlessly integrated into the existing platform.

Instead of acquiring large competitors, dLocal 2025 has primarily targeted smaller payment institutions in South East Asia and Africa acquired smaller payment institutions in Southeast Asia and Africa.

The purpose: Instead of waiting years for government approvals, dLocal bought companies that already had the necessary local e-money and payment gateway licenses. licenses.

Acquisition in the field of AI & fraud prevention

In the summer of 2025, there were reports of the integration of a specialized fintech start-upthat focused on AI-based fraud detection for emerging markets.

The purpose: This paid directly into the goal of increasing approval rates to increase approval rates. In emerging markets, distinguishing between legitimate payments and fraud is particularly difficult; the new technology helped dLocal to differentiate itself even more clearly from global giants.

Why is the stock down >80% from its all-time high? Time for a comeback

dLocal shares experienced a massive drop of over 80% due to a mixture of market conditions, temporary setbacks and misperceptions. Nevertheless, the company is well positioned for a recovery.

1) The short report - A "storm in a teacup"

One of the main reasons for the sell-off was a short report accusing dLocal of fraud. On closer inspection, this turned out to be insubstantial - filled with technical jargon but without any real evidence. The new CEO Pedro Arnt described the report as an attempt to throw accusations around to see what sticks. The company's fundamentals remained unaffected.

2) Devaluation of emerging market currencies

Currency volatility, particularly in Argentina, put pressure on the financials. But what started as a headwind could become a tailwind: Despite the devaluation, dLocal tripled its transaction volume on Black Friday in Argentina compared to the previous year, highlighting the huge demand in e-commerce.

3) Change of leadership

The fact that the founder stepped down as CEO initially unsettled the market. But with Pedro Arnt (formerly MercadoLibre $MELI (-0,16%) ), dLocal has gained an experienced leader. His success and his vision for dLocal are now clear catalysts for a recovery.

4) One-time price adjustment in Brazil

In the first quarter of 2024, there was a price adjustment (repricing) with the largest customer in Brazil, which briefly depressed growth and margins. This was a necessary correction to an atypically high fee and is a one-off event. Regulatory changes in Brazil also caused temporary disruptions, but these do not jeopardize the long-term business model.

5) Margin pressure - stabilization and improvement

Margins were under pressure from falling fees across the sector and deliberate investments in technology. Pedro Arnt decided to make long-term investments in personnel and IT despite short-term market reactions. It is now apparent that fee rates are stabilizing and the operating leverage (economies of scale) will ensure rising margins in the coming quarters.

Conclusion: The market has overly punished dLocal due to temporary issues and misunderstandings. However, the fundamental growth story in emerging markets is more intact than ever.

Pedro Arnt - The right leader for dLocal

Pedro Arnt is a key factor in my high conviction for dLocal. His background makes him a key asset to the company and it is clear that he has the right vision to catapult dLocal into the next phase of growth.

From garage to giant

Before joining dLocal, Pedro was CFO of MercadoLibre ($MELI (-0,16%)). Pedro's time at MELI was incredible: he joined the team in his first year and stayed for over 24 years. He played a central role in building what is now the most valuable company in Latin America.

Interestingly, Pedro came across dLocal through his work at MercadoLibre. He recalls how his team at MELI was struggling to make their digital wallet appealing to global corporations, while dLocal's model was precisely designed to serve these enterprise customers in emerging markets. This realization made him understand the immense potential of dLocal.