Hello my dears,

again and again I see here the requests for the largest sporting goods manufacturer in the world

nike $NKE (-0,96%) .

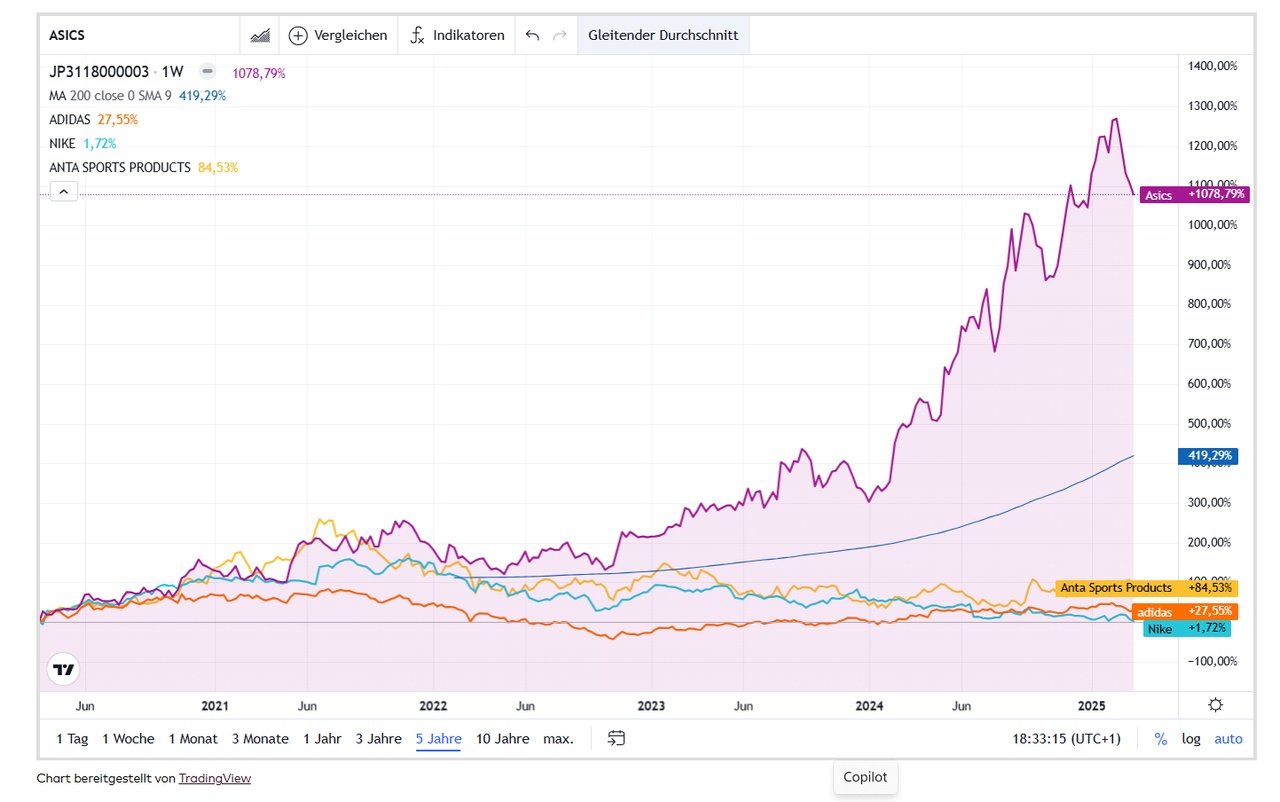

But let's take a look at who has won the performance race historically. Then we discover a very surprising picture. And we can even discover a tenbagger in the 5-year view. Which would be by far the Japanese sporting goods manufacturer Asics $7936 (-3,2%) would be.

5-year performance

Asics +1078.79%

Anta +84.53%

Adidas. +27,55%

Nike. +1,72%

The other three manufacturers lag far behind.

$ADS (-1,1%)

$2020 (-0,44%)

$NKE (-0,96%)

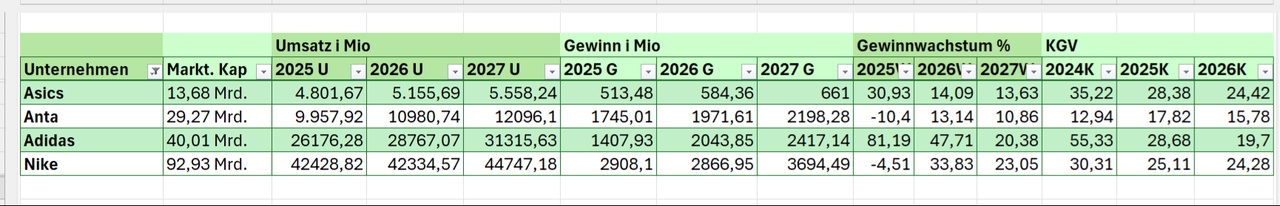

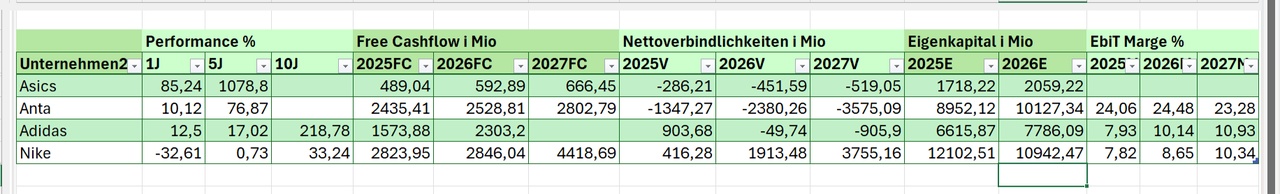

But that was in the past, so I have listed the multiples in an Excel file for comparison.

Here I notice that Adidas is ahead in terms of earnings growth, and is therefore even below Nike in terms of the forward P/E ratio. Although the current P/E ratio for Adidas is the highest and would not be a buying argument for many.

I am impressed by the high EBIT margin of the Chinese manufacturer Anta, which has managed to catch up with adidas in terms of profit despite lower sales.

Of course, this immediately raises the question of the working conditions under which production may take place here. But that would probably be a separate topic.

My dears, which is your favorite, perhaps you will now shuffle the cards again. And would anyone have expected this performance from the Japanese, will it perhaps continue here?

Your opinion is very important to me, let's discuss.