For 2025, I announced that I would build up my portfolio defensively and focus on distributions until I reached the high end. From April, I was finally able to invest in individual stocks again.

At the same time, I am aiming to reduce the crypto share to 10% (currently 27%), as the high share is also the main reason for the weak annual performance.

But let's take a look at the other portfolios and investments:

Nao is up 4%

Oskar is up 34 %

Timeless is up 26 %.

You can find the performance of my child's portfolio in Part 1.

My TR custody account is up 4% for the year

the good old Sparkasse custody account is up 29.61% since the start of the year thanks to $SLI (-1,38%) I wonder when Ms. Groth from the Wirtschaftswoche will get in touch regarding her article from last November (edit: in the podcast leben mit Aktien in der folge vom 26ten November at 31:05 she was thanked for it), in which she mentioned me with the standard lithium idea, which I have been following since 2017. Anyone who digs out the Focus Money magazine from May this year will also find me.

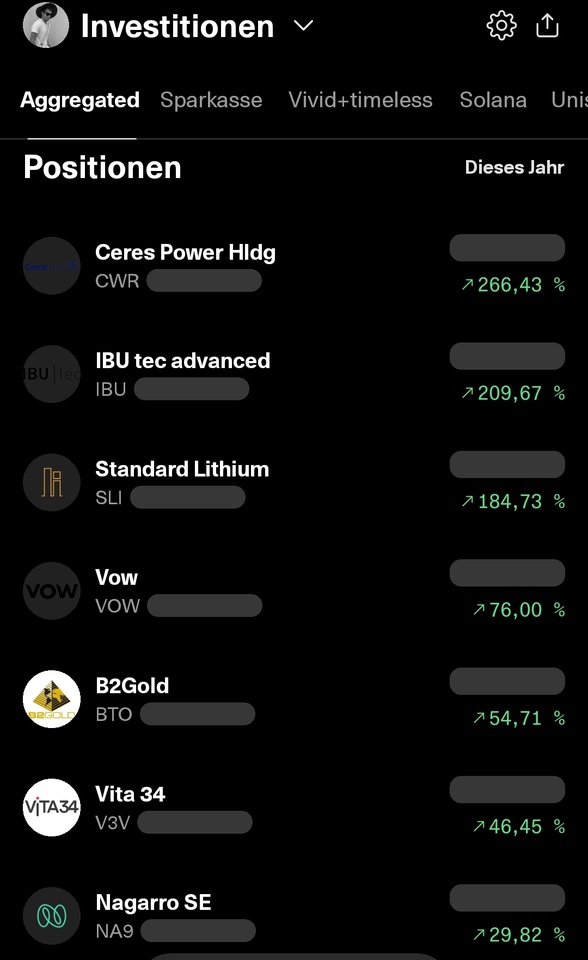

But other stocks also had a good run for my stockpicking/buyback old portfolio (see attachment).

Nevertheless, my average annual return has fallen to 32.4% since 2017 and my total TWROR is now 169%.

The fact that I did not achieve my personal annual target of 15% this year may of course be due to the distraction caused by the birth of my child or to the changeover at the beginning of the year and the start of the buyback of the old portfolio regardless of the current valuation. At the same time, my monthly expenses increased by an average of €500, while I can save €850 less compared to last year. Due to my wife's parental leave, I am now the sole provider and have taken over 60% of her fixed costs.

I'll get back to you in a few days with part 4 Outlook and goals for 2026