SoFi is a unique bank, and I think that you will see it the same way after my analysis at the latest.

As is generally known, I only have five companies in my portfolio. ($RKLB (-0,47%)

$IREN (-1,34%)

$SOFI (-0,39%)

$HIMS (+0,26%) and $PNG (+0,32%) + $BTC (+0,01%) )

So the weighting is relatively high and I have to be clear about why I have chosen exactly these five companies...

The analysis of $RKLB (-0,47%) Rocket Lab was very well received by the community last week, thank you for that! Today, I'm following up with the second of the five stocks I have in my portfolio: SoFi (Social Finance). I would like to explain to you why SoFi is not just a bank, but a modern FinTech with structural advantages. This analysis also took a lot of time, so I would be delighted if you could give me some feedback!

Overview of the analysis

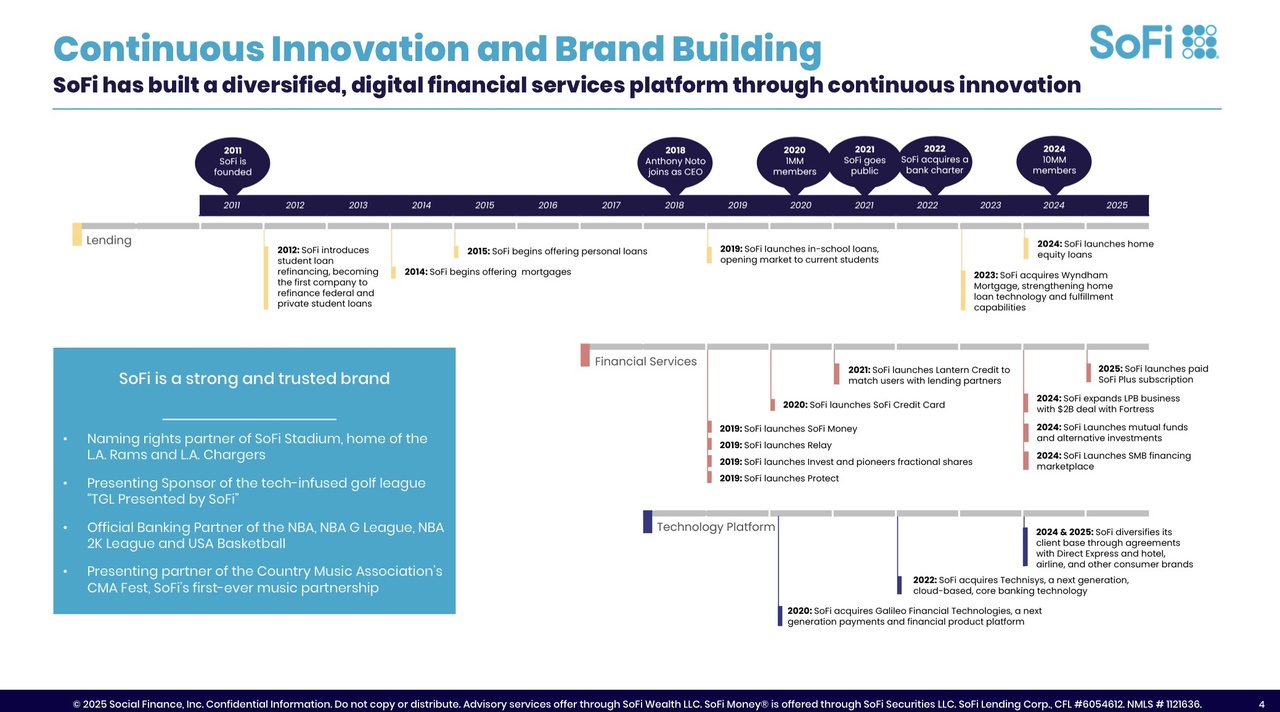

1. foundation and history

2. lending as a basis

3. own banking license

4. strategic acquisitions (Galileo, Technisys)

5.quarterly results Q3 2025

6.own opinion

1. foundation and history

SoFi was founded in 2011 by four students: Mike Cagney, Dan Macklin, James Finnigan and Ian Brady. They were students at the Stanford Graduate School of Business and had the goal of offering affordable student loans. Loans for students in the US were (and still are) very expensive and often depended on the student's credit score.

The founders had the idea of bringing together alumni - i.e. former students who are already working - with current students. The idea was to create a network in which alumni could grant loans to current students. In doing so, former students would not only demonstrate social commitment, but also earn a return through interest.

Over time, SoFi developed further and moved into new business areas. Today, SoFi offers numerous financial services, such as personal loans, savings and current accounts and investment services.

In 2021, SoFi went public with the help of a SPAC. Generally, SPAC IPOs have a rather negative reputation, but so far SoFi has clearly proven that it was not a "dead company" that was floated on the stock exchange.

2. lending - the foundation of SoFi

This segment was the beginning of SoFi. The basic idea behind the company was to finance students who would otherwise only be able to obtain a loan at a very high cost.

And most of SoFi's cash flow still comes from lending. In the last quarter, most of the revenue came from this segment. This segment is so important because it offers good margins and a stable basis for the overall business.

-> SoFi achieved a contribution margin of 54% in this segment in the last quarter.

Another advantage is that many of the loans are still taken out by students. This allows SoFi to retain customers at an early stage - creating a kind of moat. If you are with a bank, you need good reasons to switch to another bank.

In addition, young students enter working life at some point. They earn money, possibly start investing or open additional accounts for family and children. So if they've already had a positive experience with SoFi, why would they switch to another bank?

That's what makes this FinTech unique.

3. importance of the banking license

SoFi has had a banking license since 2022.

This license enables SoFi to accept its own deposits, allowing the company to refinance itself much more cheaply than through external partner banks or other FinTechs.

It also allows SoFi to grant loans directly and hold them on its own balance sheet. This leads to higher margins and more control over the lending business.

The license also allows SoFi to offer attractive interest rates on accounts, which attracts more customer money and accelerates the growth of the deposit base. (In Germany, it is comparable to Trade Republic + customer service 😂)

At the same time, the banking license gives SoFi greater credibility, which strengthens trust among customers, investors and partners.

Overall, the banking license creates the basis for SoFi to scale its business model and develop from a FinTech into a fully-fledged, modern bank (one-stop bank).

However, the banking license alone would not justify why SoFi should be "the bank of the future". There are over 4000 smaller and larger banks in the US that also have a banking license.

4. strategic acquisitions: Galileo & Technisys

Galileo was acquired in 2020 for around 1.2 billion US dollars. Galileo is SoFi's technology and payment infrastructure and is a cornerstone of its business model.

The platform provides scalable backend systems that FinTechs, banks and payment service providers use to manage accounts, issue cards, process payment flows and automate compliance processes. Companies such as Chime, Robinhood and Varo use Galileo to technically operate their banking and card products.

For SoFi, Galileo means a high-margin, recurring B2B revenue model - independent of interest income.

Another acquisition that SoFi made in 2022 is Technisys.

The software forms the cloud infrastructure for transactions and accounting. The system ensures that transactions are booked correctly and errors are avoided.

This means that SoFi not only has a banking license, but also its own technology - a combination that is rare in the US financial sector and contributes significantly to scalability.

ChatGPT explained this to me in a nutshell:

"Galileo provides the scalable back-end infrastructure for account management, card issuance and payment processing.

Technisys provides the core banking system that processes transactions, bookings and account logic in real time.

Together, the two enable SoFi to operate all of its banking functions independently and entirely on its own technology."

5. quarterly results Q3 2025

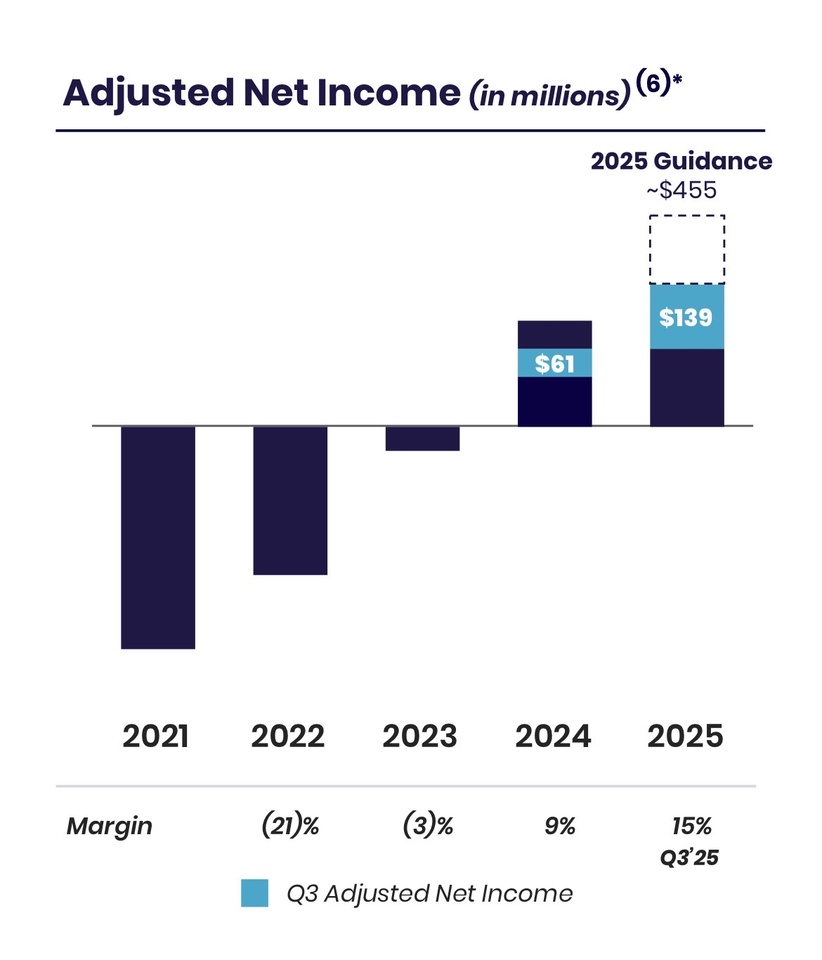

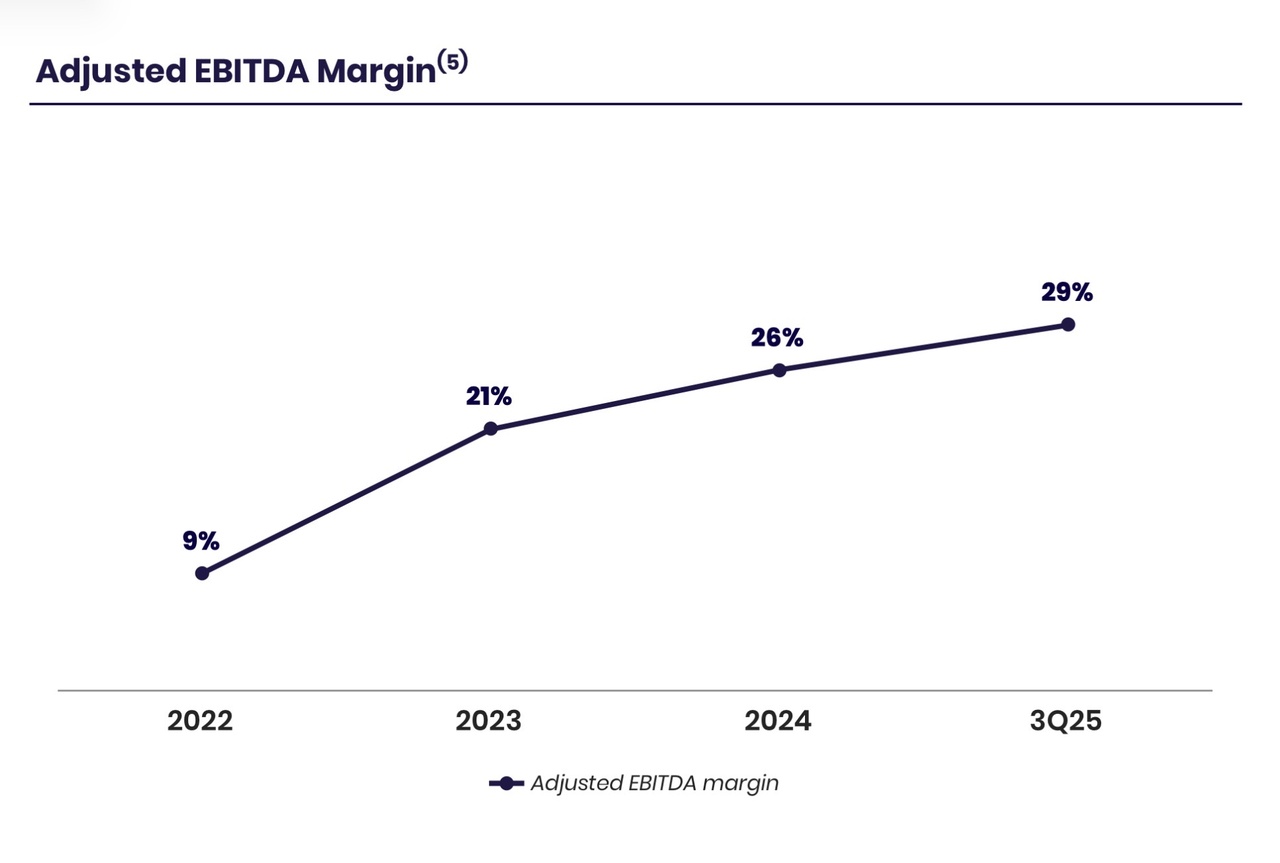

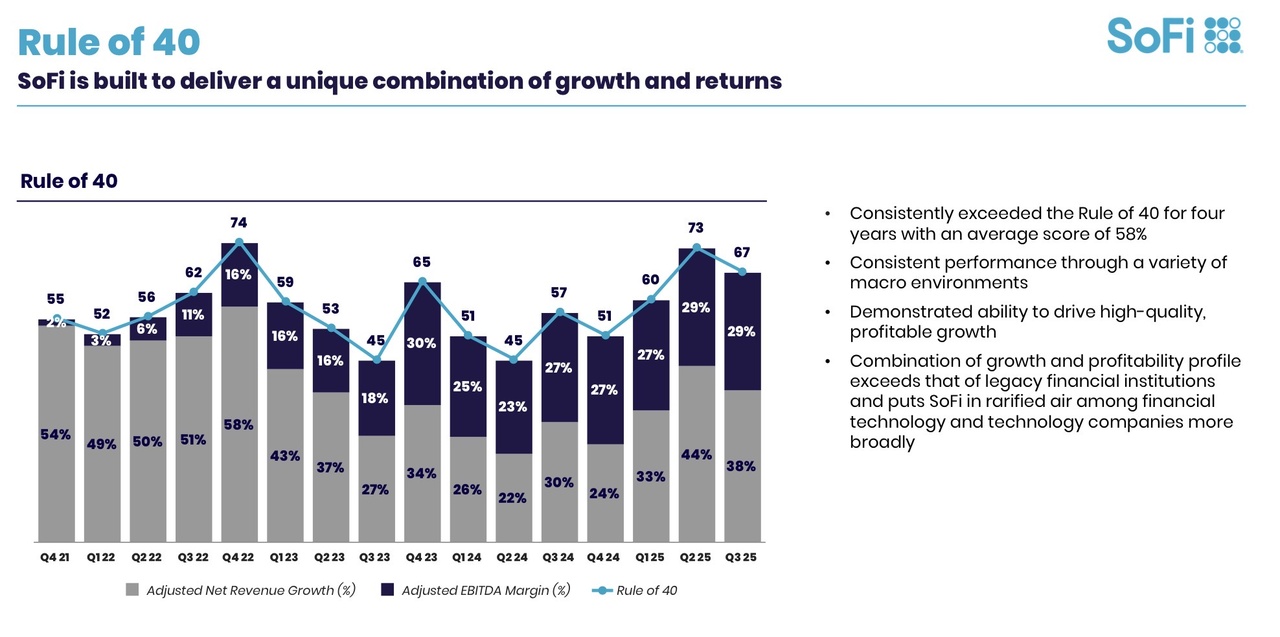

The last quarterly figures were characterized by strong growth and increasing profitability.

- Revenue (adjusted net revenue) amounted to USD 962 million, an increase of 38% compared to Q3 2024.

- Net income (GAAP) amounted to 139 million US dollars.

- The margin also improved to 29%!

- The share of fee-driven revenue also increased significantly, which shows that the company is earning money in an increasingly diversified way

- The member base was around 12.6 million, an increase of 35% year-on-year.

- The number of financial services products was around 18 million - an increase of around 36 to 37 percent.

The fact that sales have risen faster than the number of users indicates that customers are increasingly using more products on SoFi. This would confirm my theory that students who initially only had a loan on SoFi are now opening current accounts or investing via the platform.

SoFi's much-noticed Rule of 40 was recently around 67 - so the company combines strong margins with rapid growth.

Overall, the quarterly figures are very convincing and support my long-term thesis.

6 My own opinion

I think the company is well on the way to joining the league of large US banks. While large banks often have complex structures and hierarchies, SoFi is innovative and strategically well positioned.

SoFi pursues the clear goal of becoming a one-stop bank and retains customers in the long term. With its own technology platform and the early retention of students and young people, SoFi has a special position. I am very optimistic that the company can continue to grow strongly.

What I didn't mention above, Social Finance, is also heavily involved in sponsoring sporting events in the US, which leads to many young people discovering the bank through advertising or marketing campaigns...

What I think could have a negative impact on the share price in the short term is the recently announced capital measure that was announced this week. Around 1.5 billion US dollars are to be raised by diluting existing shareholders. The aim is to accelerate growth and strengthen the company's balance sheet.

In my opinion, however, this is a good decision in the long term, as the management has already proven on several occasions that it handles the capital entrusted to it strategically and sensibly - the acquisitions of Galileo and Technisys, for example.

The market capitalization is currently around 30 billion US dollars, which in my opinion makes the company slightly undervalued. However, if you look at the long-term growth, I believe that a five-fold increase or even more is quite possible in the next ten years!

In the next quarterly results, I will be paying particular attention to whether growth can be maintained and margins continue to rise...

With this in mind, I wish you a happy and reflective second Advent and hope that you enjoyed my second analysis.

Please give me feedback again - I really appreciate it when I get feedback on what I can improve 😉

Please also let me know if I should tag you or, if I already tag you under my posts, if I should continue to do so ...

If you haven't read the analysis of Rocket Lab yet here:

Part 1: https://getqu.in/7y934F/

Part 2: https://getqu.in/TQJcW6/

LG Kleinanleger ✌️

Sources:

https://investors.sofi.com/overview/default.aspx

https://de.finance.yahoo.com/quote/SOFI/

https://de.wikipedia.org/wiki/SoFi

https://stockanalysis.com/stocks/sofi/forecast/

@Tenbagger2024

@Multibagger

@BamBamInvest

@SAUgut777

@Aktienfox

@All-in-or-nothing

@Shiya

@Hotte1909

@Simpson

@Wiktor_06

@TradingHase

@TomTurboInvest

@Semos25

@Iwamoto

@HoldTheMike

@ImmoHai

@EpsEra