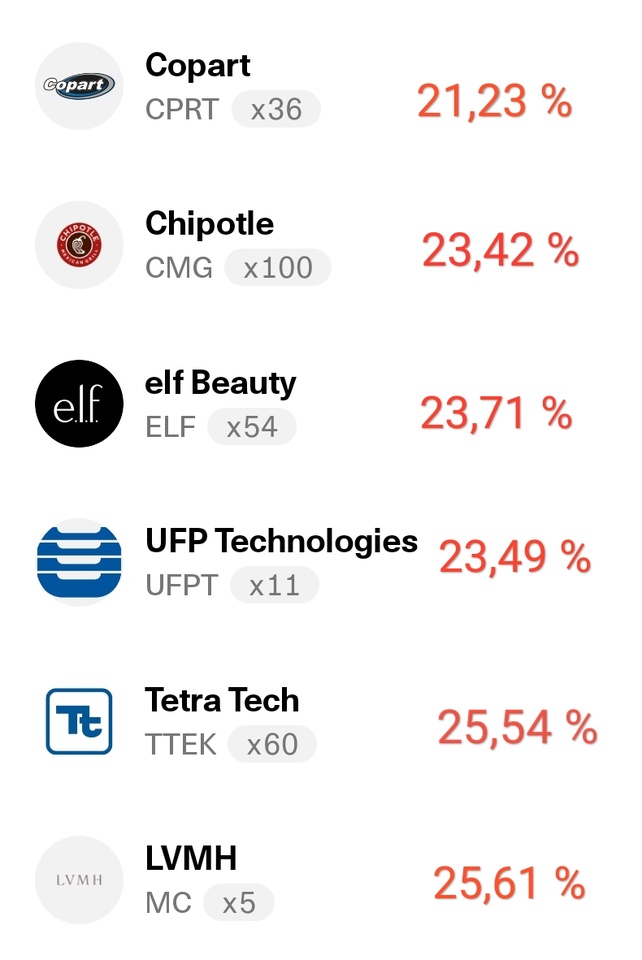

Let's wait and see whether investors will soon realize this. And perhaps Buffet or a star investor @Simpson gets involved in some companies.

Dear all, what are your value stocks?

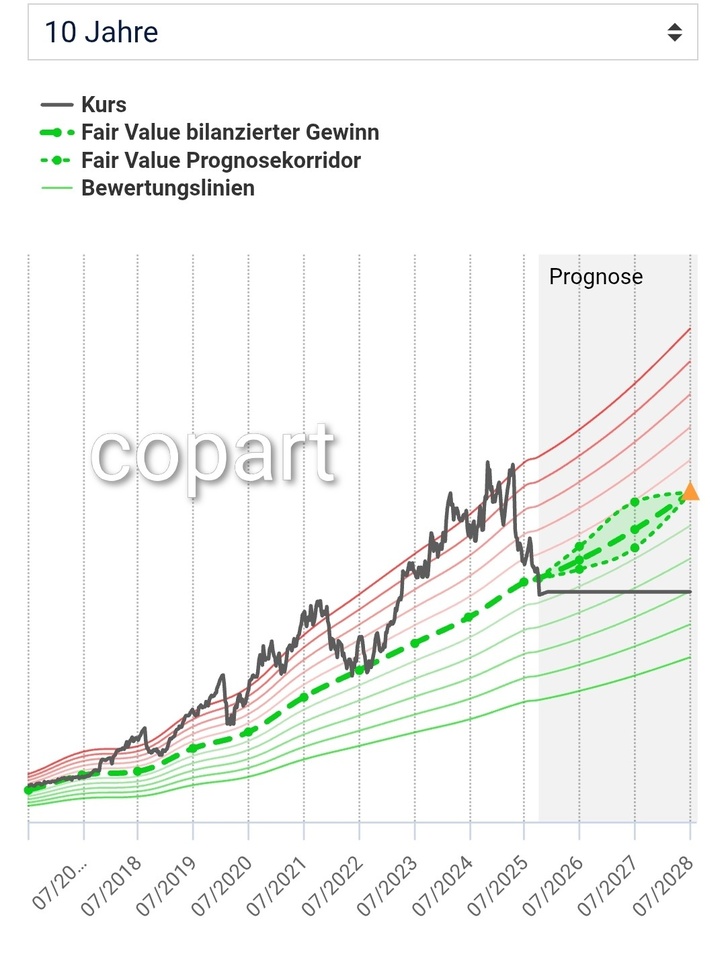

The key figure with the highest stability for the Copart share is the reported profit, which is used below for the valuation. The P/E ratio (price/earnings ratio) calculated from this figure is 25.17, which is 1.79 points below the historical average of 26.96 for the last 10 years. From this perspective, the Copart share appears to be favorably valued.

The fair value of the Copart share is calculated over the 10-year valuation period selected above. The average P/E ratio in this case is 26.96.

Multiplied by the reported earnings per share of USD 1.59 over the last 4 quarters, this results in a fair value of USD 42.87 for the Copart share. The current share price of USD 40.51 is 5.5% below this fair value, which means that the share appears to be slightly undervalued.

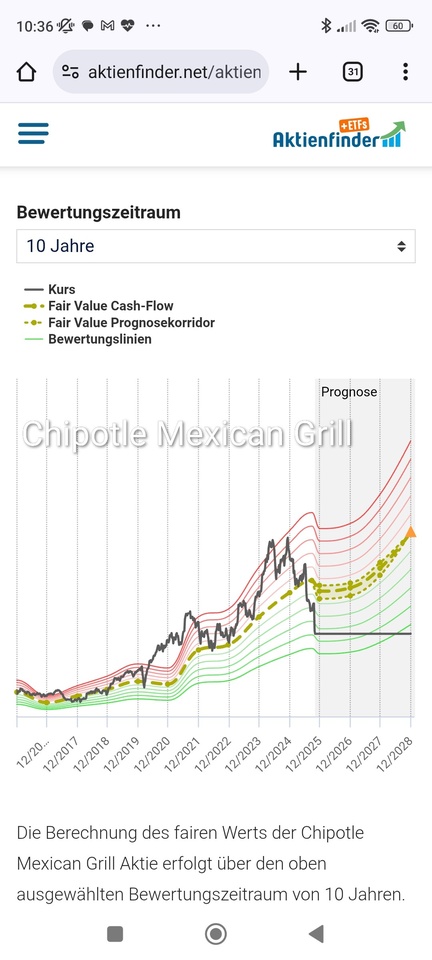

The key figure with the highest stability for Chipotle Mexican Grill shares is the operating cash flow, which is used below for the valuation. The KCV (price/cash flow ratio) calculated from this figure is 18.48, which is 12.01 points below the historical average of 30.49 for the last 10 years. From this perspective, the Chipotle Mexican Grill share appears to be favorably valued.

The fair value of the Chipotle Mexican Grill share is calculated over the 10-year valuation period selected above. The average KCV in this case is 30.49.

Multiplied by the operating cash flow per share of USD 1.65 over the last 4 quarters, this results in a fair value of USD 50.31 for the Chipotle Mexican Grill share. The current share price of USD 30.59 is 39.2% below this fair value, which corresponds to an undervaluation of the share.

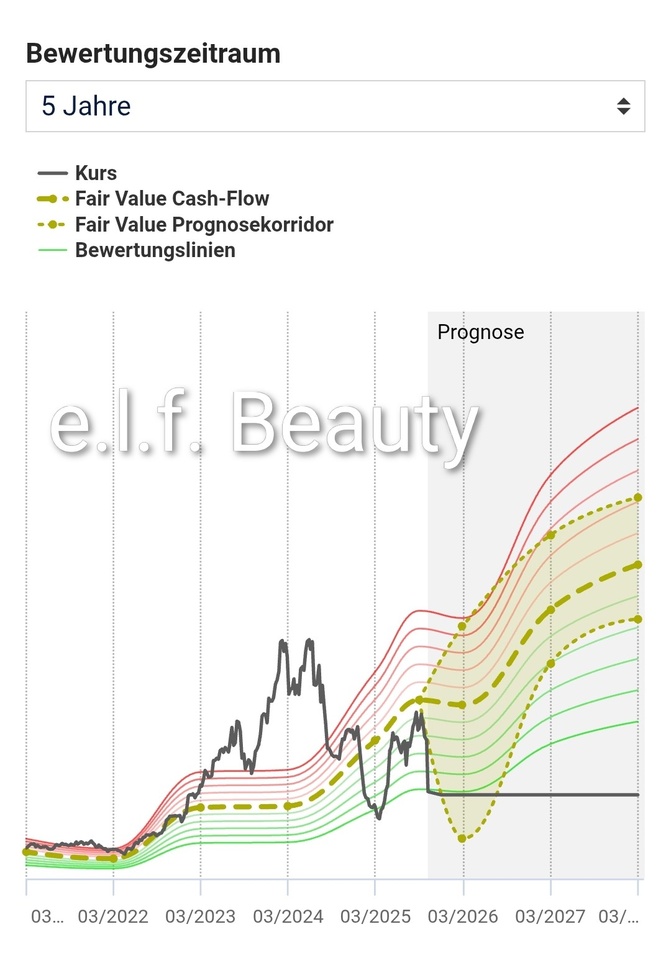

For the e.l.f. Beauty share, the most stable key figure is the adjusted profit. However, this should not be used for the valuation because the time series is too short for a representative average calculation. The operating cash flow is therefore used for the valuation. The KCV (price/cash flow ratio) calculated from this key figure is 26.51 and therefore 27.97 points below the historical average of 54.48 for the last 5 years. The e.l.f. Beauty share appears to be favorably valued from this perspective.

The calculation of the fair value of the e.l.f. Beauty share is calculated over the 5-year valuation period selected above. The average KCV in this case is 54.48.

Multiplied by the operating cash flow per share of USD 2.89 over the last 4 quarters, the fair value of the e.l.f. Beauty share has a fair value of USD 157.46. The current share price of USD 73.74 is 53.2% below this fair value, which corresponds to a strong undervaluation of the share.

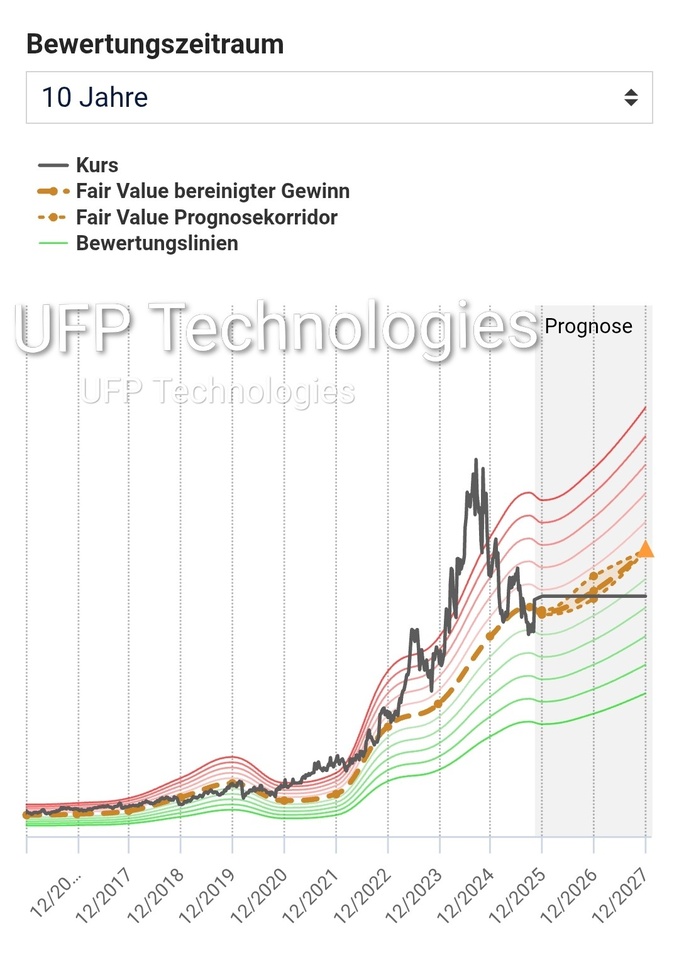

The key figure with the highest stability for the UFP Technologies share is the adjusted profit, which is used below for the valuation. The P/E ratio (price/earnings ratio) calculated from this figure is 22.69, which is 0.72 points above the historical average of 21.97 for the last 10 years. From this perspective, the UFP Technologies share appears to be fairly valued.

The fair value of the UFP Technologies share is calculated over the 10-year valuation period selected above. The average P/E ratio in this case is 21.97.

Multiplied by the adjusted earnings per share of USD 9.82 over the last 4 quarters, this results in a fair value of USD 215.77 for the UFP Technologies share. The current share price of USD 226.11 is 4.8% above this fair value, which means that the share appears to be fairly valued.

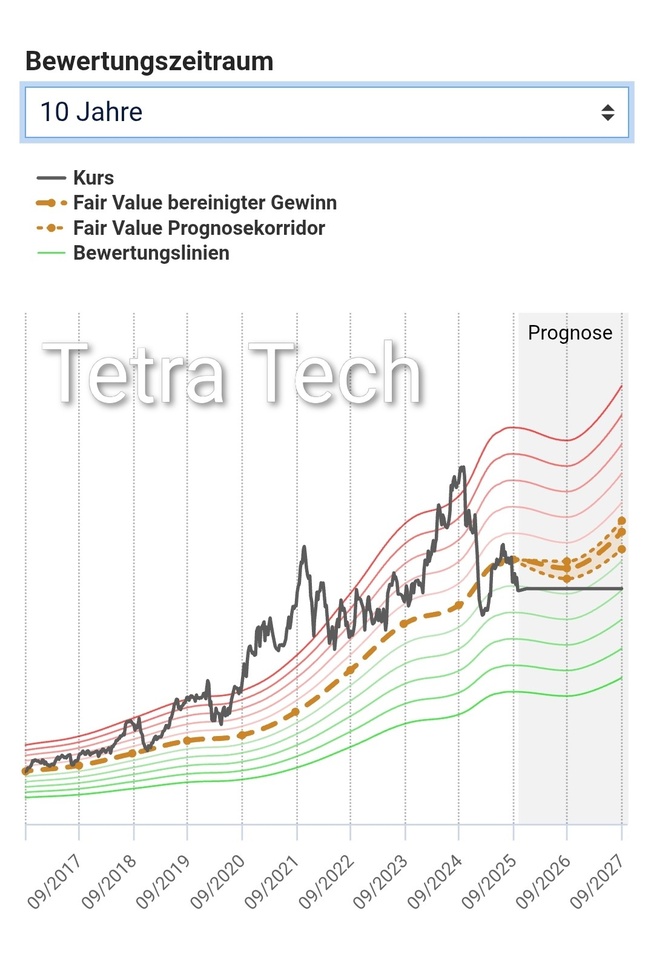

The key figure with the highest stability for the Tetra Tech share is the adjusted profit, which is used below for the valuation. The P/E ratio (price/earnings ratio) calculated from this figure is 21.07, which is 2.74 points below the historical average of 23.81 for the last 10 years. From this perspective, the Tetra Tech share appears to be favorably valued.

The fair value of the Tetra Tech share is calculated over the 10-year valuation period selected above. The average P/E ratio in this case is 23.81.

Multiplied by the adjusted earnings per share of USD 1.52 over the last 4 quarters, this results in a fair value of USD 36.19 for the Tetra Tech share. The current share price of USD 32.22 is 11.0% below this fair value, which corresponds to an undervaluation of the share.

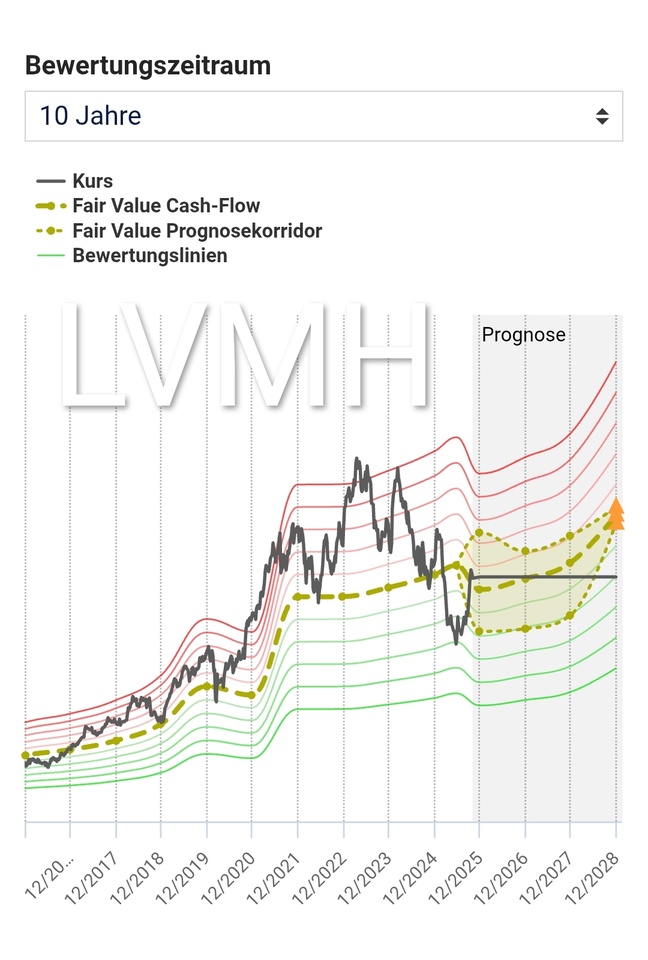

The key figure with the highest stability for the LVMH Moet Hennessy L.V. share is the operating cash flow, which is used below for the valuation. The KCV (price/cash flow ratio) calculated from this key figure is 15.32, which is 0.82 points below the historical average of 16.14 for the last 10 years. From this perspective, the LVMH Moet Hennessy L.V. share appears to be favorably valued.

The fair value of the LVMH Moet Hennessy L.V. share is calculated over the 10-year valuation period selected above. The average KCV in this case is 16.14.

Multiplied by the operating cash flow per share of EUR 39.16 over the last 4 quarters, this results in a fair value of EUR 632.04 for the LVMH Moet Hennessy L.V. share. The current share price of EUR 603.20 is 4.6% below this fair value, which means that the share appears to be fairly valued.

( Source share finder ).